HJBC/iStock Editorial via Getty Images

1. Company overview

Capgemini (OTCPK:CAPMF) is one of the largest IT services providers globally with more than 350,000 employees providing services to all kinds of private and public institutions in nearly 50 countries. The company operates under three divisions: 1) Applications & Technology (62% of revenue); 2) Operating & Engineering (31% of sales) and 3) Strategy & Transformation (7% of revenue).

These units cover the entire IT value chain. The Strategy and Transformation unit focuses on digital consulting and transformation projects that help management teams to develop new digital strategies. Then, the Applications & Technology division encompasses a full service offering for implementing, maintaining, and modernizing IT environments. Finally, the Operating & Engineering unit provides business process outsourcing solutions as well as engineering solutions. The latter helps clients to develop new products while the former enables clients to outsource daily operations at lower costs. Outsourcing is a more commoditized service but offers longer contract duration (which reduces earning cyclicality) than projects and consulting missions.

IT service providers tend to benefit from switching costs as they provide mission-critical services. Indeed, IT environments are quite complex and switching providers may have severe consequences such as poor server maintenance, poor software release or downtime. As a result, clients tend to select providers with strong reputations and do not consider costs as the main key deciding factor. In this context, major IT services providers have been able to monetize their intangible assets (reputation) and switching costs to generate an attractive return on investment.

2. Growth drivers

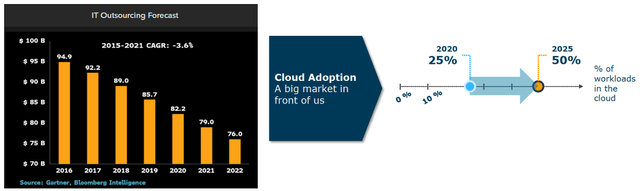

Historically, companies used IT services providers in order to reduce IT costs through offshore outsourcing. Nowadays, the same companies are more interested in the higher value-added services that enable them to thrive in an ever-evolving technological environment. As a result, the demand for traditional services such as IT outsourcing and hardware maintenance is under structural pressure. Indeed, as more workloads move in public clouds, it reduces the demand for outsourcing and increases pricing pressure on contract renewals. On the other hand, the demand for new digital services related to the cloud transition, cybersecurity, data analytics, and artificial intelligence is increasing. In addition to benefits from the digitalization, the demand for consulting and strategy services is also supported by consultant skills as they have specific industry expertise and are able to reuse solutions developed for other clients (quicker, less expensive, and less risky). Finally, we believe it provides some kind of protection to the different managers as they may be less accountable for their decisions because they have received advice or have outsourced the work.

(Bloomberg, Gartner & Capgemini)

According to IDC, the global IT services spending should grow around 4% through 2025 while some segments such as product engineering should outgrow the market with a 12% CAGR. IT budgets should continue to expand as the world keeps becoming more digital and the use of technologies expands across industries. Within this context, IT spending should account for a larger share of companies’ budgets as companies have to create/upgrade their digital capabilities and invest more in next-generation technologies in order to remain relevant in today’s world. Indeed, an adequate digital environment enables companies to make faster and better decisions, develop faster and better services/products, and improve customer relations and services while avoiding being disrupted.

