Art Wager

It’s been about seven months since I wrote my cautious note about Kirby Corporation (NYSE:KEX) and in that time the shares are up about 3.5% against a loss of ~9% for the S&P 500. The company has reported earnings since, so I thought I’d check on the firm yet again to see if it now makes sense to buy. I’ll review the latest financial results, and compare those to the stock to see if it makes sense to buy. Additionally, I’ve earned decent premia selling puts on this name in the past, and I’m absolutely champing at the bit to write about short puts as alternatives to stock ownership.

In case you missed the title of this article, and also sailed past the bullet points above, I’ll offer the thrust of this article yet again in this “thesis statement” paragraph. I think Kirby stock remains a poor investment at this point. While the company seems to have improved nicely from 2021, that’s not a tremendous feat in my view. The company remains far less profitable now than it was in 2019, and that was hardly a banner year. In fact, the performance of this business since 2014 could reasonably be called “sclerotic” in my view. That alone doesn’t disqualify the stock from consideration, as I proved when I made a very decent return on it. The problem is that the shares are very richly priced at the moment, and that’s not a great sign in my view. The shares may continue to climb in price from here, but I think any gains from current levels will inevitably be given back. I would avoid the shares until the stock price falls to match value once again.

Financial Update

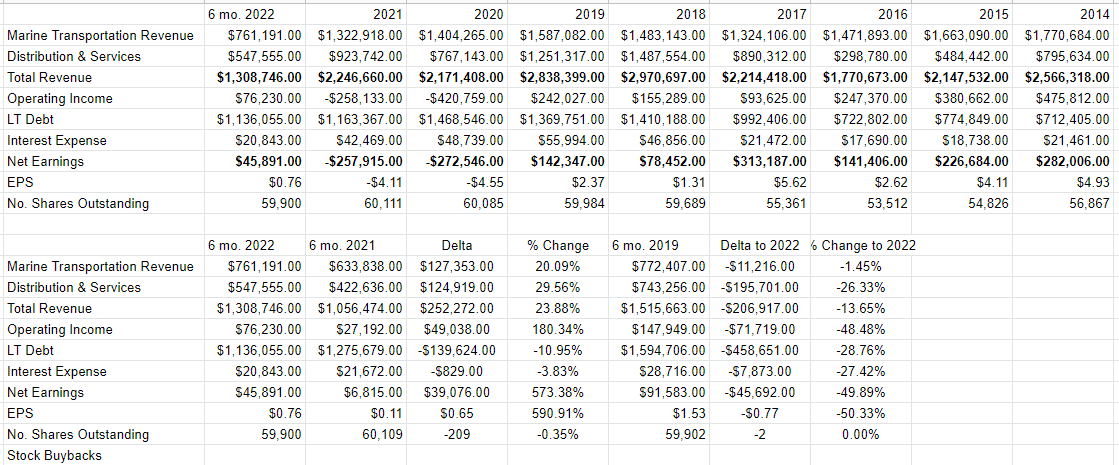

The first six months of 2022 saw a strong improvement from 2021 across the board in my estimation. Specifically, relative to 2021, revenue jumped about 24%, driven by a significant (29%) uptick in revenue from “Distribution and Services.” This drove operating income by over 180%, and net earnings by over 570%. At the same time, the capital structure improved nicely, with long term debt down about 11%. So I think it reasonable to conclude that the company has put the doldrums of 2021 behind it.

On the other hand, we should know that comparisons with a single period have a strong potential for bias. If the period under comparison is relatively strong or weak, the current state can look artificially weak or strong. For instance, as you may recall, the world was stuck in the grip of a global pandemic recently, and comparing current economic activity to the period when the global economy was in lockdown may be invalid. Thus, it’s prudent to review prior periods to get a more full understanding of the current state. Given that, I compared the most recent period to the same time in 2019 and a much different story emerges. Revenue for the first six months of 2022 was about $11.2 million, or 1.45% lower than it was in 2019. Operating and net income in 2022 are both about 50% lower than they were in 2019. On the bright side, the capital structure is much better today, with debt down about 29% over the past few years. I really like the fact that this is a much less risky enterprise than it was prior to the pandemic.

