niphon

Investment Thesis

Donaldson Company’s (NYSE:DCI) stock is up ~10% since our last article. The company’s sales benefited from the strong end markets and pricing actions in FY22. The pricing actions taken in FY22 are expected to carry over into FY23, which should support the revenue growth of the company. The volumes in Aftermarket and Aerospace & Defense businesses should benefit from the strong demand and recovery in commercial airlines which should more than offset any slowdown in on-road and off-road business. DCI plans to improve its profitability by focusing on higher-margin projects. This along with pricing action and cost control measures should help margins in FY23. Valuations are cheap.

DCI Q4 FY22 Earnings

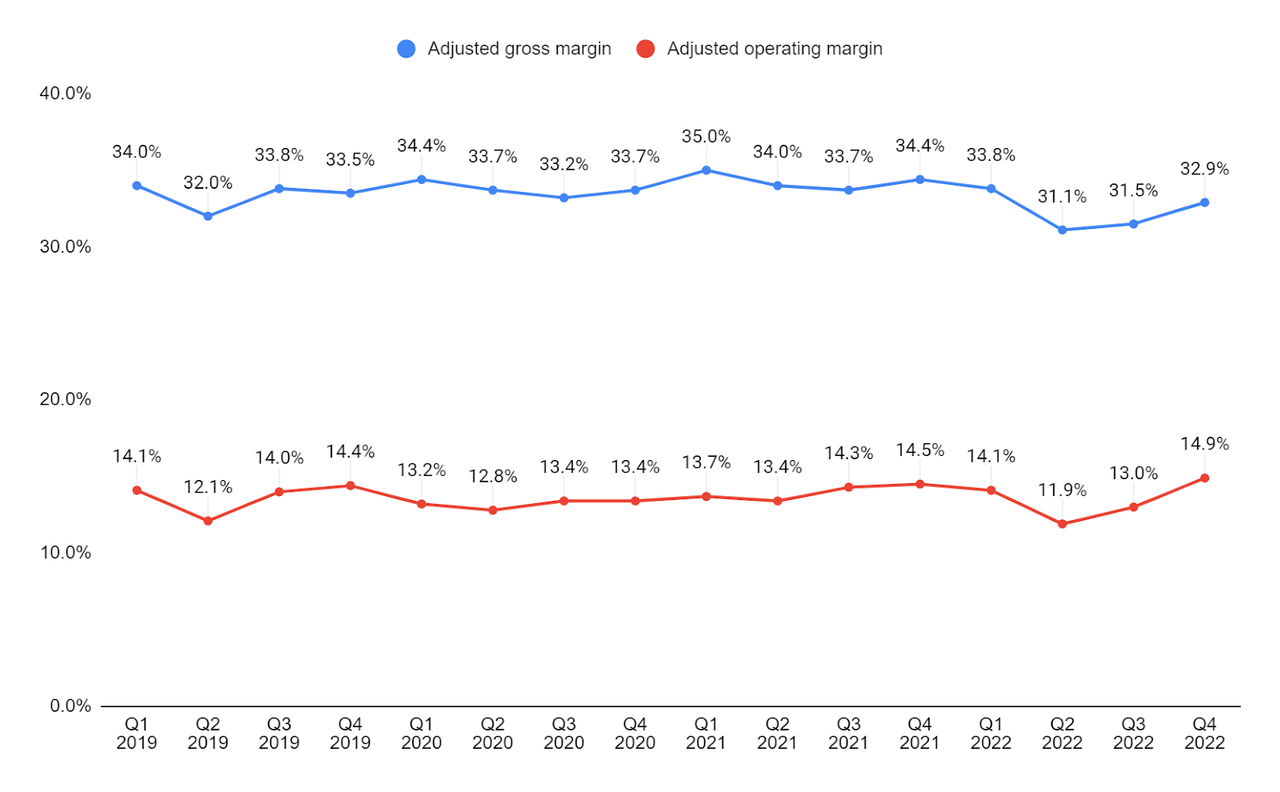

Donaldson recently reported mixed fourth-quarter FY22 financial results, with EPS in line with estimates and better-than-expected revenue. The company’s revenue in the quarter grew 15% Y/Y to $890 mn (vs. the consensus estimate of $880.24 mn). The adjusted EPS was up 27% Y/Y to $0.84 (vs. the consensus estimate of $0.84). The sales growth was driven by a 12% contribution from pricing and 10% from volumes, partially offset by a 7% negative impact from unfavorable currency translation. The adjusted operating margin in the quarter was up 40 bps Y/Y to 14.9% as operating expense leverage outweighed gross margin pressure. The gross margin was down 150 bps Y/Y to 32.9%. The improvement in adjusted operating margin and lower share count led to a 27% Y/Y growth in adjusted EPS.

