gesrey/iStock via Getty Images

Inflation has been running rampant. With the Federal Reserve showing us they’re serious with a 75-basis-point rate hike, it’s clear that there will be more pain before things level out.

Amid this backdrop, we are entering a period where a recession may well be on the horizon.

This is just the sort of environment where it makes sense to own companies which can continue to grow their businesses without huge incremental costs of capital. My targets here will be those that can grow regardless of the economic climate.

Brands have Pricing Power

If you’re producing a fungible asset that can be interchanged with any other, you can’t do much to squeeze more out of the margins. That’s a problem in an inflationary environment where cutting costs is challenging.

This is exactly the sort of time when I look for a few keys with business models:

- Strong brand recognition.

- Differentiated products.

- Pricing power.

All three items support one another, creating a virtuous cycle.

Companies with the best brands are typically those whose products stand out. When you’ve got that formula, you can afford to raise prices without scaring away customers.

Both of the companies we’ll look at today have these characteristics in place. The beauty is that such businesses have a high level of “stickiness-factor”; once they’ve contracted with an organization or user base, it becomes very difficult to switch to a competitor.

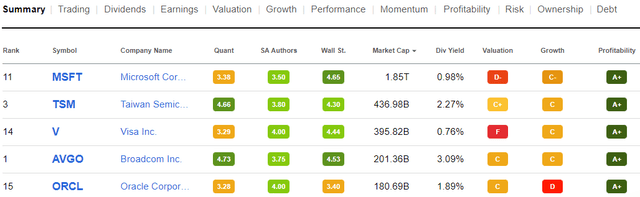

Stock Screener to Begin the Analysis

I decided for my analysis today that I would use Seeking Alpha’s stock screener to winnow the field.

With my theme being companies benefiting from secular growth trends and with real staying power, I set the screen with the following filters:

- Sector & Industry: Information Technology

- SA Authors Rating: Buy to Strong Buy

- Profitability: A+ to A-

- Dividend Growth 5Y: 5%+

- P/E GAAP (‘TTM’): 0.00 to 30.00

This left with me with a shortlist of 27 companies. Sorting by Market Cap, I was left with two companies in the top five that I’d like to highlight today:

Stock #1: Microsoft Corporation (MSFT)

MSFT is a tech company, perhaps best known for its legacy Windows and Office product lines. While the licensing revenues in this space continue to grow, I am most bullish on what it has to offer within cloud computing and personal computing.

Taking a quick look at the FY22 Q3 results posted in April, here are how its three business units have been growing:

- Productivity and Business Processes: 17%

- Intelligent Cloud: 26%

- More Personal Computing: 11%

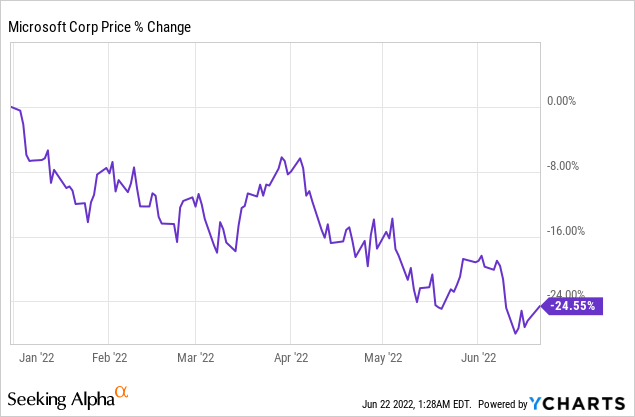

Despite the strong recent financial performance and bountiful avenues for growth, MSFT has been pulled down recently in the broader tech sell-off:

While I wouldn’t say that this ~25% pullback YTD places MSFT into a true bargain price range, it has elevated the dividend back to a ~1% yield. Coupled with the ~10% dividend growth rate over the past few years, there is the opportunity for a rising income for patient investors. With fast-growing tech companies, I look at the dividend more as a bonus than as a primary reason for owning the business.

From the business side of things, I’m most recently excited about what’s to come in the gaming space as MSFT doubles down on entertainment.

A Timely Gaming Acquisition

In the gaming space, MSFT announced at the start of the year that it is acquiring Activision Blizzard (ATVI). When I covered this at the time, I outlined three huge benefits MSFT will realize with this purchase:

- Strong recurring revenues from top-notch franchises.

- Experienced talent and teams.

- Synergies with its own gaming platforms.

While the drivers of the eSports world have been in place for many years, the pandemic fueled a further boom that is still gaining steam.

By adding ATVI’s portfolio to its gaming-war-chest, MSFT is able to accelerate its growth in a few key areas:

There is a fly-wheel of growth here where MSFT can leverage its cloud platform to host the content while providing all services needed for community, whether that be via forums or using other communications offerings. This platform, bolstered by the Xbox Game Pass and Xbox Cloud Gaming, allows gamers to connect on PCs, phones, and tablets. The Xbox console has also been a staple in the gaming community for well over fifteen years, with no signs of slowing.