I don’t mean to be a “stick in the mud”, and I want to be neither “fuddy”, nor “duddy.” That said, I’ve got to call out sluggish financial performance when I perceive it, though. For instance, between 2014 and 2021, revenue had grown at a CAGR of about negative 1.6%. Consider also that net income in 2019 (the last year it was positive before it turned negative) was 54% lower than it was in 2017. You may recall that I just pointed out that the first six months of 2019 was much more profitable than the current year. You can describe this business using many adjectives, but “growth” should not be one of them in my view. I think “sclerotic” is a more apt descriptor. That certainly doesn’t disqualify this stock from consideration, because some of my most profitable investments have been from slow growth businesses. It does suggest that we shouldn’t buy if the valuation is excessive, though.

Kirby Financials (Kirby Corporation investor relations)

The Stock

Welcome to the section of the article where I point out yet again what I consider to be screamingly obvious, namely that “the business” is quite a different thing from “the stock.” If you read my stuff regularly for some reason, this isn’t a shock to you. If you’re new here, welcome to the party. I feel a need to point this out because one of the more pernicious old adages that float around investing circles is that “we don’t buy stocks, we buy businesses.” Au contraire. You very much buy “stocks”, and they are affected by forces that are in addition to the ups and downs of the firm. For instance, a stock may move up or down in price because of what an analyst said about a related, or only peripherally related, business. For example, Kirby may be affected by someone writing about rail traffic. Additionally, the stock is also very definitely affected by our collective views about the overall market, and stocks as an asset class. For this reason, we need to consider the stock as a thing distinct from the business. It may be tiresome that your stock gets buffeted around by forces having very little to do with the company, but in my experience this creates tremendous opportunity also. The only way to consistently make money trading stocks is to spot discrepancies between the crowd’s view about a given company, and subsequent results. Further, we want to go long a stock when the crowd becomes overly pessimistic, and we want to avoid stocks when the crowd becomes overly sanguine. This approach causes investors to miss out on some great gains in the short run, but I think it preserves the purchasing power of your capital over time, and that’s really the name of the game in my view.

