ArtistGNDphotography

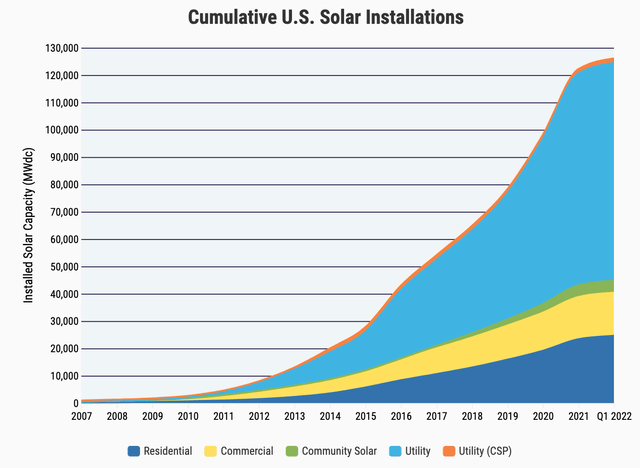

it’s Canadian Solar (NASDAQ:CSIQ) is a global solar energy manufacturing and project management company. They were founded in 2001 and have grown to become one of the biggest pure play solar companies in the industry. Over the last decade, Solar energy installations have grown by a rapid 33% annual growth rate and there is now over 121 gigawatts of solar installed across the U.S.

Solar Installations ( SEIA/Wood Mackenzie )

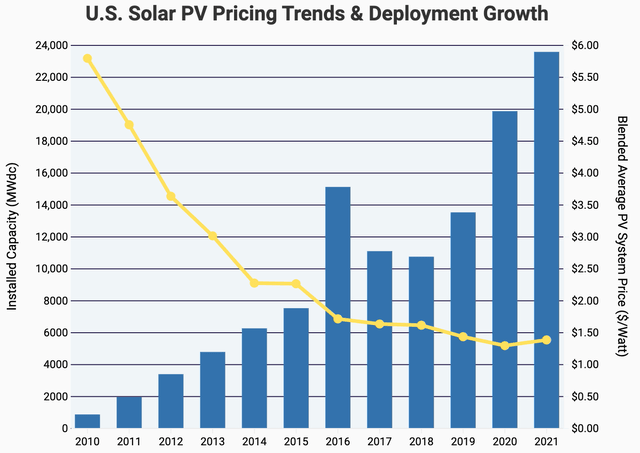

This industry growth has been driven by favorable federal policies such as the Solar investment tax credit, the Paris Agreement and the declining manufacturing cost of solar panels. The Paris agreement requires installed solar capacity to reach 5,200 GW by 2030 and 14,000 GW by 2050. The Inflation Reduction Act recently signed by Biden includes a staggering $369 billion investment in domestic renewable energy production. This includes the issuing of clean energy tax credits, such as $9 billion in home energy rebate programs.

Solar Pricing (SEIA/Wood)

Canadian Solar is poised to ride these aforementioned trends and have recently produced an outstanding quarter which surpassed revenue and earnings estimates for growth. In this post, I’m going to break down the company’s shining business model, it’s strong earnings results and the valuation, let’s dive in.

Shining Business Model

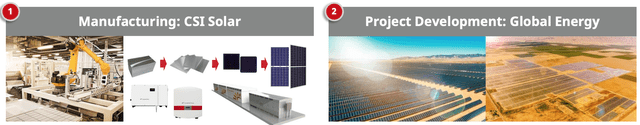

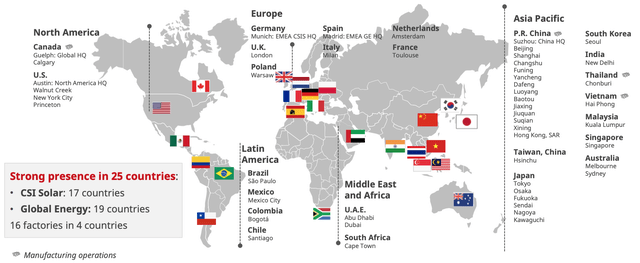

Canadian Solar has two main business segments CSI Solar and Global Energy. CSI Solar is the manufacturing segment of the business which specializes in solar module manufacturing across the company’s global footprint of facilities.

