gorodenkoff

The modern world has been founded on scientific progress. The discoveries made in the inventions created have paved the way for tremendous economic growth, significant population growth, and a rise in living standards. It has also proven instrumental in making us healthier and live longer. One of the companies dedicated to making sure that this trend continues is Bruker Corporation (NASDAQ:BRKR). As a developer and producer of scientific instruments and analytical and diagnostic solutions, with a special focus on facilitating the exploration of life and materials at the microscopic, molecular, and cellular levels, the company is a true and significant player in this market.

But just as the market often does, high-quality companies with a history of growth and attractive profitability, don’t exactly come cheap. Recently, however, shares of the business have experienced something of a decline. But even this drop has not been without cause. In some respects, the fundamental picture for the company has worsened this year relative to last. And on top of that, high-priced stocks are not exactly a great place to have your money when experiencing a down market. Although shares are getting cheaper year after year, they are not quite cheap enough to warrant significant enthusiasm just yet. Ultimately, I’ve decided to retain my ‘hold’ rating on the firm until such time that its fundamentals show material improvement and/or its share price declines further.

Not cheap enough… yet

Back in February of this year, I wrote an article discussing whether or not it made sense to invest in Bruker Corporation. At that time, I had said that the company had been performing exceptionally well up to that point. Both sales and profitability were faring quite well. I did express some concern over whether that recent growth would be here to stay. And I also expressed concern over how pricey shares looked. In fact, I even went on to say that there is a possibility that they were overpriced. At the end of the day, I ended up rating the company a ‘hold’. When I do that, it’s my way of saying that the firm’s share trajectory should more or less match the trajectory of the broader market. So far, that call has proven to be fairly decent. While the S&P 500 has dropped by 7.4%, shares of Bruker Corporation have generated a loss for investors of 11.4%.

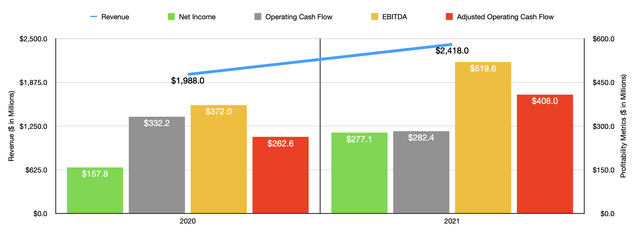

Author – SEC EDGAR Data

To see why this has occurred, we need only look at the company’s recent financial performance. Revenue for the 2021 fiscal year, for instance, came in at $2.42 billion. That did represent a significant improvement over the $1.99 billion generated during the firm’s 2020 fiscal year. Unlike some firms, management wasn’t very transparent about what caused this increase in sales. The greatest growth came from the products the company sells as opposed to its service revenue. Product revenue was up by 23.1% year over year. On the whole, management just said that revenue increases were driven by strong broad demand for the company’s products and solutions. They attributed some of this also to the business and end market recovery versus the same time of the 2020 fiscal year.

This rise in revenue brought with it an increase in profitability. Net income, for instance, rose from $157.8 million in 2020 to $277.1 million last year. Operating cash flow fell, dropping from $332.2 million down to $282.4 million. But if we adjust for changes in working capital, it would have risen from $262.6 million to $408 million. Over that same window of time, EBITDA also improved, rising from $372 million to $519.6 million.

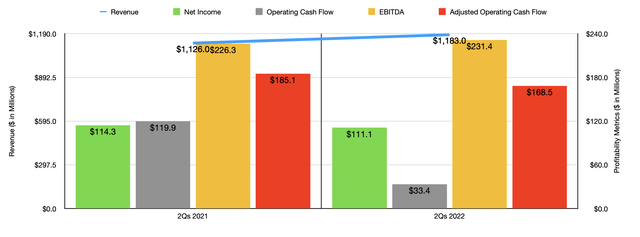

Author – SEC EDGAR Data

So far, the picture for the company looks pretty positive. But when we move into the 2022 fiscal year, we see a significant slowing down of progress. Revenue in the first half of the 2022 fiscal year, for instance, came in at $1.18 billion. That’s up only marginally compared to the $1.13 billion generated the same time last year. In this case, management was a bit clearer on what happened with revenue. The company cited strong demand for its differentiated instruments and solutions. In particular, its BioSpin Group saw revenue grow by 3.2% year over year, with the second quarter alone experiencing upside of 7.6%. Unfortunately, however, the company was negatively impacted by foreign currency translation.

