PM Images/DigitalVision via Getty Images

Mativ Holdings, Inc. (NYSE:MATV) signed several large acquisitions very recently, which significantly pushed the revenue growth up. In the future, I would be expecting a decrease in sales growth, however the increase in EBITDA margins thanks to the new acquisitions was probably underestimated by the market. Besides, if the company continues to acquire other targets, synergies and cross-selling could be fantastic catalysts for future free cash flow. Even considering risks from inflation, supply chain problems, or new environmental laws, Mativ is a stock to follow very carefully.

Mativ Holdings

Mativ Holdings is a global performance materials company offering highly engineered films, papers, nets, and other products using resins, polymers, and other specialty applications.

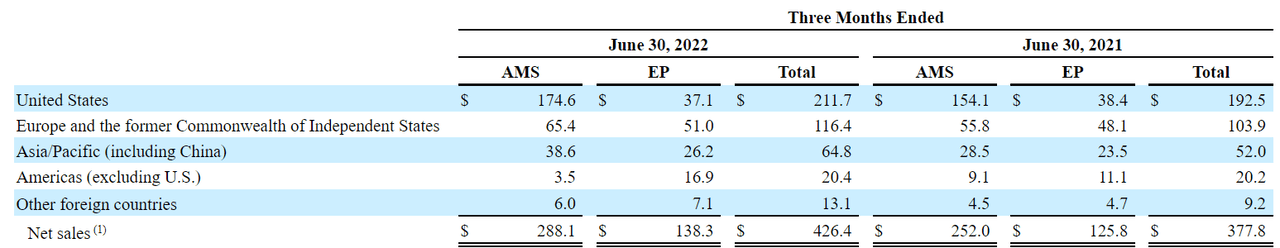

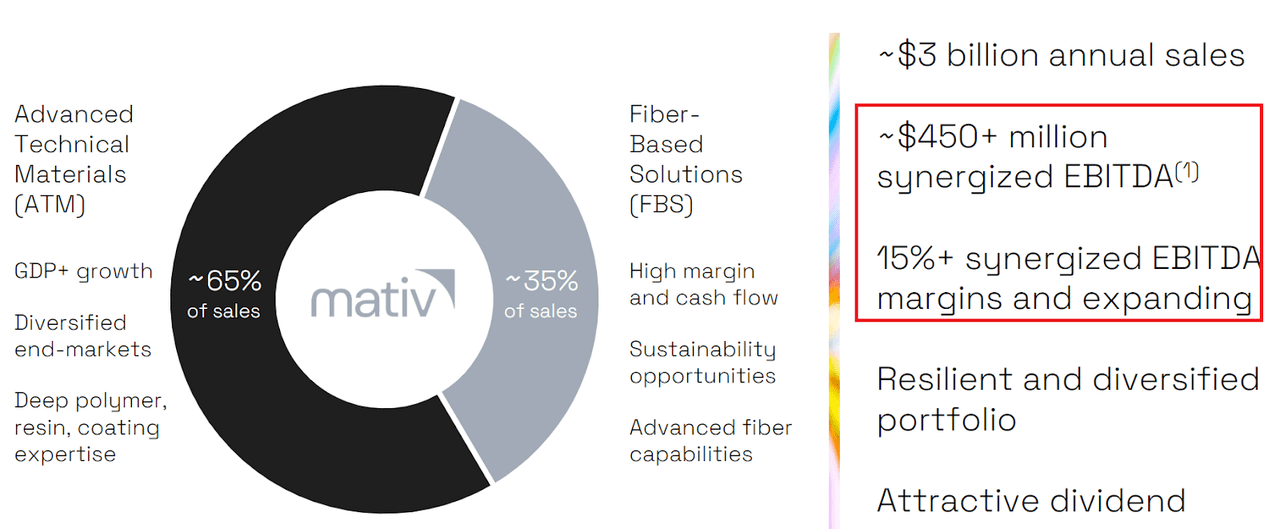

65% of the company’s revenue is related to advanced technical materials, and the rest thanks to the sale of fiber-based solutions. Mativ sells products all over the world.