Business Model (Investor Presentation June 2022)

The CSI segment also includes the manufacturing and installation of system solutions such as inverters (Converts D.C to A.C electricity), Battery storage and installation kits. The Battery storage systems are particular interesting given they usually come with long-term service agreements with lock in recurring revenue for the future. Canadian Solar currently manages over 3.1 GW of operational projects under long-term O&M agreements. Management has bold plans to reach 20 GW of projects under O&M agreements by 2026.

The two types of Battery Storage you can see below include utility scale for industrial operations and slimline residential power banks similar to the Tesla Powerwall.

Battery Storage (Investor Presentation 2022)

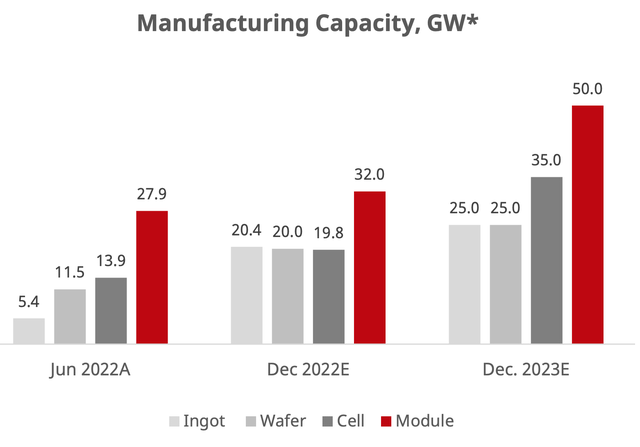

The company’s manufacturing capacity has gradually increased over time and its module capacity is expected to grow from 27.9GW in June 2022 to 50 GW by the end of 2023.

Manufacturing capacity (Canadian Solar)

The second part of Canadian Solar’s business is the Global Energy segment. This is the company’s project development arm which is one of the largest in the world. This segment specializes in developing, financing and building solar power plants globally. Canadian Solar has a range of exit strategies with its projects which give them flexibility when trying to maximize returns. Example strategies include; develop-to-sell, build-to-sell and build-to-own. Management has bold plans to grow its project sales volume at a blistering 50% compounded annual growth rate [CAGR] up into 2026.

Canadian Solar also has a number of advanced strategies which include the creation and investment into local investment vehicles, which they can then hold to produce stable long term cash flows. Examples include a 15% ownership stake in Canadian Solar Infrastructure Fund (CSIF TSE: 9284), which is the largest Japanese infrastructure fund listed on the Tokyo Stock Exchange. In addition to creating a similar investment fund in Italy (CSFS Fund I). Management expects to have 1.3 GW of combined ownership in solar projects by 2026.

Manufacturing Facilities (Investor Presentation June 2022)

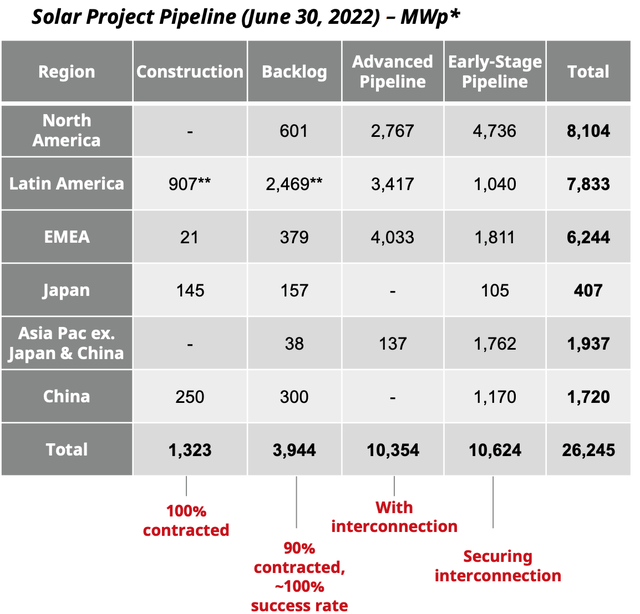

The company currently has 26 GWp in total pipeline and energy storage project development with over 31 GWh of aggregate pipeline which is substantial.