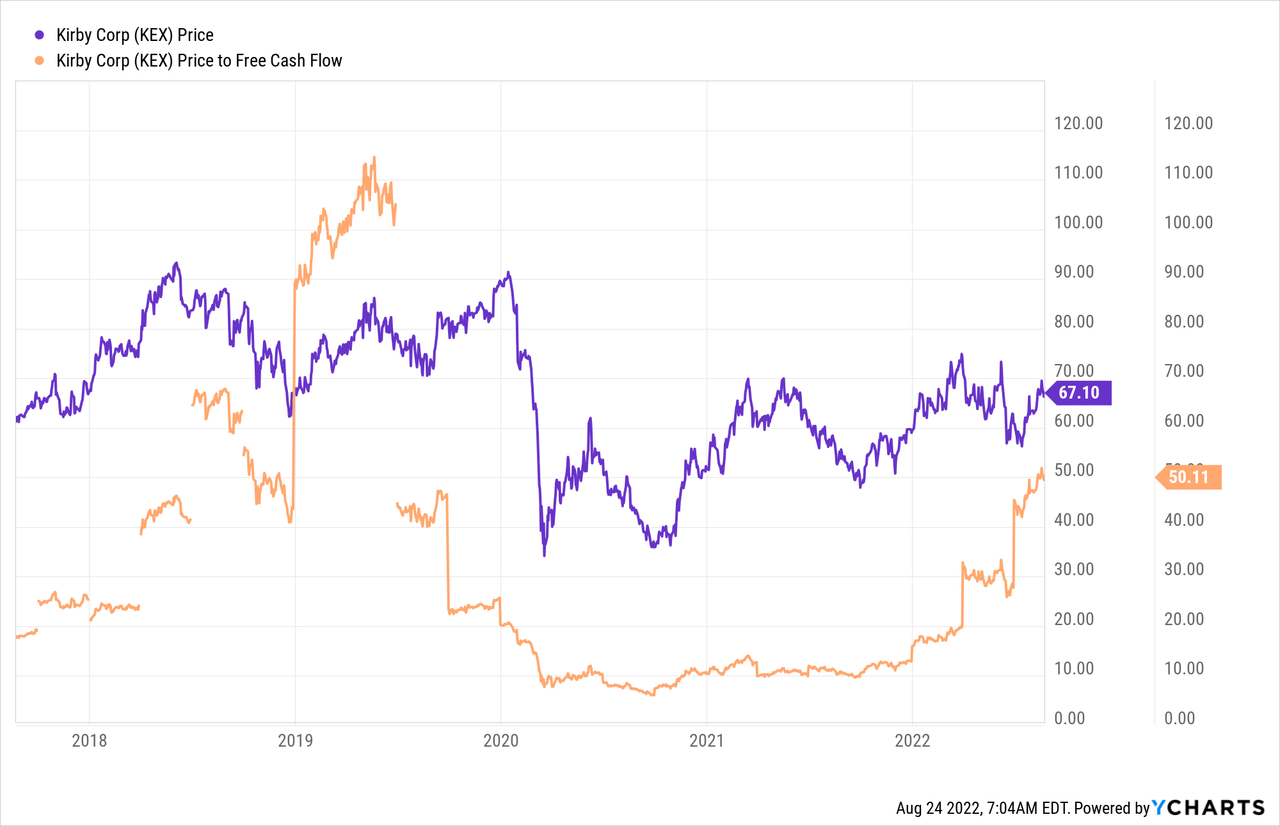

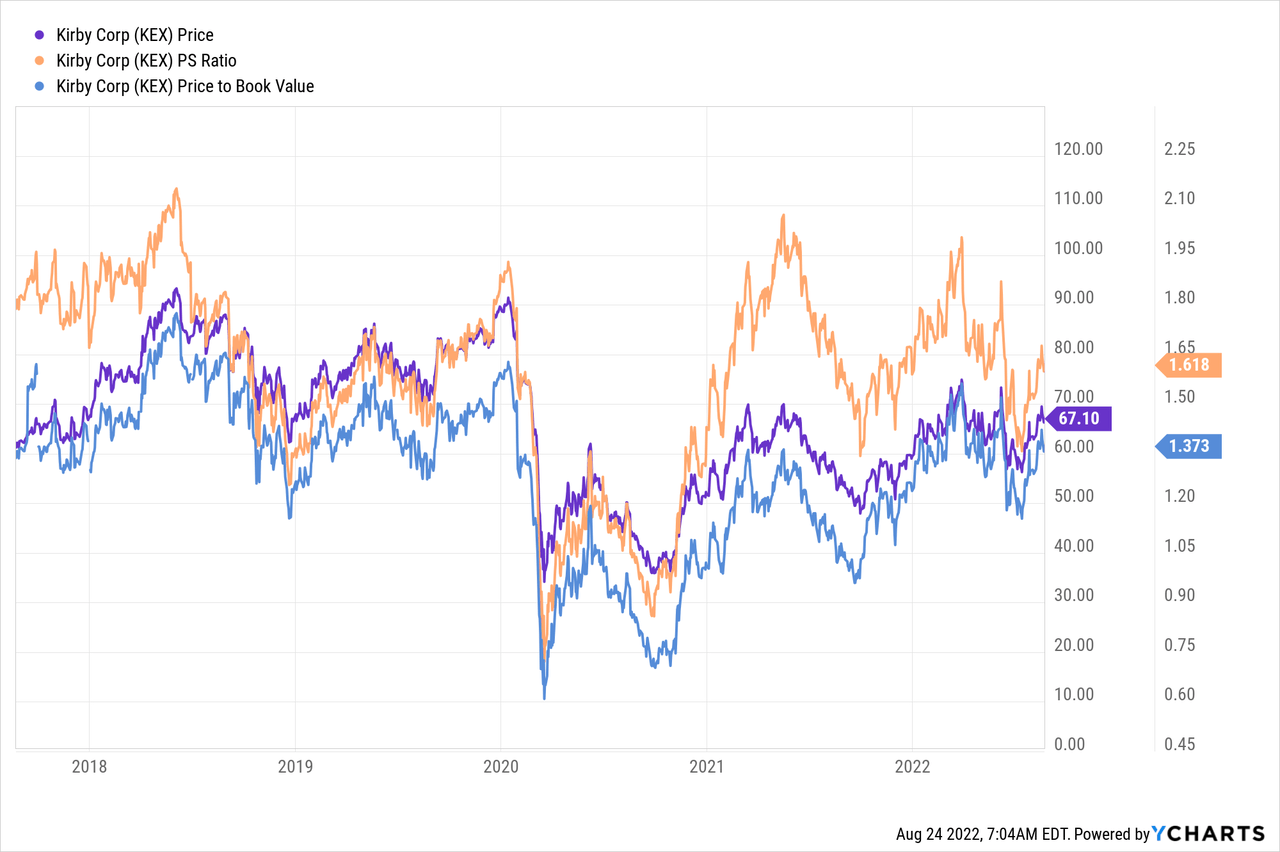

I want to buy when the crowd is particularly pessimistic. I measure pessimism in a few ways, ranging from the simple to the more complex, and I publish some of those measures on this forum. On the simple side, I look at the ratio of price to some measure of economic value like earnings, free cash flow and the like. I want to see a stock trading at a discount to both the overall market and its own history. When last I reviewed Kirby, I was distraught by the fact that price to free cash flow was hovering just below 13, price to sales was about 1.75, and price to book was 1.35. Fast forward several months and the shares are slightly cheaper on a price to sales, and price to book basis, but are much more expensive on a price to free cash flow basis, per the following:

To put all of that in context, I bought aggressively in September of 2020 when the shares were trading at a price to free cash flow of about 6.8.

One of my more complex approaches to valuation involves trying to isolate what the market is currently “thinking” about the long term growth prospects for a given company. I do this by using the magic of high school algebra to isolate the “g” (growth) variable in a standard finance formula. This is an approach described by Professor Stephen Penman in his tome “Accounting for Value.” It’s also described, in a slightly more accessible manner, in Mauboussin and Rappaport’s recent update to their classic “Expectations Investing.” The approach tries to uncover the current assumptions that go into “making” the current stock price. When I last reviewed Kirby, I became “freaked out”, as the young people say, by the fact that perpetual growth expectations were hovering around 12.5% for this business. Fast forward to the present and the assumptions are hovering around 16.5%. That is egregiously expensive in my view, and given that, I can’t recommend buying at current prices.

