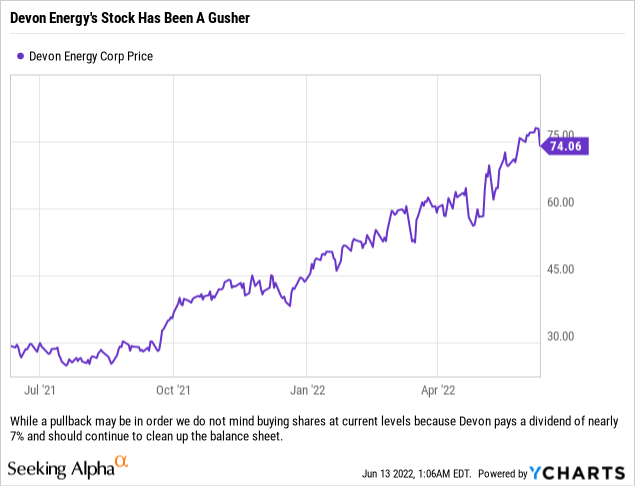

Devon Energy shares can continue higher even if energy prices stall out at currently levels due to its inventory of high quality drilling locations and management’s financial discipline. ahopueo/iStock via Getty Images

We hate to tell people that a stock is a buy when that stock is trading at or near a 52-week high, but sometimes the facts are so overwhelming that there is only one position to take, and that is to be long. As someone who watched the whole shale cycle play out, it is very refreshing to see the industry take a more purposeful approach to CapEx, debt and M&A activity, because we remember a time not long ago where it seemed no dollar amount was too big for any of those categories regardless of the facts. Today however, the oil patch survivors are methodical in their CapEx spending, have a realistic view on debt and its relationship with their businesses, and as an industry now view M&A as a process to create value today rather than kicking that burden down the road for someone else to accomplish.

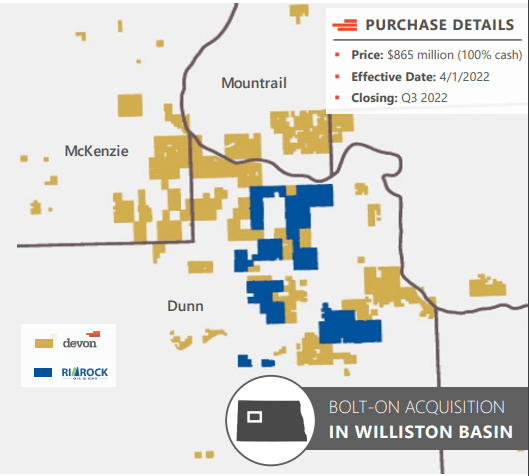

We mention all of this as a little background, because every time we see a new acquisition announced in the energy industry, our first inclination is to cringe a little as we open the press release based off of all of the years of bad deals we watched. Last week however, we actually had a little bit of hope when we opened the Devon Energy (NYSE:DVN) press release announcing their latest acquisition, as we saw “bolt-on” and “Williston Basin” included in the headline. In our experience, bolt-on acquisitions tend to make a lot of sense in almost any industry and the Williston Basin has great economics. After reviewing the deal and doing some more research, Devon Energy’s acquisition of RimRock assets in the Williston Basin for $865 million in cash certainly looks like a solid M&A move which has the potential to reward shareholders even if energy prices retreat from current levels.

Deal Background

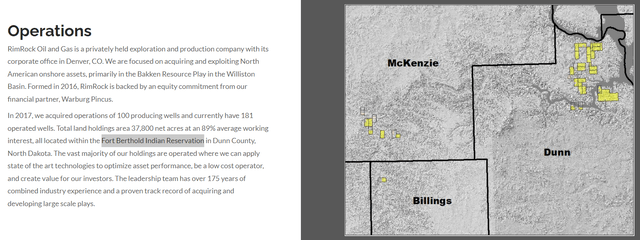

First, let’s talk about the acreage and production. Devon is purchasing 38,000 net acres (88% working interest) From RimRock Oil and Gas, LP which are contiguous to Devon’s current position in the Williston Basin (note: according to the RimRock website, this acreage is on the Fort Berthold Indian Reservation). Currently, RimRock’s acreage produces 15,000 boe/d (as of Q1 2022) with roughly 78% of production being oil. Devon also stated that they expected production to increase by 33% to 20,000 boe/d over the next year as they spend $100 million in CapEx in 2022 after the closing (most likely Q3).