Revenue Outlook

In Q4 FY22, the company saw a modest improvement in the supply chain constraints, including chip shortages. This led to an increase in sales by 18% Y/Y in the Engine Products segment. The sales in Off-road, Aftermarket, and Aerospace & Defense businesses grew in double-digits Y/Y. The Aftermarket business benefited from the growth in Exhaust and Emission business in Europe. The Aerospace & Defense business grew with the strength of replacement parts as commercial aerospace is recovering. However, the sales of the On-road business dropped by a low single-digit due to the weakness in the Asia-Pacific region. The Engine Products business in China was down 6% Y/Y due to the shutdown of plants for two weeks in China, resulting from COVID-19 lockdowns. The company is expanding its independent channels of the Engine Aftermarket business to increase its presence in underrepresented regions such as Mexico and Brazil.

The sales in both Off-road and On-road businesses are expected to decline by the low single digits due to the strategic exit from certain low-margin programs. The company is focusing on projects with higher margins to improve its profitability. This should impact sales negatively in the near term but should improve profitability along with increasing sales in the long term. The volume growth across both businesses, i.e., Off-road and On-road are expected to slow in FY23. In the off-road business, the volumes related to the new emission program in Europe are expected to have peaked in FY22. This should result in a slowdown in volumes next year. Even though the supply chain constraints are moderating, the On-road business should remain impacted to some extent in FY23. This should be offset by mid-single-digit growth in the Aftermarket and Aerospace & Defense businesses. The demand in the Aftermarket business remains robust with the high levels of utilization of vehicles. The company’s strategy to expand its Aftermarket business in the underrepresented region should also help gain market share. The Aerospace & Defense business sales are expected to be supported by the strengthening commercial aerospace industry, which remains below pre-COVID levels. Even though the business in the APAC region, especially China is still getting impacted by Covid, I believe the situation should improve next year and the company has good long-term plans in China which are expected to drive market share gains and growth.

The Industrial segment sales increased 10% Y/Y last quarter driven by growth in industrial dust collection, new equipment, and replacement parts. Sales of industrial filtration solutions grew by 14%, mainly driven by industrial dust collection new equipment and replacement parts. DCI’s process filtration sales benefited from new program wins. Sales of Gas Turbine Systems increased by 39% bolstered by the timing of replacement parts sales in EMEA. Sales of special applications were down 17% due to the COVID-19 shutdowns in China impacting disk drive sales partially offset by growth in venting product sales.

In the Industrial segment, the sales are expected to be driven by the strong demand for dust collection and Process Filtration products and the contributions from the three acquisitions made in FY22. In the fourth quarter, the company acquired Purilogics to expand its presence in the Life Sciences sector. Purilogics’ technology platform, when integrated with DCI’s technology, should allow DCI to bring a broad portfolio of purification tools to the market.

Looking forward, the pricing actions taken by the company in FY22 are expected to carry over into FY23 and contribute significantly to the revenue, especially in the first half of FY23. The pricing benefit in 2H FY22 was twice that in 1H FY22, which should result in stronger gains earlier in FY23. The company will also be implementing its regular price hike that is normally done each year, but the majority of the pricing benefit will likely be from the price hikes already implemented in the back half of FY22. So, there is good visibility in terms of pricing benefits in FY23. The sales guidance range for FY23 is between 1% and 5%, which includes pricing benefits of ~6% and ~4% headwind from currency translation.

The company is positioning itself to withstand the economic downturns by utilizing its global footprint to circumvent supply chain issues, capitalize on replacement parts business, manage costs, and utilize its balance sheet to pursue opportunities in the “Advance and Accelerate” businesses and Life Sciences sector. DCI has been cementing its position as a leader in technology-led filtration by meeting customer demand by working down its backlog and inventory. This bodes well for the company’s long-term growth.

Margins

In the fourth quarter of FY22, the company saw some stabilization in commodity costs and a slight easing of global logistics and labor pressures. However, the gross margin in the quarter remained under pressure as it declined 150 bps Y/Y to 32.9%. While the company is offsetting inflation in commodities and freight through price hikes, other transitionary factors such as inefficiencies, labour turnover, and training costs as well as sales mix are dampening the margins. The operating expense leverage outweighed these pressures, resulting in an improved adjusted operating margin.

Adjusted gross margin and adjusted operating margin (Company data, GS Analytics Research)

Looking forward, the company’s margins in FY23 should improve, driven by gross margin expansion and operating expense leverage. With the moderation in input costs, the gross margin should improve. The company is also working on managing its expenses and operating efficiently during the recessionary environment. This along with gross margin improvement should benefit the adjusted operating margins. Additionally, the company is focusing on improving its profitability by investing in higher-margin projects to improve the mix. The adjusted operating margin is expected to be between 14.5% and 15.1% in FY23, which is a good improvement versus FY22’s 13.5% operating margins. This along with a modest improvement in revenues should help the company post good earnings growth.

Valuations & Conclusion

The stock is currently trading at 16.92x FY23 consensus EPS estimate of $3.00, which is lower than its five-year average forward P/E of 23.25x. Despite the concerns of the broader market slowdown, the company should be able to grow its revenues in the current year, helped by pricing benefits and growth in certain end-markets like aftermarkets and aerospace. In addition, the company should see a meaningful increase in margins thanks to its pricing actions. This coupled with lower valuations makes DCI a good buy.

Be the first to comment