mrtekmekci/E+ via Getty Images

Thesis

Blade Air Mobility, Inc. (NASDAQ:BLDE) (“BLADE”) is a company that should be of interest to investors. We believe that the commercialization and adoption of Electric Vertical Aircraft is a huge catalyst for the company’s future growth, and we have liked management’s current strategic execution and recent financial performance. We think that BLADE provides a favorable risk reward proposition at current levels.

Company Overview

BLADE is an “Urban Air Mobility” company that provides transportation services between various cities in the United States. For example, BLADE provides 5-minute-long helicopter transportation services between Manhattan and JFK Airport for prices starting at $195. BLADE offers similar services in various other routes, such as helicopters and seaplane rides between Manhattan and Hamptons destinations, and also operates private charters.

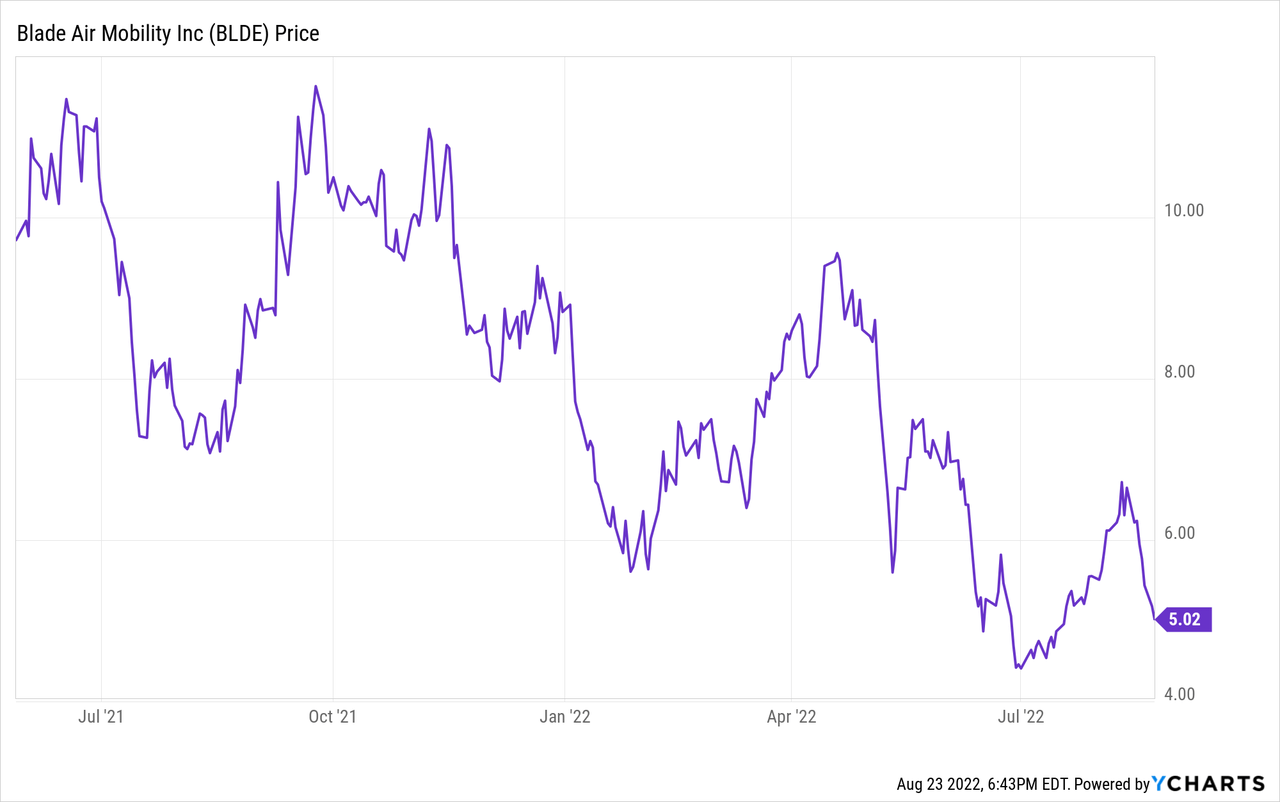

BLADE went public through a SPAC on May 10, 2021 at a valuation of $825 million, and since then, the company’s stock price has fallen precipitously and now the valuation hovers at around ~$360 million. BLADE also has $258 million cash and short-term assets on hand, and has access to ample liquidity.

Urban Air Mobility Strategy

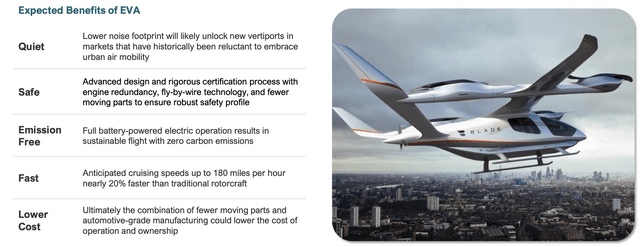

BLADE management has a clear strategic goal in mind of becoming the leading player in Urban Air Mobility. The company expects Electric Vertical Aircraft to become commercialized in 2024, and managements believes that Electric Vertical Aircraft will revolutionize transportation by offering a quick, efficient, and affordable transportation option for many consumers. BLADE believes that with its brand recognition, loyal customer base, and technology platforms, the company will become the go-to leader in the Urban Air Mobility space.

