Sundry Photography/iStock via Getty Images

Unless you have been living under a rock for the last six months, you might have noticed that inflation has started to spiral out of control. The CPI index (which is rigged to understate inflation for various reasons) was just under 8% for February. One of the best REIT sectors to own in an inflationary period is the apartment sector. AvalonBay Communities Inc. (NYSE:AVB) is widely regarded as one of the best options in the sector. If I knew what I know now, I would have bought shares in 2020, but hindsight is 20/20. Unfortunately, shares have gone from cheap to very expensive in the last year.

Investment Thesis

AvalonBay is a large apartment REIT with a market cap of $34.5B. They focus primarily on large coastal cities and the surrounding areas. The company has seen impressive rent growth and shares are up over 30% in the last year. Unfortunately, the valuation is expensive relative to the FFO/share growth, with a price/FFO near 29x. The dividend isn’t much to get excited about either, with a yield of 2.6%. The company does have a solid history of dividend growth, but at the current price, there is no margin of safety for new investors.

The Business

AvalonBay is one of the REITs that I have had on my watchlist for a while, but I haven’t been able to pull the trigger. The company has a solid operating history and was able to navigate the financial crisis and the COVID lockdowns without cutting their dividend. Their focus on large cities and the surrounding areas means that they shouldn’t have any issues with occupancy. The shorter lease terms than most REITs mean that AvalonBay can handle inflation better than REITs with longer lease terms (especially ones without significant or CPI-linked rent escalators).

I like the business model a lot. There is always going to be demand for apartments in coastal cities. This is especially true for the best buildings in the largest markets, which describes many of AvalonBay’s properties. The company also has a solid balance sheet with manageable debt levels compared to the assets. Unfortunately, the valuation has become very expensive as the shares have run up significantly in the last year and a half.

Valuation

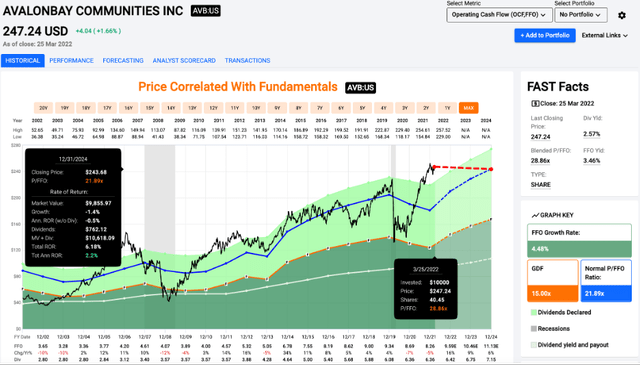

AvalonBay has been on a tear since the end of 2020. Shares bottomed out near $130 and have been marching higher ever since. Shares currently trade at a blended price/FFO of 28.9x. This is well above the average multiple of 21.9x. FFO/share is projected to grow at a decent clip over the next couple of years, but I don’t think it justifies a multiple near 30x.

I can see how shares might be worth a 25x multiple, but that still doesn’t leave a margin of safety for new investors. I will be keeping AvalonBay on my watchlist, but I don’t think the forward returns will be that attractive for investors buying near $250 a share. The other reason to wait is that the dividend yield is near an all-time low.

The Dividend

Shares of AvalonBay currently have a yield just under 2.6%. This isn’t going to attract investors looking for current income, but the company has been able to grow the dividend at a decent rate, with a 5% CAGR since the IPO. The dividend has been frozen since the beginning of the pandemic lockdowns, but I think the dividend growth will restart at some point in the next year. However, the income and growth profile aren’t enough to get me to buy shares at the current price.

Conclusion

AvalonBay is one of the REITs that I have had on my watchlist for a while. If you had the foresight to buy shares in 2020, you are likely sitting on some impressive gains. It’s up to each investor to decide when to sell, but I don’t think the current valuation is going to lead to attractive returns from here. If you have a better alternative, it might be time to take some profits and reinvest elsewhere.

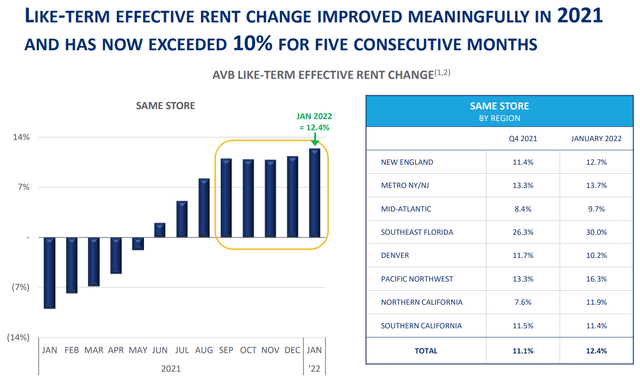

While apartment REITs are able to handle inflation better than other real estate sectors, AvalonBay’s valuation has run too far, too fast in my opinion. The dividend yield of 2.6% isn’t enough to justify starting a position today. With a starting price/FFO valuation of 28.9x, AvalonBay will have to grow significantly to produce double-digit returns from here. The company has a solid strategy of focusing on large coastal markets, and the rent growth has been impressive, but I would wait for a pullback before buying shares.

Be the first to comment