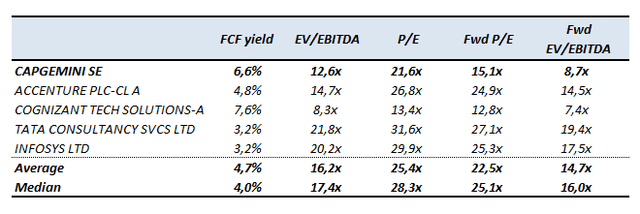

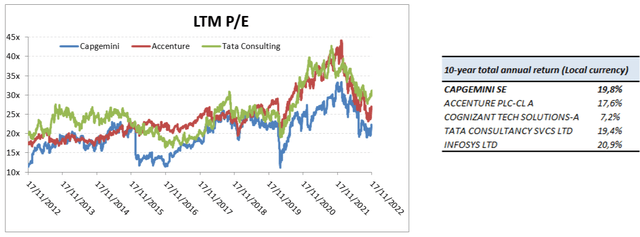

3. Valuation metrics

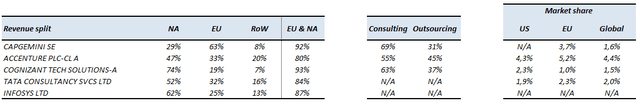

Capgemini looks cheap compared to its most direct peers as it trades to a valuation discount on most valuation metrics. In fact, this discount has been persistent for years. Over the last 10 years, Capgemini was trading at an average of 20X earnings while Accenture and Tata Consultancy were trading closer to 25X. However, this valuation discount did not prevent Capgemini’s shareholders to be handsomely rewarded as highlighted by the 19.8% total annual shareholder return over the last ten years, which is in line with peers’ performance.

4. Why does this valuation discount exist?

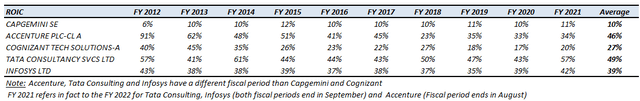

We believe that the valuation discount is the result of a lower return on invested capital and lower organic growth. On a reported revenue basis, which means that M&A and FX fluctuations are factored in, Capgemini is still lagging its peer group.

(Bloomberg and Author) (Bloomberg and Author)

5. Where does the underperformance come from?

5.1. ROIC

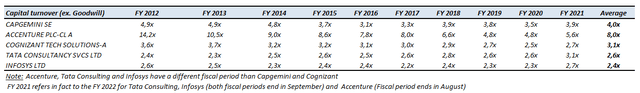

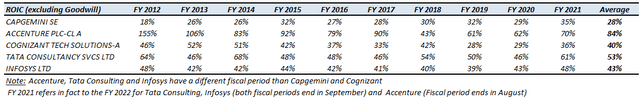

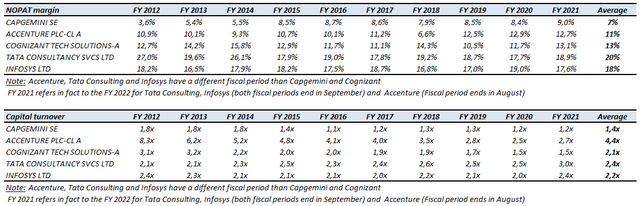

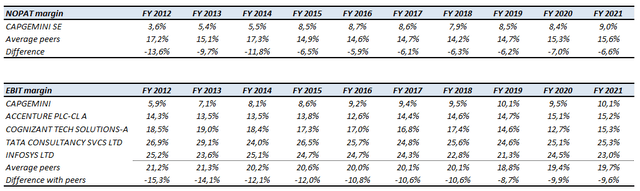

A breakdown of the ROIC calculation into NOPAT margin and capital turnover suggests that Capgemini has a lower profitability and a lower capital efficiency.

5.1.1. Margins

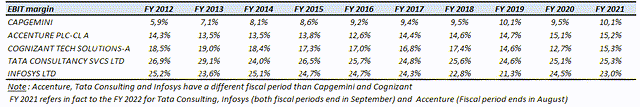

Even though margins are lower than peers, they have significantly improved over the last decade, further reducing the gap with peers.

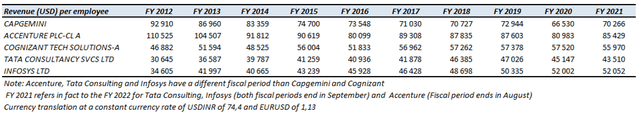

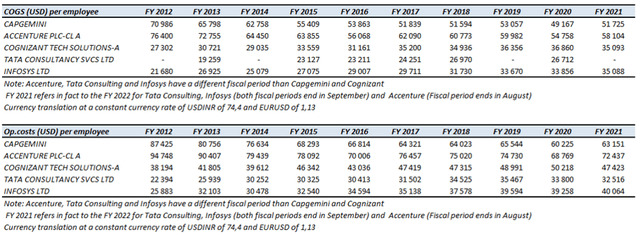

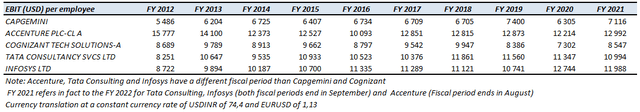

Employees are the main assets for IT consulting firms, thus it makes sense to analyze the company’s profitability at the employee level. Capgemini generates roughly 40% more revenue per employee than Indian peers and Cognizant but 20% less than Accenture.

