Michael Vi/iStock Editorial via Getty Images

As the 2022 holiday shopping season nears its end, many investors are looking to retail stocks to speculate on holiday sales. Specific stocks, such as Walmart (NYSE:WMT), carry great exposure to the holiday shopping season as its sales are usually 10-15% higher during the fourth quarter. US retail sales declined materially in November after being low for most of the year, indicating potentially disappointing sales. Even more, most retailers began the quarter with excessive inventory levels, making it likely Walmart and peers offered significant discounts that likely negatively impacted profit margins. Looking toward 2023, the company faces a seemingly negative economic trend that may create challenges for Walmart, particularly if inflationary forces remain.

Of course, compared to Target (TGT) and Best Buy (BBY), Walmart is known for its discount platform, which may limit its exposure to negative headwinds. That said, today’s economy operates under a paradigm different from its historical norm, with cost-push inflation creating additional headwinds for discount retailers. Walmart may not see its sales decline dramatically due to a recession, but it may see its operating margins collapse into negative levels, as indicated last quarter. Even if Walmart’s fundamentals are more robust than many of its competitors, WMT trades at a near-peak price and a very high “P/E” valuation of 23.5X. Thus, a slight decline in Walmart’s profitability may be sufficient to dramatically lower the equity’s value. In my opinion, this situation makes WMT a very high-risk stock today, with relatively low upside potential.

The Economic Storm Facing Walmart

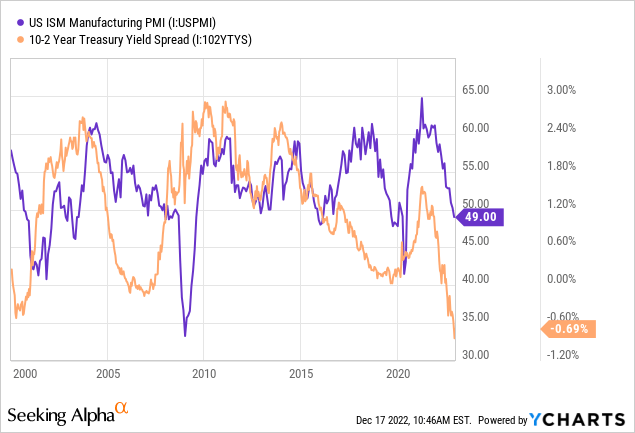

Most economic models and a majority of analysts suggest the US economy is headed into a recession in 2023. Based on traditional measures, the US economy was in a recession in 2022 as there were two-quarters of negative GDP growth, but it was never declared so. That said, going into 2023, numerous historically strong recession indicators, such as the manufacturing PMI and yield curve, indicate further contraction to the GDP:

The yield curve and the manufacturing PMI (a leading measure of business activity growth) have trended lower through 2022. Each measure is a solid historical recession indicator (1,2), so considering both are pointing toward a recession, that outcome looks highly likely. The high inflation rate during the past two years may “muddy the waters” for some data since it artificially increases nominal spending (and growth) levels and directly strains real wages. Inflation is now clearly declining, partly due to a fall in household and business spending power. Many people see these recession indications as a net positive since it moderates the Federal Reserve’s policy outlook; however, in my opinion, that may not be true due to potentially rising inflationary factors in the currency and oil markets that may halt any dovish shift.

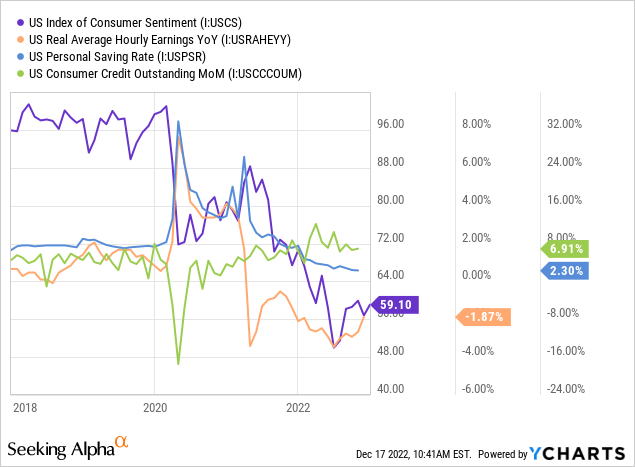

Narrowing in on Walmart, the negative economic trend is certainly bearish for retail spending activity. Falling real hourly income results in deficient savings, causing many to increase debt via consumer credit. During much of 2022, consumer credit grew rapidly as many households used debt (credit cards) to offset lost real wages. However, that trend is reversing, indicating that many will need to reduce discretionary spending rapidly. See below:

I believe 2023 will likely be a very challenging year for retailers. While many analysts and investors find that point contentious, it is made very clear by a plethora of economic data with solid track records. Additionally, because most households are under growing strain, this trend will likely impact retail spending more than other segments, particularly if the US dollar declines in value, as I suspect, as that would increase import prices.