It has also recently been announced that MSFT is already working on integrating simple games into Teams. While they might be starting with Solitaire, it’s possible to imagine any combination of the company’s offerings being embedded here. This represents just one more avenue to accelerate consumer attachment using their immense entertainment intellectual property assortment.

Stock #2: Oracle Corporation (ORCL)

ORCL has been around since the late 1970s, so it has a history extending far beyond the present-day Internet-as-we-know-it. Speaking again to the concept of branding, Oracle’s name is synonymous with best-of-breed data warehousing. This includes its autonomous database which boasts the use of machine learning to reduce costs and increase uptime.

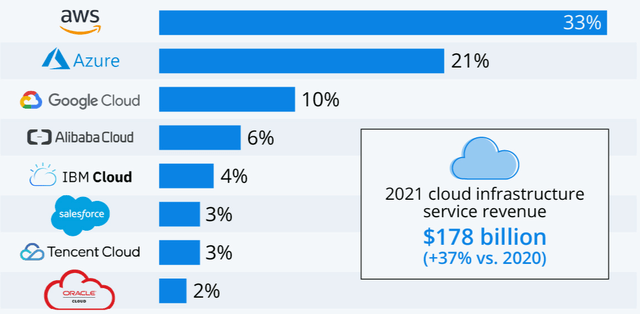

The company has a wide array of tech offerings. Over the past years, they have moved from a products-based-business to a services-based-company. Leveraging the Oracle Cloud, the company offers Software as a Service (‘SAAS’) for applications, Platform as a Service (‘PAAS’), and Infrastructure as a Service (‘IaaS’) capabilities.

With regard to the large and growing cloud computing space, ORCL has a solid franchise with plenty of room to expand both through organic industry growth and by aiming to improve market share:

Source: Statista

ORCL’s recent quarter had a few key metric highlights worth mentioning (all in constant currency):

- Total revenue growth increasing 10%.

- Total cloud revenues (IaaS + SaaS) up 22%.

- License revenues up 25%.

These were incredibly solid results.

Safra Katz, Oracle CEO, had these promising words to say on the recent Q4 2022 Earnings Call:

“[O]ur infrastructure business has now entered a hyper-growth phase. Couple a high growth rate in our cloud infrastructure business with the newly acquired Cerner applications business—and Oracle finds itself in position to deliver stellar revenue growth over the next several quarters.”

This leads us to what I am most excited about for ORCL over the coming years.

A Huge Healthcare Acquisition

Like MSFT above, ORCL also made a recent acquisition that can be a game changer for it over the long term.

The company made a $28.3B offer for Cerner near the end of December 2021. This deal as finalized this month, with the rebranded division named “Oracle Cerner”.

Prior to the acquisition, Cerner was recognized as one of the largest public electronic health record (‘EHR’) vendors in the world.

This is one of those rare cases where I can see genuine synergies between the buyer and the acquired. Cerner is a healthcare company that needs to be focused on doing what it does best, which is providing technology solutions for patients and providers.

Now being combined with ORCL, it internally has access to world-class cloud and database services to keep up with the pace of change happening in the health-tech space.

Future Plans

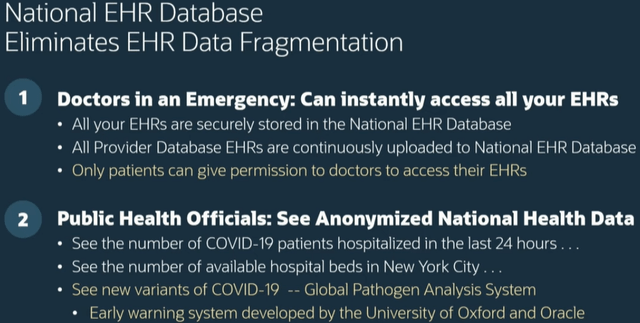

On June 9, ORCL hosted a webinar where some key players—including board chairman Larry Ellison—laid out the company’s vision within the healthcare space.

Among the opportunities the combined companies have ahead of them, here were a few of the important takeaways that ORCL has slated:

- Creation of a National EHR Database.

- Voice UI to improve clinician efficiency.

- Disease-specific AI modeling.

It’s the first one that really stands out:

From the micro-level of individual patients and providers, a unified national database could address the glaring gaps in the system caused by a fragmented system with all EHRs housing their own databases of patients. This would bring the data together and allow a provider anywhere in the country to provide the proper care, with the full patient story available.

At the public health level, the data can be aggregated in anonymized fashion and used effectively. This would allow to-the-minute accuracy as far as the number of ICU beds available in a region. It would make it simple to understand exactly how a disease is spreading without the need for a system overhaul.

Long story short, ORCL didn’t buy Cerner just to do healthcare the way it has already done. This stands to be a truly ground breaking shake-up.

Conclusion

Both MSFT and ORCL are legacy technology names with incredibly long growth runways ahead of them. As both personal and professional life shifts online at an increasingly fast pace, the need for companies to facilitate this growth will only accelerate.

The companies both undertook transformative acquisitions within the last year. These strategic moves will provide further opportunities for sustainable acceleration of their businesses in the years to come.

Be the first to comment