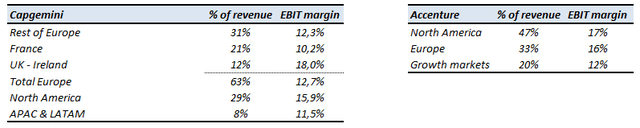

The combination of regional mix (developed countries, especially in the US), strong market positioning, and brand reputation are the key elements to generate higher revenue per employee. Unsurprisingly, Accenture is the best positioned given its strong US exposure, brand reputation, and high-end strategy and management services offering. Indian peers are the worst performers as they do not have a strong reputation in developed countries for the most lucrative services. In fact, they enjoy a strong reputation for outsourcing low value-added services. Capgemini enjoys a strong market share in Europe (especially in France) but lacks a strong US presence.

(Bloomberg, annual reports and Author) (Bloomberg, annual reports, IDC, Gartner and Author)

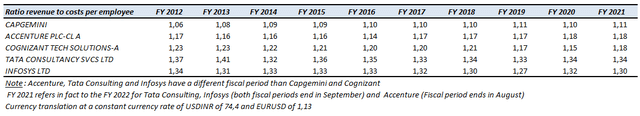

In terms of costs per employee, Indian players score the best as they have access to a lower-cost workforce. Cognizant has a significant portion of its workforce (around 83%) in offshore locations while Capgemini has significantly increased its offshore exposure (from roughly 40% to 58% nowadays) over the last ten years. Accenture has the highest cost per employee because of its strong US footprint (more expensive workforce).

(Bloomberg, annual reports and Author)

The lower cost of Indian players’ workforce more than offset its lower revenue generation, which enables them to display the strongest operating margin. Accenture has also strong margins despite paying much more its employees (as they are able to generate more revenue) while Capgemini has the lowest margin. The company is most likely unable to price its services adequately because of its strong exposure to Europe.

(Bloomberg, annual reports and Author) (Bloomberg, annual reports and Author) (Bloomberg, annual reports and Author)

(Bloomberg, annual reports and Author)

5.1.2. Capital efficiency

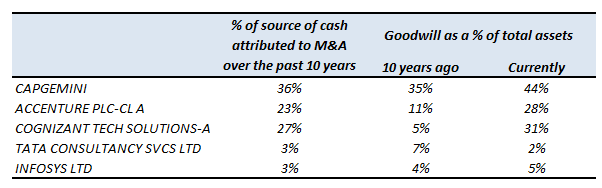

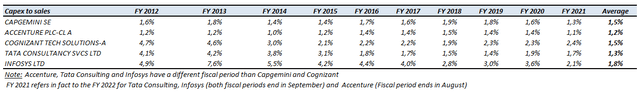

In addition to lower margins, the return on invested capital is also impacted by its M&A strategy. Indeed, Capgemini spent more financial resources than its peers to pursue acquisitions in order to build new capabilities. As a result, its balance sheet is inflated by goodwill, which tends to depress its ROIC. However, the capital turnover (ex-goodwill) and the capex to sales ratio do not suggest that Capgemini is more capital-intensive than its peers.

(Bloomberg, annual reports and Author) (Bloomberg, annual reports and Author) (Bloomberg, annual reports and Author)

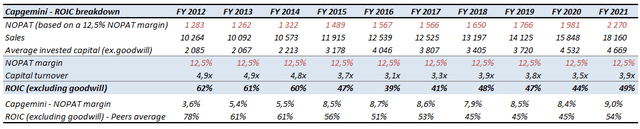

In fact, a simulation using Capgemini’s capital turnover and an assumption of a NOPAT margin of 12.5% (which is in line with Accenture), suggests that the ROIC of Capgemini is in line with peers.

