alvarez/E+ via Getty Images

During the previous earnings season, airlines were rather upbeat on their performance in the second quarter. That upbeat prospect gained another leg up as airlines revised their expectations upwards. My main concern with airlines has always been that even if the prospects are good, there’s always something keeping prices down and while I have been criticized for that view it seems that with rising recession fears and inflation things don’t look good for airline stocks even when they are currently executing well.

In this report, I will have a look at how Sun Country Airlines (NASDAQ:SNCY) has performed during the first quarter and the outlook and updates the airline provided for the second quarter and 2022 if any.

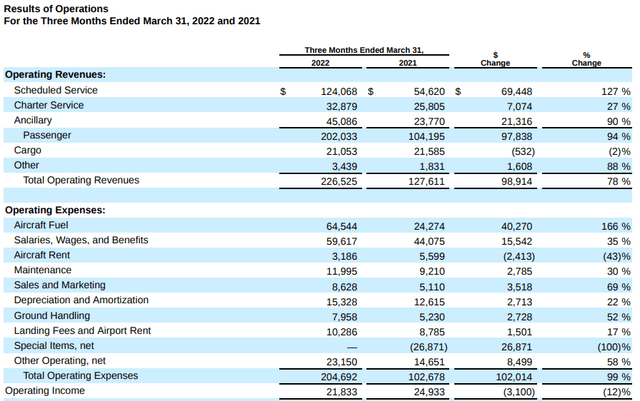

Results: Cost Increase Absorbs Strong Revenue Increase

Sun Country Airlines Q1 2022 results (Sun Country Airlines )

Revenues rose by 78% year-over-year driven by higher passenger volumes and mostly focused toward growth in the scheduled services segment. The increase in operating revenues was supported by a 36% uptick in base fares. However, the $98 million higher revenues did not translate into higher operating income as expenses increased by $102 million marking a 99% increase in costs. Part of that was driven by a 25% increase in block hours, but the surge in fuel prices also plays a big role. A rough calculation shows that around $26 million of the $40.27 million increase in aircraft fuel costs is related to higher jet fuel prices. Additionally, last year there was payroll support that reduced the cost load by $26.9 million. Those two components already account for around two thirds in increase in costs. During the quarter aircraft rents decreased by 43%, this is driven by Sun Country Airlines transitioning from operating leases where the aircraft should be returned to the lessor by the end of the lease to financial leases where the aircraft is the airline’s property by the end of the lease term. So, over time the airline is turning cash items into non-cash items.

Excluding payroll support, Sun Country Airlines would see profits improve by $23.8 million, which is around 10% when expressed as a percentage of revenues. So, we did see significant improvement on an adjusted basis and we see that Sun Country Airlines was profitable in Q1 last year as well as this year.

Year-over-three comparisons, which are used to quantify the recovery to pre-pandemic levels are a bit less effective for Sun Country Airlines as the airline added cargo services to its portfolio but total revenue per available seat mile was down 1% on lower fares. Excluding cargo services, revenues were still up $9 million. Total fares were around $144.2 per passenger in 2019 compared to $183 in the first quarter of 2022.

On an increase of 30% in block hours, a more useful measure since Sun Country Airlines operates a cargo business as well, the hybrid low-cost carrier was able to reduce costs by 6%. What I’m liking about Sun Country Airlines is the combination of scheduled services, cargo and charter flights. The latter two provide some stability as they are partially insulated from economic shocks with long-term contracts, recurring set of customers regardless of economic downturn and fuel costs are passed through to customers. Obviously for the cargo business, an economic downturn leads to lower demand for e-commerce shipping but Sun Country Airlines is well protected with long-term contracts. The element is not completely true but there still are long-term contracts (six years with two two-year extension options) in place which insulate the company somewhat.

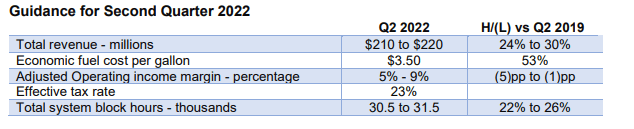

Outlook Disappointing for Sun Country Airlines

Sun Country Airlines guidance (Sun Country Airlines)

My main concern with Sun Country Airlines is that it’s operating 30% more block hours compared to the same quarter in 2019 and for the second quarter its expecting revenues up 24% to 30%. This will lead to margins of 5% to 9% which is a reduction from the 10% margin in Q2 2019 and Q1 2022. So, there’s a strong uptick in demand for air travel but it’s not going to be translating to the bottom line at all. For a company that has been doing 10% adjusted margins this quarter that’s disappointing. It’s not unrealistic, but definitely not the kind of stuff you want to see in a market where airlines are dictating the prices. Additionally, the economic fuel cost per gallon is a watch item. For the second quarter, the hybrid carrier expects fuel prices of $3.50 per gallon but the IATA monitor shows fuel prices in North America of $4.20 per gallon which is down from the prior month. So, I’m somewhat cautious about the accuracy of the cost environment prediction and I have not seen the carrier provide any detail on fuel hedging policies. On top-line, fares are going to be up supported by ancillary revenue that should tick up from $49 to $60 over the longer term.

Crew Challenges Addressed in a Questionable Way

One element that I was missing or I felt wasn’t discussed in detail was how crew challenges are being dealt with in terms of really hiring people and training them. Sun Country Airlines did increase pilot pay and that’s pressuring margins now, but over the longer term will attract pilots and also improve margins on escalated contracts when the pricing of contracts outpace the pilot pay rate increase. So, Sun Country Airlines did something to become more attractive to pilots but I feel it did not outline how they get from hiring to training to having proficient workers.

What’s more worrying is that Sun Country Airlines says it will cherry pick and fly into the high-yield markets amidst crew shortages and the current pricing environment. Indeed, if you don’t have the staff to fly the aircraft there isn’t much you can do and flying at a loss doesn’t sound attractive at all. However, simply not flying also means that utilization is suboptimal. In the first quarter, charter block hours were down 14.3% as Sun Country Airlines prioritized scheduled services due to crew shortages. At the same time, there are the charters that allow the airline to pass through higher fuel costs. So crew shortages are in some way not allowing the airline to optimally benefit from the parts of the business that are insulated from the jet fuel price environment and that is disappointing.

Conclusion

I like the scheduled service-cargo-charter set up that Sun Country Airlines has and I believe that it allows the company to deploy assets based on demand and provides some stability due to the different nature of each of the segments. However, I do not see prioritizing flying in some segments as a sustainable solution to the pilot supply problem. The company has increased pilot pay, which should help in the process of hiring but I feel that with decreases to charter flying which provides a part of the business where the high fuel prices can simply be passed through, the company is making the most out of its available staff but not the most out of the nature of the pass-through businesses.

Additionally, I find the Q2 2022 guidance disappointing. Fares should be at record highs and many airlines are expecting that regardless of the fuel price environment margins will be strong but Sun Country Airlines has guided for a disappointing quarter ahead in my view. That in part might be caused by the fact that the airline already was profitable in previous quarters, but also because the company is transitioning its cost structure where pilots are paid more and aircraft are being owned or brought under financial lease. The big question is whether the demand environment remains as robust as seen today and whether Sun Country Airlines can grow its fleet and staff to turn growth into profits. The airline has a lot of potential, but also depends on scaling up operations to unlock further scale benefits because the current demand-and-cost environment is not what’s going to unlock that potential.

Be the first to comment