ASKA/E+ via Getty Images

Investment Thesis

Iteris, Inc. (NASDAQ:ITI) has positioned itself as a pure-play integrated provider of traffic data and intersection intelligence. It is the leader in smart mobility infrastructure, and hardware sensors with a 33% market share of above-ground signalized intersections in the U.S. ITI have sales growth opportunities to increase its recurring revenues and SaaS ecosystem penetration, expanding into the highways market and expanding into the fixed-position connected vehicles market.

ITI is highly differentiated by its reliable product performance, better data workflow, ecosystem, and high switching costs. Its high renewal rates and customer stickiness are backstopped by the reliable data loop that ITI creates by sourcing from multiple data points in the detection space and meeting the rising specifications set by each state. ITI’s innovations and bundled solutions create a catalyst for states to raise the bar for specs, which prevents most new entrants and allows ITI to gain market share. ITI also has many patents as barriers for its capabilities, managing an intersection zone, pedestrian detection, classifying certain objects, and extreme weather performance.

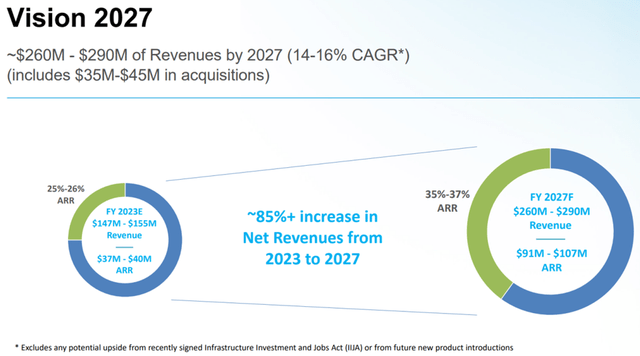

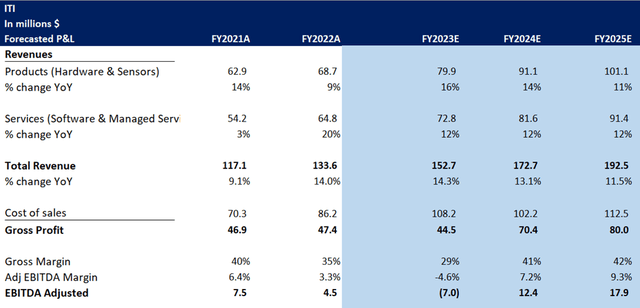

In my view, investors are not fully appreciating how ITI has evolved after its acquisition of TrafficCast International, its strong market shares, high win rates, high renewal rates, and its migration to an integrated solution offering to customers, including its cloud-based software analytics. I forecast a positive 7% EBITDA margin for the March 2024 fiscal year and 9% for the following year driven by its recent orders, scale benefits, a growing mix of recurring revenues (27% to possibly 40% in 2026) and growing Software-as-a-Service (SAAS). I expect margin expansion, along with 13% organic sales growth, to trigger a re-rating of the stock.

My $5.50 price target on the stock is based on an 18x EV/EBITDA multiple of my March 2024 fiscal year EBITDA estimate of $12.4 million. This compares to the peer group trading at a median of 15x 2023 EV/EBITDA. I assign a 20% premium to ITI’s valuation for its rising recurring revenue mix potential and SaaS cross-selling.

Why am I bullish on ITI?

Pioneer in Smart Mobility Infrastructure Management

ITI specializes in data and traffic detection at intersections and on highways. Its detection systems and end-to-end cloud-enabled solutions are for public transportation agencies, municipalities, and other transportation infrastructure providers. Its ClearMobility platform helps its customers monitor, visualize and optimize infrastructure to make mobility safer, decrease traffic congestion and make infrastructure more efficient. ITI’s platforms monitor the performance of intersections, freeways, and arterials, with visualization data to predict and improve traffic flow.

Integrated Platform Ecosystem & Cross-Selling

Unlike most of its competitors, ITI has an open architecture design, which allows its customers to benefit from collaborating with other agencies and leverage a more diverse data flow for a nationwide reach. ITI can overlay its unique data flow with real-time incident data. It aggregates several data points from multiple sources and incident systems at multiple transportation agencies, which allows ITI to utilize its artificial intelligence software to validate the accuracy of the data. This differentiated approach and better product performance allow ITI to achieve 95-99% accuracy rates. It also facilitates cross-selling of traffic studies and reporting.

Real-Time Capabilities & Analytics

ITI is further differentiated by its unique software and high-performance detection sensors for the Internet of Things (IOT) as ITI expands its SaaS cloud-based platform. Customers rely on ITI’s advanced detection sensors, mobility data sets, and intelligence software for a digital representation of mobility infrastructure and real-time performance.

Recurring Revenues Increase & Cloud-based Platform Conversion

The stock should re-rate from better predictability as its recurring revenues grow from 27% of sales during the past six months to 40% in 2026. Its cloud-enabled platform is only 13% of sales today and could reach 20% in 2026 as customers migrate to ITI’s enriched traffic data. Its SaaS offering helps its customers be more updated, efficient, and make real-time decisions. ITI is in a unique position to upsell its cloud platform because it already has years of hardware and detection systems at many departments of transportation (DOTs) throughout the U.S. Two years ago, Iteris was selling only detection devices for intersection traffic, but now provides the reporting data and software integration. ITI also provides traffic data to satellite radio operators (SiriusXM, iHeart radio) and recently began making inroads to insurance companies and fleet logistics customers to augment their existing data with ITI’s enriched data.

ITI Vision 2027 (company presentation)

13% Sales Growth Potential & Margin Expansion

New order bookings have been strong, and its backlog is up 34% over the past year. I have forecasted ITI to average 13% annual sales growth through March 2025. The supply chain disruptions, which held back its profit margin over the past three quarters, are abating. This, along with ITI’s redesign of three circuit boards, should trigger strong gross margin expansion in the next two quarters. The management team is now overcoming the shortage of processing chips, and sourcing parts from more suppliers, and the management is targeting to reach a 16-19% adjusted EBITDA margin in calendar 2026.

ITI is targeting adj. EBITDA margin of 16-19% by 2027 (company presentation)

Valuation

My $5.50 price target is based on an 18x EV/EBITDA multiple of my March 2024 year EBITDA estimate of $12.4 million. This compares to the peer group trading at a median of 15x 2023 EV/EBITDA. I have assigned a 20% premium to ITI’s valuation for its rising recurring revenue mix potential and SaaS penetration opportunity through cross-selling. I like ITI’s potential of double-digit organic sales growth and EBITDA margin expansion catalysts.

Forecasted P&L of ITI (my estimates)

Risks

Risks to my rating include:

- Government funding uncertainty and delays, including the Infrastructure Investment and Jobs Act.

- Substitute technologies or better artificial intelligence by competitors.

- Gross margin contraction if its software grows much faster than its higher-margin hardware.

- Dilution to shareholders from equity raises, issuance of stock options/warrants, and private placements.

Final Thoughts

Iteris is a pure-play integrated provider of traffic data and road intersection intelligence, and I believe that investors have not noticed the successful evolution of ITI’s business model and how it is on track to generate positive EBITDA next year. It is an emerging growth stock with a strong sales backlog and ecosystem likely at an inflection point of achieving profitability in the upcoming March quarter. It also has an attractive 12% organic sales growth goal. These attributes, along with a rising share of recurring revenues and Software as a Service (SAAS) penetration, should trigger a re-rating of the stock’s valuation. I keep a strong buy rating on the stock with a target price of $5.50.

Be the first to comment