Walmart Is Not “Recession Proof” Anymore

Walmart is, by far, the largest US retailer, with $460B in retail sales in 2021, far above Amazon’s (AMZN) ($217B), Target’s ($104B), and others. Walmart is also the most significant corporate employer in the US, with around 2.3M employees. Walmart’s immense size makes it a subject of all US economic and social trends. It is difficult for the company to make significant quick changes given its footprint. Fortunately, its long-held model is maximizing its economy-of-scale and out-competing peers for lower prices has been an extremely successful strategy.

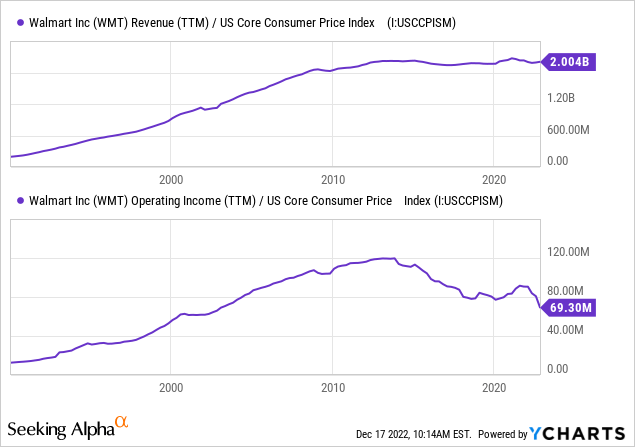

Interestingly, adjusting for core consumer prices, Walmart has not grown its “real” sales since around 2010. Further, the company’s real operating income has fallen dramatically since then. See below:

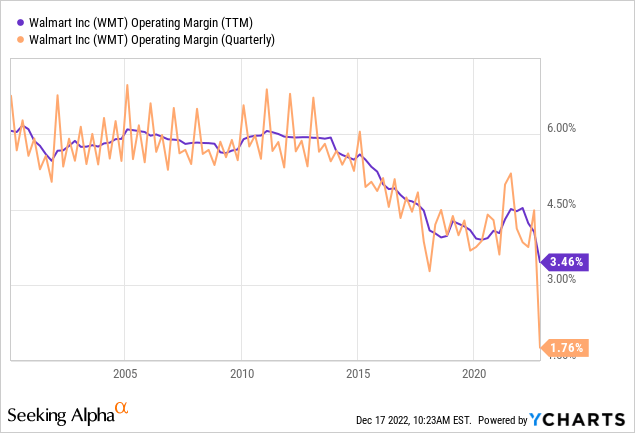

On the surface, Walmart may still appear to be a fast-growing company, as seen by its steady revenue per share growth. However, its sales per share are only increasing due to inflation and the continued decline in its share outstanding due to buybacks. Given this, it is apparent that Walmart is struggling to compete against the rising tide of E-commerce. While the company has an impressive E-commerce footprint, it largely offsets declines in real store sales, and the competitive pressure is resulting in falling operating margins. See below:

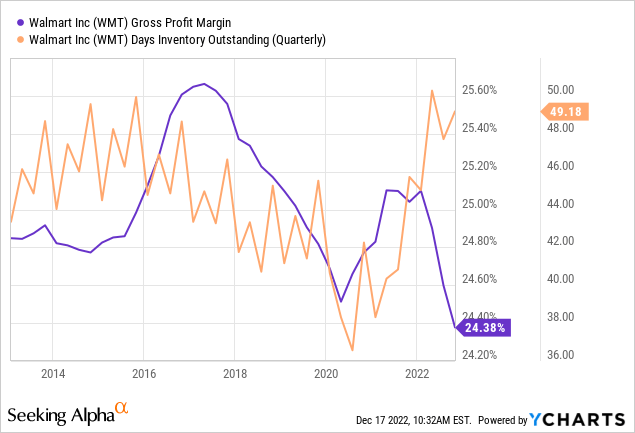

As Amazon’s footprint expanded during the early 2010s, Walmart suffered massive declines in its operating profitability. That trend does not appear to be ending and accelerated through much of 2022. Its Q3 operating margins were abysmally low due to the enormous costs associated with its opioid lawsuit settlement. However, its gross margins remained low, causing a considerable decline from a TTM standpoint. The company also ended the quarter with very high days-inventory-outstanding, indicating a very high likelihood of a reduction in gross margins during Q4. See below

Walmart, like many retailers, entered the holiday shopping season with excessive inventory levels, making competitive price cuts likely. Retail sales declined in November despite Black Friday, indicating further strain as customers were likely more price-sensitive amid economic pressure. Walmart has also recently seen a decline in website visits, suggesting its Q4 holiday sales may not rise despite discounts.

