apidechphoto/iStock via Getty Images

Published on the Value Lab 21/8/22

We knew that the high oil price would do wonders for Japan Petroleum Exploration Co. Ltd.’s (OTCPK:JPTXF) (or JAPEX) E&P business, where it owns interests in several international oil assets, but we were under the illusion that its infrastructure and utility business was more of a toll-road. In fact, it benefited massively from regasification and reselling of LNG into natural gas that it also transported to various parts of northern Japan. This means that the growth in profits has been double what we expected, and is indeed double what it was in the last FY. While commodity prices at Q2 levels won’t likely last, the windfall is a blessing and the company continues to trade at <1x EV/EBITDA multiples. Remains a no-brain buy.

Q1 Results

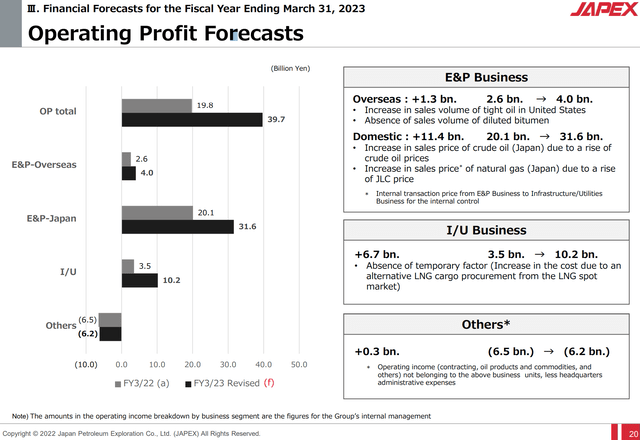

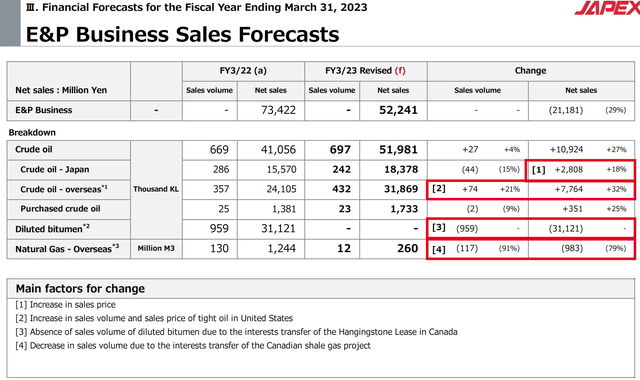

The E&P business saw declines but because of the sale of the Canadian dilbit business. Crude prices rose and operating profit forecasts remain on track and in line with what you’d expect from an E&P business exposed to oil prices. The sales declines are forecast at 29% as the dilbit business gets nixed but will still produce 36 billion Yen in profit on forecast sales of 52 billion Yen. This 36 billion Yen in profit is way ahead of the profits in the year ended March 2022, where E&P profits were closer to 23 billion Yen. All segments within E&P, other than dilbit, saw a 20-40% growth spurt on account of the higher prices.

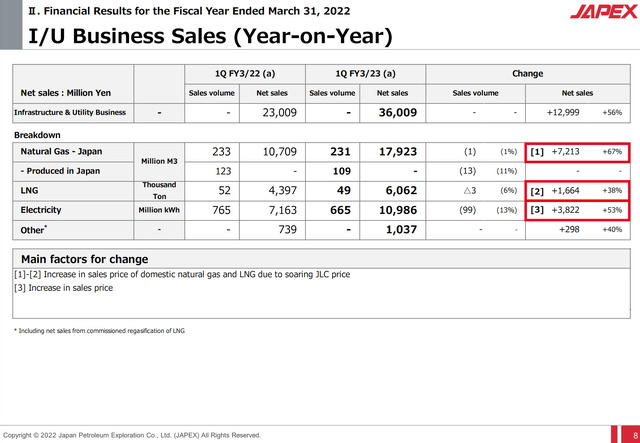

The bigger news is the infrastructure and utility performance. While we knew that the electricity business was going to be commodity levered, we were under the false impression that the pipeline businesses were commercially structured as toll businesses, as they are in the US. They are not. JAPEX buys LNG, regasifies it in its own facilities, stores it in its own terminals, and transports it around northern and central Japan for sale to the end-customer. This reselling import model means that they stand to gain a boatload of money from the rise in gas prices. We thought this would just be the typical transmission business, or like a US pipeline business, but it wasn’t at all.

I/U Actual Results (Q1 2023 Pres)

The rising prices, to which JAPEX is in fact levered, has meant meaningful sales increases for the company in the I/U segment, and consequently a forecast tripling in profits.

Segment EBIT Forecasts FY 2023 vs FY 2022 (Q1 2023 Pres)

Falling gas prices will eventually return this segment to normal, and it is indeed falling taking pressure off headline inflation figures. However, JAPEX investors should consider a VERY important point regarding the JAPEX infrastructure. With the reduced dependence by Japan on Russia, which is connected by a gas route through a Gazprom operated pipeline that runs through Sakhalin, the regasification and logistics that JAPEX runs become profoundly more valuable. This is because without taking gas through a pipeline provided by Russia, a greater share of gas imports will come on LNG tankers. Those have to e regasified to become usable natural gas for use in Japanese households. This is fantastic news for JAPEX investors, and is akin to hearing about the decline in refining supply for Gulf Coast refiner investors.

Conclusions

The fact that the I/U assets have some enduring power now that LNG imports are more important, that only builds atop the already no-brainer case for JAPEX. Profits are forecast to double, and the upside from current levels, updating our previous chart, is now over 100% with a target price over 8,000 Yen/share, currently trading at 3,700. Regardless of whether they double or even halve, the net debt of the company is close to exceeding the EV. The implied multiple is a good deal less than 1x EV/EBITDA, despite all the stock’s merits. Clear buy.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment