naphtalina/iStock via Getty Images

The Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2x Shares ETF (NYSEARCA:DRIP), or “the Fund,” seeks daily investment results, before fees and expenses, of 200% of the inverse (or opposite) of the performance of the S&P Oil & Gas Exploration & Production Select Industry Index (“the Index”). There is no guarantee the Fund will meet its stated investment objectives, and the return will almost certainly vary from its objective if the holding period is less than, or more than, one day.

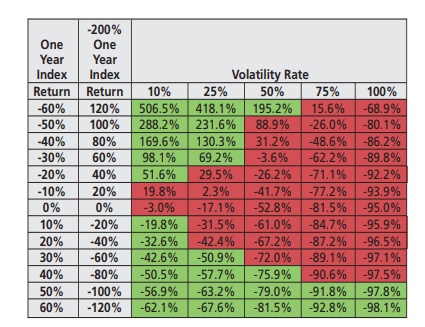

The largest holdings of the Fund as of the end of May were as follows:

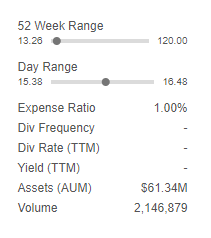

The Fund has an Expense Ratio of 1.0% and Assets Under Management (“AUM”) of about $60 million.

Seeking Alpha

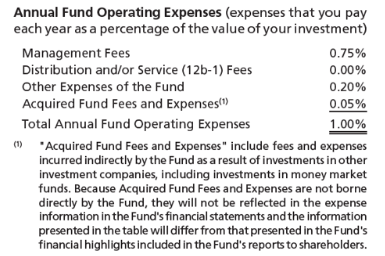

Expenses consist of a management fee of 0.75 % and other expenses as follows:

Direxion

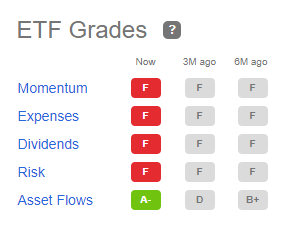

Seeking Alpha has rated the Expense Ratio an “F” in its ETF Grades:

Seeking Alpha

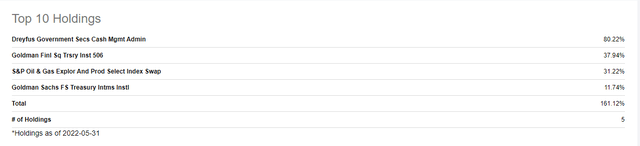

The total return of the Fund over the past year was -78%, as compared to the return of the SP500TR of -19%.

Over the past 5 years, DRIP has lost 99% of its value, compared to a gain of 67% in the SP500TR.

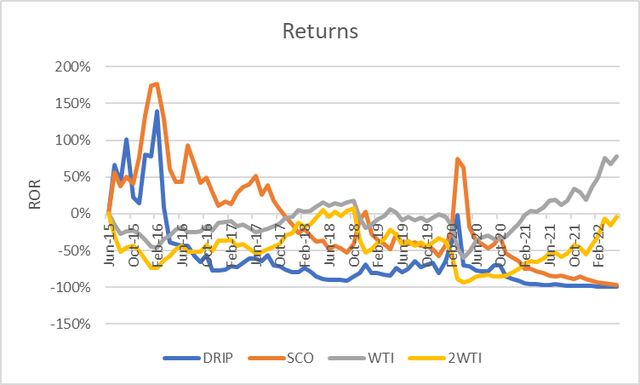

Since inception in June 2015, DRIP has lost 99% of its value. Comparing that to another oil double short ETF, ProShares UltraShort Bloomberg Crude Oil ETF (SCO), which I recently reviewed in an article, SCO: A Short Oil Position And How It Can Be Used, SCO lost 96% over the same period. The continuous NYMEX WTI second nearby crude oil futures contract (“WTI”) actually gained 78 % over the same period, whereas 2X of the same contract (“2WTI”) lost 5% over the same period.

