imaginima

Thesis

On Friday, the G7 countries decided to set a price cap for Russian oil. Although exact details are still pending, it is already clear that the goal is to reduce Russian oil revenues and lower the purchase price for G7 countries and other participating countries. In this article, I will explain why I believe there is no chance this will work. Instead, there will be a massive arbitrage and export opportunity for stocks in XLE.

The buyer cartel

So far, we have seen in the oil market always a seller cartel (OPEC+), which agrees on how high the production quantities should be, on the one hand, not to let the world economy crash, on the other hand, the profit remains high. The now-decided price cap heralds a new chapter because buyers try to fix the price. One could also say it is an attempt to take power away from the seller cartel and transfer it to the buyers.

Something similar happened on a small scale in Germany recently: Some supermarkets did not want to accept the price increases of Coca-Cola (KO) and threatened to take their products out of the assortment. This case has two possible outcomes: Coca-Cola backs down, its margin falls, and the supermarkets win. Or: Coca-Cola does not back down; its products are removed from the shelves. Everyone loses. There is less revenue for Coca-Cola, and the supermarket’s customers can no longer buy a popular product.

The G7 countries are trying something similar: Russia could buckle, and their profit margin would drop. This would be a success for the G7 countries, which want to weaken Russia. However, Russia could also not comply and instead reduce or stop oil production – thus putting the market under stress.

Russia’s answer

The answer came quickly and clearly. Russia announces it will not make deliveries to any countries participating in this price cap. Of course, this could be a bluff, so we’ll see.

Companies that impose a price cap will not be among the recipients of Russian oil. We simply will not cooperate with them on non-market principles.

Kremlin spokesman Dmitry Peskov

The problem for G7 countries is that the success of this attempt does not depend on themselves but on countries like India and China. These and many other countries have recently increased their oil imports from Russia. Moreover, they are already receiving Russian oil at reduced prices.

Market tightness is on Russia’s side

The most obvious and likely risk with a price cap is that Russia might choose not to participate and instead retaliate by reducing exports. It is likely that the government could retaliate by cutting output as a way to inflict pain on the West. The tightness of the global oil market is on Russia’s side.

J.P. Morgan analysts

Of course, India and China would also like to have even cheaper oil. But they know very well that they are already in a good position with regard to their competitiveness, especially against Europe. Both countries have excellent diplomatic relations with Russia, which they do not want to risk. Another reason why the whole thing cannot work is that it is not in the interest of the other OPEC+ countries either.

Let’s assume the whole thing would work; Russia agrees and sells oil, e.g., $50 per barrel, in the future. The world would want this oil, putting price pressure on the other OPEC+ producers. Of course, Russia does not have the capacity to supply the whole world, but there would be a certain effect. This is precisely the opposite of the goal of OPEC+. They have formed their cartel to determine production and prices better and not to put pressure on each other’s prices until the margin is almost non-existent.

What if the whole world unites against Russia?

This is very unlikely, as Russia would have OPEC+ on its side. In a battle of who will last longer, buyers’ cartel vs. sellers’ cartel, the sellers would have advantages since there would be a worldwide oil shortage within a short time. India and China certainly have no interest in this.

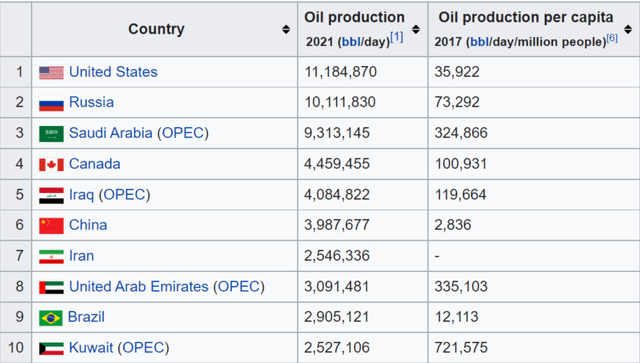

Russia was the world’s second-largest oil producer in 2021, producing 10M barrels daily. You cannot pressure a country that produces 10% of the world’s oil. There is no substitute; oil prices would shoot through the roof in that case. JPMorgan’s analysts wrote the price per barrel could soar to $380.

So what is going to happen now?

The most likely outcome is that G7 countries will try to push the price cap through and convince as many countries as possible to join in. This attempt is doomed to fail. India and China are partners of Russia and have no interest in price wars, especially since they already get discounts. OPEC+ has no interest, either. For some time now, we have seen a slow change of camp from Saudi Arabia, away from the USA, towards the BRICS states.

The strange thing about all this is that the US hardly imports Russian oil. Canada none at all, and Europe wants to get away from it. But for Europe, of course, it will not happen that fast. The consequence of this price cap will be that oil deliveries will now stop even quicker than planned. So Europe needs a replacement.

And we have already seen a particular development for months: oil (and gas) importers are suddenly exporting to Europe. What happens is that Russian oil and gas travels halfway around the world instead of coming directly to Europe via pipelines. Countries like India are lining their pockets, and the losers are (as almost always at the moment) European countries. But the USA is also an importer, despite its enormous production. In recent months, oil and diesel exports to Europe have increased. A huge arbitrage business is going on, and everyone wants to participate. US oil companies will profit enormously from this and probably for years. For example, they can import more oil from Canada or Saudi Arabia and send it directly to Europe. It is also possible that they will find ways to continue trading with Russia and not participate in this price cap themselves.

Therefore, one more theory at the end: The USA hardly imports Russian oil but nevertheless favors this price cap. Perhaps they know what the Russian response will be and that trade with Europe will reach a standstill. This opens the door for more and more of their exports to Europe.

Be the first to comment