piranka

2022 has been a rough year for many, as equities have been hammered. The S&P is down nearly 18% year-to-date, with the tech-heavy NASDAQ down over 30%. Workiva Inc. (NYSE:WK) hasn’t been exempt from the bloodbath, as WK stock is down nearly 40% year-to-date.

Workiva did deliver some respectable news in their third quarter results as revenue figures topped estimates and the number of large contract customers continued to increase. New XBRL requirements such as the pay vs. performance proxy initiative will continue to bring in additional revenue for the company.

However, it remains to be seen if Workiva will continue as a public company. There has been recent speculation a private equity firm may take over the software company.

Let’s dig deeper into the Q3 results and the recent news to determine whether this stock may shine in 2023 and beyond.

XBRL – Pay Vs. Performance

In prior articles, I have mentioned the various situations in which additional XBRL usage may come into play such as environmental, social, and government (ESG) investment practices, cybersecurity, insider training and SPACs.

The most recent ruling which will impact many filers relates to pay vs. performance within an entity’s proxy statement (this requirement excludes emerging growth companies, business development companies, and a few others included in this SEC article).

Beginning with companies whose fiscal year end on or after December 16, 2022, companies will have to provide a table disclosing executive compensation and financial performance measures. Within the table registrants are required to include compensation information pertaining to the principle executive officer (“PEO”) other named executive officers (“NEOS”), actually compensation paid, as well as other financial performance measures.

Small reporting companies (OTC:SCRS) are required to shown results for the last three fiscal years, and companies other than SCRs will need to show five years of data. SCRs will also be able to phase in iXBRL tagging.

This additional requirement clearly indicates XBRL is here to stay. Investors and data consumers alike want more information. Executive compensation has been a hot topic for quite some time and now there will be a way to easily review and compare executives compensation.

Now, I’d like to further discuss the status of XBRL quality for Workiva, Toppan Merrill, Donnelley Financial Solutions (DFIN) and the industry as a whole.

XBRL Quality

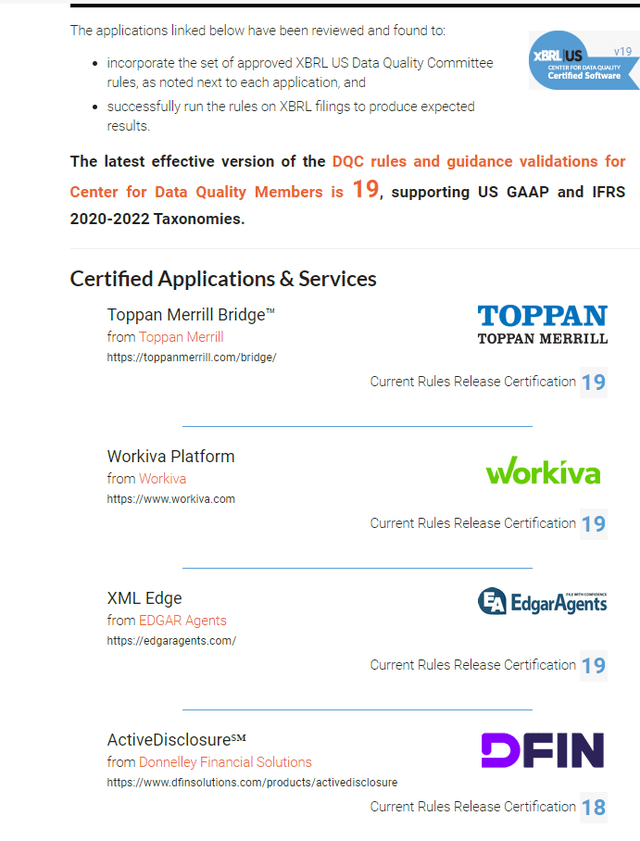

XBRL quality is essential for data consumers. Without quality, the data can’t be easily consumed and is more difficult for it to be relied upon. I’m not going to do a deep dive into the origins of XBRL (extensible Business Reporting Language) or the current process for creating new XBRL data quality rules, but that information can be found in a few of my prior articles. Since my last article, two new XBRL rules have been added. Workiva, and Toppan Merrill support the last XBRL ruleset, ruleset 19. DFIN currently only supports up to ruleset 18.

