Sky_Blue

The energy storage potential for Tesla (NASDAQ:TSLA) remains very vibrant and very much underestimated. The company’s target remains that autos will represent just 50% of revenue.

As Elon Musk stated at the 2021 Shareholders meeting:

Over time we think the demand for stationary storage is going to be at least as high as the demand for vehicles

The situation with energy storage remains analogous to that of autos for the company. Tesla cannot meet surging demand. The company is far and away the largest BEV manufacturer and had record auto production in June. When they do, revenues will soar still further. The huge potential applies to both commercial projects and residential projects. Tesla’s new factory in California manufacturing “Megapacks” should be the game-changer on the commercial side. Reports suggest that the Lathrop facility is effectively completed and Tesla is now finishing up all the details for scaling up factory production. Where residential becomes commercial in a sense is through VPPs (virtual power plants) and this may be the largest long-term market of them all.

Tesla’s current stock price is based around its auto division sales and potential. Yet in the long term, the power generation and energy storage markets in general will be larger than the world’s auto markets as this article detailed. Tesla is the leader in both.

The Supply Problem

Ever since the Model 3 emerged to huge demand, Elon Musk has had to prioritise batteries and semiconductor chips for autos over batteries and chips for energy storage. He had previously thought this problem would be reduced by 2022. However, COVID and the general logistics problems around the world have left the situation pretty much unchanged. I know this firsthand, having recently tried to order a fairly standard Model 3 in London and received a delivery date of March/April 2023. Despite this, 25% of cars delivered in London this year so far have been EVs. Tesla has the largest market share. That is a typical position for Tesla around the world.

When Tesla’s own #4680 battery reaches substantial production, that will undoubtedly be a game-changer. The company will though need to continue its battery deals with the world’s giant battery manufacturers. It currently has substantial deals in place with CATL, Panasonic (OTCPK:PCRFY), BYD Auto (OTCPK:BYDDF), and LG (OTCPK:LGCLF).

As with autos, Tesla’s energy storage products are seeing substantial price increases. This is a combination of demand exceeding supply, and costs increasing. In March this year, Tesla announced quite substantial price increases for the Megapack. Capacity of the product was also increased at the same time to about 4 MWh. It is thought that customers for future orders will pay about $1.53 million per Megapack.

The situation should improve due to the Lathrop facility currently under construction. My earlier article detailed the under-reported importance of this. The facility will provide 40 GWh of lithium storage batteries by next year. It is designed to produce 47.48 GWh in the initial phase next year. Anyone who doubts the revenue potential of Tesla’s energy storage business should take this into account. Lithium batteries provide the best answer to 4-hour storage requirements for the short and medium term. Long-term, there should also be a significant role to play for redox flow offerings.

Projects

* The company recently commissioned one of the many major projects in which it is involved. The Elkhart project at Moss Landing for PG&E (PCG) was commissioned in June. Tesla supplied 296 Megapacks for the 182.5 MW mega-projects (at current prices this would represent $450 million in revenue for Tesla, not including forward service contracts). They have future substantial projects with PG&E coming down the road by all accounts.

Almost everywhere you look, U.S. States are looking to ramp up energy supply projects. For instance, New York State has announced 22 large scale energy projects by 2027. They aim to get 70% of their electricity from renewables by 2030.

* Australia has been a leading supplier of high value projects for Tesla. Another project with a new partner, Edify Energy, was recently announced. This $120 million 300 MWh project in New South Wales will complete in 2023. It composes three independent but coordinated sites.

* In Texas, the company commissioned its first Big Battery project in the State last year. It is now setting up a second one in coordination with its Gigafactory in Texas.

* In Nevada, the company is supplying the “Townsite Solar & Storage Facility” in conjunction with renewable energy company Arevon. This consists of 360 MWh of Megapacks. The long-term deal with Arevon consists of 2 GW/6 GWh of Megapacks. To illustrate the growth trajectory of Tesla, this comes to more than all the energy storage Tesla has supplied in the past two years.

As my January article detailed, a range of projects of varying sizes are due to be commissioned this year. These include the Bouldercombe Project in Australia, the Chapel Farm and Jamesfield projects in the UK, and various substantial projects around the USA and Australia. These not only produce one-off substantial revenue but ongoing revenue through management contracts and utilisation of Tesla’s “Autobidder” software and other software suites.

Residential

Just as Tesla has to bid only on a certain percentage of projects it could get, so it has offered “Powerwall” only in certain markets. For instance, where I mostly live, in Singapore, the Tesla website cites Powerwalls as “unavailable”.

Last year, the company supplied 250,000 Powerwalls worldwide, a fraction of the quantity it could supply.

VPPs (virtual power plants) provide almost infinite potential business for Tesla. That is as long as the company can supply the product and if (in some cases) they get approval. The approval issue has recently come into play in Texas. Tesla is attempting to get State approval to link an initial 200 households with Powerwalls in a VPP and to expand from there.

In South Australia, Tesla is involved in setting up a VPP linking 50,000 households. This is a long-term project over several years.

