GoodLifeStudio

Thesis

We updated investors in our June article on Airbnb, Inc. (NASDAQ:ABNB) that ABNB was at a near-term bottom, and its valuation was reasonable after the collapse from 2021. Moreover, even though it fell further to its July lows, the support zone held resiliently, as it recovered by nearly 25% toward its August highs since our article. As a result, ABNB outperformed the broad market recovery, despite its recent pullback.

We surmise that Airbnb has proved the resilience and adaptability of its business model through the pandemic and post-reopening. Moreover, given the pervasiveness of its operating reach and the ease of host onboarding, it has mitigated the worsening macro headwinds, as it posted a robust Q2 performance.

Therefore, we believe the market anticipated a solid performance despite the recessionary themes, as ABNB staged most of its recovery pre-earnings. However, ABNB has given back most of its August gains. Nevertheless, we are confident that ABNB is unlikely to break below the support zone it formed in June/July.

Notwithstanding, our analysis suggests that the current entry level is not ideal, coupled with a more well-balanced valuation. Therefore, we believe it’s appropriate for investors to consider a deeper pullback before adding more positions.

Accordingly, we revise our rating on ABNB from Cautious Buy to Hold.

Reopening Tailwinds Are Levelling Off

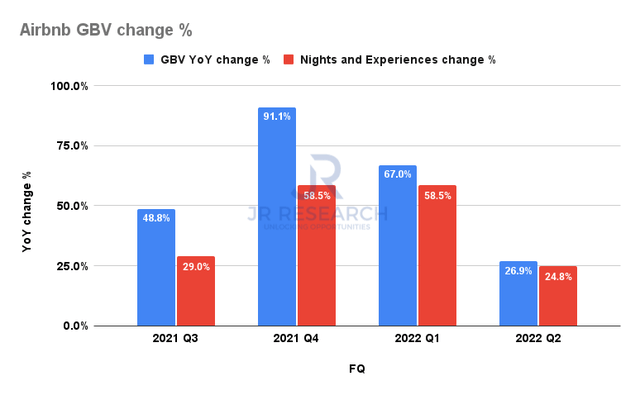

Airbnb GBV change % (Company filings)

Despite posting a record Q2 performance in its revenue, investors need to consider that its reopening tailwinds have normalized, as seen above. As a result, Airbnb’s gross booking value (GBV) increased by 26.9% in Q2, down from Q1’s 67% uptick. Notably, the deceleration was also driven by the slowdown in the growth of nights and experiences booked, as it posted an increase of 24.8% in Q2, down markedly from Q1’s 58.5%.

Notwithstanding, we are not surprised by the moderation, as the company lapped easier comps from the COVID lockdown days in its previous quarters. Therefore, investors need to adjust their expectations moving ahead as Airbnb’s growth normalizes.

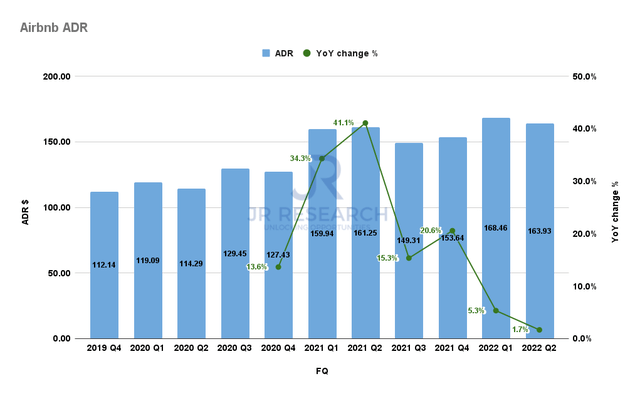

In addition, Airbnb’s average daily rate (ADR) growth has also moderated further as guests returned to cross-border and urban travel. Despite that, its price leadership, which benefited from the inflationary tailwinds, helped keep its ADR well above its pre-COVID highs, as Airbnb posted an ADR of $163.9 in Q2, up 1.7% YoY.

We believe the tailwinds from longer-term stays seem to have moderated significantly. Therefore, while Airbnb should be able to maintain its price leadership, demonstrating its platform stickiness, its ADR growth should contribute lesser to GBV growth moving forward.

Europe’s Recovery and China’s Outbound Travel Could Spur A Re-rating

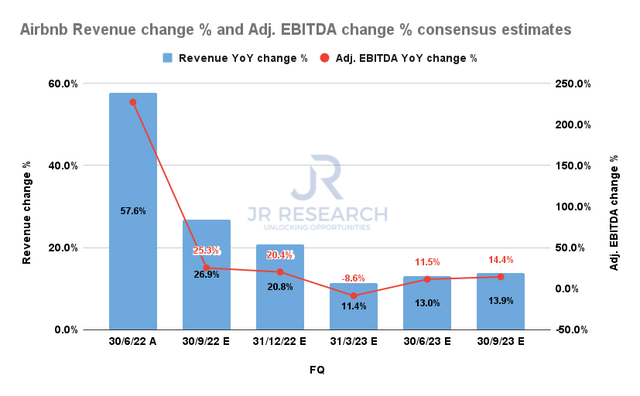

Airbnb revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Consequently, the consensus estimates (bullish) indicate that Airbnb’s growth should moderate through FQ1’23 before stabilizing. As a result, it’s also expected to affect the growth of its adjusted EBITDA, suggesting a much slower growth cadence.

However, we postulate that two medium-term growth drivers could emerge to help the company reaccelerate its growth. Management highlighted that Europe’s malaise had been a considerable headwind to its growth in Q2. Coupled with the surging energy crisis in the EU, exacerbated by the ongoing Russia-Ukraine conflict, it has impacted consumer confidence amid an increasing likelihood of a recession. Therefore, an improvement in the macro and political environment in Europe could lift the gloom for Airbnb, helping to drive growth in its critical region.

In addition, management remains confident in the long-term growth drivers from China’s outbound travel in APAC. In the near term, the visibility over China’s COVID headwinds is highly uncertain, significantly impacting the growth in nights and experiences booked for APAC. Management accentuated that the headwinds from APAC reduced its overall growth in nights and experiences booked.

Therefore, a potential move away from China’s zero-COVID policy could help lift the somber sentiments over China’s outbound travel. In addition, pent-up demand from Chinese consumers should help reinvigorate Airbnb’s APAC segment. Hence, we believe these are two critical drivers that could help reaccelerate Airbnb’s medium-term growth and stoke a re-rating.

Is ABNB Stock A Buy, Sell, Or Hold?

ABNB price chart (weekly) (TradingView)

ABNB has pulled back about 10% from its August highs, with most of its recent recovery before its Q2 earnings.

We also gleaned a bull trap (indicating the market denied further buying upside decisively) at its August highs, given the rapid surge from its July lows. Coupled with our assessment of a more well-balanced valuation, we deduce that the entry zone for ABNB is not ideal. Therefore, we suggest that potential downside volatility for ABNB could still be in store to shake off some weak hands before a more robust bottoming process could form.

Despite that, we remain confident that ABNB has staged its medium-term lows in July. As a result, we revise our rating from Cautious Buy to Hold as we await a more constructive entry point.

Be the first to comment