Zolnierek/iStock via Getty Images

Investment Thesis

ChargePoint Holdings, Inc. (NYSE:CHPT) has been growing its market share and geographical footprint aggressively, with over 188K charging ports in North America and the EU in FQ1’23, representing 67.8% YoY growth from 112K in FQ1’22. Given that there is an estimated total of 18.8K of public charging ports in Canada, 108K in the US, and 340K in the EU YTD, it is apparent that the company holds a robust market share in the EV charging market. These numbers are also impressive, given that Tesla (TSLA) operates 33.6K charging ports globally as of Q1’22.

Since the US EV charging market is expected to grow from $3.99B in 2021 to $49.1B in 2030 with a CAGR of 36.9%, while the EU EV charging market grew even more to $61.73B by 2030 with a CAGR of 34.7%, it is evident that CHPT still has a long runway for growth. Therefore, given that the North American market accounts for 80% of the company’s revenue in FQ1’23, combined with its bold expansion into the burgeoning EU market, we expect the company to do very well indeed as one of the leading EV charging providers in the world.

CHPT Reports Stellar Execution In FQ1’23

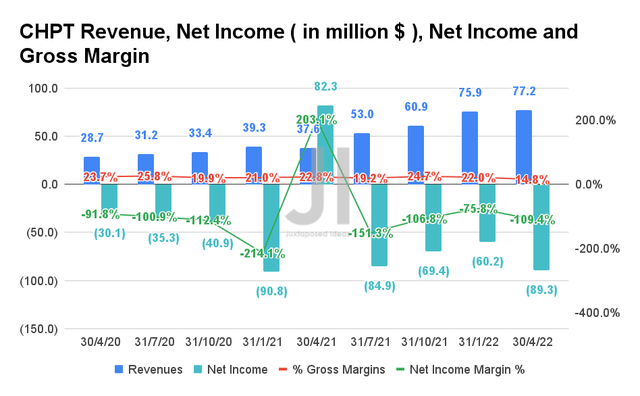

CHPT Revenue, Net Income, Net Income, and Gross Margin

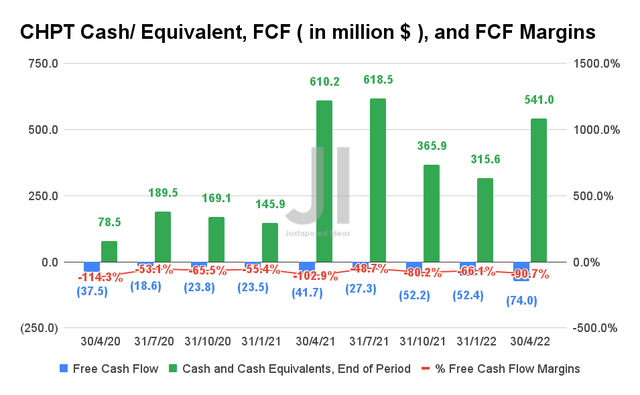

CHPT has been growing its revenues at an excellent CAGR of 40.42% in the past four years. The company also reported revenues of $77.2M in FQ1’23, representing an impressive 205% YoY growth. Nonetheless, it is apparent that the company has yet to achieve profitability, with -$89.3M of net income and -$74M of Free Cash Flow (FCF) in FQ1’23. The situation is significantly worsened by the ongoing supply chain issues, which continue to drive up material and logistical costs. However, we can potentially expect improvements moving forward, given its price hikes.

Nonetheless, given that it is a land grab situation now, we are encouraged by CHPT’s aggressive reinvestment into the business. In addition, with $541M of cash and equivalents on its balance sheet, the company would still have sufficient capital for the next few quarters.

CHPT Cash/Equivalents, FCF, and FCF Margins

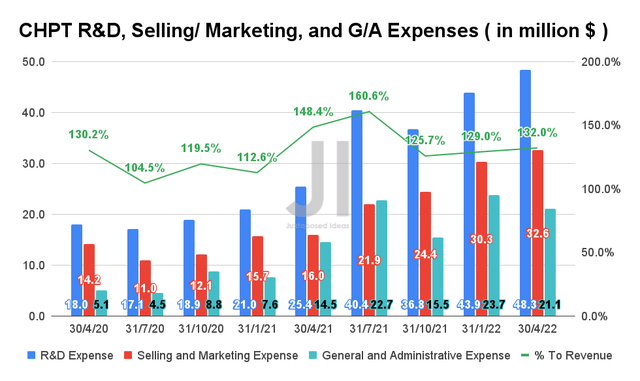

CHPT R&D, Selling/Marketing, and G/A Expenses

CHPT has also been increasing its operational costs over time, given its impressive geographical expansions. By FQ1’22, the company reported $102M of R&D, Selling/Marketing, and G/A Expenses, representing an 82.4% increase YoY. However, it is essential to note that the growth rate in its expenses could be unsustainable in the long term, given that it comprises 132% of its revenue in FQ1’23. Therefore, it is highly possible that CHPT would need to continue to rely on debt leveraging to raise capital before it achieves sustained net income and FCF profitability in the future. Nonetheless, we must also commend the company on its careful capital expenditure of $3.19M and a net Property, Plant, and Equipment assets of $59.17M in the latest quarter.

