Thomas Barwick/DigitalVision via Getty Images

Introduction

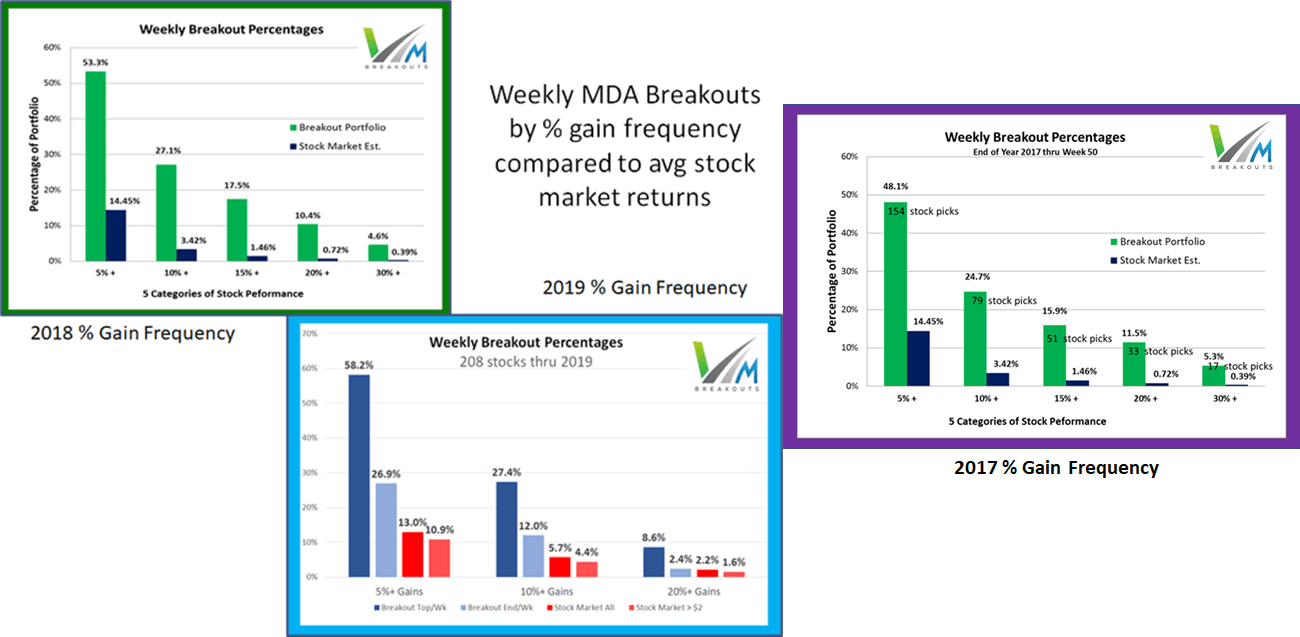

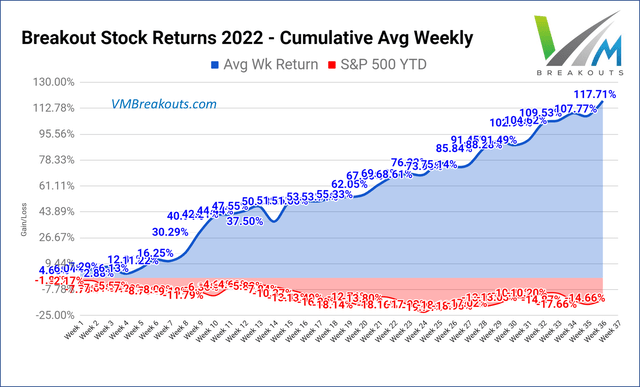

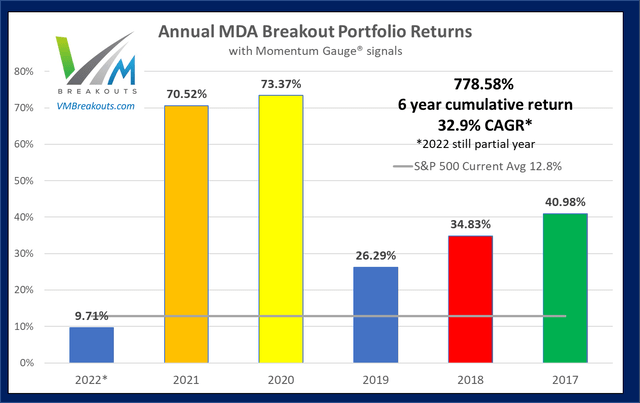

The Weekly Breakout Forecast continues my doctoral research analysis on MDA breakout selections over more than 7 years. This subset of the different portfolios I regularly analyze has now exceeded 260 weeks of public selections as part of this ongoing live forward-testing research. The frequency of 10%+ returns in a week is averaging over 4x the broad market averages in the past 5+ years.