In California, there has been a trial VPP for some time. In June, it was announced that Tesla would work with PG&E on a new VPP. This is currently in its beta stage and is entitled the ELRP (Energy Load Reduction Programme). Consumers sign up through the Tesla App and will be credited with $2 per KWh for energy sent back to the Grid in this way. Full details of how it will work are detailed here. There are approximately 50,000 Powerwalls in the State, so this once again shows the tremendous capacity and revenue promise of VPPs utilising Powerwalls. It has been reported that in the first week alone of this project, 1,262 homes signed up to it. The San Diego VPP project is set to provide 165 MW/336 MWh.

In the U.K. (where Tesla autos are in hot demand), the company offers its “Tesla Energy Plan”. This links substantial savings if consumers buy a package of a Powerwall, solar panels, and a car. This is effectively a VPP.

VPPs provide better value for home owners and produce further stabilisation of the grid. This latter is much needed in Texas. The State may have been built to a large extent on the back of the fossil fuel industry. However, major blackouts in the last few years show they need energy storage systems to maintain the State’s power supply. In a rather extraordinary turn of events, a strong supporter of the pro-fossil fuel industry, Republican Congressman Troy Nehls, recently stepped into the debate. He said he was keen to work with Elon Musk to find ways to stabilise the grid in Texas. He acknowledged the renewables revolution and energy storage practice was an irrevocable change in the country’s energy picture. Musk must think it is indeed possible to “sup with the devil”.

Indeed Tesla recently applied to the State Authorities in Austin to build its own Megapack project for its new factory in the State. This would imply a substantial quantity of Megapacks as the company cannot afford the power shortages from which the lacklustre Texas grid suffers.

A popular new feature last year on the Powerwalls was their “Storm Watch” function. This allows users to get advance warning of adverse weather events. It was deployed 250,000 times by users last year. As global warming intensifies, so will the need for such functions.

In a sign of how big business can be a force for good, Tesla has been supplying Powerwalls and solar systems widely around Ukraine. This has been done to keep up power and connectivity in areas being destroyed by the Russian invaders:

Musk has also been aiding the Ukrainians through his “Starlink” satellite networks as has been widely reported.

This illustrates the complete integrated suite of products Tesla is developing. On a micro level, last year the new standalone inverter from the company enabled households to have a complete set of products linking their solar, energy storage and car charging products.

Figures

My article here detailed the potential numbers involved. Lathrop should enable Tesla to meet its orders. These are currently estimated at $6 billion. No doubt by the time Lathrop is fully commissioned, this order value will have increased substantially as orders continue to exceed supply.

Last year Musk said the company was aiming at 20,000 Powerwalls per week. This now looks some way off to my eyes.

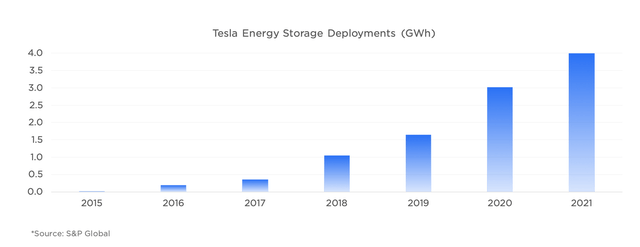

Even despite these supply constraints, Tesla’s energy storage business is growing strongly. The graph below reproduced from the company’s impact report illustrates this:

In 2021, the company supplied 3,992 GWh of energy storage products. This represented approximately 15% of the global 25 GWh demand.

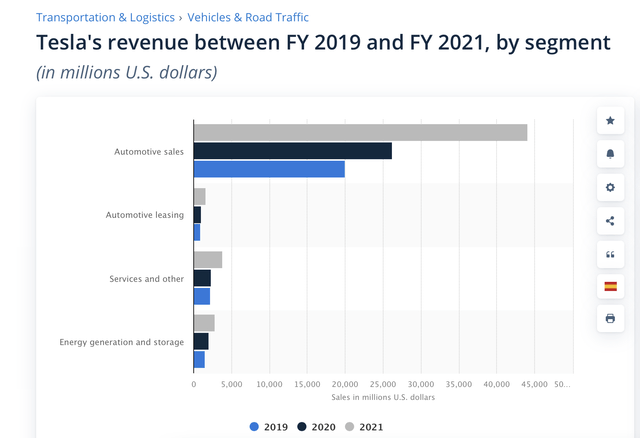

In Q1 2022, Tesla accrued $1.279 billion in revenues from energy storage deployments of 846 MWh. This was up 90% from Q1 2021, but quarterly figures can vary greatly. The probably $6 billion in pending orders for energy storage will instantly lift this sector into a meaningful percentage for Tesla, up from the current approximate 6%.

