EXTREME-PHOTOGRAPHER/E+ via Getty Images

Physical activity is a great way to stay in shape. And one of the most enjoyable ways to stay active is by playing sports or engaging in some other physically-oriented game. One company that’s dedicated to helping consumers achieve this objective is sporting goods and outdoor goods retailer Academy Sports and Outdoors (NASDAQ:ASO). After seeing a remarkable 2021 fiscal year, the company has started to experience some weakness. A reduction in spending caused by the absence of economic stimulus and by a return to normalcy in our daily activities has resulted in declining sales and profits. Economic pain might also be a factor here. This was proven true once again when management reported, just the other day, financial results covering the second quarter of the company’s 2022 fiscal year. Having said this, shares of the company do still look quite cheap, even if we assume that financial performance will eventually revert back to what it was in prior years. Given how shares are priced today and the limited downside they likely have, I would still make the case that the company warrants a ‘buy’ rating at this time.

All fun and games

A little over a year ago, on October 25th of 2021, I published an article detailing the investment worthiness of Academy Sports and Outdoors. In that article, I acknowledged the company’s historical growth in the years leading up to the publication of said article. I was especially impressed by its performance between 2020 and 2021, with both e-commerce sales and comparable store sales rising nicely. At that time, I did say that the company was a bit pricey relative to similar players. But even so, I said that shares were cheap enough to warrant a ‘buy’ rating. Since then, the company has outperformed even my own expectations. While the S&P 500 has fallen by 9.5%, shares of Academy Sports and Outdoors have generated a profit for investors of 18.9%.

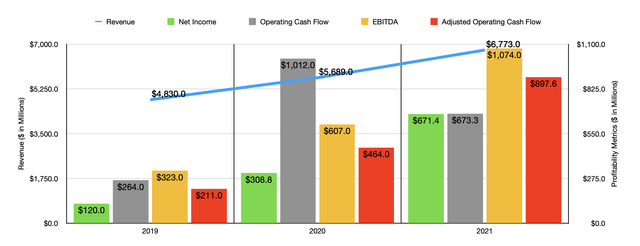

To see why this massive disparity exists, we should first start with how the company ended its 2021 fiscal year. For that year, sales came in at $6.77 billion. That represents an increase of 19.1% over the $5.69 billion generated in 2020. This increase in revenue came even as the number of stores the company has in operation remained flat at 259. The real driver, then, related to an 18.9% increase in comparable store sales. This included strong performance across all of its merchandise divisions. The company particularly focused in its annual report on the impact that apparel and footwear merchandise had. Another driver related to the company’s e-commerce operations. Sales there increased by 6.2% year over year, working out to 9.3% of the company’s overall merchandise revenue for the year.

On the bottom line, performance was also impressive. Net income for 2021 came in at $671.4 million. That’s more than double the $308.8 million generated in 2020. Operating cash flow plunged from $1.01 billion to $673.3 million. But if we adjust for changes in working capital, it would have soared by 93.4% from $464 million to $897.6 million. Over that same window of time, EBITDA for the company also expanded, climbing from $607 million in 2021 to $1.07 billion last year. If these year-over-year increases look unrealistic, keep in mind that rising comparable store sales means increased margin as a result of the company’s ability to spread the same amount of fixed costs over more revenue. This has a magnifying effect on any sort of retailer or similar asset-intensive business.

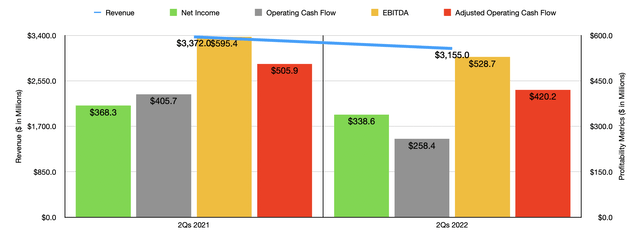

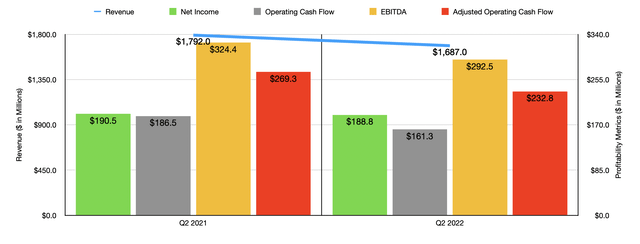

Although 2021 proved to be a great year for the company, we have seen some weakness. For the first half of 2022, sales came in at $3.16 billion. That’s 6.4% below the $3.37 billion generated the same time last year. In the second quarter of the year in particular, sales dropped by 5.9%, declining from $1.79 billion to $1.69 billion. The company also, as a result of this decline, missed analysts’ expectations to the tune of roughly $10 million. Management chalked this up to a 6% decline in comparable store sales, some of which was offset by the addition of one new store to the company’s portfolio. Despite this pain, the company did benefit from a 12.1% rise in e-commerce sales, bringing the portion of overall revenue that comes from online avenues from 8.4% in the second quarter of last year to 10% this year.

On the bottom line, the company saw some contraction. Net income dropped from $368.2 million to $338.6 million. In the second quarter alone, profits declined from $190.5 million to $188.8 million. On a per-share basis, the company earned $2.22. That actually managed to beat analysts’ expectations by $0.19 per share. On an adjusted basis, the company beat expectations on the bottom line by $0.26 per share. Of course, we should also pay attention to other profitability metrics, as the charts above and below both illustrate. But the bottom line here is that the decline in revenue did have a rather negative impact on all of its profitability metrics. Focusing on the first half of the year as a whole alone, operating cash flow declined from $405.7 million to $258.4 million. On an adjusted basis, it declined from $505.9 million to $420.7 million. Even EBITDA took a beating, declining from $595.4 million to $528.7 million.

When it comes to the 2022 fiscal year as a whole, management does expect revenue to come in a bit weaker, somewhere in between $6.43 billion and $6.63 billion. This would come as a result of a 3% to 6% decline in comparable store sales as consumer spending eases. Profitability is also expected to weaken, with net income totaling between $550 million and $615 million. If we take the midpoint here and apply it to the other profitability metrics for the company, we should anticipate adjusted operating cash flow of $778.7 million and EBITDA of $931.8 million.

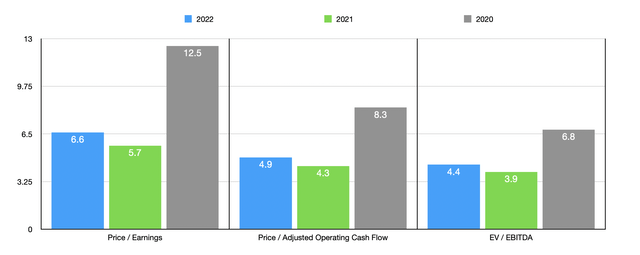

Using these figures, we can easily value the business. On a forward basis, the company is trading at a price-to-earnings multiple of 6.6. This compares to the 5.7 reading that we get using results from 2021. Even if financial performance reverts back to what we saw in 2020, we would get a multiple of 12.5. On a price to adjusted operating cash flow basis, the multiple on a forward basis should be 4.9. This is up from the multiple that we get using results from 2021 but is down from the results we would get using data from 2020. A similar relationship can be seen with the EV to EBITDA approach, with a multiple of 4.4 beating out the 3.9 from 2021 but coming in lower than the 6.8 reading that we get using data from 2020. As part of my analysis, I also compared the company to three similar firms. On a price-to-earnings basis, the forward multiples for the companies was between 4.2 and 10. In this case, two of the three companies were cheaper than Academy Sports and Outdoors. Using the price to operating cash flow approach, the range was from 5 to 18.3, with our prospect being the cheapest of the group. And when it comes to the EV to EBITDA approach, the range is between 2.3 and 4.4, with Academy Sports and Outdoors tied as the most expensive.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Academy Sports and Outdoors | 6.6 | 4.9 | 4.4 |

| Dick’s Sporting Goods (DKS) | 10.0 | 18.3 | 4.4 |

| Big 5 Sporting Goods (BGFV) | 4.6 | 5.0 | 2.3 |

| Sportsman’s Warehouse Holdings (SPWH) | 4.2 | 7.5 | 2.6 |

Takeaway

Based on all the data provided, I will say that while I understand why investors would be cautious because of recently declining sales and profits, I also believe that shares of the company still look very cheap. Of course, a turn back to what the business experienced from a profitability perspective in 2020 could make shares less affordable. But even in that case, I have a hard time believing that the company would be even close to being overvalued. If anything, it would be closer to fair value in nature. For this reason and more, I’ve decided to retain my ‘buy’ rating on the company for now, reflecting my belief that it will likely outperform the broader market for the foreseeable future.

Be the first to comment