In 2017, the sample size began with 12 stocks, then 8 stocks in 2018, and at members’ request since 2020, I now generate only 4 selections each week. In addition 2 Dow 30 picks are provided, as well as a new active ETF portfolio that competes against a signal ETF model. Monthly Growth & Dividend MDA breakout stocks continue to beat the market each year as well. I offer 11 top models of short and long term value and momentum portfolios that have beaten the S&P 500 since my trading S&P 500 since my trading studies were made public.

Market Outlook

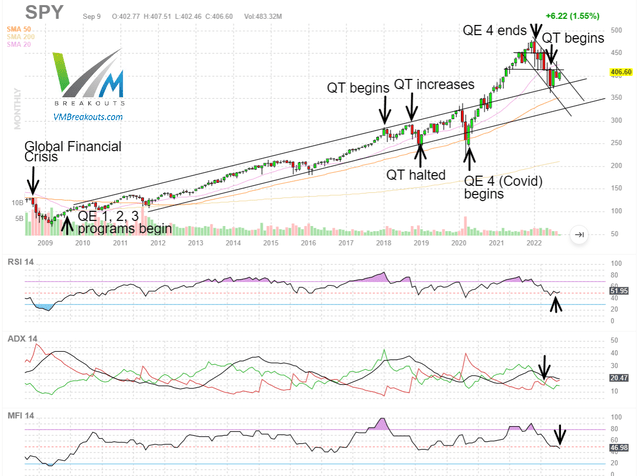

The Momentum Gauges®, economic events, and weekly market outlook are now separated into weekly articles here which also includes my new weekly Technical Market update videos. Currently we are in the biggest short squeeze in 5 months as institutions cover record hedge positions:

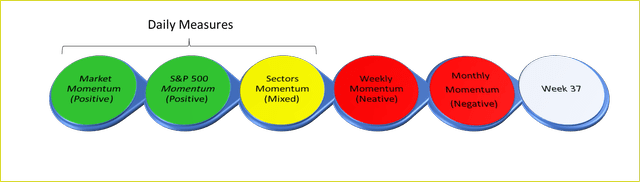

Momentum Gauges® Stoplight signals for Week 37 with gauges turning more positive and monthly gauges consecutively negative from November 2021. Short term conditions look increasingly positive.

Current Returns

In a quick study of the MDA breakout selections YTD there are 93 picks in 36 weeks beating the S&P 500. 59 are picks beating the S&P 500 by over 10%+ in double digits. Leading MDA gainers include (CLFD) +65.5%, (VRDN) +76.0%, (TDW) +107.9, (COCO) +51.1%, (HOWL) +51.1%. Fully 110 weekly picks for 2022 are beating the Nasdaq YTD that is down -22.6%.

Additional background, measurements, and high frequency breakout records on the Weekly MDA Breakout model is here: Value And Momentum MDA Breakouts +70.5% In 52 Weeks: Final 2021 Year End Report Card

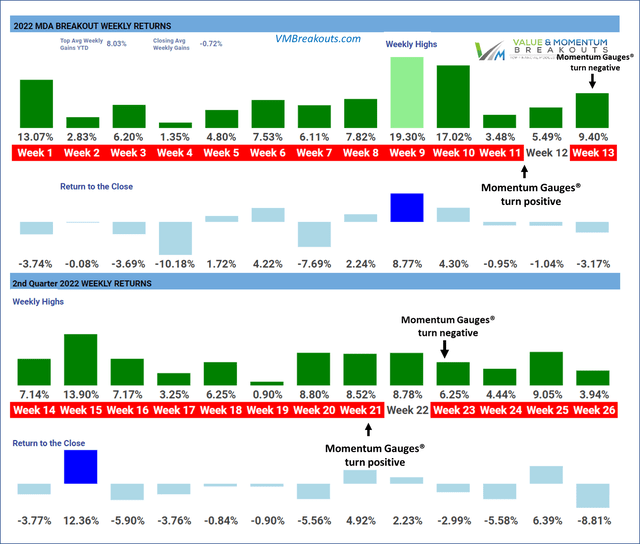

2022 First-half weekly return results

First half returns with all weekly returns on the V&M Dashboard

Red weekly color indicates negative Market Momentum Gauge signals. MDA breakout selections outperform when the market signal is positive and daily negative values are below 40 level.