This increase in revenue brought with it some mixed results on the bottom line. Net income, for starters, declined year over year from $114.3 million to $111.1 million. Operating cash flow fared even worse, plunging from $119.9 million to $33.4 million. Even if we adjust for changes in working capital, it would have dropped year over year, declining from $185.1 million to $168.5 million. The only profitability metric to show an improvement was EBITDA. For the first six months of the company’s 2022 fiscal year, this came in at $231.4 million. That’s only marginally higher than the $226.3 million generated in the first half of the 2021 fiscal year.

Now when it comes to the 2022 fiscal year as a whole, management expects some of the same themes that have impacted the company so far this year to continue. Overall revenue should rise by between 2.5% and 4.5%. However, this underscores the strength of sales overall. Organic revenue should actually rise by between 7% and 9%, while mergers and acquisitions should add another 1.5% to the company’s top line. The weakness, then, should come from foreign currency translation, which could impact revenue to the tune of 6%. That’s almost double the 3.5% impact the company anticipated when it offered prior guidance.

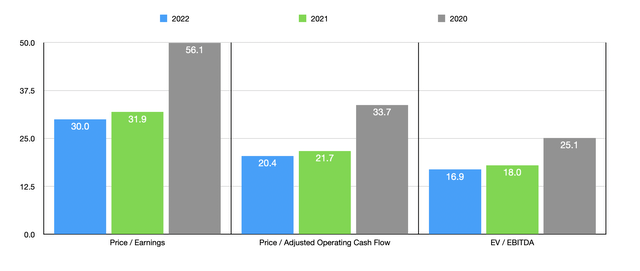

Author – SEC EDGAR Data

In terms of profitability, the only guidance that management gave was when it came to adjusted earnings per share. This should be between $2.29 and $2.33, translating to a year-over-year improvement of between 9% and 11%. Applying that same increase to other profitability metrics, and we should get net income of $294.9 million, adjusted operating cash flow of $434.2 million, and EBITDA of $553 million. This should translate to a price to earnings multiple of 30, a price to adjusted operating cash flow multiple of 20.4, and an EV to EBITDA multiple of 16.9. As you can see in the chart above, this represents a modest improvement across the board compared to what the company achieved in 2021 and it compares favorably to what the firm was priced at if we used 2020 results. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 12.8 to a high of 86.1. In this case, four of the five firms were cheaper than our prospect. Using the price to operating cash flow approach, the range is between 6.6 and 93.6, while using the EV to EBITDA approach, the range is between 5.3 and 50.9. In both of these cases, three of the five firms were cheaper than Bruker Corporation.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Bruker Corporation | 31.9 | 21.7 | 18.0 |

| Repligen Corporation (RGEN) | 86.1 | 93.6 | 50.9 |

| Syneos Health (SYNH) | 24.8 | 16.7 | 13.7 |

| Qiagen N.V. (QGEN) | 21.2 | 14.6 | 13.3 |

| Maravai LifeSciences Holdings (MRVI) | 12.8 | 6.6 | 5.3 |

| Thermo Fisher Scientific (TMO) | 31.3 | 26.1 | 20.3 |

Takeaway

Based on all the data provided, it looks to me as though Bruker Corporation continues to grow, but that foreign currency translation and issues regarding profitability have slowed progress rather considerably. Companies can only trade at lofty multiples, justifiably at least, if they are growing at a nice clip. And that is clearly not the case right now. That, combined with the market’s general volatility, helps to explain why shares have taken a step back. Although I believe that the future of the business is bright, I also think that shares are still rather pricey at this time. Because of this, I’ve decided to retain my ‘hold’ rating on the firm for now.

Be the first to comment