metamorworks

Intro

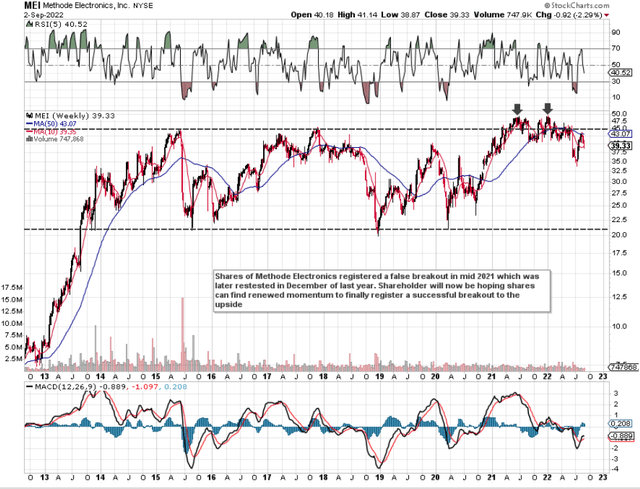

It will be interesting to see if Methode Electronics, Inc. (NYSE:MEI) shares can get back to some solid footing here and retest their recent 2021 highs. Shares registered a marginal breakout last year above long-term resistance but unfortunately, the breakout could not be sustained. This means that investors need to be careful here as the shares of Methode could easily retrace back down to the lower trendline of the multi-year trading range we see below.

Methode Electronics currently pays out a 1.4%+ dividend yield which will not attract income-derived investors in the present climate. However, often, dividend investors make the mistake of not researching the company’s total return potential which many times can supersede the dividend yield by quite some distance. Suffice it to say, a strong dividend yield combined with strong forward-looking fundamentals is essentially the route to successful dividend investing. The company’s quality in essence has to always come first.

Therefore, from this standpoint, let’s delve into the total return potential of Methode Electronics. The stronger the trends we witness in the areas below, the more possibilities that shares can finally break out above that long-term multi-year resistance depicted below.

MEI Trying To Bump Above Long-Term Resistance (StockCharts.com)

Pay Out Ratio

Before we get into Methode’s total return potential, we must first see if the company can grow and maintain its dividend. We get this information using the payout ratio which presently comes in at just under 29% over a trailing twelve-month average from a cash basis and approximately 22% over the same period from an earnings basis. Suffice it to say, MEI does not have an issue with the affordability at present concerning its dividend.

Profitability

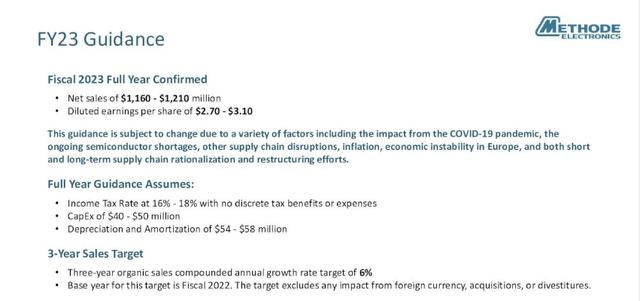

In the company’s recent first-quarter earnings numbers for fiscal 2023, the company reported a bottom-line beat ($0.58 per share) on sales of $282.4 million. Although earnings were well down over the same period of 12 months prior, the Q1 earnings beat and the confirmation of the company’s previous annual guidance was what bulls wanted to see in the report.

What we would say here though is that management’s annual guidance of between $2.70 & $3.10 per share as we see below is on the low end of this year’s consensus estimate ($2.79). Furthermore, consensus has dropped its expectations by approximately $0.09 per share over the past 30 days alone, so we need this trend to change to the upside for a sustained rally to ensue.

Methode Fiscal 2023 Annual Guidance (Seekingalpha.com)

Inflation continues to hit Methode hard on the front end which we witnessed by the lower gross margin number in Q1. Gross margin fell to 21.9% on rising input costs, lower sales, and cost recovery initiatives which to date have not been able to match or surpass elevated inflation on the front end.

Margins really come under scrutiny in times of high inflation due to how earnings can get quickly eroded if measures are not implemented swiftly. Suffice it to say, the ongoing multi-million dollar awards ($90 million in Q1 alone) Methode continues to win have to start impacting top-line sales sooner rather than later to keep the income statement ticking over.

We state this because if we average out Methode’s Q1 net profit of $21.5 million over an annual basis and calculate an adjusted return on equity, we get an adjusted ROE number of 9.44%. The stated trailing number comes in at 10.25% which is also well behind the company’s 5-year ROE average of 13.75%. This ties in with the negative earnings growth trend alluded to above.

From a debt & free cash-flow standpoint, the company remains in solid shape. Shareholder equity continues to rise and the company’s debt to EBITDA ratio came in at 1.3 at the end of the first quarter. Free cash flow came in at $3.1 million for the quarter despite elevated working capital and share buybacks have been earmarked for some time to come.

Suffice it to say, Methode’s financials definitely buy the company time, but the market needs to see better growth in both sales and earnings in order to price shares higher. With some luck, the annual guidance number takes into account (to a substantial degree), the ongoing impacts of Covid in China, the semiconductor supply problem, sustained inflation, and the ramifications of the war in Ukraine. If we see a loosening up in one or more areas, forward growth estimates (buoyed by continued strength in the industrial segment and a recovery in the Auto segment) could quickly be revised to the upside.

Conclusion

Based on Methode’s present valuation (which illustrates that the stock is not undervalued to any great degree), the market needs to see better forward-looking growth rates in the upcoming quarters. The double whammy of lower product sales volume and higher costs must reverse to protect the income statement. Let’s see what Q2 brings. We look forward to continued coverage.

Be the first to comment