Pixland/Pixland via Getty Images

As I had hoped by this time, Primo Water Corporation (NYSE:PRMW) is starting to break out as the company appears to prove it is on track to hit ambitious forecasts and beyond. Strong Q3 performance encouraged Primo Water to increase its 2022 guidance and extend its bullishness out to 2025. This kind of visibility makes Primo Water an attractive, recession-resistant company for the potential macroeconomic headwinds coming ahead.

The Bullish Guidance

Primo Water slightly increased 2022 full-year revenue guidance to $2.22B – $2.24B for a normalized revenue growth rate of 13% – 14%. Guidance for $415M – $425M adjusted EBITDA is in-line with previous guidance. (Note the revenue guidance in Q2 did not clearly distinguish between normalized and organic revenue). Looking ahead, the company also nudged upward its 2024 adjusted EBITDA guidance from around $525M to around $530M and adjusted EBITDA margin of around 21%. Primo Water stuck by 2024 guidance for adjusted EPS to $1.10 – $1.20 per share, net leverage of under 2.5 times and ROIC (return on invested capital) greater than 12%. The company maintained its 2024 revenue guidance at “high-single annual organic revenue growth.” The company’s operational performance facilitated a reduction in expected capital expenditures. Incremental capital investments will go down from $50M in 2023 and 2024 to $30M each year.

In January, Primo Water will give more detail on 2024 expectations and even extend to 2025 expectations. This kind of visibility despite a potential recession around the corner makes PRMW a top 2023 pick for me.

This Recession Will Be Different

During the Q&A (see the Seeking Alpha transcript), an analyst asked management how the next recession would be different for Primo Water; the unstated pretext for the question was the company’s poor performance in 2008 (pre-IPO of PRMW). CEO Tom Harrington relied on two differentiating points: 1) a management team with “muscle memory” and the experience navigating the 2008-2010 period and the pandemic in the U.S. and Europe, and 2) the shift to a pure play water business. Harrington feels the company is prepared to be as flexible as necessary, particularly on the cost side. On the demand side, Primo Water now has a lower cost refill business which gives cost-conscious consumers an attractive hydration option.

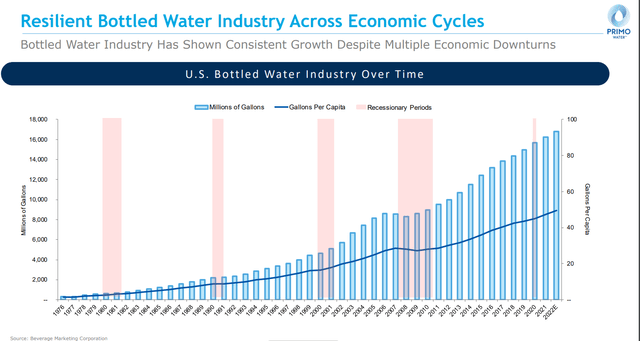

The secular industry trends also favor Primo Water. The company included in its earnings presentation a chart of industry trends from the Beverage Marketing Corporation to demonstrate likely recession resilience. The consistent growth since 2011 is reassuring. Given a coming recession, if it happens, will be more like 2000 – 2001 than 2008-2010, I expect industry resilience to translate to Primo Water resilience. The company’s operational excellence means it should be able to pace and even out-perform industry trends.

Strong secular trends for bottled water support sustained tailwinds for Primo Water Corporation. (Primo Water Corporation)

Profits and Margins

Prime Water continues to exhibit pricing power in its business. Management reported that “customers feedback related to the higher pricing has been minimal as we track this through a combination of metrics, including call center activity, customer retention and customer growth.” Increased pricing helped Primo Water offset the significant impact of inflation including from labor, fuel, and freight. Greater sales volume and expense management combined with pricing to generate a 10% year-over-year increase in EBITDA to $117M in the quarter. Alongside the profit increase, margin increased 80 basis points year-over year to 20%. This inflation resilience may not be as important going forward if inflation has indeed peaked, but at least the pricing power demonstrates the stickiness of the water products and services.

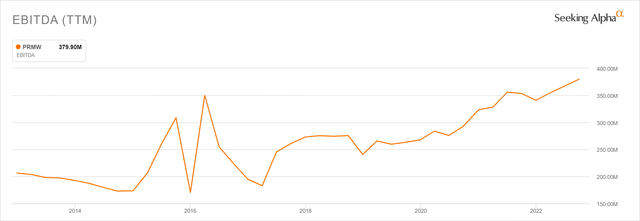

The 5-year chart below shows the momentum in EBITDA since 2020. This general uptrend points to the strong guidance the company is giving through 2024 as the company keeps hitting all-time highs for EBITDA.

Primo Water’s EBITDA is on a promising uptrend. (Seeking Alpha)

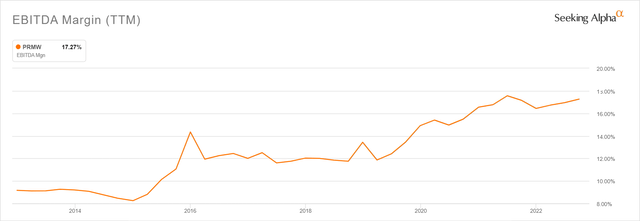

EBITDA margin has also broken out and points to on-going strength in the coming quarters.