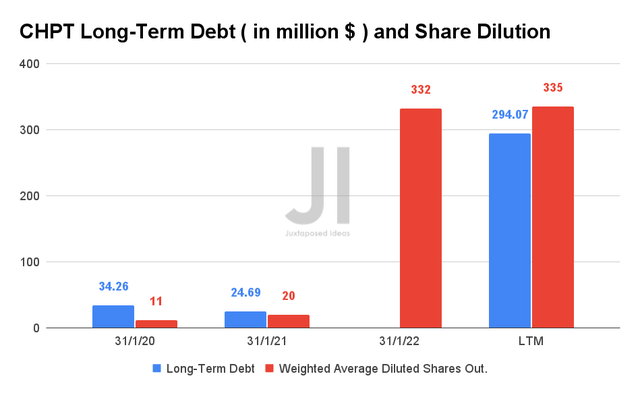

CHPT Long-Term Debt and Share Dilution

During its IPO on 26 February 2021, CHPT reported 225.53M of diluted shares outstanding in FQ1’22. However, it is immediately apparent that investors who had bought in during the IPO would have been diluted by 48.3% YoY to a total diluted share count of 334.62M as of FQ1’23. In addition, CHPT had spent $67.3M in stock-based compensation (SBC) in FY2022, with another $15.5M reported in FQ1’23. Assuming a similar rate of expenses, we may expect the company to report up to $62M in SBC expenses for FY2023. Nonetheless, we are not overly concerned, given that it will represent only 22.9% of its net income for the year compared to 50.8% in FY2022.

On the other hand, CHPT also accumulated $294M of long-term debt in FQ1’23 due 2027, potentially to fund its growing operational costs. Therefore, investors must be aware of its potentially continual share dilution and/or debt leveraging moving forward, given that CHPT has not and will not be reporting profitability for the next few years.

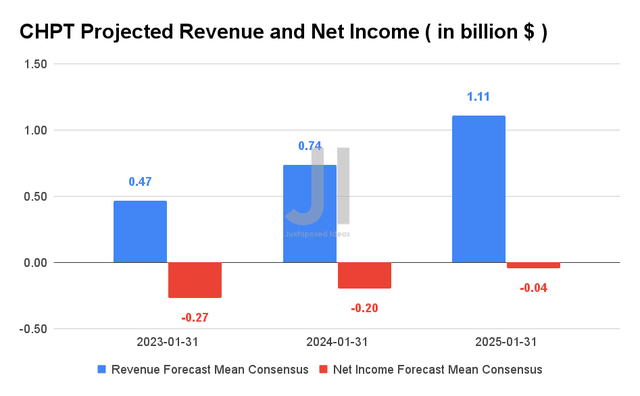

CHPT Projected Revenue and Net Income

Over the next three years, CHPT is expected to grow its revenues at a CAGR of 69.73% while potentially reporting net income profitability from FY2026 onwards. For FY2023, consensus estimates expect that the company will report revenue of $0.47B and net income of -$0.27B, representing YoY growth of 207% and a decline of 200%, respectively.

Nonetheless, it is apparent that CHPT is more optimistic, with FY2023 revenue guidance of up to $0.5B representing YoY growth of 219% and FQ2’23 guidance of up to $106M representing YoY growth of 200%. In addition, there is a chance of an upwards re-rating moving forward, given that its sales are gated by supply through the 35% sequential growth in backlog in FQ1’23.

So, Is CHPT Stock A Buy, Sell, Or Hold?

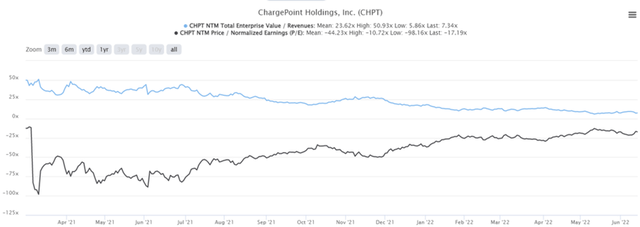

CHPT 1Y EV/Revenue and P/E Valuations

CHPT is currently trading at an EV/NTM Revenue of 7.34x and NTM P/E of -17.19x, lower than its 3Y mean of 19.52x and -37.86x, respectively. The stock is also trading at $13.36, down 56.6% from its IPO price of $30.83 on 26 February 2022, though at a 57.1% premium from its 52-week low of $8.50.

CHPT 1Y Stock Price

CHPT is indeed a solid stock with proven execution and excellent potential. No matter which auto company wins the EV race by the next decade, all EVs need to be charged either through public charging ports or through private residential solutions. Therefore, CHPT could easily emerge as a leading provider of EV charging technologies then, matching oil industry giants such as Shell (SHEL), which aims to operate over 500K charging ports by 2025.

However, despite consensus estimate price target of $20, we believe that the stock may continue to retrace in the short term, given the bearish market sentiments and a potential recession. Given the slowing auto sales due to chip shortages in Q1’22, EV adoption could also be slower than expected for FY2022. As a result, we are of the opinion that a stock price of $8 would be a potential entry point for speculative portfolios. We shall continue to monitor the situation.

As a result, we encourage investors to wait for a deeper retracement before adding CHPT to their portfolio.

Therefore, we rate CHPT stock as a Hold for now.

Be the first to comment