Wolterk/iStock Editorial via Getty Images

As one of the top Human Capital Management (‘HCM’) software providers in the world, we analyzed Paychex, Inc (NASDAQ:PAYX) Management Solutions segment based on its customers and revenue per customer growth as well as a comparison with competitors on features and reviews to determine if it has a competitive advantage. This is as its management raised its guidance for the segment to grow between 12% to 13% from 10% to 11% YoY in FY2022.

Customer Base Growth

|

Paychex |

2017 |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Customers (‘000s) |

605 |

650 |

670 |

680 |

710 |

731 |

752 |

773 |

794 |

815 |

|

Growth % |

7.4% |

3.1% |

1.5% |

4.4% |

3.0% |

2.9% |

2.8% |

2.7% |

2.6% |

Source: Paychex, Khaveen Investments

In the past 5 years, the company had consistently positive customer growth an average growth rate of 4.1%. Although its growth rate had decelerated from 2018 to 2020, it recovered in 2021. Furthermore, based on its Q3 FY2022 earnings briefing, the company’s management highlighted its client base growth in the quarter driven by sales performance and high customer retention levels. Additionally, it highlighted its high levels of client retention near record levels and better than pre-pandemic levels.

Our client retention continues to surpass our expectations and remains near our record levels of the prior year, well ahead of the pre-pandemic levels. – Martin Mucci, Chairman & Chief Executive Officer

In comparison to its 4 competitors, the company is tied with Paylocity (PCTY) with the highest customer loyalty at 82% according to Comparably. Besides that, the company also highlighted its improvement in the mid-market segment benefitting from its products and technology. Previously, the company was awarded by the Brandon Hall Group in the “Best Advance in HR or Workforce Management Technology for Small and Medium-Sized Businesses” category.

Overall, we expect the company’s high customer loyalty to benefit its customer retention and support its customer base growth in addition to its brand recognition among the small and mid-size businesses and forecasted it based on its average customer increase of 21,000 per year through 2026, translating to a low average growth rate of 2.8%.

Revenue Per Client

|

Paychex Management Solutions ($ mln) |

2017 |

2018 |

2019 |

2020 |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Revenue Per Customer |

4,431 |

4,244 |

4,295 |

4,357 |

4,258 |

4,683 |

4,638 |

4,593 |

4,549 |

4,506 |

|

Growth % |

-4.2% |

1.2% |

1.4% |

-2.3% |

10.0% |

-1.0% |

-1.0% |

-1.0% |

-1.0% |

|

|

Revenue |

2,681 |

2,758 |

2,878 |

2,963 |

3,023 |

3,423 |

3,488 |

3,551 |

3,612 |

3,672 |

|

Growth % |

2.9% |

4.3% |

3.0% |

2.0% |

13.2% |

1.9% |

1.8% |

1.7% |

1.7% |

Source: Paychex, Khaveen Investments

Although the company’s customer base growth accelerated in 2021, its average revenue per customer declined. This is similar to 2018 when its customer base grew by 7.4% and its revenue per customer also declined which could be due to new customers having lower spending compared to existing customers. On average, its revenue per customer declined by 1% during the period. However, in its Q3 2022 earnings briefing, the company highlighted its Management Solutions segment growth of 13% YoY driven by higher revenue per client. Also, it stated growth from ancillary HR services such as its Employee Retention Tax Credit (ERTC) solution which was introduced in 2021 to assist customers to maximize their tax credits as part of the COVID-19 stimulus program. Notwithstanding, management highlighted that the revenue associated with ERTC is substantially nonrecurring based on its earnings briefing. Besides that, it also released its Pooled Employer Plan solution in 2021 and has already secured over 10,000 clients 11 months after its launch. Moreover, the company had recently had a new product launch with enhancements for companies to manage their on-site and distributed workforce.

All in all, as the company continues to enhance and introduce new solutions for its customers, we expect the company’s average client base to increase in 2022 based on its prorated Q1 to Q3 Management Solutions segment revenue and a forecasted client base of 731,000 as discussed above. Beyond that, we projected it based on a 4-year average growth (-1%) as a conservative assumption as its ERTC solution revenue is nonrecurring according to management, resulting in an average segment revenue growth rate forecast of 4.1% through 2026.