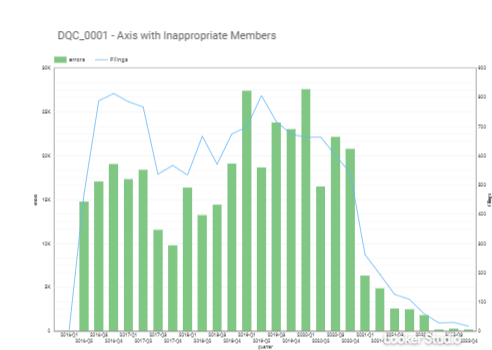

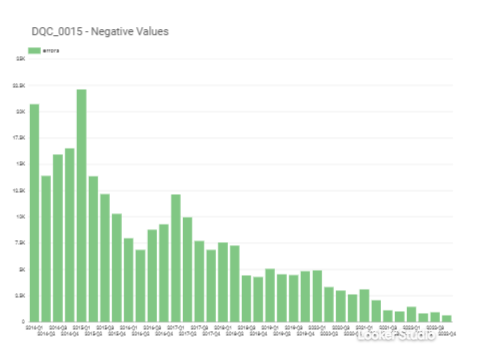

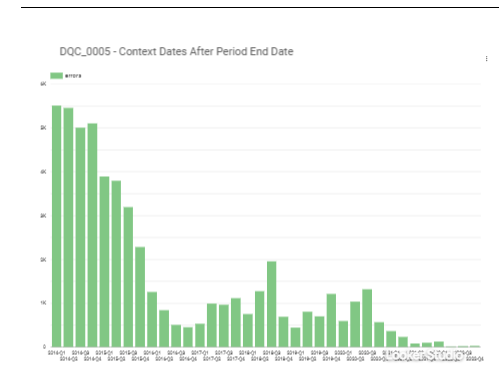

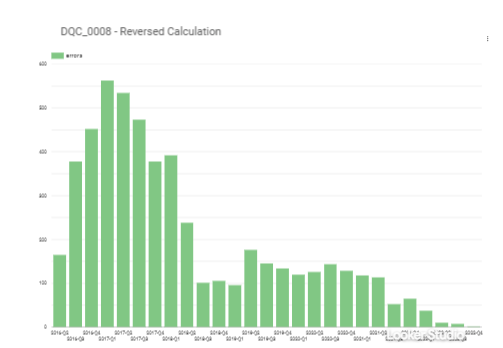

Looking at the overall XBRL industry the trend continues to be positive. Similar to the prior quarters, XBRL data quality continues to improve as the number of errors continues to decline. Below are a few graphs depicting the decline in specific XBRL rules.

Axis With Inappropriate Members

XBRL US

XBRL US

Context Dates After Period End Date

XBRL US

XBRL US

Over the past several quarters, I’ve been following the XBRL data quality results for several large companies. Toppan Merrill has consistently had the best quality among the three companies. Many of the errors I have found early in the year have been addressed by my sample of Workiva clients. In comparison, DFIN results continue to have errors. The below provides additional information regarding the various large companies I have been following and their corresponding XBRL results.

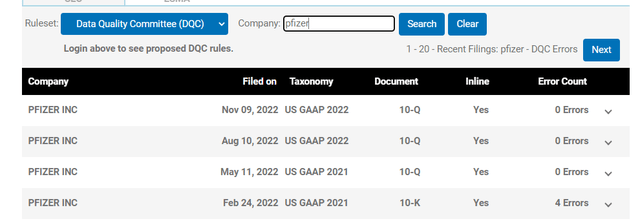

Pfizer Inc. (PFE)

Workiva has been providing the XBRL services for this company, and you can see the following results from the XBRL US website:

As you can see, there were no issues present this quarter.

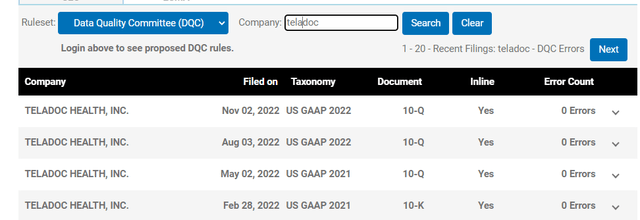

Similar to last quarter, I was unable to find any issues with Toppan Merrill filings. For example, here is one of their company’s filing results:

Teladoc Health, Inc. (TDOC)

Toppan Merrill has been providing the XBRL services for this company, and you can see the following results from the XBRL U.S. website:

I found errors in my sample of DFIN filings. As you can see below, Goldman Sachs jumped all the way up to 5 errors this quarter. Given the ongoing issues this year, DFIN appears to be liking the least accurate when it comes to XBRL accuracy.