10-q

Mativ is appealing because its business model includes double digit margins and a long list of end-markets. It is well-diversified in terms of clients. Mativ Holdings recently acquired several targets, which is expected to bring more than $450 million EBITDA and significant margin expansion.

Source: Presentation

I believe that the market didn’t really have a look at the potential free cash flow generated by Mativ’s activities. The size of the targets acquired is quite impressive. In my view, the acquisition of Neenah, Inc. and Scapa Group plc will most likely reshape Mativ’s business model.

On March 28, 2022, the Company entered into an Agreement and Plan of Merger to combine with Neenah, Inc.

On April 15, 2021, we completed the previously announced acquisition of Scapa Group plc , a UK-based innovation, design, and manufacturing solutions provider for healthcare and industrial markets for aggregate cash consideration of $630.6 million. Source: 10-q

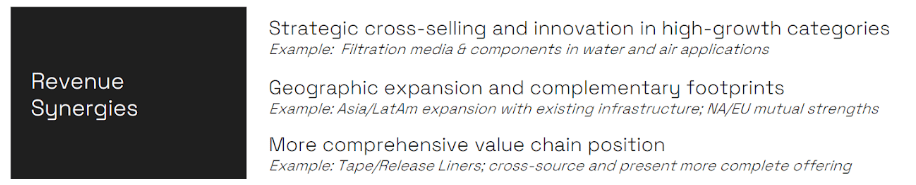

Let’s keep in mind that Mativ Holdings expects to engage in new strategic cross-selling thanks to the new targets acquired. Besides, synergies will likely appear from a more comprehensive value chain position and geographic expansion:

