simpson33

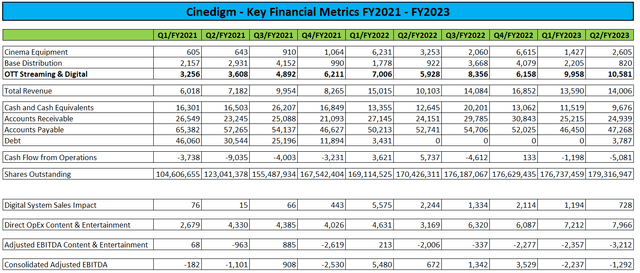

On Tuesday, market participants punished shares of niche OTT content provider Cinedigm (NASDAQ:CIDM) following a less-than-stellar Q2/FY2023 report.

While the company’s core streaming business continued its growth trajectory, cash flow and profitability disappointed.

Free cash flow for the quarter was negative $5.3 million while Adjusted EBITDA for the all-important “Content & Entertainment” segment decreased to a new all-time low despite the much-touted benefits of the recent acquisition of Digital Media Rights or “DMR”, a small provider of Asian film and television content:

Not only does DMR add 10 new streaming channels and 7,500 films and TV series to our asset base plus a projected $10 million in revenues and $3 million in adjusted EBITDA over the next 12 months, but it also drives Cinedigm to an expanded business scale that will support the launch of four new growth initiatives that we expect will generate over $28 million in incremental annual revenues when fully rolled out.

While the purchase of DMR has certainly helped the company’s top-line, profitability appears to have deteriorated following the close of the transaction in late March.

Moreover, increased cash usage apparently resulted in the decision to enter into a $5 million revolving credit facility with East West Bank (emphasis added by author):

On September 15, 2022, the Company entered into a Loan, Guaranty, and Security Agreement with East West Bank (“EWB”). The agreement provided for a revolving line of credit (“the Line of Credit Facility”) of $5.0 million, guaranteed by substantially all of our material subsidiaries and secured by substantially all of our and such subsidiaries’ assets.

The Line of Credit Facility bears interest at a rate equal to 1.5% above the prime rate. The Line of Credit Facility expires on September 15, 2023 with a one-year extension available at EWB’s discretion. As of September 30, 2022, $3.8 million remained outstanding on this line of credit.

The interest rates as of September 30, 2022 were approximately 7.75%. Under the Line of Credit Facility, The Company is subject to certain financial and nonfinancial covenants including terms which require the Company to maintain certain metrics and ratios, maintain certain minimum cash on hand, and to report financial information to our lender on a periodic basis.

Please note that Cinedigm has not yet filed the credit agreement with the SEC, so it is difficult to assess potential covenant implications.

That said, on the conference call, management projected a “very strong performance in the next two fiscal quarters and significant topline growth for the full year as we move closer to our goal of sustainably positive cash flow and profits“.

As highlighted several times on the call, these expectations are backed by the stellar box office performance of the low-budget slasher movie Terrifier 2 which has become a rare sleeper hit following its release in early October and recently eclipsed $10 million in box office revenues.

Company Press Release

Cinedigm acquired all North American rights to the movie in late June and following the theatrical release, Terrifier 2 also debuted on the company’s SCREAMBOX streaming channel last month (emphasis added by author):

While still in theaters on Halloween, we also launched Terrifier 2 on our Screambox, horror streaming channel, fueled by continued heavy viral marketing by Bloody Disgusting, the film has already driven increased traffic on Screambox of more than 250%, with subscriptions up more than 295% compared to the channel’s previous high month.

On November 11th, we also released the film onto Transactional VOD across a wide footprint that includes Amazon Prime, iTunes, Vudu, Google Play, Microsoft and Red Box, where it is performing extremely well and exceeding our expectations.

In December, we are shipping the film in DVD and Blu-ray of Walmart and Best Buy, among many other outlets. And then after that, it will be available for additional licensing to streaming and other platforms.

We are also considering other ancillary options to support and extend the film, including graphic novels, podcasts, additional editorial, documentaries, television, NFTs and potential rerelease into theatrical.

Suffice to say, Terrifier 2 should have a very positive impact on the company’s financial results over the next couple of quarters as also stated in the earnings press release:

We are very well-positioned going into our next fiscal quarter, the seasonally best of the year, where, in addition to continued strong streaming growth, the success of the breakout film phenomenon Terrifier 2 is going to provide a significant upside to our fiscal Q3 financial results and beyond.

Bottom Line:

Cinedigm reported somewhat mediocre second quarter results with ongoing growth in the core streaming business offset by material cash usage and weak profitability metrics. In addition, the company resorted to debt financing for the first time in many quarters.

That said, the surprise success of Terrifier 2 should provide some major tailwinds for the second half of fiscal 2023. The company should easily beat consensus estimates for H2 and might even achieve profitability in both Q3 and Q4.

While one swallow certainly does not make a summer, Terrifier 2 has improved Cinedigm’s near-term outlook considerably with positive cash flow and even profitability apparently close at hand.

Given strong near-term prospects, I am upgrading shares from “Sell” to “Speculative Buy“.

Be the first to comment