Goldman Sachs Group (GS)

DFIN has been providing the XBRL services for this company and you can see the following results from the XBRL US website:

Overall, it’s encouraging to see data quality continue to improve within the industry. Amongst the three top firms, Toppan Merrill continues to have excellent data quality and has been the most consistent XBRL provider. Workiva’s results have been improving and I have been seeing less issues in the latter part of this year. I would be concerned if I was a client using DFIN. The results are the worst and DFIN has been the least consistent in this group. Additionally, DFIN is not in compliance with the most recent ruleset (Ruleset 19).

Financials

Despite the current market conditions, Workiva delivered solid results in Q3 2022. The company generated revenue of roughly $133 million in Q3 2022 which is an increase of nearly 18% compared to Q3 2021. Most of this revenue was generated from subscription and support revenue and revenue from professional services accounted for the rest. Subscription and support revenue was roughly $119 million, an increase of 20% compared to prior year’s third quarter. New logos and new solutions helped drive this growth. Professional services revenue was roughly $14 million for the quarter, an increase of 4% compared to prior-year third quarter.

Management noted that larger subscription contracts have continued to grow. Workiva had 1,257 contracts valued over $100,000 per year, which is an increase of 21% compared to Q3 of 2021. The number of contracts valued at over $150,000 per year totaled 676, which is up 25% compared to the prior year. The number of contracts valued at over $300,000 per year totaled 214, which is up 25% compared to Q3 2021.

Retention remains outstanding as well, as the subscription and service revenue retention rate was roughly 98% for the quarter, which is up slightly from 96% compared to prior year’s third quarter rate.

Client count continues to rise as well as Workiva finished Q3 2022 with 5,541 clients, which is an increase of 1,395 customers compared to Q3 2021. For the current quarter, the company added 160 new customers. The total number of ParsePoint customers was 895.

Takeover Interest

In late September it was reported Workiva had received takeover interest from several private equity firms such as Thoma Bravo and TPG. Various software companies have been taken private this year including Zendesk and very recently Coupa.

When asked about this takeover interest on the conference call, Workiva CEO’s Vanderploeg stated, “We really can’t comment on rumors. But I’ll say this, we are a great company. And I think in general, we think we are on the upswing. We don’t think we are broken.”

Valuation

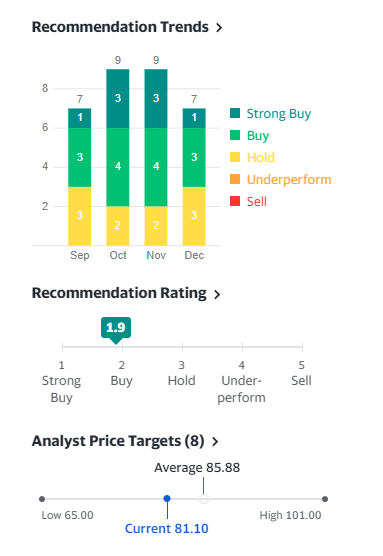

Workiva still has yet to achieve profitability. Over the last three months, Workiva’s stock price has increased by over 20% (likely given the takeover news). However, the company’s stock is still down significantly year-to-date. Most analysts view Workiva either as a “Buy” or a “Hold,” but none currently have a “Sell” rating. Also, based on many analysts’ projections, the current stock price is below analyst price targets.

Based on one analyst’s opinion, he believes Workiva may be worth up to $117 a share in a takeover. At this point it’s all speculation, but the current share price may seem attractive to buyers believing a takeover is likely.

Yahoo financial

Conclusion

The new pay vs. performance proxy requirement will proceed further revenue to firms in the XBRL industry. I believe XBRL usage will only continue to expand over the next several years, especially with the ESG reporting which will likely be coming in 2023. Given the current economic and global climate, this is not an easy industry to disrupt, and thus I believe Workiva will be an advantageous position in the years to come.

However, there is a possibility Workiva Inc. is taken over by a private equity firm. If you believe that’s likely, now might be a good opportunity to accumulate Workiva Inc. shares, as it seems very likely the private equity firm would pay more per share than the current stock price.

Be the first to comment