Pipeline (Q2 Earnings report)

As an extra note, the company is well connected to China and aims to carve out an IPO of CSI Solar in China, on completion of registration with the China Securities Regulatory Commission [CSRC]. This is expected to help expand the company’s investment base, raise more capital and lower their cost of capital long term.

Growing Financials

Canadian Solar (CSIQ) generated strong financials for the second quarter of 2022. Revenue was $2.31 billion which increased by a blistering 62% year over year and beat analyst consensus estimates by $83.3 million. This growth was driven by a large increase in solar shipment volumes which increased to 5.06 GW, which was at the high end of managements guidance range of between 4.9 GW and 5.1 GW. In addition, higher project sales, higher average selling price and growth in the battery storage segment also boosted revenue. It’s Global Energy solar project pipeline expanded to 26 GWp and storage pipeline increased to over 31 GWh.

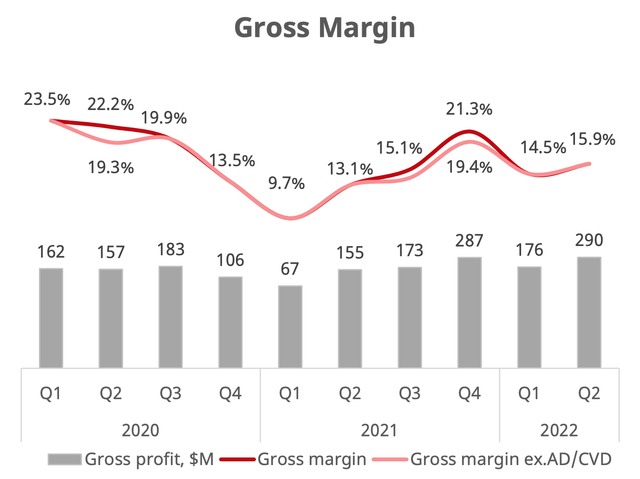

Gross Profit also showed strong growth of 105% quarter over quarter or 101% year over year, which was fantastic. It’s Gross Margin also expanded to 16% which was higher than the 14.5% achieved in the first quarter of 2022. This increase was driven by higher module pricing, lower manufacturing costs and favorable exchange rates as the Renminbi decreased in value relative to the U.S Dollar. The company is finally starting to see economies of scale benefits in its manufacturing, this is a positive trend I expect to continue.

Gross Margin (Q2 Earnings Report)

Total Operating expenses did increase by 54% year over year to $255 million. This was a negative sign but was mainly due to the macroeconomic environment of higher shipping and handling costs, in addition to an impairment charge related to certain manufacturing assets.

The company benefits from a strong dollar and achieved a net foreign exchange gain of $6 million compared to a net loss of $3 million in the second quarter of 2021.

Income tax expense came in at $28 million in the second quarter which was higher than the $2 million income tax benefit in the second quarter of 2021. This extra expense was a result of the company’s extra income generated and thus not a negative sign overall.

