da-kuk

Written by Nick Ackerman. A version of this article was originally published to members of Cash Builder Opportunities on September 5th, 2022.

Dividend growth stocks aren’t always the most exciting investments out there. They often aren’t grabbing the headlines; they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. Trust me. There are yield-traps out there – I’ve owned a few that I’m not particularly proud of.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all return back into your pocket from that point forward.

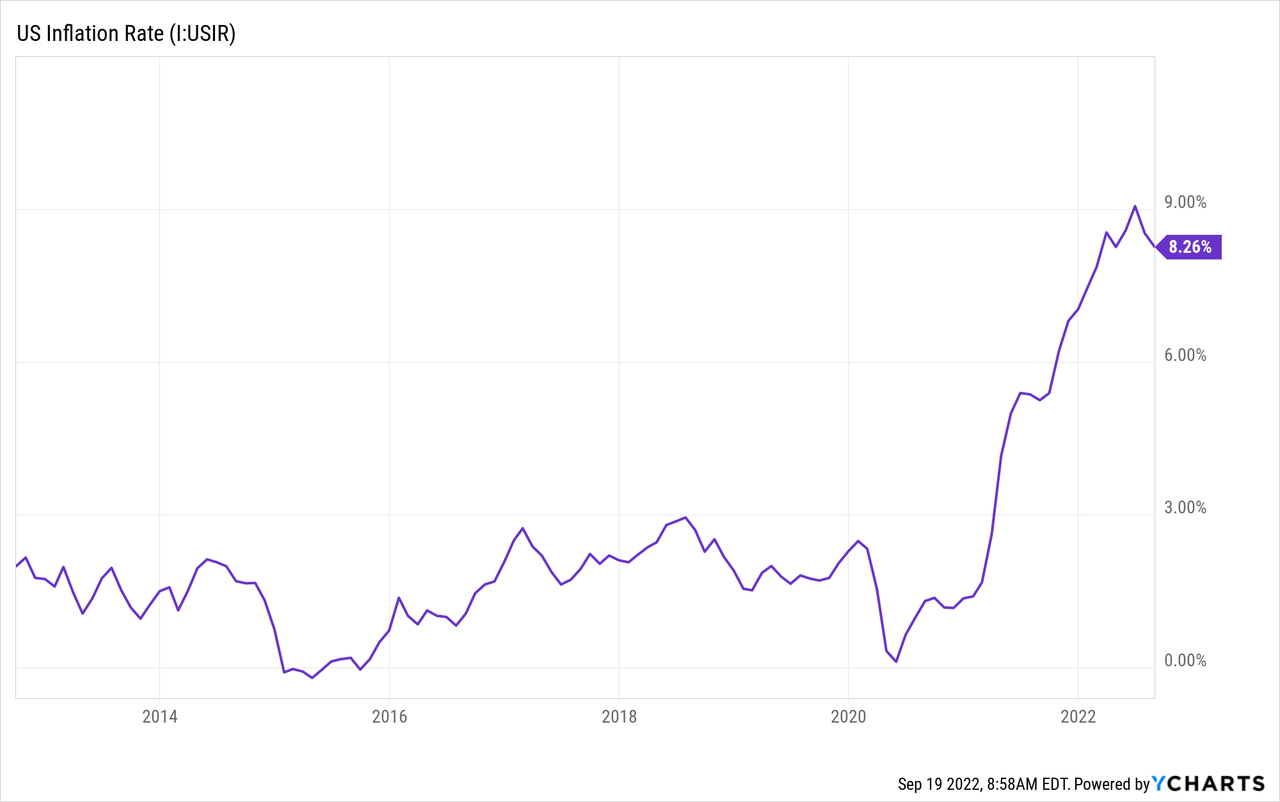

These dividend growth stocks can be even more critical in the current environment as it combats inflation. With the rising prices, an income investor needs a growing income to compensate for the price erosion. Inflation has been a key theme of 2022.

We see that inflation had cooled just a bit before this latest reading. That doesn’t mean it wasn’t still remaining extremely elevated. At this point, we still have the Fed remaining aggressive towards lowering the inflation in the U.S. With Powell speaking at Jackson Hole noting that we could see “some pain,” but it would be to prevent more pain from inflation later on.

Now, with the more recent inflation reading, we saw it above expectations. Meaning the Fed can keep its foot on the gas pedal. That latest inflation report sent the markets spiraling lower.