Source:Presentation

Considering The Business Model, In My View, The Debt Does Not Seem Large

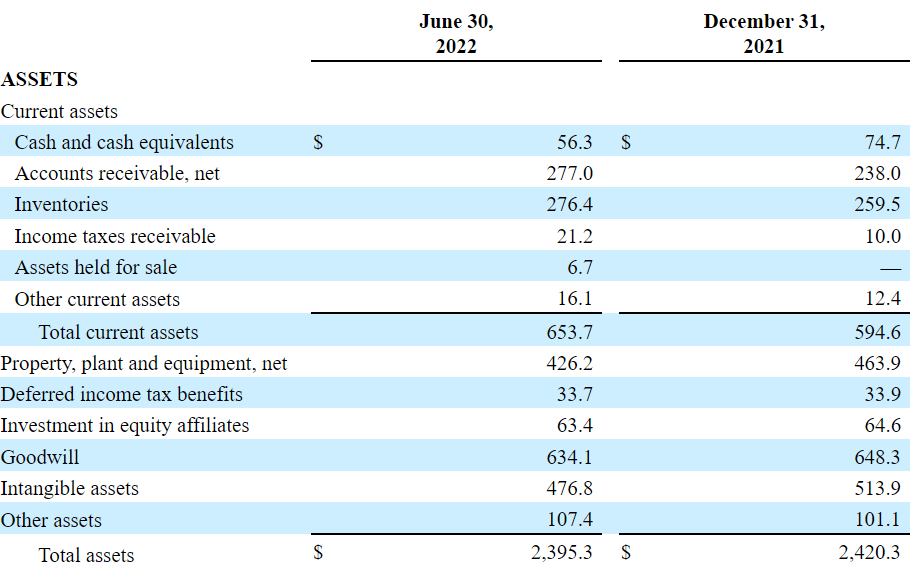

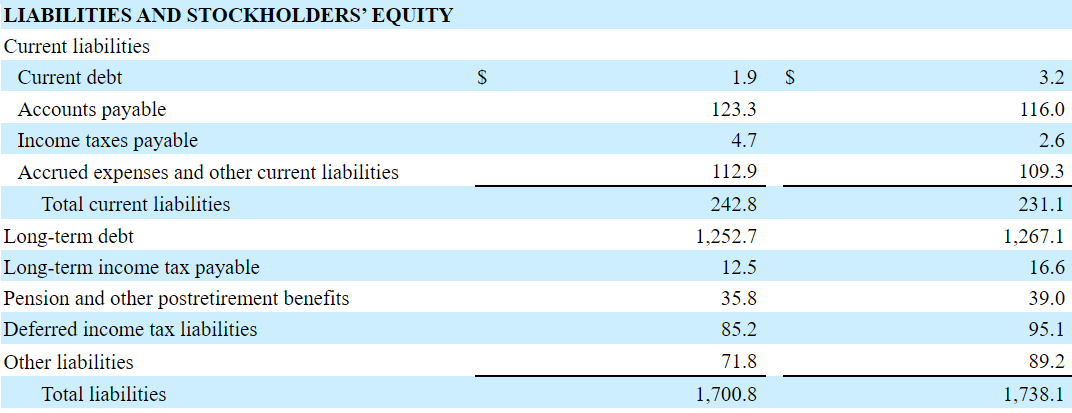

As of June 30, 2022, Mativ Holdings reported $56 million in cash, $2.39 billion in total assets, and $1.7 billion in total liabilities. The goodwill stands at $634 million, which is larger than the current amount of property and equipment. Considering the size of the goodwill, I believe that the most recent acquisitions do matter quite a bit.

Source: 10-q

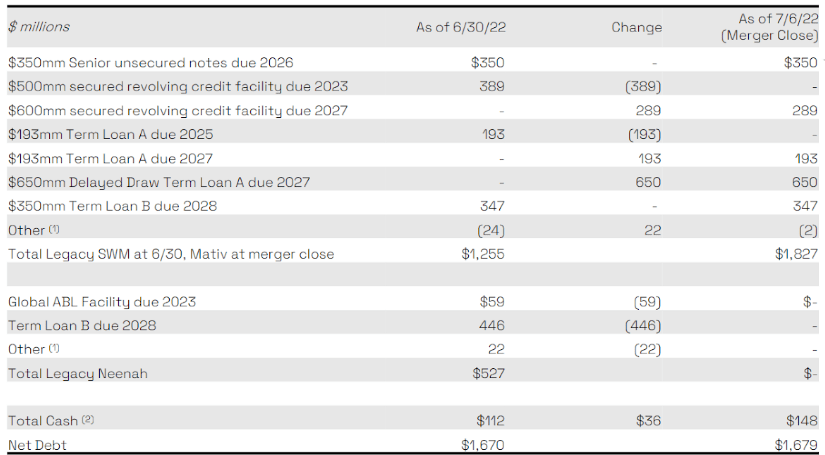

As of June 30, 2022, long-term debt stands at $1.25 billion, which is not a small number. Hence, I took my time to understand the net debt and when the debt payments are due.

Source: 10-q

According to information provided from Mativ, the net debt stands at $1.67 billion, and the largest part of the debt is payable in 2030. With this in mind, I wouldn’t worry much about the debt right now. Mativ has a lot of time left to pay.

