LPETTET/iStock Unreleased via Getty Images

Something big is happening with sports media rights and it’s not the record breaking contracts every time a deal is renewed.

For decades, or the entire history of televised sports, the media rights went to established media companies with large over the top distribution through a cable or satellite provider.

That meant Disney’s (NYSE:DIS) ESPN, Fox (FOX), Paramount (PARA) and NBC (CMCSA) held the vast majority of sports content from college to professional sports.

That’s all about to change.

The cost of sports coverage is getting so expensive, traditional media is being priced out. Not only are the leagues getting record amounts every time a contract is renewed, commentators like Tony Romo are signing $100M+ deals.

Usher In Mega Cap Tech

Over the past decade Apple (AAPL) has been piling up a cash position that’s so unusually large the company has little use for it. The regulatory environment in Washington makes it almost impossible to make transformative deals inside a company’s industry. With an excess of cash flows, Apple has been reduced to buying back shares at an unprecedented rate.

Recently Apple has found a new use of cash in the form of two major live sports broadcast deals. The first allows Apple to air two MLB baseball games on Friday nights. The second is a league-wide deal to show MLS Soccer games.

Apple is also rumored to be the front-runner for NFL Sunday Ticket rights which renew for the 2023 NFL season. Story probably checks out because this is a multi-billion dollar deal – where Apple has the advantage of it essentially being a rounding error on operating profits … let alone revenues.

Amazon (AMZN) has also been aggressive acquiring live sports rights. It started non-exclusively showing Thursday Night Football in 2017 and that’s evolved into an exclusive airing of this game starting this NFL season. The company also streams an array of other lives sports including the WNBA.

Google (GOOG, GOOGL) is also rumored to be a bidder on the 2023 NFL Sunday Ticket rights. Through the company’s YouTube and YouTubeTV platforms, the company has huge distribution of not only the games, but highlight shows & user generated content. This means that Google benefits largely without even needing to spend big on the actual content rights.

Meanwhile, ESPN recently lost out on a new Big Ten football contract, along with the MLS and MLB contracts Apple acquired. However the company still holds NFL Monday Night Football until 2033, SEC football through 2034, NHL games through 2028, and NBA television rights through 2024.

With the NBA supposedly wanting $75B for its next TV deal, it begs the question if a mega cap company could simply buy the league itself – as the top 10 NBA teams have an estimated value roughly half the cost of a TV deal.

On a more serious note as it pertains to ESPN, the company still has a large portfolio of live sports assets, however one has to assume future negotiations will have bids from Amazon, Apple and Google – let alone traditional media.

When analyzing Disney’s quarterly reports, Q3 2022 is littered with references to sports coverage costs rising. This fact is evident when analyzing operating profits from the media division.

| 9 Months Ended | 9 Months Ended | Growth | |

| Media & Entertainment | July 2022 | July 2021 | |

| Revenue | $42.3B | $37.8B | 12% |

| Operating Income | $4.1B | $6.3B | (35%) |

Source: Q3 2022 Earnings

Over the past 9 months, Disney has grown the Media business (which encompasses ESPN) 12% Y/Y, however operating income is down 35%. Again, the company primarily cites rising sports coverage costs – albeit sometimes related to scheduling differences.

2022 isn’t going to get any better. The company indicated 2022 programming costs, including sports rights, would be near $33B or $8B more than 2021 spend of $25B. (Disney 2021 10-K Annual Report p. 47) That’s an increase of 32% Y/Y.

The problem is ESPN lost 10% of its pay-TV subscribers in 2021 to 76M, well below its peak over 100M a decade ago; as consumers continue to shed traditional cable services. This is partially offset by the growth in ESPN+.

Either way, with Apple, Amazon and Google at the table of every major sports television contract – things are likely to exponentially get more expensive.

This is likely one reason why activist investor Dan Loeb recently sent a letter to CEO Bob Chapek stating the company should spin-off ESPN. Chapek is rumored to have cooled on shedding ESPN from Disney’s portfolio.

Certainly with asset prices down nearly across the board in 2022, selling ESPN in this climate isn’t ideal for shareholders. Additionally Warner Bros. Discovery (WBD) is down 49% year to date – and that company owns some key sports rights as well.

How Much Is ESPN Worth?

Difficult to track down any extensive research on how much ESPN is worth today, but it was estimated to be worth north of $50B 8 years ago.

In 2008 Disney had $10B in cable network revenue, primarily from ESPN affiliate fees. (Disney 2008 10-K p. 59) In 2021 Disney generated $15.2B in domestic affiliate revenue. (Disney 2021 10-K Annual Report p. 38)