All of this being said is important to understand my approach to dividend stocks and why screening dividend stocks can be important for income investors. These are September’s 5 dividend growth stocks that might be worthwhile for a deeper exploration. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors but earnings payout ratios, debt and free cash flow are amongst these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends for us for a very long time. In particular, hopefully, they are raising yearly, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 517 stocks at this time — from August’s 480 listings. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more. I then sorted the list by forward dividend yield, highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

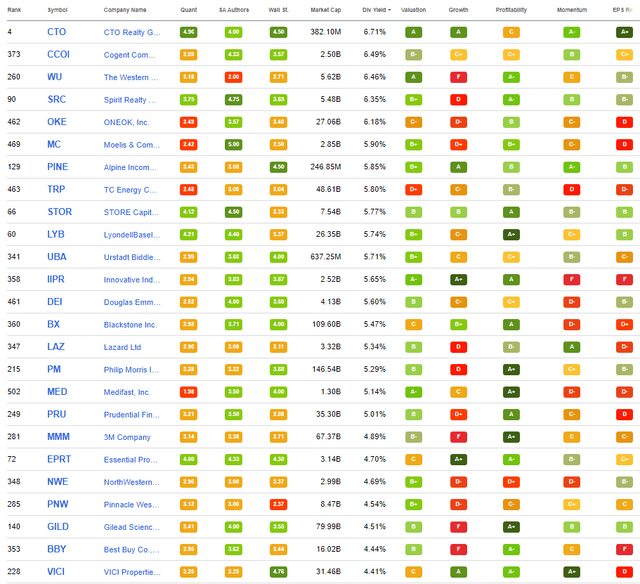

I will share the top 25 that showed up as of 09/05/2022.

Top 25 From Screening (Seeking Alpha)

For this month, we will be looking at CTO Realty Growth (CTO), Cogent Communications Holdings (CCOI), The Western Union Company (WU), ONEOK (OKE) and Moelis & Company (MC).

We are skipping out on Spirit Realty (SRC) due to the cut in the dividend, reverse split and lack of dividend growth since that time. However, they did raise in their latest quarter finally, which is something probably worth exploring, but not for today’s article.

CTO Realty Growth 6.71% Dividend Yield

This is an incredibly coincidental name to have showing up. I would have otherwise never heard of this name unless I looked at Alpine Income Property Trust (PINE). PINE was brought up in a previous screening, as it showed up again here, but others were higher yielding. Therefore, it isn’t included in looking at this month’s top five.

These two REITs are connected because PINE is managed by CTO externally. PINE was also spun off from CTO. CTO holds a sizeable stake in PINE, so the success of PINE and CTO are fairly well aligned. More so than what we could otherwise see in some other externally managed cases.

CTO is larger than PINE in terms of market cap, but not overwhelmingly so. We are still looking at a small operation at a market cap of $382.10 million. They have 22 properties that are 94% leased. They’ve increased their Core FFO and AFFO full-year guidance. They also recently completed a 3-for-1 stock split. While that doesn’t change anything fundamental about the REIT, it also suggests they are moving in the right direction.

This is a higher-yielding position that continues to grow its dividend. The latest was a 1.8% increase to $0.38 from $0.37333. That works out to an increase of 14% over the prior year when split-adjusted. That alone, in my book, makes it a position that’s probably worth giving a deeper look.

Cogent Communications Holdings 6.49% Dividend Yield

Since this posting, CCOI and T-Mobile (TMUS) announced a deal that CCOI would be acquiring the wireline business of TMUS. While it seemed like it might be quite favorable at first. They were getting these assets for $1 and paid for transit services. However, an analyst noted that this business was losing money before and will likely continue to generate losses despite these payments to CCOI. Therefore, with this latest uncertainty thrown into the stock, I’ve moved my buy target down once again, to around $45.

CCOI is a position we’ve looked at many times since starting this regular screening. It is also a position on my watchlist, and we somewhat recently had locked up some option premium after selling puts that expired worthless.

However, since then, the stock has reported its earnings, and the shares have declined. That has some to do with the overall market, but the earnings also weren’t too impressive either. We’ve discussed previously that the dividend coverage here remains tight. Slower revenue growth in the latest earnings could have contributed to some of the latest caution and pullback in the shares too.

Despite this, they raised their dividend right on cue, as they have done for many years. The latest raise was a 2.8% increase. That might seem rather small, but it represents a 12.42% increase year-over-year.