10-q

Beneficial Sales Growth Expectations And Growing New Income From 2023

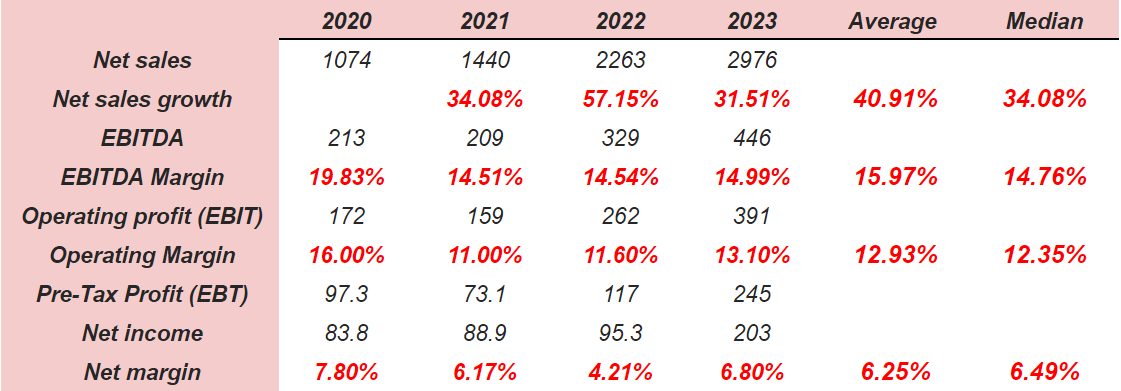

I am talking about Mativ because I saw the expectations of other financial analysts. They are quite impressive. With a median sales growth of 34%, an EBITDA margin of 14%, and net margin of 6.5%, Mativ did retain my attention. Have a look at the numbers delivered by management. I used some of them in some of my financial models.

marketscreener.com

My Base Case Scenario Implies $33 Per Share

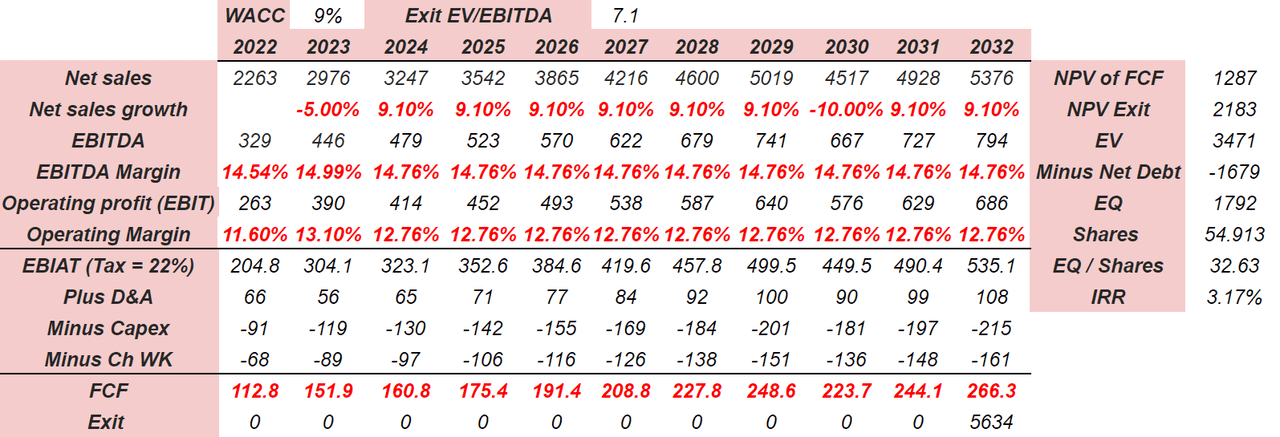

Under my base case scenario, I assumed that the acquisitions would be successful. The company would obtain an EBITDA margin a bit better than that in the past. Mativ would not acquire any more targets, so sales growth would be a bit smaller than that in the last two years.

Experts believe that the global high-performance materials market size is expected to grow at a CAGR of 9.1% from 2021 to 2030. With this in mind, I believe that Mativ Holdings could grow at that rate under normal circumstances and without new acquisitions.

The global high-performance materials market size reached USD 71.82 Billion in 2021 and is expected to register a revenue CAGR of 9.1%. Source:High-Performance Materials Market Trend | Industry Forecast by 2030

With the previous assumptions, I obtained 2023 revenue of $2.9 billion and 2032 sales of $5.3 billion. I also included an EBITDA margin of 14%, which is close to the median observed in the past. Besides, with an operating margin around 12%, 2032 EBIAT could stand at close to $534 million. Finally, with conservative D&A, capital expenditures, and changes in working capital, I obtained 2032 FCF of $266 million.

With a weighted average cost of capital of 9% and an exit multiple of 7.1x for the year 2032, the implied enterprise value would be $3.4 billion. If we subtract $1.6 billion for the debt, the implied equity per share would stand at $33, and the IRR would be 3%.

Arie’s DCF Model

Worst Case Scenario

Under my worst case scenario, the synergies will not be as large as expected. Mativ will likely not be able to produce sufficient free cash flow to reduce its net debt. As a result, bankers will not provide management funding to acquire other companies. Let’s keep in mind that the company has to respect certain net debt to EBITDA ratio, which will likely limit what Mativ can and can’t do:

The Company is required to maintain certain financial ratios and comply with certain financial covenants, including maintaining a net debt to EBITDA ratio, as defined in the amended Credit Agreement, calculated on a trailing four fiscal quarter basis, not greater than 5.75x and an interest coverage ratio, also as defined in the amended Credit Agreement, of not less than 3.00x. The maximum allowable net debt to EBITDA ratio will decrease quarterly returning to 4.50x effective as of June 30, 2023. Subsequent to the closing of the Merger, the maximum allowable net debt to EBITDA ratio will be 5.50x, decreasing to 4.50x as of the end of the sixth fiscal quarter following the Merger. Source: 10-q

I also believe that changes in environmental matters are also quite likely. Keep in mind that the company operates in many jurisdictions. One or two governments will likely try to change the environmental laws. In the worst case scenario, new obligations may reduce the EBITDA margins, and reduce the company’s profitability. The stock price could certainly decline.

The Company’s operations are subject to various nations’ federal, state and local laws, regulations and ordinances relating to environmental matters. While the Company has incurred in the past several years, and will continue to incur, capital and operating expenditures in order to comply with environmental laws and regulations, it believes that its future cost of compliance with environmental laws, regulations and ordinances, and its exposure to liability for environmental claims and its obligation to participate in the remediation and monitoring of certain hazardous waste disposal sites, will not have a material effect on its financial condition or results of operations. Source: 10-q

Finally, I am concerned about how inflation and supply chain pressures could affect the company’s future business model. In the last quarterly report, higher energy costs and inflation played a major role in reducing Mativ’s profits:

The impact of inflationary and supply chain pressures were offset by price increases implemented since the prior year quarter. Source: 10-q

The decrease was primarily driven by higher energy costs, while other inflationary pressures also contributed to the decline. These decreases were partially offset by volume growth and price increases. Source: 10-q