EBITDA margins experienced a strong breakout. (Seeking Alpha)

A Tax Tailwind

On September 7th, the U.S. Customs and Border Protection announced it would reclassify hot and cold water dispensers. Changes were also made for water filtration units. The change dramatically reduced the tariff from 25% to 2.7% as of November 2, 2022. Primo Water will pass along the savings to consumers and anticipates a boost in demand from the lower pricing. Consumers will enjoy the benefit once Primo Water works through its existing supply chain inventory taxed at the higher rate. Primo Water will also be able to reduce capex for their rented water dispensers. The company described the benefit to consumers as follows:

“…pre tariff, the opening pricing point for an introductory cooler was just below a $100. That’s really the sweet point for coolers. It’s now a $125 or $130…Now when we work our inventory, we’ll get to the lower tariff rate. We’ll be able to get back to that price point, add promotions, sell even more dispensers, bring more consumers into our product, and then have increased connectivity to our three highly profitable water services.”

In other words, Primo Water will convert the reduction in the tariff into an important support for demand that further bolsters the prospects for the company’s bullish guidance in the next 2+ years.

Costco Takeover

I previously described Costco (COST) as a source of competition for Primo Water. Now, Costco has become a major source of incremental demand in coming years. A 5-year deal makes Primo Water the “exclusive service provider for bottled water delivery services direct to consumer and business members” and accordingly provides another strong support for the long-term bullish story. The Costco deal supports the company’s high single-digit organic revenue growth expectations. The deal also provides operational benefits by increasing customer density and supports the 21% EBITDA margin expectations.

An analyst asked how this deal will be different from an earlier deal Primo Water did with Costco. Harrington explained that in 2016 the company had an inferior “pricing architecture.” Significant improvements in the customer experience from providing OTIF (on-time in full) also give Harrington a “high degree of confidence” that Primo Water will “be able to profitably handle the new customers… at the appropriate revenue and profit levels for the company.”

The exchange made me wonder whether the deal includes any performance-related clauses. I did not see any related SEC filings for reference. Hopefully, more details will surface as the results unfold for this deal. Regardless, tracking the performance of this deal should be a good indicator of Primo Water’s odds for obtaining its bullish forward guidance.

The Trade

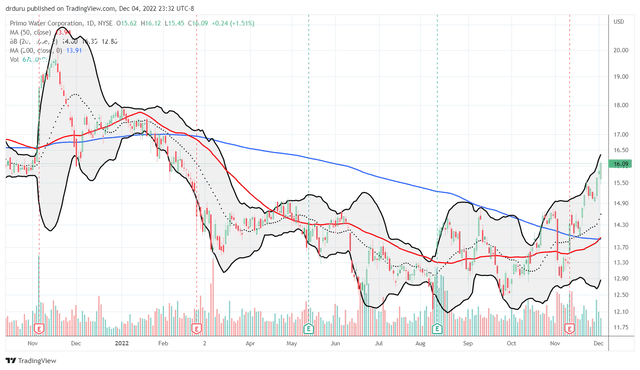

PRMW gained 7.7% after reporting Q3 earnings. The stock has barely looked back since. The resulting breakout above the 200-day moving average (DMA) (the blue line in the chart below) and buying follow-through is a bullish technical development that affirms the underlying bullish fundamental news. As of this writing, PRMW traded at a 10-month high and looks set to challenge its November, 2021 high in due time. If Primo Water continues to execute, I also expect PRMW to challenge the all-time high set in August, 2018 at $20.45. As a target, let’s say a 25% gain in two years; not bad considering the upside for the S&P 500 (SPY) next year will likely be tightly capped by recessionary pressures.

Primo Water Corporation has sustained a bullish 200DMA breakout since reporting Q3 2022 earnings. (TradingView.com)

PRMW could reach previous highs on a rerating for higher valuation premiums. Absent that, delivering on guidance and demonstrating consistent execution will push PRMW toward the former highs over time.

Of course, trying to project out a year and beyond is still fraught with risks. If the next recession turns out to be a lot worse than feared, then PRMW is not likely to escape with its guidance intact. In such a case, any related sell-off in PRMW would offer a fresh buying opportunity on the longer-term secular bet on Prime Water and the overall water industry. Primo Water is staking a claim to “multiple favorable tailwinds such as increased consumer attention to health and wellness and aging water infrastructure”, and these will not irrevocably disappear because an economic slowdown.

Primo Water should also be prepared for any temporary setbacks in its stock. The company’s Board of Directors recently approved $100M for an “opportunistic share repurchase program.” In Q2, Primo Water spent roughly $11M repurchasing 800,000 shares.

Finally, if PRMW reverses its most recent post-earnings gains, then I will assume that investors no longer share my optimism. Such a setback could happen if Primo Water stumbles and backs off guidance in any way. I want to see the company hold the line and over time get incremental wins with beats and periodically increased guidance.

Be careful out there!

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment