Denis_Vermenko

REITs are an ideal place to be for income investors, due to their contracted cash flows that provide shareholders with a steady income stream. This asset class, however, is often misconstrued for bond proxies, and predictably decline in price whenever interest rate hikes come to the forefront.

This provides income and value investors to opportunities to layer in before the market inevitably comes to its senses. This brings me to UDR Inc. (NYSE:UDR), which remains well below its near $60 price level from as recently as April. This article highlights why income investors seeking to diversify their dividend streams may want to consider this stock.

Why UDR?

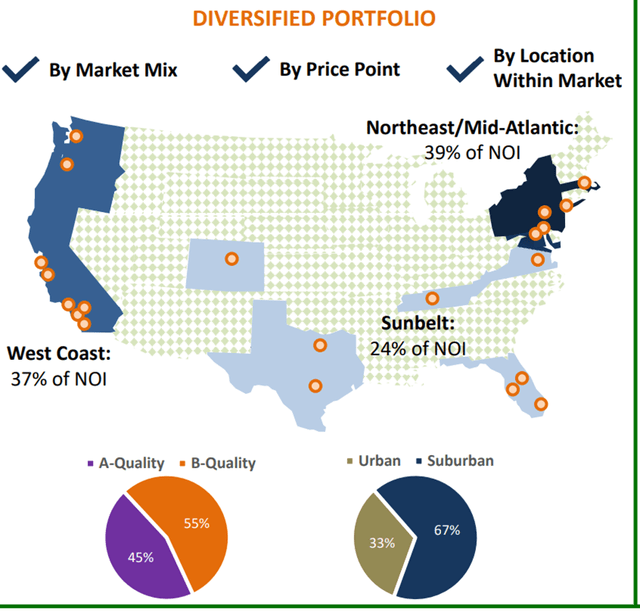

UDR is an S&P 500 (SPY) company and a leading multifamily REIT with a long track record. It’s been around for over 50 years and at present, owns over 58K apartment units, and has an enterprise value of over $22 billion. As shown below, UDR’s portfolio is centered around 21 population dense and growing markets along the Sunbelt, Northeast, and West Coast of the U.S.

UDR Property Locations (Investor Presentation)

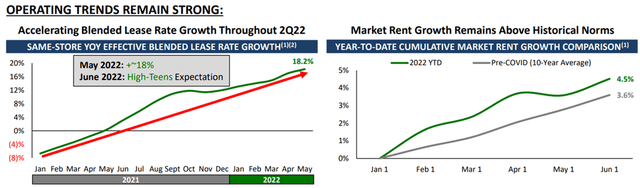

The supply constrained and growing nature of UDR’s markets have enabled it to enjoy above market rent growth. This is reflected by same store net operating income growing by an impressive 14.4% YoY and 4.4% sequentially in the second quarter. This was driven by high tenant for apartments in the current environment, with blended lease rate growth of 17.4% YoY on new and renewal leases. As shown below, market rent growth this year has outpaced that of the pre-COVID 10-year average, and UDR’s rent growth has accelerated as is well above market growth.

UDR Rent Growth (Investor Presentation)

Looking forward, UDR should continue to see robust growth, as management is projecting full-year blended lease rate growth in the 9% to 11% range. This is largely driven by housing prices that remain sticky at high prices despite higher interest rates, and apartments are 50% less expensive to rent than own versus the 35% pre-COVID average. This gives UDR plenty of remaining headroom for rental increases.

Factors that could drive the share price down include the potential for an economic recession, which may impact some residents’ ability to pay rent. Moreover, higher interest rate could raise UDR’s cost of debt. However, income growth in UDR’s core markets helps in the near-term, and apartments remain an affordable option compared to a new home purchase, as noted by management during the recent conference call:

First, income growth remains robust, resulting in portfolio-wide rent to income ratios in the low 20% range. Consistent with our historical ratios, we have not seen any material evidence of doubling up and residents who turned over have been backfilled with rents at higher rates.

Second, our in-place residents are increasingly paying rent on time. Collection rates improved sequentially in the second quarter and long-term delinquents continued to decline. Third, traffic remains strong, enhanced by the larger funnel generated by our shift to a self-service business model. Fourth, concessions are virtually non-existent with the exception of 1 week on average in specific submarkets of San Francisco and Washington, D.C. And last, multifamily has become incrementally more affordable versus alternative housing options.

Furthermore, UDR maintains a solid BBB+ rated balance sheet with a net debt to EBITDAre of 6.2x, and management expects to strengthen this ratio to the mid-5x range by the end of the year. Plus, 93% of UDR’s debt is fixed rate at very low rates, as it carries a sector-leading 2.8% weighted average interest rate, and just 12% of the debt matures through 2026.

The strengthening balance sheet plus $1.7 billion available liquidity puts UDR is a strong position to fund development opportunities on recent land acquisitions in Dallas, TX and Riverside, CA, which make up a combined 965 potential new apartment homes.

Meanwhile, UDR pays a 3.2% dividend yield that’s well-covered by a 73% payout ratio (based on Q2 FFO per share of $0.52). UDR has also increased its every year for 11 years, and while the 5-year dividend CAGR is just 4.2%, I would expect for dividend growth to accelerate considering the strong lease growth rate.

Lastly, I find UDR to be a sound by at the current price of $48, with a forward P/FFO of 20.7. While this sits slightly above UDR’s normal P/FFO of 20.4, I believe the slight premium is justified considering the well above average rental growth rate. Sell side analysts have a consensus Buy rating on the stock with an average price target of $54.24, implying a potential one-year 16% total return including dividends.

Investor Takeaway

UDR has been a key beneficiary of rising housing prices and high interest rates, which have fueled apartment demand. This, combined with attractive properties in in-demand markets has resulted in well-above average rental growth, yet shares trade at just a slight premium to its normal valuation. As such, I believe there is ample upside potential in this top-quality apartment REIT.

Be the first to comment