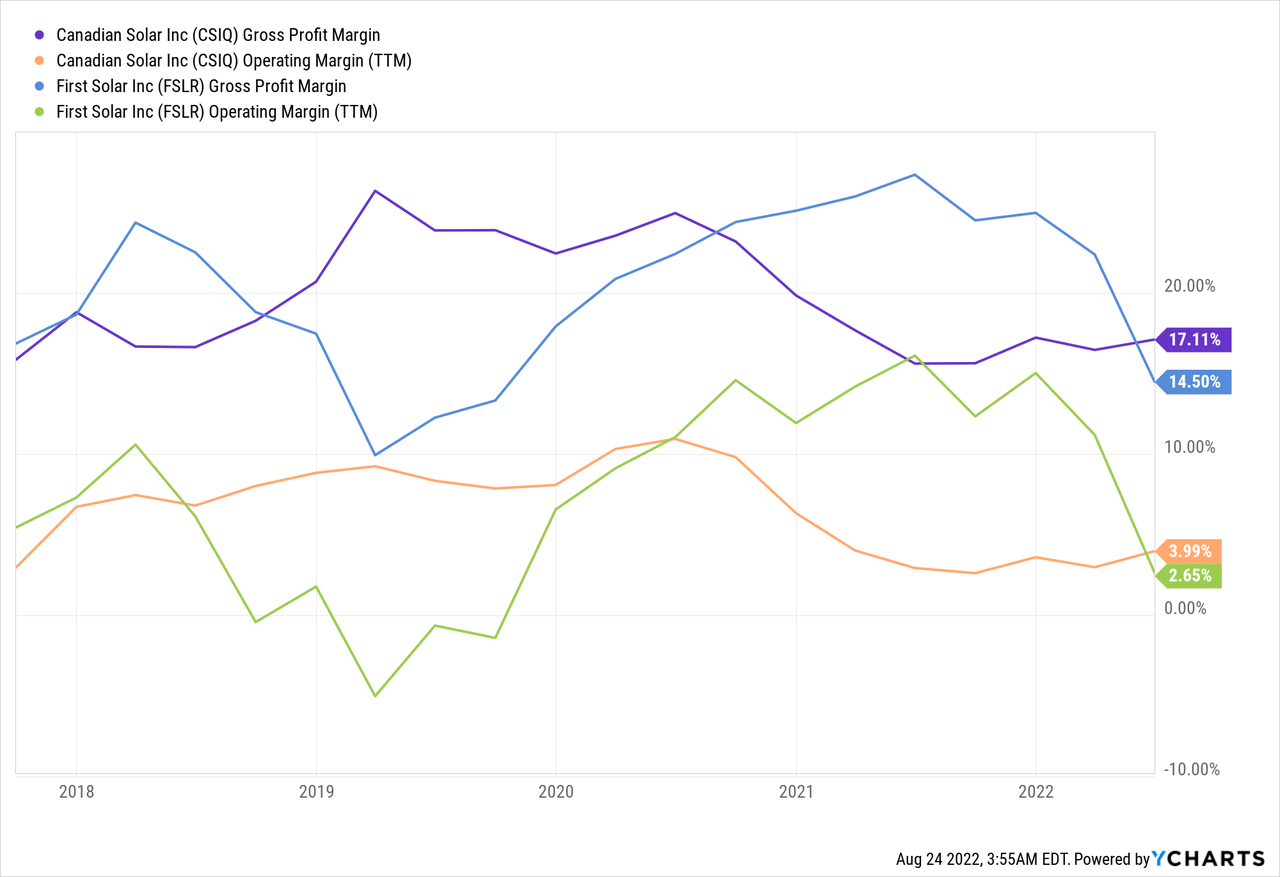

As an indication of overall trends it was interesting to see Canadian Solar has now overtaken competitor First Solar (FSLR) on a Gross margin and Operating margin basis as you can see on the chart below.

Net Income was $74 million in Q2’22 which was a staggering 572% higher than the $11 million generated in the second quarter of 2021.

Earnings Per Share [EPS] was $1.07 for Q2’22 which beat analyst consensus estimates by $0.40. Net Cash flow from operations also showed a positive increase of 84% to $293 million, due to higher earnings and monetization of project assets.

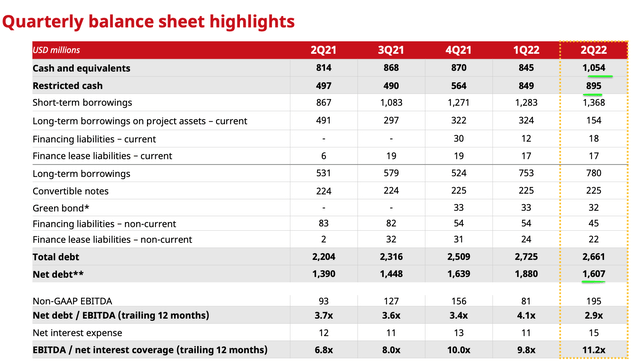

Canadian Solar has $1.95 billion in cash, equivalents and restricted cash in Q2’22. In addition, to fairly high debt of $2.7 billion. To give some perspective competitor First Solar has taken a much more conservative approach when it comes to leverage with just $232 million in total debt. Although they are growing at a much slower rate with revenue virtually flat year over year. The good news for Canadian Solar is they have decreased their “Non Recourse debt” (which is debt secured on assets) from $550 million in Q1 to $264 million in Q2.