Competitive Landscape

To determine whether our low growth outlook of the company beyond 2022 is justified, we compared its HCM solution against competitors based on common and total HCM features as well as customer reviews from GetApp.

|

Comparison |

Common HCM Features |

Total Product Features |

Average Customer Reviews |

|

Workday HCM (WDAY) |

43 |

103 |

4.4 |

|

Paylocity |

37 |

95 |

4.2 |

|

Ceridian Dayforce (CDAY) |

36 |

76 |

4.3 |

|

ADP Workforce Now (ADP) |

39 |

85 |

4.4 |

|

Paychex Flex |

29 |

55 |

4.1 |

Source: GetApp, Khaveen Investments

Based on the table above, Paychex’s HCM solution has the lowest number of features in terms of both common HCM software features (29) and total features (55) compared to its competitors. In terms of common HCM features, its competitors have but it does not include succession planning, employee self-service and time-off requests. Additionally, the company has the lowest average customer reviews of 4.1 stars out of 5. In comparison, Workday has the highest number of features with 43 common HCM features and 103 total product features as well as having the highest customer reviews with ADP (4.4/5). Whereas ADP has the second-highest number of common HCM features and is tied with Workday with the highest customer reviews.

All in all, based on a comparison of its HCM, we believe Paychex is at a competitive disadvantage to its competitors with the lowest number of product features and average customer reviews. Thus, we believe our low growth outlook for the company is justified. On the other hand, we believe that Workday has the strongest competitive advantage over the companies with the highest number of features and customer reviews.

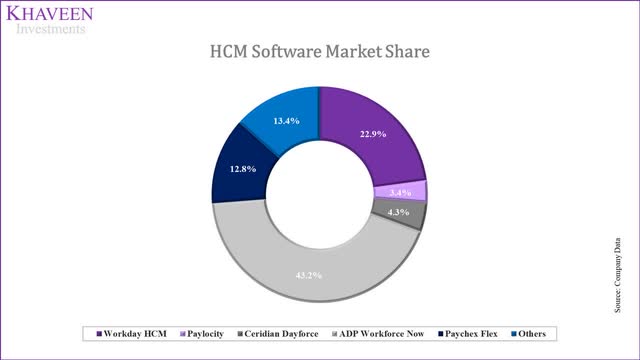

Risk: Market Share Loss

The HCM software market is highly competitive and fragmented with various competitors. According to Fortune Business Insights, the HCM software market is forecasted to grow at a CAGR of 9.1% through 2029. We believe that the company could face competition headwinds and lose market share.

Company Data, Khaveen Investments

|

Company |

Market Share |

5-yr Revenue CAGR |

|

Workday |

22.9% |

25.90% |

|

Paylocity |

3.4% |

22.76% |

|

Ceridian |

4.3% |

10.2% |

|

ADP |

68.3% |

5.69% |

|

Paychex |

12.8% |

7.68% |

Source: Company Data, Khaveen Investments

Verdict

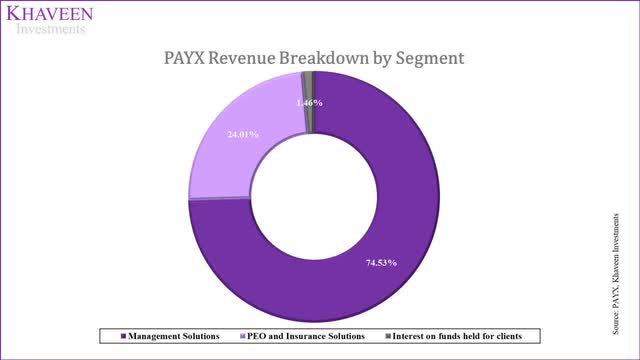

Despite being the third-largest HCM software provider, we expect the company to lose share to its competitors with a greater competitive advantage than the company in HCM. This is as we forecasted its Management Solutions segment with an average revenue growth forecast of 4.1% through 2026 driven by customer growth of 2.8% and average revenue per client growth of -1% beyond 2022 based on its past 4-year average as a conservative assumption due to the nonrecurring nature of its ERTC solution as highlighted by management. While the company’s PEO segment has a higher average growth rate of 24.6%, we expect its Management Solutions segment to affect its overall revenue growth as it is its largest segment accounting for 75% of its total revenues. Thus, we referred to the low end of the average analyst consensus price target of $110 which is a downside of 8.5%.

Be the first to comment