(Bloomberg, annual reports and Author) (Bloomberg, annual reports and Author)

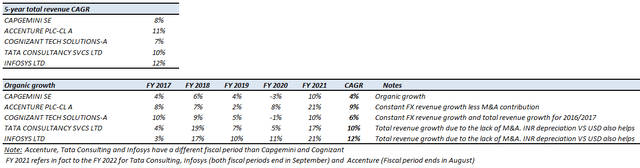

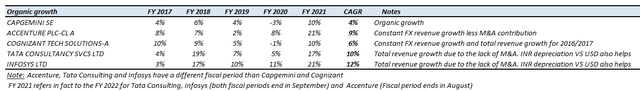

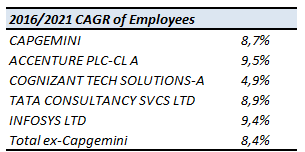

5.2. Organic growth

Peers have been able to grow organically at a high-single-digit number since 2016 while Capgemini was able to grow mid-single digit. This difference cannot be explained by a difference in terms of organic investment as Capgemini’s workforce grew at a similar rate than peers and capex investments do not differ materially. We believe that this lower organic growth might be the result of price concessions, especially in Europe. Indeed, we think that Capgemini had to offer price concessions to its European clients as it moves more work in offshore locations (sharing the benefits).

(Bloomberg, annual reports and Author)

(Bloomberg, annual reports and Author)

6. Will the valuation discount close?

We believe that the valuation discount will tighten as the difference in organic growth with its peers will close and operating margin will improve.

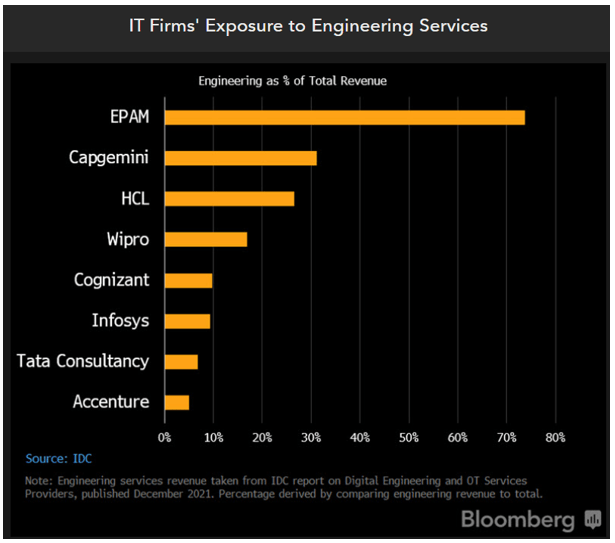

In terms of organic growth, Capgemini is well-positioned to outgrow the market (without outgrowing the leaders). The company guides for (+7%/+9%) annual revenue growth at constant currency through 2025 (from 2020). Back in 2018, the company aimed for (+5%/+7%) organic growth through the cycle. On top of that, Capgemini expects that revenue growth will be 1.5 percentage points higher because of M&A. This improvement in the organic growth profile is the result of different initiatives (sales team, hiring capacity…) as well as the repositioning of the portfolio towards higher-growth segments. Following the Altran acquisition in 2020, Capgemini has one of the strongest digital and engineering footprints, which is one of the fastest-growing businesses.

(Bloomberg and IDC)

Besides, digital and cloud account for 65% of Capgemini’s activity and are outgrowing the market. Finally, Capgemini is in a good position to gain market share over two of its competitors that face challenging situations. Atos’ (OTCPK:AEXAF) legacy business (hardware maintenance) is in structural decline while its management focuses on the potential spin-off of the cyber-security business. Following the war in Ukraine, EPAM Systems (EPAM) suffers business disruption as a significant portion of its workforce was based in Ukraine, Russia, and Belarus.

In terms of profitability, Capgemini has a strong track record as operating margin improved by >400 bps over the last 10 years. The company targets an operating margin of 14% by 2025 while it was 12.9% in 2021. Offshoring should continue to benefit margins as the US business is growing (higher mix of offshoring than Europe) and Europe moves towards more offshoring. Moreover, cost synergies from the Altran acquisition (70 to 100 M€ run rate by 2023) will also help to boost margins.

Risks

Staff retention and hiring: Retaining key employees without overpaying them is key to the company’s profitability and growth profile.

European exposure: Capgemini relies significantly on Europe as it generates a significant portion of its revenue (64% of revenue) in Europe, especially in France ( 21% of revenue).

Digitalization and Cloud transition will cannibalize some parts of the legacy business such as outsourcing (accounting, call centers…) or IT maintenance and implementation (less software customization, upgrades).

Be the first to comment