There is a notion that Walmart is a “recession-proof” company. While it is likely true that its sales are more resilient to a recession than most of its peers, its bottom line is not recession-proof. In 2008, when Walmart was essentially not competing with Amazon, Walmart was recession-proof since it had the lowest prices. That is no longer true today as its operating margins drift ever-lower due to E-commerce competition. In my view, given its high inventories and data suggesting a significant decline in 2023 retail sales, this competitive pressure may accelerate to the extent Walmart’s profits tumble on margin compression.

Rising Theft Further Constrains Margins

Walmart is unlikely to manage to outcompete Amazon for lower prices on most goods due to its higher store overhead costs. Amazon can also subsidize its retail business losses from profits in its other segments (AWS, etc.). More importantly, Amazon does not need to raise prices to offset losses from theft.

Retail stores have reported skyrocketing theft rates since 2020. Walmart’s CEO recently stated that the company is struggling with this trend and may need to raise prices higher or close stores to offset “shrinkage” losses. Many blame Walmart’s shift to automated check-out as a culprit for growing theft. If the only way to stop theft is to increase its retail workforce, Walmart’s operating margins and competitive potential will slide further.

Walmart does not publish details regarding the specifics of its theft rate. For comparison, Target has seen store theft rise by a staggering 50% year-over-year in 2022, with organized shoplifting being far more common. This comes after a significant increase in theft in 2021 and over the proceeding years. With Walmart’s profit margin generally only around 2%, a “shrinkage rate” of around 1% can negatively impact its bottom-line profits. Ironically, many stolen products are sold as “new” on Amazon through its fulfillment system, which has notoriously low seller verification. As such, Walmart is not only losing profits due to theft and competitive pressure but, to an extent, is transferring some of that lost revenue to its competitor.

In my view, given theft levels are rising as fast as they are, theft is a significant risk factor for Walmart, given the enormous impact growing shrinkage can have on a company with thin margins. It may raise prices to offset those losses, but that would only make Walmart less competitive with Amazon. Hypothetically, Walmart’s profits could rise quickly if it managed to stop the trend without high overhead costs, but without government support, I do not believe that is likely. Unfortunately for the company, some large states are shifting against that trend and have reduced charges for retail theft. As the economy weakens and prices rise, this trend seems likely to grow over the next twelve months.

The Bottom Line

In my opinion, Walmart is a high-risk stock at its current price, with far more downside risk than upside potential. Contrary to popular belief, I believe the recessionary economic trend is bearish for Walmart and threatens to push the company’s low margins to negative levels. This potential seems more likely when we add on the negative impact of the growing theft trend and reasonable discounts due to its elevated inventory levels (and its peers). Walmart has also not grown its real sales over the past decade and has seen its real operating income fall dramatically.

Although inflation and share buybacks have obfuscated that trend, the fact is that Walmart is failing to compete against Amazon and is not seeing any real organic growth. In the past, Walmart was able to grow by outcompeting Mom & Pop retailers, but it no longer benefits from that trend and is becoming the “smaller fish” in the retail fishbowl. Walmart is also likely to struggle amid the negative economic trend. The company is launching a “buy now, pay later” service to offset that trend, but that may eventually jeopardize the firm with bad debt losses.

Most importantly, these risk factors are not priced into WMT. The stock is trading near its all-time high and at a forward “P/E” of nearly 24X. WMT’s yield is also only 1.57%, far below that of Treasury bonds or inflation. Even if the “worst case scenario” of significant margin compression is avoided, I believe these headwinds are substantial enough that Walmart’s growth capability will be impaired over most of the next decade. At such a high price and valuation, it would likely take a moderate decline in Walmart’s outlook to lower its valuation potentially dramatically.

The S&P 500 trades at a 19X “P/E” today; given I believe Walmart’s EPS may fall faster than the S&P 500’s, it seems WMT would be more fairly valued at a “P/E” of ~16X, or around $90 per share. The stock was trading at a price around the end of 2019. Quite frankly, with theft rising and recession risks mounting, it may be worse today than it was then. Thus, in a “worst-case scenario,” I believe WMT may fall well below $90 per share. That said, I am very bearish on WMT as long as it is above $90 per share.

I believe WMT may be a suitable short opportunity at its current price. The primary catalyst would be a disappointing Q4 holiday shopping season and/or a negative shift to its 2023-2024 earnings outlook due to a recession. At a short interest of just 0.9% and well-below-average implied volatility, few are currently betting against the stock. For me, that is a solid contrarian bearish sign, giving it a low short-squeeze risk. With its low implied volatility, long put options may be a suitable way to bet against WMT with defined risk. Chief bullish risks to WMT are likely stronger-than-expected holiday sales, a reversal in recession odds, and an end to global inflation factors. However, it seems WMT does not have a large upside potential even if these occur, considering it is trading near its all-time high.

Be the first to comment