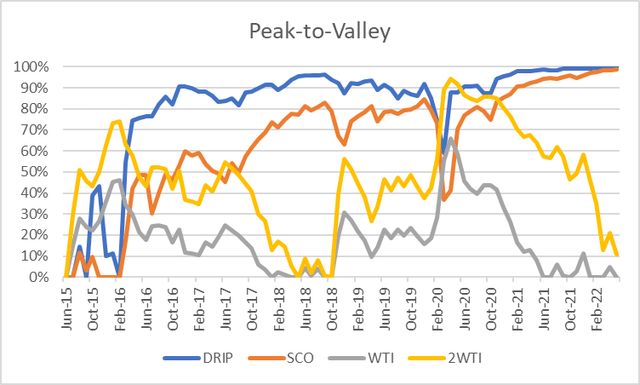

In addition, the risk of the Fund was massive. Typically, downside risk is measured as Peak-to-Valley (“P2V”) and the maximum drawdown (“MD”) over a period is the largest P2V experienced. For more about P2V calculations, read here. I take the opposite sign of the drawdown, so that it is a positive number.

According to my calculations, DRIP’s MD was 99%. In other words, from the Fund’s highest peak since mid-2015, it lost 99+% of its investment value. The Fund is still down 99+% from its peak at its inception. SCO’s MD was also 99+% over the same period. By contrast, the WTI contract’s MD was 66 % and the 2WTI MD was 94 %.

Needless to say, such a massive loss in DRIP would (or should) exceed the risk tolerance of any investor. And investors typically exit investments once losses exceed their risk tolerances, locking in the loss.

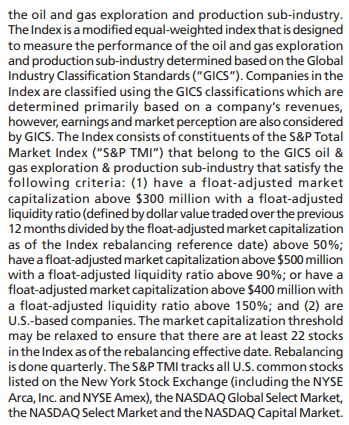

The Index

The Index that the Fund seeks to track 2X the inverse of is defined in greater detail below.

direxion Direxion

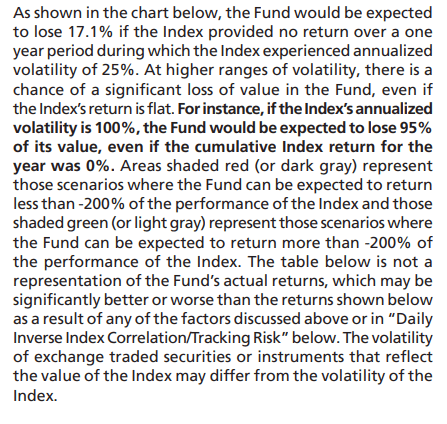

More Ways To Lose: Volatility and Leverage

In addition to losing value if the Index goes negative, volatility and leverage can affect have a large effect on the Fund’s return. According to the Prospectus, “During periods of higher Index volatility, the volatility of the Index may affect the Fund’s return as much as, or more than, the return of the Index.”

Direxion Direxion

In addition, the Fund’s use of leverage could lead to a total loss in one day, as explained in the Prospectus:

The Fund obtains investment exposure in excess of its net assets by utilizing leverage and may lose more money in market conditions that are adverse to its investment objective than a fund that does not utilize leverage. An investment in the Fund is exposed to the risk that a rise in the daily performance of the Index will be magnified. This means that an investment in the Fund will be reduced by an amount equal to 2% for every 1% daily rise in the Index, not including the costs of financing leverage and other operating expenses, which would further reduce its value. The Fund could theoretically lose an amount greater than its net assets in the event of an Index rise of more than 50%. This would result in a total loss of an shareholder’s investment in one day even if the Index subsequently moves in the opposite direction and eliminates all or a portion of its earlier daily change. A total loss may occur in a single day even if the Index does not lose all of its value. Leverage will also have the effect of magnifying any differences in the Fund’s correlation with the Index and may increase the volatility of the Fund.”