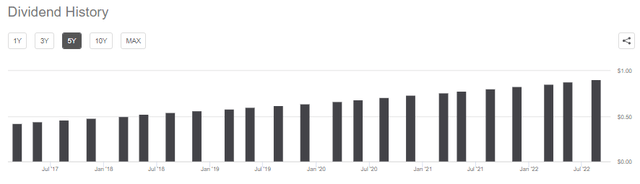

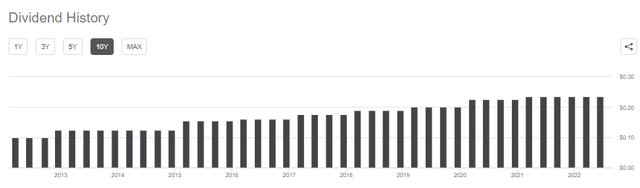

CCOI Dividend History (Seeking Alpha)

We are certainly in some tumultuous times, but I’ve become more cautious after the latest earnings report. This one was always a bit more of a speculative type of position, but I would be looking at a buy target of around $50 now. That’s where I’d feel more comfortable. One way to achieve this could be utilizing the selling of cash-secured puts once again.

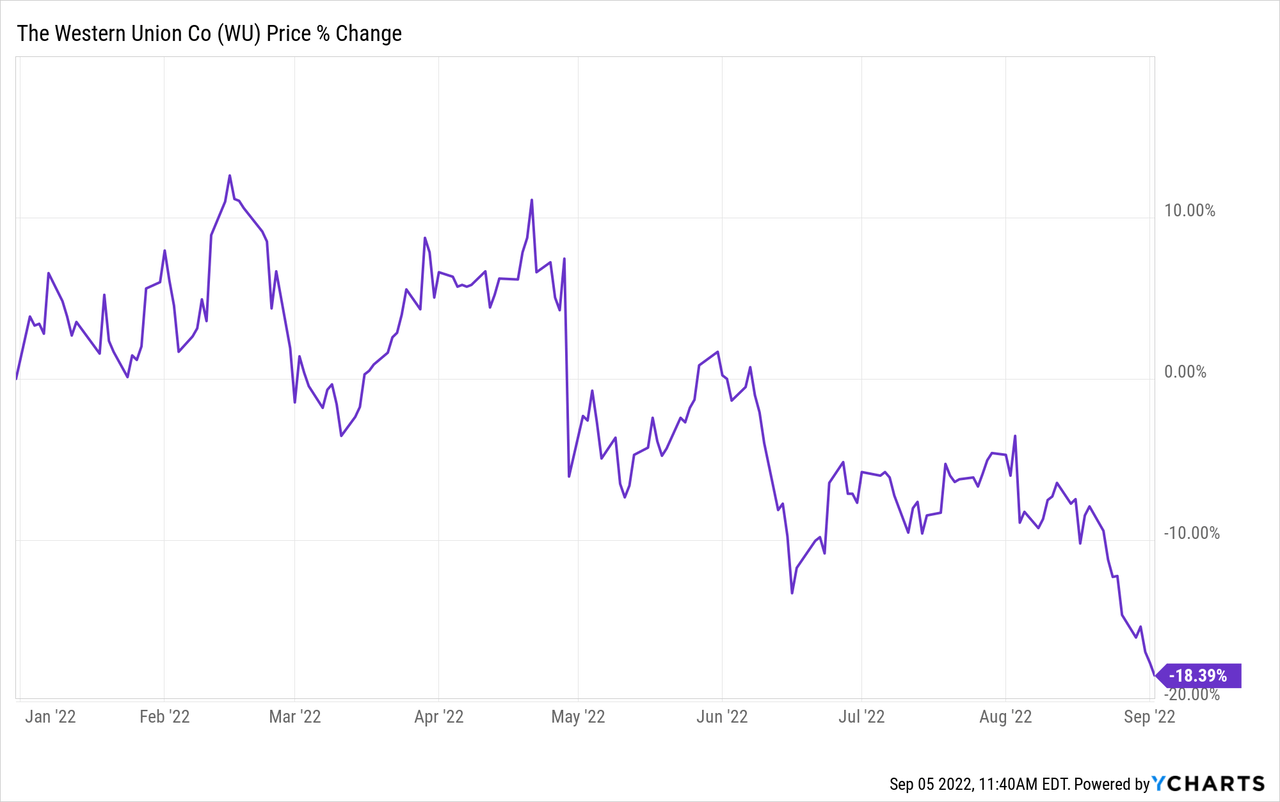

The Western Union Company 6.46% Dividend Yield

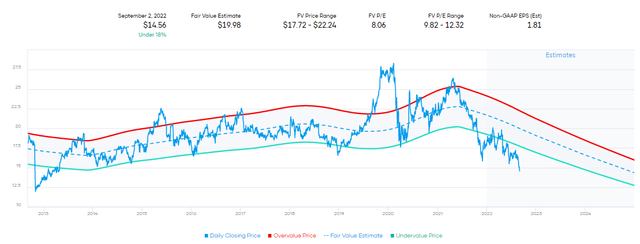

This is another name we regularly run across when running this screen. This time the yield continues to push higher. It’s in a similar boat as CCOI and really the rest of the market. The yield is getting elevated due to declines in its stock price. The stock has lost over 18% on a YTD basis, which isn’t too bad, relatively speaking.

Ycharts

As we noted previously, they have frozen their dividend at the current amount. At least that means they haven’t cut, and it doesn’t appear that would even be necessary with a dividend payout ratio of 41.05%.

WU Dividend History (Seeking Alpha)

That being said, growth is estimated to be quite low over the next several years. For 2022, analysts expect a decline in EPS of 17.5%, then returning to 1.39% growth in 2023 and 5.24% growth in 2024. Heavy competition into their money transfer space seems to have stalled their business.

The valuation based on historical P/E seems to suggest other investors are leery of investing in this name. While this then presents the counterargument that WU is cheap at this time, I remain skeptical about WU overall.

WU Fair Value Estimates (Portfolio Insight)

ONEOK 6.18% Dividend Yield

OKE has also been a recurring name on our list in the last several months. June was the last time we covered this name by providing some commentary. As a former MLP turned C-corp, they will issue a 1099 and not a K-1 form. That can be seen as beneficial for some investors.

At the same time, investors can still benefit from the return of capital in the distributions. ROC can be utilized as a way to defer tax obligations for investors as it reduces an investor’s cost basis instead of being taxable at the time of receipt. For 2021, 61% of the distributions were taxed as ROC. The remaining 39% was taxable.

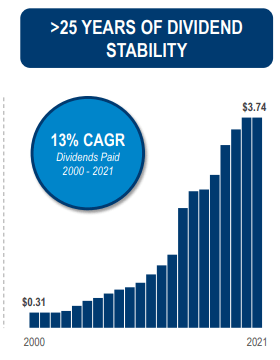

This one has been a beneficiary of elevated energy prices, pushing the stock price higher. However, it hasn’t needed higher energy prices to provide consistent dividends to investors. That includes the 2020 crash in energy prices, where the price for a barrel of oil went negative briefly. They are focused on natural gas, so that helped provide some stability in earnings. Since 2020, the dividend has been stuck on pause at $0.935 per quarter.

OKE Investor Presentation (ONEOK)

With EBITDA and EPS expected to keep growing, that should resume the dividend growth at some point. The latest earnings report posted on August 8th, 2022, was a positive one highlighting this growth. There was an increase in net income of 21% and an 11% increase in adjusted EBITDA.

Moelis & Company 5.90% Dividend Yield

We finally have MC, this is one we touched on in May, but it did come up in July’s screening too. This is an investment banking and brokerage advisory firm. They emphasize “expert capabilities in M&A and strategic advisory, capital structure advisory, capital markets and private funds advisory.”

Considering the market trend overall, these financial types of stocks are generally at the mercy of those declines. Conversely, it should also benefit from a rising market too. I believe that’s precisely why we saw some massive special dividends paid over the years.

MC Dividend History (Seeking Alpha)

MC could reward shareholders through dividends because we were in a strong bull market for most of this period. That meant assets and M&A would have been generally strong. They also were growing their regular dividend. Some of the wind in their sails was removed in 2020, but they quickly raised their dividend back.

While I want to focus more on stocks with strong track records of growth in the dividend, I also think that MC shows that it was able to be flexible to get through a tough period. They choose to cut the dividend to provide greater balance sheet flexibility. The regular quarterly is now $0.10 higher than the $0.50 they were paying pre-COVID.

The payout ratio at this time is quite elevated since the forward EPS is projected at $2.83. Given the $2.40 in expected dividends over the next twelve months, we have come to a payout ratio of nearly 85%. After this tough year, analysts do expect earnings to rise once again. That would help reduce the elevated payout ratio. Suffice it to say, I wouldn’t be expecting any specials anytime soon.

Be the first to comment