RimRock’s holdings are located inside the Fort Berthold Indian Reservation (RimRock Website)

We believe that this is a very important part of the deal, because RimRock’s current owners, a portfolio managed by Warburg Pincus, were most likely not going to spend anywhere close to that in the next 12 months and this deal would appear to help increase production. Washington, D.C. is keen on adding production and having energy companies drill wells, and while this transaction does not add a lot of wells upfront, it does create a situation where the acquirer is going to spend just over 11.5% of the deal value (in addition to the $865 million for the deal) to add production. Plus, Devon will be able to drill out the 100+ drilling locations much faster than RimRock would have. We think all of this will prevent any issues from those looking to politicize the deal and with the transaction being below $1 billion we doubt that the regulators will object.

Devon should be able to optimize drilling locations and potentially lower drilling expenses with the additional acreage. (Devon Energy Investor Presentation)

The deal structure on this is pretty attractive, especially when viewed through the context of Devon’s dividend structure (which is a fixed-plus-variable model). With the transaction structured to be immediately accretive, Devon’s Board of Directors approved a 13% increase to the fixed dividend payout following the closing of the transaction and still expect to bring net debt-to-EBITDAX down to 0.2x by 2022 year-end. Also, because it appears that the deal will add 3-5% improvement in earnings and cash flow growth, the company believes that the variable portion of the dividend will rise in 2022 and carry over into future years as well.

Our Take

Based on the current market, this transaction looks pretty attractive from the viewpoint of Devon shareholders. Devon is purchasing the acreage at a 2.2x cash flow multiple and a 25% free cash flow yield, which is above the free cash flow yield Devon itself would trade at were WTI prices at $120/barrel (based on slide 6 of the Q1 Earnings Presentation, it would appear to be 20%).

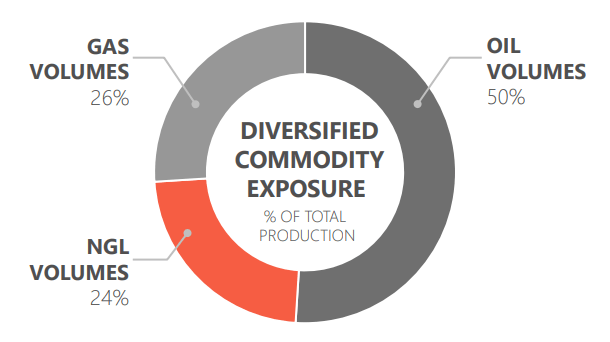

Devon Energy has a very attractive production mix, with gas only making up about a quarter of production. (Devon Energy Q1 2022 Investor Presentation)

These are high quality assets and with the high proportion of oil in production, we think that Devon could continue to deliver for shareholders. The company has about 20% of its 2022 production hedged, which in our opinion is an effective hedging strategy as it locks in prices to keep the company running if the energy market collapsed but also gives shareholders plenty of upside with energy pricing improving. The skew of production towards Oil and NGLs we think should benefit the company as it is our opinion that oil prices have a better chance of remaining higher for longer than does natural gas. This is because we doubt that Venezuelan or Iranian oil production is going to be able to enter the market fast enough to efficiently fill the void of the Russian crude facing sanctions and it is doubtful that Saudi Arabia itself will increase production by a meaningful amount to offset the lost Russian production. A lot of maintenance needs to occur in Venezuela’s oil fields to get them back up and running and Iran has work to do as well (although it does not seem that the nuclear talks are going well for them right now, so it might be a moot point as their production still would not be able to reach international markets).

Summary

We think that Devon Energy is a name that investors can add to their portfolios even with shares trading near 52-week highs. While a pullback may be due, we believe that this management team, coupled with the outstanding assets they control and strong balance sheet, will enable Devon to continue to fund an attractive dividend for shareholders while also retiring debt. Management spent just about a third of the $2.6 billion in cash they had as of 3/31/2022 on this transaction, and if there are more deals like this one to be had, we certainly hope that they will pursue them.

Be the first to comment