Balance Sheet (Q2 Earnings Report)

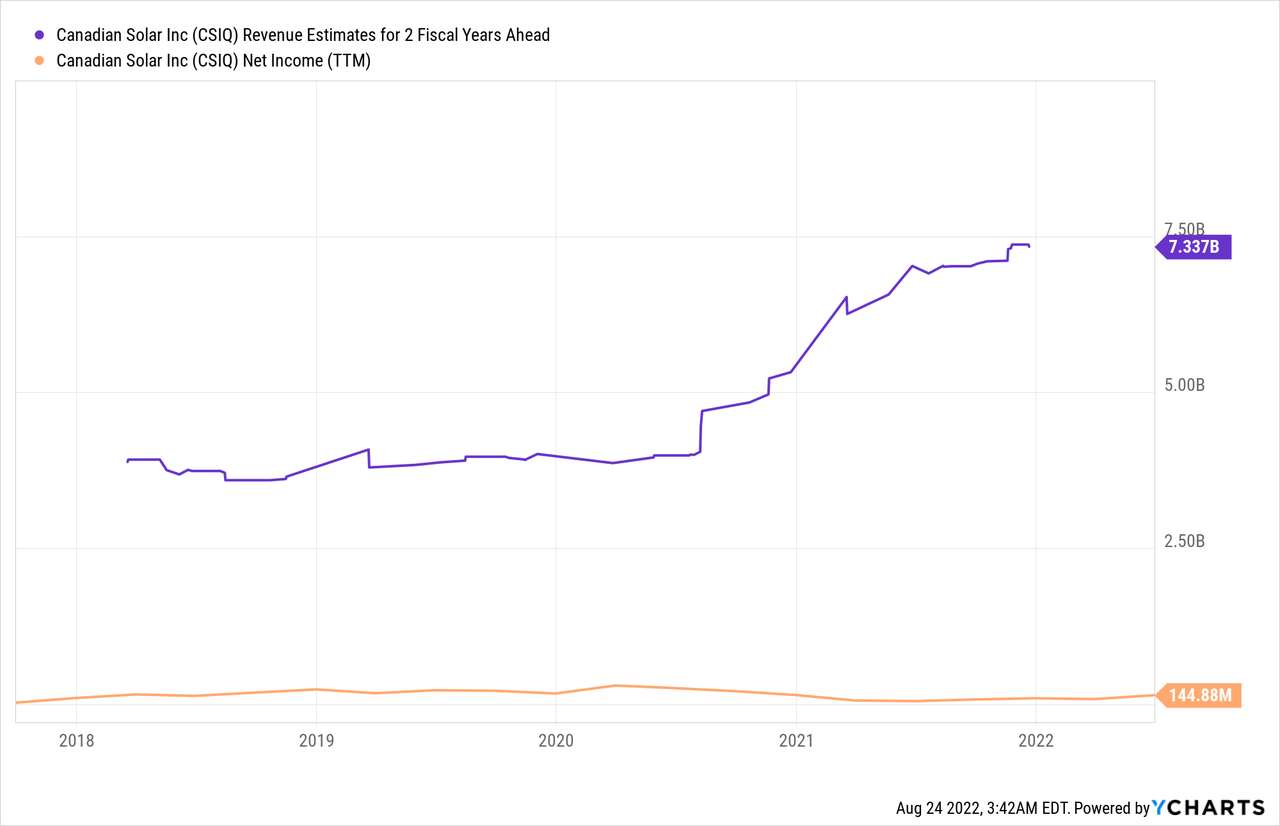

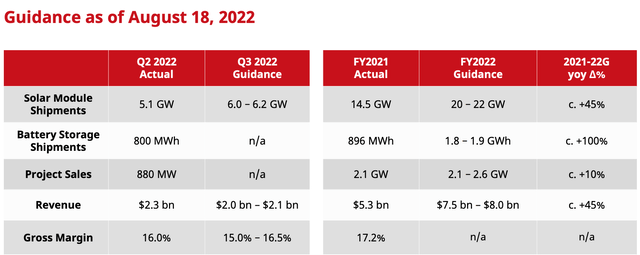

Moving forward the company is guiding for strong solar module shipments in the third quarter, jumped from 5.1 GW to 6-6.2 GW. However, they are expected slightly lower revenue of between $2 billion and $2.1 billion. This is because management believes the second quarter will be the largest quarter of the year for the company due to the timing of project sales and battery storage shipments. Moving into the full year 2022 Revenue is expected to come in at between $7.5 billion and $8 billion up a healthy 45% year over year.

Guidance (Q2 Earnings Report)

Profitability is also expected to remain healthy into 2022 as manufacturing cost reductions and lower logistics costs offset higher polysilicon prices.

According to Dr. Shawn Qu, Chairman and CEO:

We are excited to officially introduce our long-awaited battery storage products for utility and residential applications in the upcoming Solar Power International exhibition in California.

In a gradually improving market backdrop aided by strong policies such as the recently passed Inflation Reduction Act, Canadian Solar is strongly positioned to achieve profitable growth as we continue to focus on long-term investments and create lasting value for shareholders.

Advanced Valuation

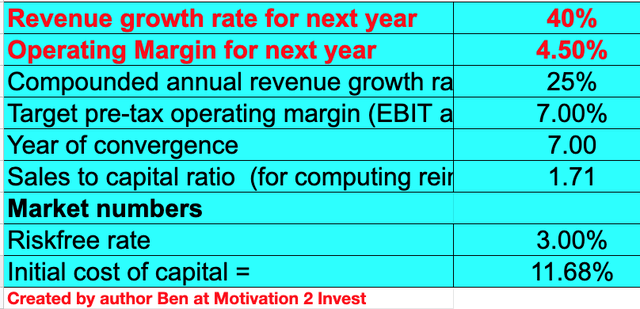

In order to value Canadian Solar I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 40% revenue growth for next year and 25% for the next 2 to 5 years, which is fairly conservative given historic growth rates and the industry tailwinds.

Canadian Solar stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted operating margins to increase from 4.5% to 7% over the next 7 years as the company continues to benefit from economies of scale and lower manufacturing costs. In addition to the expected rebalancing of supply chain costs.

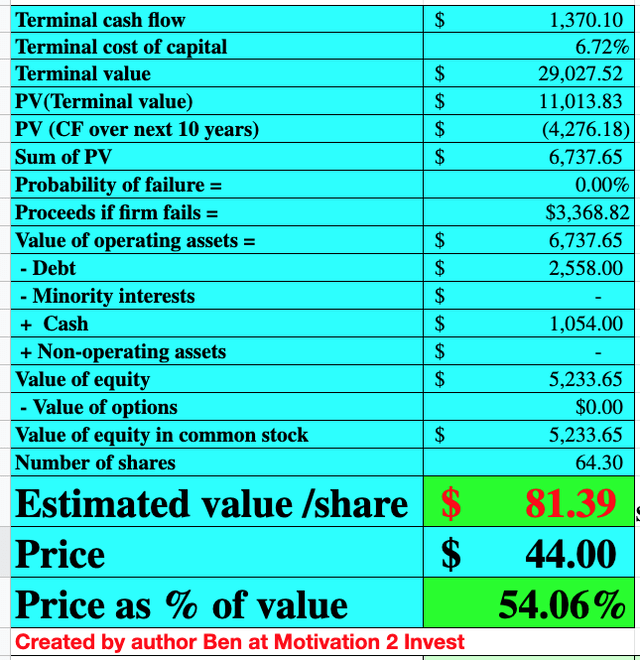

Canadian Solar Stock Valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $81.39 per share, the stock is trading at just $44 per share at the time of writing and thus is significantly undervalued.

As an extra datapoint, Canadian Solar trades at an EV to Sales (FWD) ratio of 0.62 which is ~16% cheaper than its 5 year average. It’s EV to EBITDA Ratio also looks to be close to fair value across the trailing twelve month and forward multiples.