Key Wins

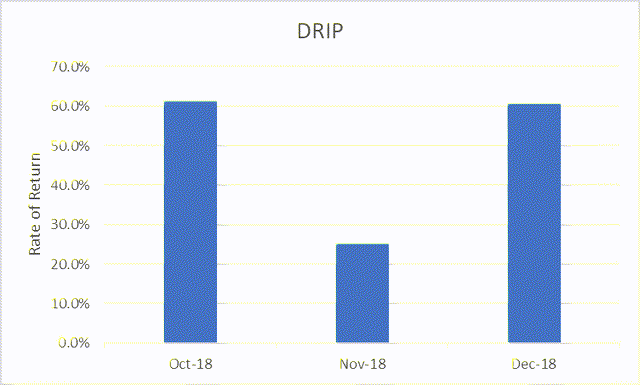

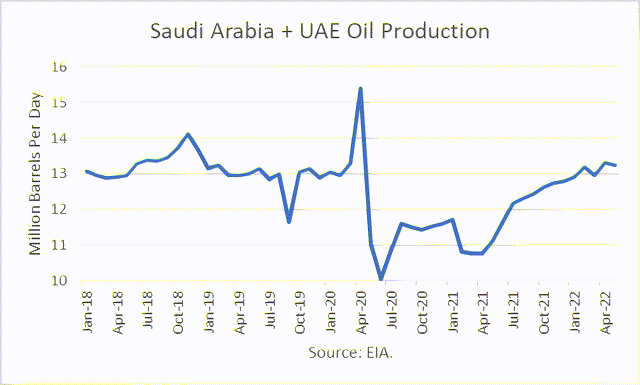

Notwithstanding the risks and historical returns discussed above, there were recent periods where DRIP provided outsized returns. One period was October through December 2018. President Trump had secured a promise from two OPEC countries, Saudi Arabia and the UAE, to increase supplies when he was deciding to pull out of the Iran nuclear deal in May 2018, to offset expected losses from sanctioning Iranian exports. But when Iranian sanctions were to go into effect in November, the sanctions were waived for a while, and so the market was glutted.

DRIP returned 61%, 26% and 66% in October, November and December, respectively.

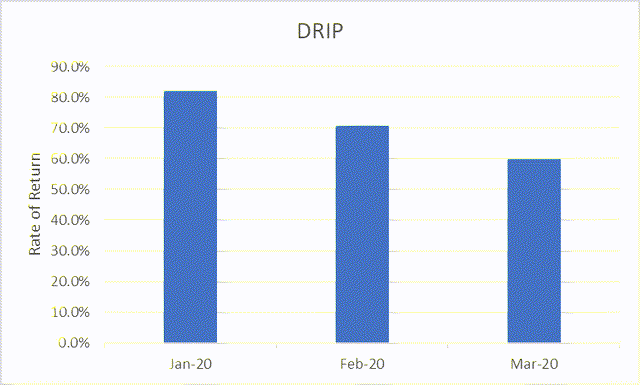

Another stellar performance was January through March 2020, as Covid-19 spread. Also, Saudi Arabia and Russia got into an oil price war.

DRIP returned 82%, 71% and 60% in January, February, and March, respectively.

Potential Future Opportunities

There may be times in the months ahead during which using a double short oil instrument may be useful. I discussed my successful uses of SCO in the aforementioned article.

Investors interested in such a trade should keep abreast of several possible developments.

Regime Change in Moscow

Russia’s “special military operation” in Ukraine has resulted in unforeseen complications for Russia. It has suffered large losses of lives in its army and of its military arsenal, including the sinking of its flagship cruiser Moskva in the Black Sea. The disappearance of Putin as President could lead to a major change in prosecuting the war and in Russia’s policies toward the West.

According to an ex-MI6 spy, Putin will be ‘incapacitated’ and replaced in a coup within six months. Ex-British intelligence officer Christopher Steele told BBC Radio 4 The World at One show: “I don’t see him [Putin] being in power for more than three-six months from now.”

Rumors have been reported that an unnamed Russian oligarch said that Putin is “very ill with blood cancer.” Other news stories suggest that Putin’s health appears to be deteriorating and that he might be fighting blood, thyroid, or abdominal cancer, and/or that he has early-stage Parkinson’s disease.

Putin’s current term as president ends in 2024. However, Russia passed reforms in 2020 allowing him to serve for two more six-year terms.

Demand Destruction

High oil prices and inflation are causing some economists to expect a recession is coming, which would adversely impact oil demand. “There is a significant likelihood of a recession in the not-too-distant,” according to economist Larry Summers, former Treasury Secretary and past president of Harvard University.