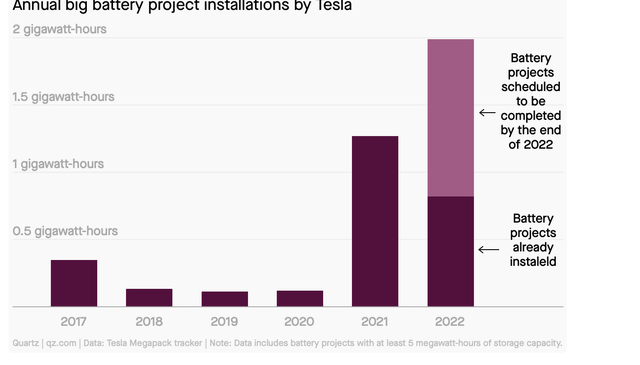

According to reports on Quartz, already 2022 is showing strong growth in Megapack installations on past years, as illustrated here:

This growth is meaningful in revenue terms but only a fraction of what it would be if Tesla could meet all its firm orders this year.

The relative importance in revenue terms is illustrated by the graph below:

While storage soared, the figures for solar installation continued to be problematical for the company. Long-term though, the company continues to see a comprehensive renewables future comprising autos, storage and solar. It aims to secure its position as an electricity generator and a distributed utility.

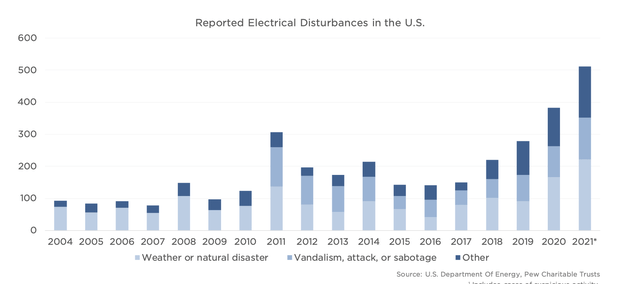

This demand will soar worldwide as costs for solar and storage continue to decline. My article in September last year detailed the huge secular increases in the addressable market. A vertically integrated Tesla is very well placed to continue to attain a significant market share. Currently on average in the USA it takes about 10 years for a household to pay off its investment. If fossil fuel prices remain high, the economic advantage will increase greatly. A further strong driver of demand will be created by the increasing incidence of black-outs from adverse weather. Climate change problems will no doubt accelerate such incidents. The company’s impact report illustrates this:

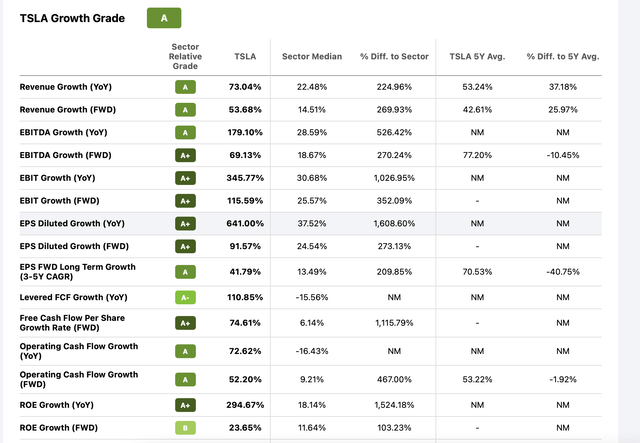

The company has high valuation metrics, as discussed in this article. However, there is a reason for that. Its revenue growth for the past 5 years has averaged 53% per annum and is 73% year-on-year. As the Seeking Alpha Quant ratings show, it has a fantastic record and great metrics as a growth company:

Growth companies may be somewhat out of fashion. However, long-term that is where investors get their best returns. Tesla has certainly provided that. Against the risk profile of a growth company, Tesla has cash in hand of $18.01 billion against total debt of $7.02 billion. Its free cash flow is growing rapidly and its profit margins are high and still improving.

Conclusion

As an excellent article here detailed, investors are I believe failing to take into account Tesla’s forward-looking revenues from energy storage. This will come not just from Powerwalls to residential projects and Megapacks to commercial projects. It will also come from Tesla’s role as a distributed global utility. They have already been granted this status in Texas, in the UK, in Germany and elsewhere.

Although not covered in this article, Tesla’s other growing activities are not fully accounted for in its current stock price. These include AI opportunities, the “Optimus” robot project, insurance, the Boring Company, and possible coordination with SpaceX and Starlink activities. These are though long-term possible revenue generators. The short and medium term generators are substantial enough.

Elon Musk recently re-iterated that he foresaw Tesla as being at the head of a sustainable energy future, which will comprise three pillars. These will be:

-

Transport

-

Power Generation

-

Energy Storage

It is estimated that the renewable energy market will be worth $2 trillion by 2030 and the energy storage market will be worth $435 billion. As the leading player in the nascent industry now, this offers a huge potential revenue opportunity for the company. This is not currently baked into the stock price. That has been depressed by macroeconomic matters, not by the company’s performance.

As with the auto division where it is the market leader for BEVs, huge forward growth momentum can be sustained when Tesla improves the supply position. Commissioning of the Lathrop plant is a giant step forward in this respect. Demand for Powerwalls and Powerpacks makes Tesla a Buy based on long-term growth projections and the currently lower stock price.

Be the first to comment