Valuation Metrics (Seeking Alpha)

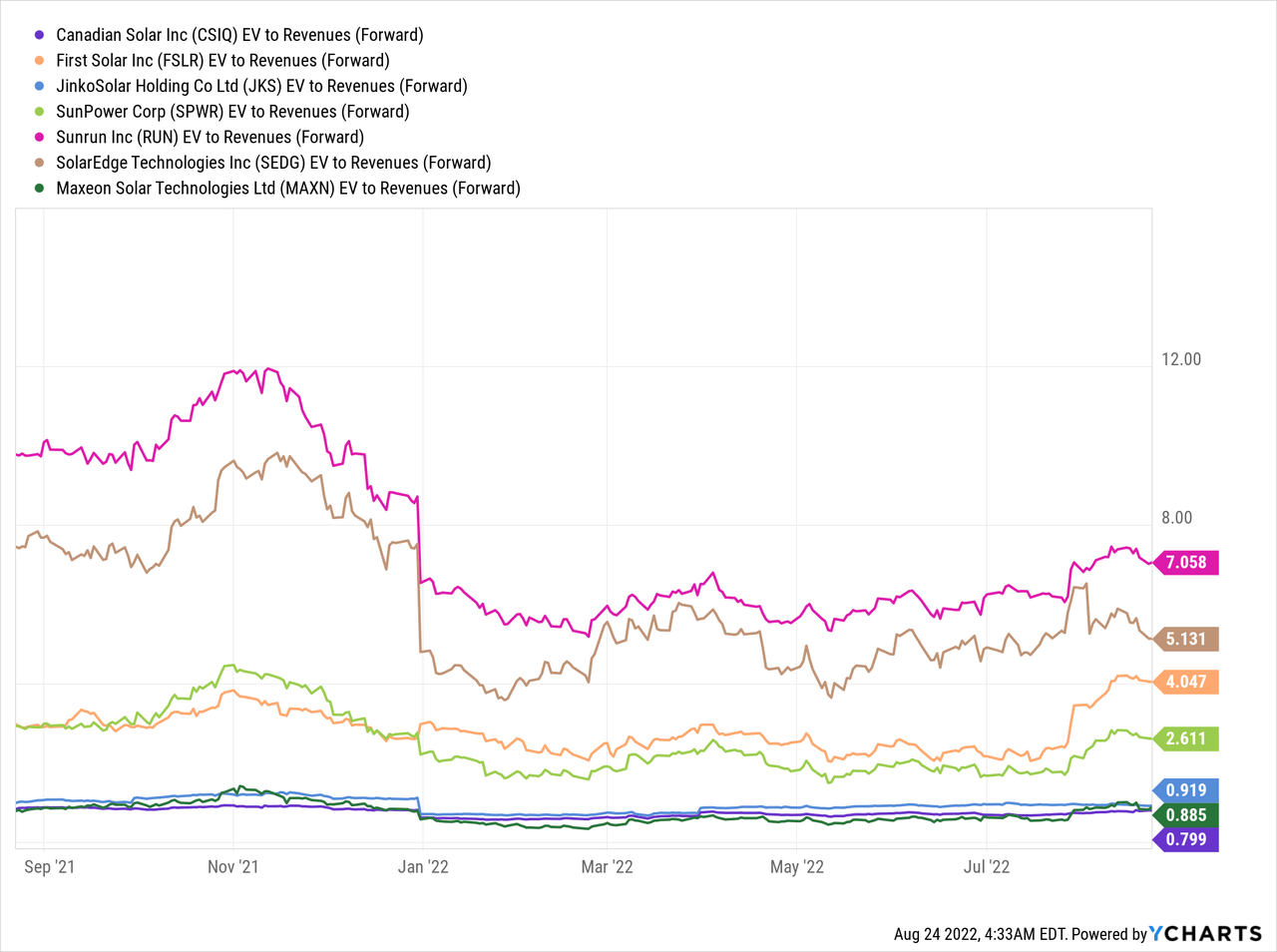

In comparison to peers in the solar industry, Canadian Solar trades as the cheapest (purple line) with an EV to Revenue of between 0.62 and 0.79. First Solar by comparison trades at an EV to Revenue (forward) = 4.

Risks

High Debt

As mentioned prior Canadian Solar does have fairly high debt relative to industry peers. This could be an issue especially given the rising interest rate environment.