Options

As I pointed out in my latest article on this company, in addition to my capital gains, I earned $7.50 per share from selling put options on this stock. This involved selling deep out of the money puts that presented a “win-win” strategy. If the shares dropped in price, I’d be obliged to buy a great business at a very good price. Since the shares remained above the strike price, I simply pocketed the premia. I remind investors of this in order to brag about my $7.50, obviously, but also to remind them that short puts represent an excellent way to make risk adjusted returns.

In my previous article on this name I pointed out that I tried to sell the September puts with a strike of $45 for $1.80, but no one accepted my offer, so the order expired worthless. I write about this to point out that I think you should insist on only ever accepting reasonable premia for your puts. Unfortunately, the options market isn’t currently offering reasonable premia for reasonable strike prices, so I’m forced to sit on the sidelines and wait for what I think will be an inevitable price decline.

Conclusion

In my view, investing is about making decent risk adjusted returns. It’s no use to buy something, make some short term gains on it, and then watch those gains evaporate. My approach involves buying reasonably good companies when the market is excessively pessimistic about the shares. The approach seems to have worked reasonably well, even when you don’t count the returns I’ve earned from short puts. The shares of this company may continue to outperform in the short term, but that’s not relevant in my view. We are after superior risk adjusted returns, and I don’t think Kirby offers them at the moment. I’ll obviously change my tune if the shares drop to a more reasonable price.

Be the first to comment