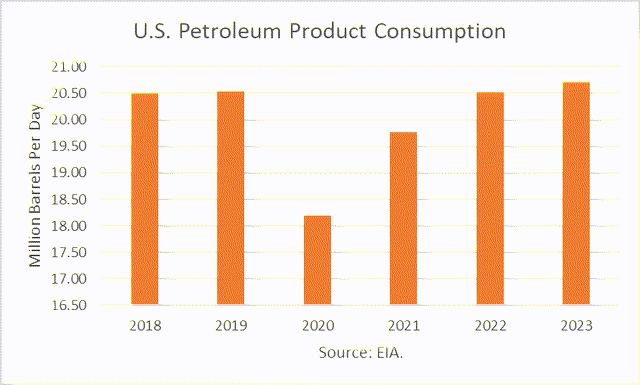

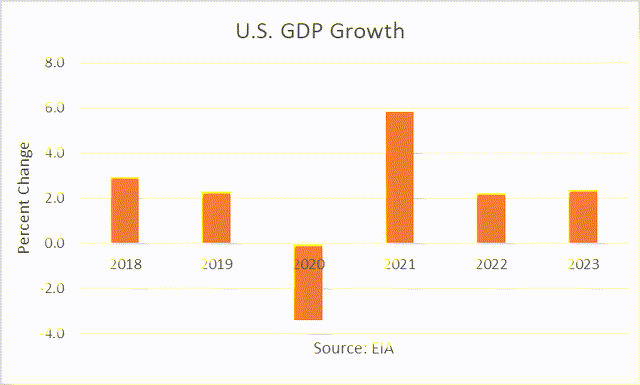

Even without a recession, high oil prices are impacting demand growth forecasts. The EIA projects in its Short-Term Energy Outlook (STEO) dated June 7th that total U.S. petroleum product consumption in 2022 will average 20.54 million barrels per day ((mmbd)), about the same as in 2019. And it projects consumption of 20.73 mmbd in 2023, a very small increase.

But that forecast is based on GDP growth assumptions of about 2% a year in 2022 and 2023.

Additions to World Supplies

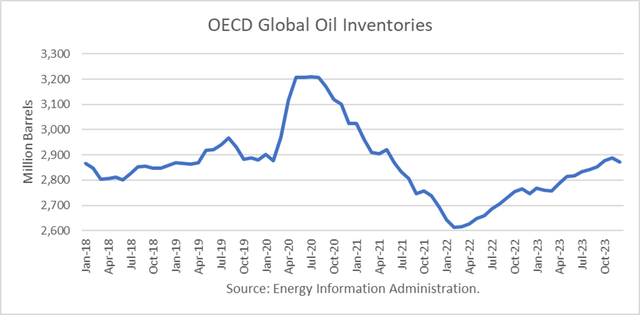

The EIA projects that commercial OECD inventories have bottomed and will rise steadily through 2023. That forecast relies on drawdowns from governmental Strategic Petroleum Reserves, which amount to one million barrels per day for six months from the U.S. alone, with additional drawdowns from IEA members.

What is not expected is a surge in production from OPEC members Saudi Arabia and UAE, as occurred in late 2018.

The White House announced on June 14th that President Biden will be travelling to Saudi Arabia in mid-July to attend the Gulf Cooperation Council’s summit, at the invitation of Saudi King Salman. One of the topics will be “ensuring energy security.”

President Biden may ask that the two OPEC members, Saudi Arabia and the UAE, increase their oil production to reduce the oil price-induced threat of recession, and to reduce retail gasoline prices in the U.S., which is hurting him politically. However, during his 2020 presidential campaign, Biden promised to make Crown Prince Mohammed bin Salman (“MbS”) a “pariah.”

It was reported that MbS refused to take Biden’s call in March, which was expected to be a request to increase oil production (Saudi Arabia and UAE leaders ‘reject calls with US President Biden’). Previously, President Obama was not greeted by King Salman on the tarmac upon his arrival, unlike other heads of state, when Biden was vice-president, because the Obama-Biden Administration was seen to be too friendly with Iran, KSA’s arch enemy.

Conclusions

DRIP is a high-risk financial product and should only be used by sophisticated traders. A continuous long position over time has produced an almost 100% loss.

However, there have been short periods where it provided massive gains. And it is possible there will be opportunities for huge returns in the months ahead, if any of the unexpected events mentioned above come to fruition.

Be the first to comment