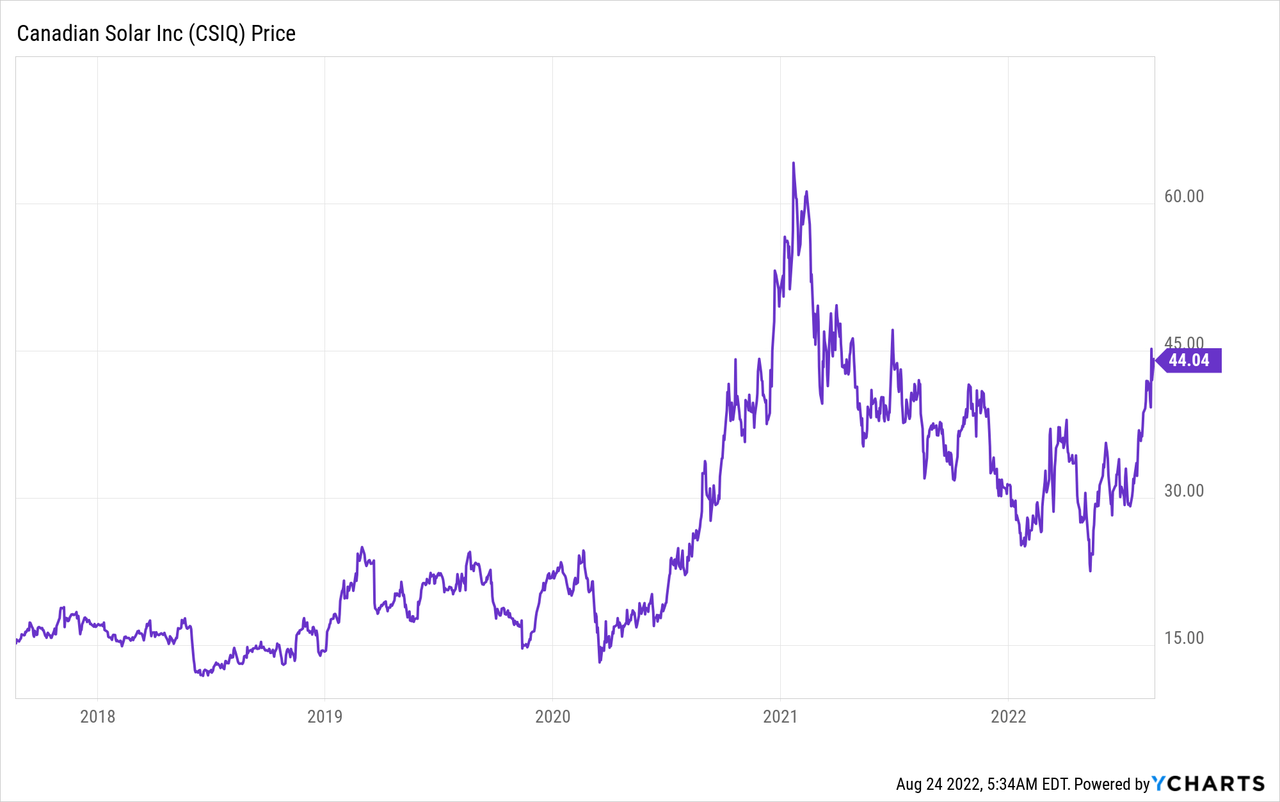

Stock Price has Popped Significantly

I first invested into Canadian Solar in early 2020 and held the stock through the decline. Between May and August 2022 the stock price has popped by 81%. As a contrarian investor I tend to prefer to buy stocks on bad news as opposed to good news, thus one may wish to wait for pullback or check the technicals if you are momentum trading. I will be announcing an investment service soon on Seeking Alpha so feel free to follow to be alerted when I will be releasing my real time investments.

Solar panels aren’t unique

The issue with Solar Panels is many companies can and do produce them. Therefore it tends to be a product with elastic demand in that suppliers compete on price as a main factor and effectively it’s a race to the bottom. Long term this is good for the global energy situation but for individual solar companies’ margins may be eaten into longer term.

Final Thoughts

Canadian Solar is a leading solar provider that has a vast global footprint, excellent manufacturing facilities, and access to multiple public markets. The company is poised to benefit from the increasing number of climate change agreements issued globally and the strong growth is testament to that. If you’re looking for a pure play bet on the future of Solar than Canadian Solar is arguably the best bet.

Be the first to comment