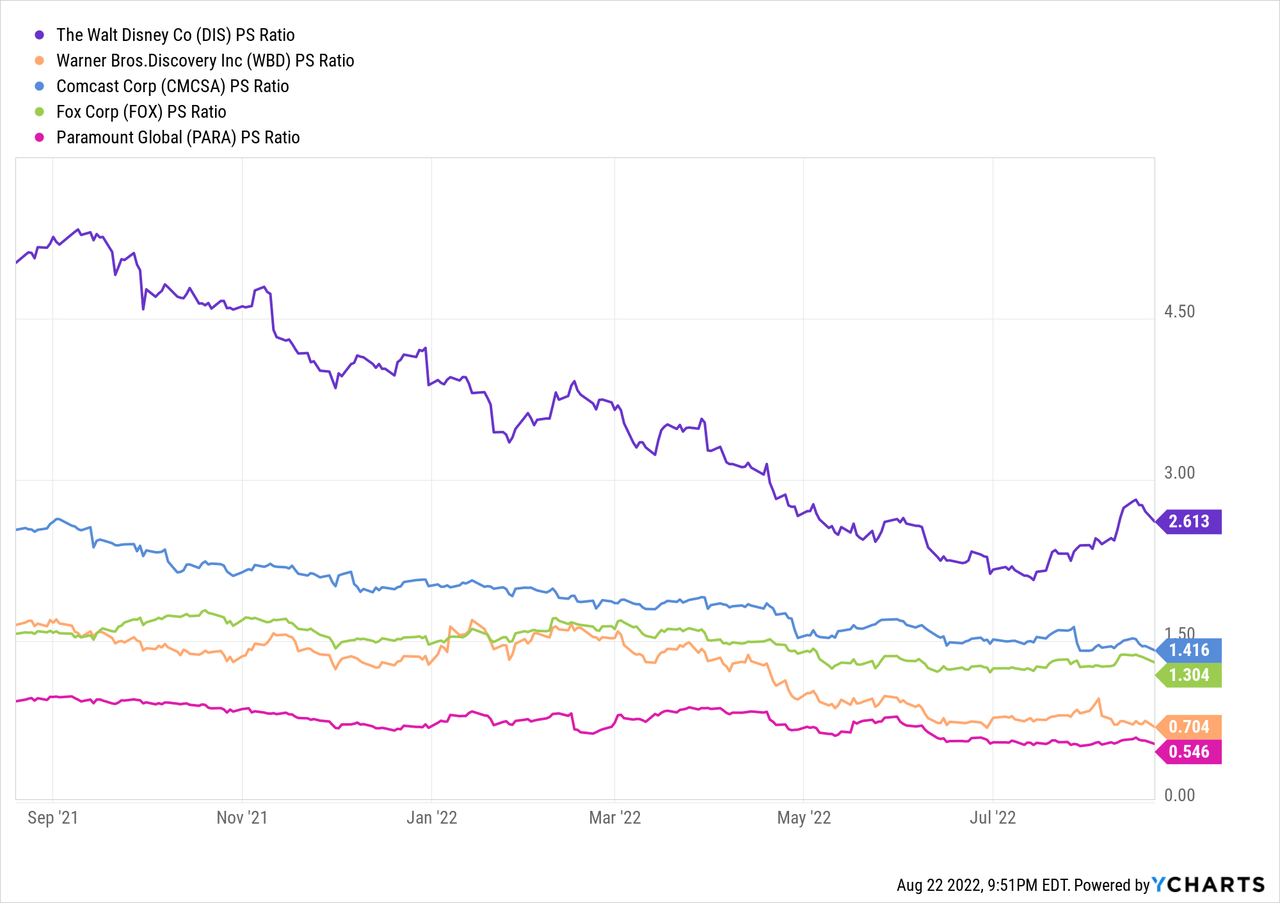

In the public markets, there’s virtually no media company trading at a large premium to sales. One could argue Disney’s premium over the group is related, in part, due to ESPN. However, the company’s parks division, direct-to-consumer, movie assets and children’s programming is also superior to most competition.

Although an open bidding war for ESPN’s assets would create a large premium. Last year Amazon purchased MGM Studio for $8.45B on just $1.5B in 2021 revenue and net income of $33.9M. Apple was also rumored to be a bidder.

An MGM Studio-like 5-6x sales multiple on ESPN’s affiliate revenues alone would be north of $75B, that doesn’t include advertising and ESPN+.

Bottom line is ESPN is going to face sports right negotiations that will include the world’s richest companies. The end-game is either pay way more for sports content or lose the competitive advantage ESPN held over affiliates because the company had most major sporting events.

Neither sound like a good option.

The End Game

If Disney waits too long to explore a sale of ESPN, investors could eventually see a televised sports landscape that has ESPN showing little live sports. That might not be a bad thing from a cost perspective and recently the company has seen ratings growth in studio content like SportsCenter and talk shows.

However it’s a risky game to play. Based on the valuations of other traditional media companies, it’s hard to imagine a stand-alone ESPN ticker that trades much higher than Disney’s current 3-5x multiple on sales.

Wait too long and companies like Apple, Amazon and Google will have already plucked the best sports rights and studio talent that it might not see a need buying ESPN outright.

Conclusions

A sale of ESPN, sooner rather than later, would be beneficial for Disney shareholders in the long run. While the company would see a meaningful reduction in revenues from affiliate fees – the company’s operating profits from the media business continues to decline because of the higher costs. When more sports rights deals come up for renewal, the costs are only going to rise with new bidders at the table – likely further deteriorating profits. Additionally, if ESPN is no longer the premier destination to watch live sports – how much leverage does Disney have demanding high affiliate fees?

A streamlined Disney without the weight of expensive sports contracts would return Disney to a company that owns its content free & clear. I recommend continuing to hold Disney stock, as a potential sale would free up resources to pursue content with less expensive costs.

Be the first to comment