Historical Performance Measurements

Historical MDA Breakout minimal buy/hold returns are at +70.5% YTD when trading only in the positive weeks consistent with the positive Momentum Gauges® signals. Remarkably, the frequency streak of 10% gainers within a 4- or 5-day trading week continues at highly statistically significant levels above 80% not counting frequent multiple 10%+ gainers in a single week.

Longer term many of these selections join the V&M Multibagger list now at 113 weekly picks with over 100%+ gains, 54 picks over 200%+, 18 picks over 500%+ and 11 picks with over 1000%+ gains since January 2019 such as:

- Celsius Holdings (CELH) +2153.8

- Enphase Energy (ENPH) +2,110.4%

- Intrepid Potash (IPI) +1,275.9%

- Northern Oil & Gas (NOG) +1076.4%

- Trillium Therapeutics (TRIL) +1008.7%

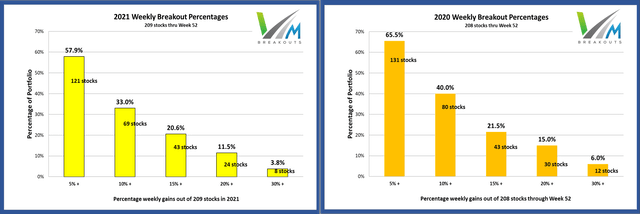

More than 200 stocks have gained over 10% in a 5-day trading week since this MDA testing began in 2017. A frequency comparison chart is at the end of this article. Readers are cautioned that these are highly volatile stocks that may not be appropriate for achieving your long term investment goals: How to Achieve Optimal Asset Allocation

The Week 37 – 2022 Breakout Stocks for next week are:

The picks for next week consist of 1 Energy and 3 Technology sector stocks. These stocks are released to members in advance every Friday morning near the open for the best gains. Prior selections may be doing well, but for research purposes I deliberately do not duplicate selections from the prior week. These selections are based on MDA characteristics from my research, including strong money flows, positive sentiment, and strong fundamentals – but readers are cautioned to follow the Momentum Gauges® for the best results. These picks are up over +3.2% for member from release Friday.

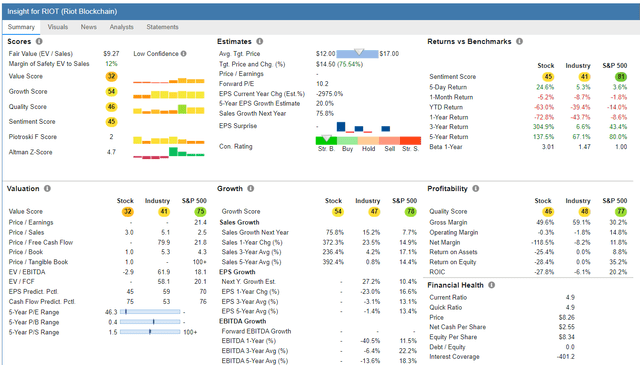

- Riot Blockchain (RIOT) – Technology / Software – Application

- Cactus (WHD) – Energy / Oil & Gas Equipment & Services

Riot Blockchain – Technology / Software – Application

FinViz.com

Price Target: $14.00/share (See my FAQ #20 on price targets)

(Source: Company Resources)

Riot Blockchain, Inc., together with its subsidiaries, focuses on bitcoin mining operations in North America. It operates through Bitcoin Mining, Data Center Hosting, and Electrical Products and Engineering segments. As of December 31, 2021, it operated approximately 30,907 miners.

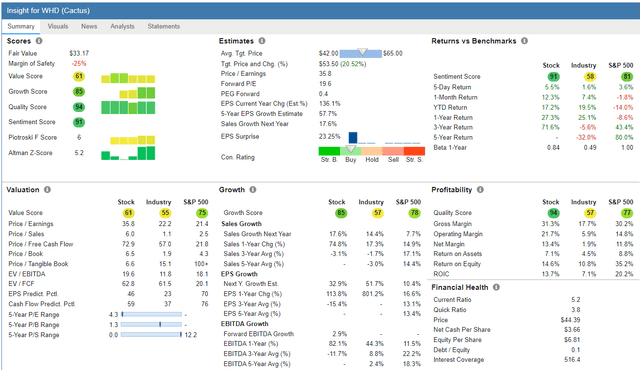

Cactus – Energy / Oil & Gas Equipment & Services

FinViz.com

Price Target: $55.00/share (See my FAQ #20 on price targets)

(Source: Company Resources)

Cactus, Inc. designs, manufactures, sells, and rents a range of wellheads and pressure control equipment in the United States, Australia, China, and the Kingdom of Saudi Arabia. The company’s principal products include Cactus SafeDrill wellhead systems, Cactus SafeLink monobore, SafeClamp, and SafeInject systems, as well as frac stacks, zipper manifolds, and production trees. It also provides field services, such as 24-hour service crews to assist with the installation, maintenance, repair, and safe handling of the wellhead and pressure control equipment; and repair and refurbishment services.

Top Dow 30 Stocks to Watch for Week 37

First, be sure to follow the Momentum Gauges® when applying the same MDA breakout model parameters to only 30 stocks on the Dow Index. Conditions have delivered the worst first half to the stock market since 1970. Second, these selections are made without regard to market cap or the below-average volatility typical of mega-cap stocks that may produce good results relative to other Dow 30 stocks.

The most recent picks of weekly Dow selections in pairs for the last 5 weeks:

| Symbol | Company | Current % return from selection Week |

| (AAPL) | Apple, Inc. | -1.16% |

| (CVX) | Chevron Corp. | +1.87% |

| (JPM) | JPMorgan Chase & Co. | +3.92% |

| (DOW) | Dow Inc. | -7.25% |

| MRK | Merck & Co. | -2.53% |

| (AMGN) | Amgen, Inc. | -1.12% |

| (MCD) | McDonald’s Corporation | -0.44% |

| (MRK) | Merck & Co. | -2.53% |

| (CRM) | Salesforce | -14.50% |

| (MSFT) | Microsoft Corporation | -6.52% |

If you are looking for a much broader selection of large cap breakout stocks beyond the weekly stocks, I recommend these long term portfolios. The new mid-year selections were released to members to start July:

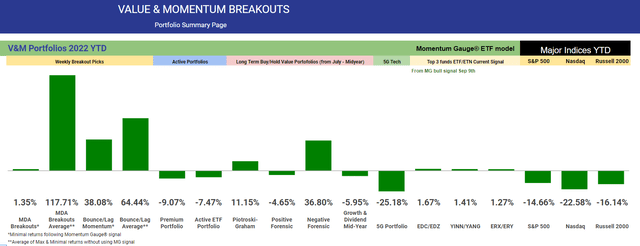

Piotroski-Graham enhanced value –

- July up +11.15%

- January portfolio beating S&P 500 by +26.67% YTD.

- July down -4.65%

- January Positive Forensic beating S&P 500 by +2.50% YTD.

- July up +36.80%

- January Negative Forensic beating S&P 500 by +14.62% YTD

Growth & Dividend Mega cap breakouts –

- August up +6.10%

- January portfolio beating S&P 500 by +10.92% YTD

These long term selections are significantly outperforming many major Hedge Funds and all the hedge fund averages since inception. Consider the actively managed ARK Innovation fund down -52.9% YTD, Tiger Global Management -52% YTD, RTW Investment Group -34% YTD.

The Dow pick for next week is:

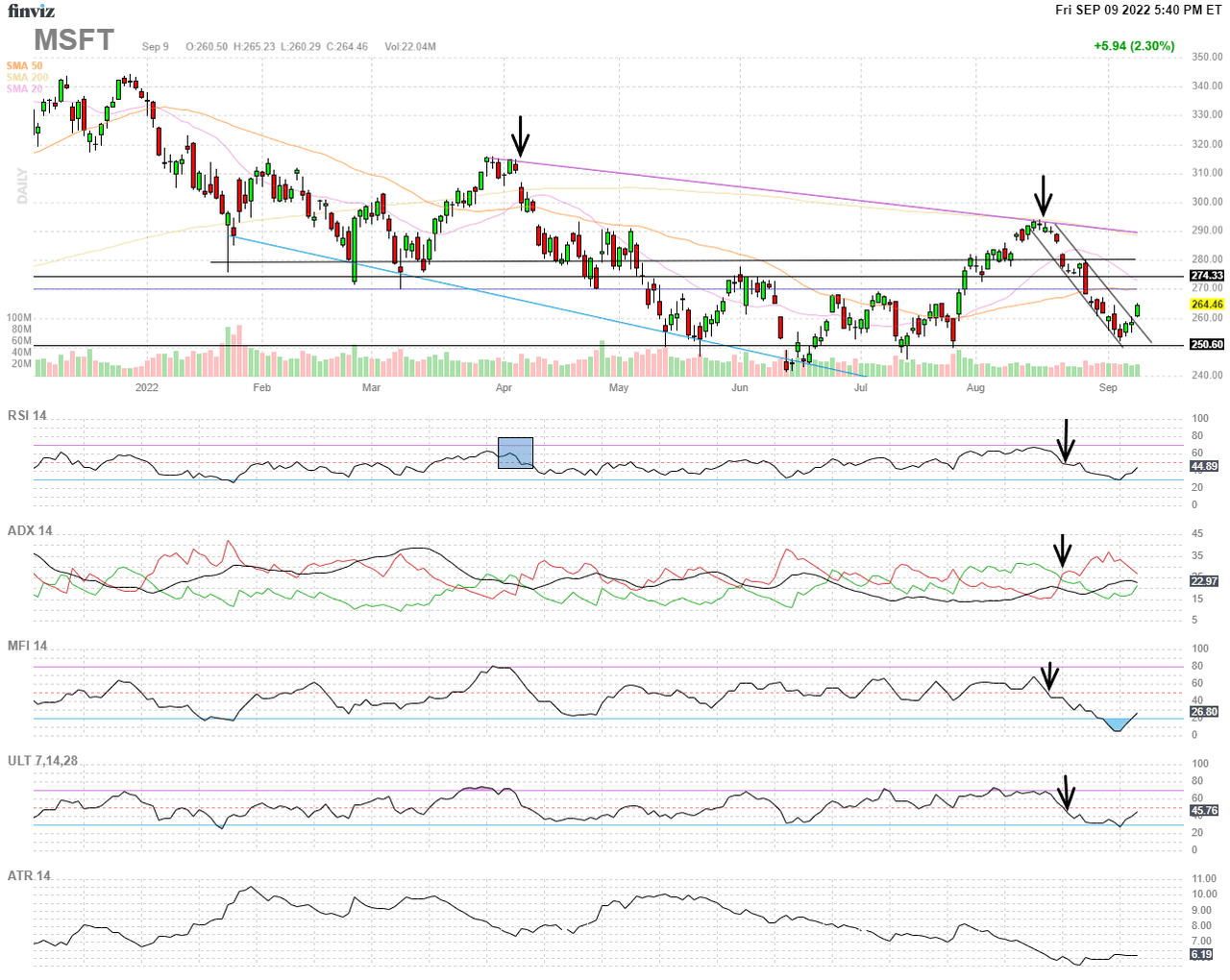

Microsoft

Microsoft has made a breakout of the negative channel from August and although all the proxy sentiment and money flow indicators are still negative they are improving sharply toward early breakout. Institutions are slight net buyers in the current quarter again and the short float remain very low 0.5%.

FinViz.com VMBreakouts.com

Background on Momentum Breakout Stocks

As I have documented before from my research over the years, these MDA breakout picks were designed as high frequency gainers.

These documented high frequency gains in less than a week continue into 2020 at rates more than four times higher than the average stock market returns against comparable stocks with a minimum $2/share and $100 million market cap. The enhanced gains from further MDA research in 2020 are both larger and more frequent than in previous years in every category. ~ The 2020 MDA Breakout Report Card

The frequency percentages remain very similar to returns documented here on Seeking Alpha since 2017 and at rates that greatly exceed the gains of market returns by 2x and as much as 5x in the case of 5% gains.

VMBreakouts.com

The 2021 and 2020 breakout percentages with 4 stocks selected each week.

MDA selections are restricted to stocks above $2/share, $100M market cap, and greater than 100k avg daily volume. Penny stocks well below these minimum levels have been shown to benefit greatly from the model but introduce much more risk and may be distorted by inflows from readers selecting the same micro-cap stocks.

Conclusion

These stocks continue the live forward-testing of the breakout selection algorithms from my doctoral research with continuous enhancements over prior years. These Weekly Breakout picks consist of the shortest duration picks of seven quantitative models I publish from top financial research that also include one-year buy/hold value stocks. Remember to follow the Momentum Gauges® in your investing decisions for the best results.

All the V&M portfolio models are beating the market indices through the worst 6 month start since 1970. New mid-year value portfolios are up sharply to start the next long term buy/hold period.

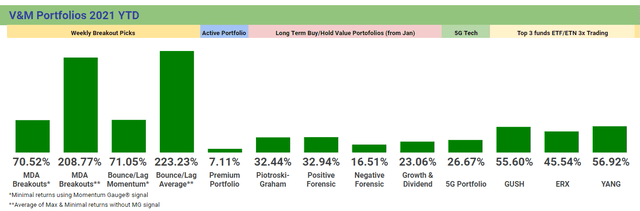

The final 2021 returns for the different portfolio models from January of last year are shown below.

All the very best to you, stay safe and healthy and have a great week of trading!

JD Henning, PhD, MBA, CFE, CAMS

Be the first to comment