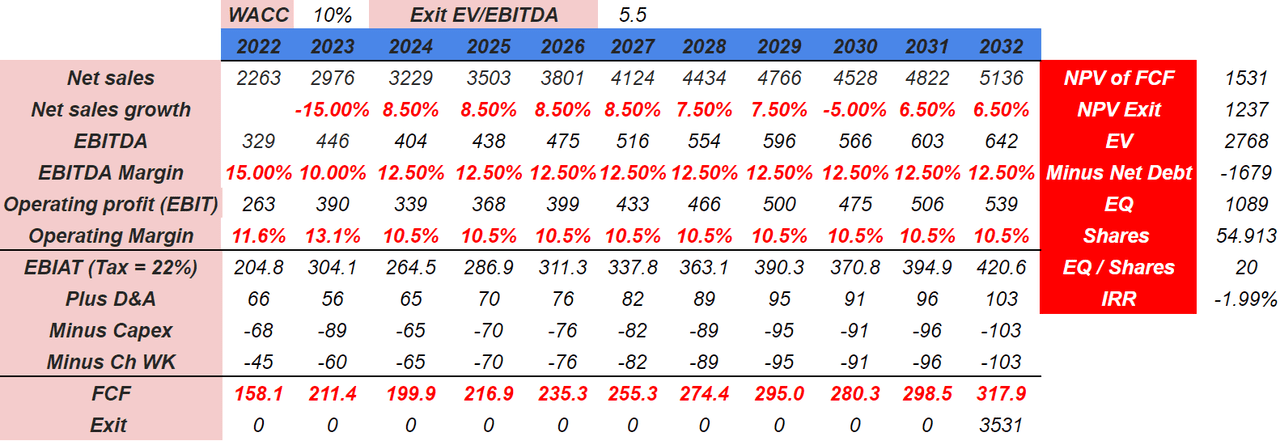

In the worst case scenario, I used a discount of 10%, an exit multiple of 5.5x, sales growth close to 8.5%-7.5%, and operating margin of 10.5%. In 2032, from an EBIAT of $420 million and D&A close to $103.1 million, I obtained 2032 FCF close to $320 million. If we sum both the terminal value and the free cash flow from 2022 to 2032, the enterprise value stands at almost $2.71 billion, and the fair price would be $20 per share.

Arie’s DCF Model

My Best Case Scenario Would Include More Acquisitions, And Would Imply A Valuation Of $70 Per Share

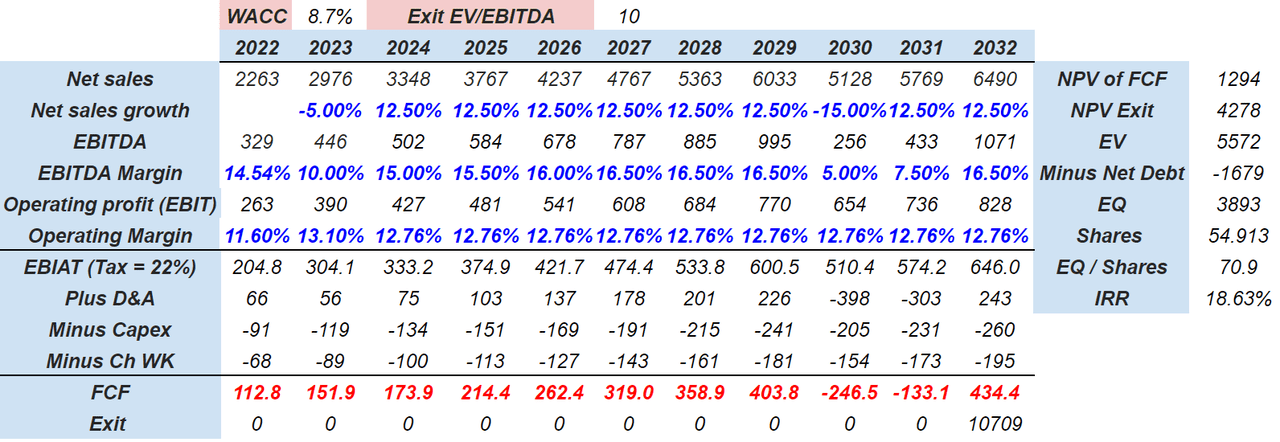

If Mativ successfully reduces its debt thanks to new free cash flow, and banks accept new acquisitions, sales growth could be larger than expected.

With sufficient acquisitions, I believe that net sales growth could be close to 12.5% y/y. Also with an EBITDA margin growing up to 16.5%, I obtained 2032 EBIAT around $645 million. My results also increase from around $110 million in 2022 to close to $435 million. Finally, the enterprise value would stand at $5.5 billion, and the equity per share would be $70 per share.

Arie’s DCF Model

Conclusion

In the last two years, Mativ Holdings reported impressive sales growth thanks to inorganic growth. In my view, if we consider that new acquisitions are not executed, but the former are well closed, Mativ’s fair price could be close to $33 per share. On the contrary, if new free cash flow is sufficient to reduce the total amount of debt, new acquisitions could be expected. In any way, even taking into account risks from failed transactions, inflation, and new environmental laws, I think that the current stock price is too low.

Be the first to comment