In addition, BLADE has worked hard to secure partnerships with Electric Vertical Aircraft manufacturers like Airbus, so that BLADE can become the platform partner of choice for these manufacturers. We believe the partnerships will be pivotal to the company’s long-term business strategy, and at the current time, we believe that BLADE’s platform is poised to benefit from the commercialization of Electric Vertical Aircrafts.

Strong Financial Growth

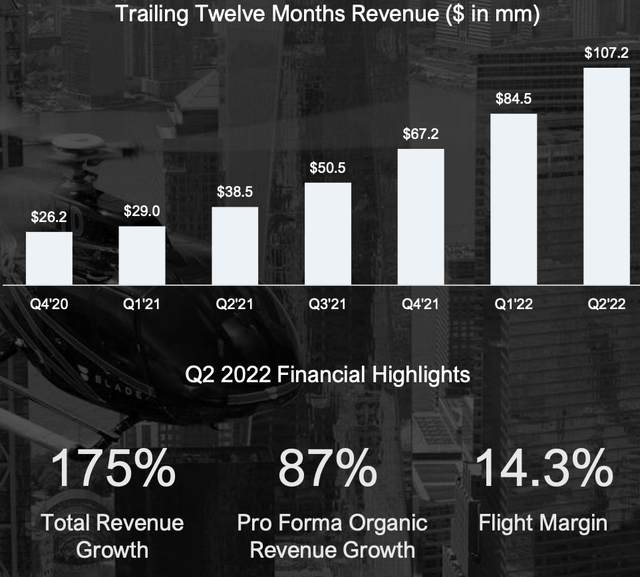

BLADE has been able to continue to consistently grow its revenue and other key performance metrics. The company has been growing its revenue on a quarterly basis, and compared to the same quarter last year, the company grew its revenue by a whopping 175% YoY, partly attributable to recent acquisitions. Organic growth has also been strong as well. With a $107.2 million TTM revenue, the company is roughly trading at around ~3x its TTM revenue, which is low multiple for a business that is growing its revenue at a 175% YoY clip.

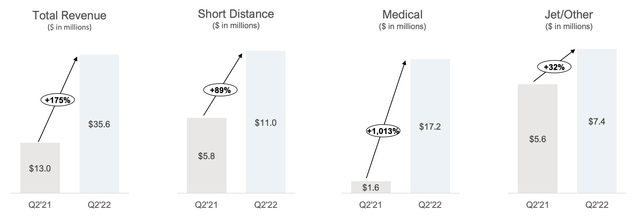

In addition, when segmenting the revenue growth by business lines, we see strong growth on all of BLADE’s revenue segments. Most notably, short distance flights have seen a 89% YoY growth, and the medical segment has seen an absurd 1,013% YoY growth as a result of the Trinity Air acquisition. Management has cited that the medical segment has grown as a result of “new hospital clients and growth with existing accounts.” We believe that there are many interesting potential applications of the type of transportation that BLADE offers, and we believe the foray into medical transportation (i.e., transportation of organs, etc.) is an example of such application.

Attractive Valuation

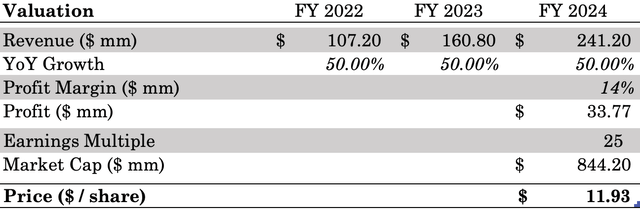

BLADE has huge potential for price appreciation in the next few years. We estimate that based on a 50% average revenue growth (a substantial deceleration from 87% YoY organic growth) over the next three years and using the flight margin as a proxy for medium-term net profit margin, the company is valued at $11.93 per share on a 25x TTM P/E multiple in the span of a few years based on our model. That presents a ~138% upside from its current levels. This valuation model does not factor in the potential catalyst that the company can have if Electric Vertical Aircrafts were to be commercialized. We believe such a large upside potential makes this bet worth the risk.

Conclusion

BLADE presents an asymmetric risk/reward opportunity for investors. The company has shown to be financially strong since the SPAC IPO, and has ample liquidity to fund its operations for the foreseeable future. The company’s long term strategy relies on the commercialization and adopt of Electric Vertical Aircrafts, which we believe BLADE is well-poised to benefit from in the event of its commercialization. Regardless, our valuation model without the impact of Electric Vertical Aircrafts shows that the company is undervalued and can present an asymmetric upside for investors if the company continues to increase revenue and generate consistent profits.

Be the first to comment