KanawatTH/iStock via Getty Images

George Ball, Chairman of Sanders Morris Harris, a multibillion-dollar broker-dealer and RIA firm, recently joined us on The Weekend Bite to shed light on this year‘s market volatility, geopolitical factors, and his favorite stock picks. One surprising takeaway is that George Ball believes raising some cash from FAANG companies is the key to investing during this time and for the future. Given the current environment, Ball advises that investors remain cautious and ready to pounce on yield plays and broader tech growth stocks. Let‘s dive into this legend‘s background and shine a light on his key insights.

George Ball

As a CEO, George Ball has been a titan on Wall Street by leading top investment firms. Ball was at the helm of both Prudential Securities and E.F. Hutton & Company as Chief Executive Officer. He also served as a former Governor of the American Stock Exchange and the Chicago Board Options Exchange. He now serves as Chairman of Sanders Morris Harris.

Ball started his career in the U.S. Navy and graduated from Brown University. He was a young power broker at E.F. Hutton & Co. and quickly rose through the ranks to become President of the brokerage firm at age 39. Subsequently, Ball became the CEO of Bache & Co, later purchased by Prudential Insurance Company of America, to become Prudential Securities. He has continued to deliver decades of long-term results. In addition to his role with Sanders Morris Harris, Ball serves as Director and Co-Chairman of Tectonic Holdings, Sanders Morris and Harris‘ parent company with approximately $3.7B AUM.

Mr. Ball has been doing something right over the last few decades, which is why we are interested in learning more about his investment insights. Ball, on past occasions, demonstrated an ability to stay calm as many investors panicked. The phrase ‘Buy on the Dip‘ could be coined around his investment prowess. The “Black Monday” stock market crash of Oct. 19, 1987, saw U.S. markets fall more than 20% in a single day. It is thought that the cause of the crash was precipitated by computer program-driven trading models and portfolio insurance strategies. Black Monday was one of the darkest days ever for financial markets. It was awash with alarm, confusion, fear, and trepidation. The crash hit Prudential Bache‘s bottom line hard. The following day after the Crash of ‘87, the Prudential Bache risk arb department showed a $100mm plus portfolio loss. It was a very large sum, by the standards of that era. George Ball consulted with the highly talented and cool minded Head of Risk Arb, Guy Wyser-Pratte, and directly with the CEO of Prudential Insurance. George and Guy were convinced that the panic/drop was temporary. Ball asked the CEO of Prudential Insurance to “double the positions.” He had the courage to authorize that “double down”. The loss was eliminated, and turned into a profit, within weeks.

Ball, as the CEO of Prudential Securities, guided the firm and its clients to stay calm and logically assess the environment at the very height of the crisis and bottom of the market. In the moment of peak mayhem, his courage transferred a sense of calm, and his astute insight created a windfall for his investment firm.

Today, when many firms are promoting ‘all you can eat trading at no cost,‘ Ball‘s mantra is “Investment in Common… We are committed to establishing and maintaining long-term relationships based on insight, integrity, and trust.” While not a new concept, it is antithetical to the churn style of handheld mobile electronic platforms that are promoted by the likes of Robinhood and Webull.

Four Investment Insights from Mr. Ball

In speaking with Ball about the escalating tensions in Russia and Ukraine, which come at a time when the stock market is already vulnerable, add on inflation worries and the Federal Reserve tightening, “Cash is a greater risk shredder,” says George Ball. He suggests raising some cash and keeping powder dry for investment opportunities in the coming months. From all indications, Ball is recommending that investors lighten up on FAANG. According to Ball, the stocks have been premium priced for quite some time and taking some profits should remove the risk of dramatically overweighting a few (vulnerable) monopolies. From a SA Quant perspective, the FAANG stocks are overvalued (priced for perfection) and there are other tech stocks with superior growth. With cash on hand and increasing the amount one would normally hold, it provides the ability to react and buy stocks that may have pulled back or already corrected once geopolitical events unfold.

Russia‘s invasion of Ukraine has created worldwide turmoil and economies and global markets are on a rollercoaster ride. Because markets look forward and typically affect the big trends six months down the road and longer-term, Ball believes the geopolitical events will have bigger consequences on investments for the long-term investor versus the day-to-day trader. As such, building up a shopping list of value stocks that are great companies with solid fundamentals as the market weakens and simultaneously lightening up on FAANG stocks to focus on the broader tech sector are some possible options. In hearing Ball‘s interview, he provided some key takeaways.

1. Raise Cash

According to Ball, cash is the ultimate king when markets are volatile and this environment is a prime opportunity for investors to raise cash. An investor who usually holds 5% of their portfolio in cash, with the remaining in stocks and bonds, should consider increasing their cash position to 10%-20% of their portfolio, with the remainder divided in the normal 60/40 allocation between stocks and bonds.

2. Inflation is Not Permanent

Inflation will go away – not immediately – but eventually and it will be tolerable at 3% or so by year-end. With the Fed behind the curve, Ball indicates that we will not experience another Great Inflation of 1980 when it was near 14.5% and unemployment was above 7.5% and former President of the Federal Reserve Chair Paul Volcker went to great lengths to stem rising prices.

The market has already given in to the fact that there will be a number of Fed rate hikes; stocks have been trading at a premium for quite some time and a mixture of increasing interest rates, military threats, and the highest rate of inflation since 1980 “makes (for) a modest baby bear move in stocks likely in the near-term,” says Ball. However, by the second half of the year, inflation will likely have subsided to some degree and additional rate hikes will not have as devastating of an impact as roughly 125 basis points are already baked into the market.

3. Corporate Earnings

Corporate earnings are not terribly vulnerable as there is a ton of corporate earnings power today versus the corporate debt seen during the Great Recession. During the Great Recession, Corporate Debt was 3x EBITDA versus today at only 1x. Hence, there‘s lots of earnings power that can be put to use and it is a great safety net (less leverage) than in the past. Companies are not highly leveraged this time around – a great sign for stock prices going forward, and as a result, Ball does not think we‘ll go into a recession in the near term because goods and manufacturing are robust and the economy and corporate earnings will continue to be strong.

4. Investment Ideas

Because stocks are already in a correction and experienced somewhat of a pullback and bear market phase prior to Russia‘s invasion of Ukraine, Ball believes “the market is pricing in that Russia will conquer Ukraine but be unable to occupy it.” He further thinks there‘s a good chance of people exploring alternate investments with compelling yields versus defensive stocks.

So that investors are able to cover their lifestyle and expenses, Ball suggests looking into Master Limited Partnerships (MLPs). One Limited Partnership Ball likes is Enterprise Products Partners (EPD). The company operates through four segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services, and Petrochemical & Refined Products Services.

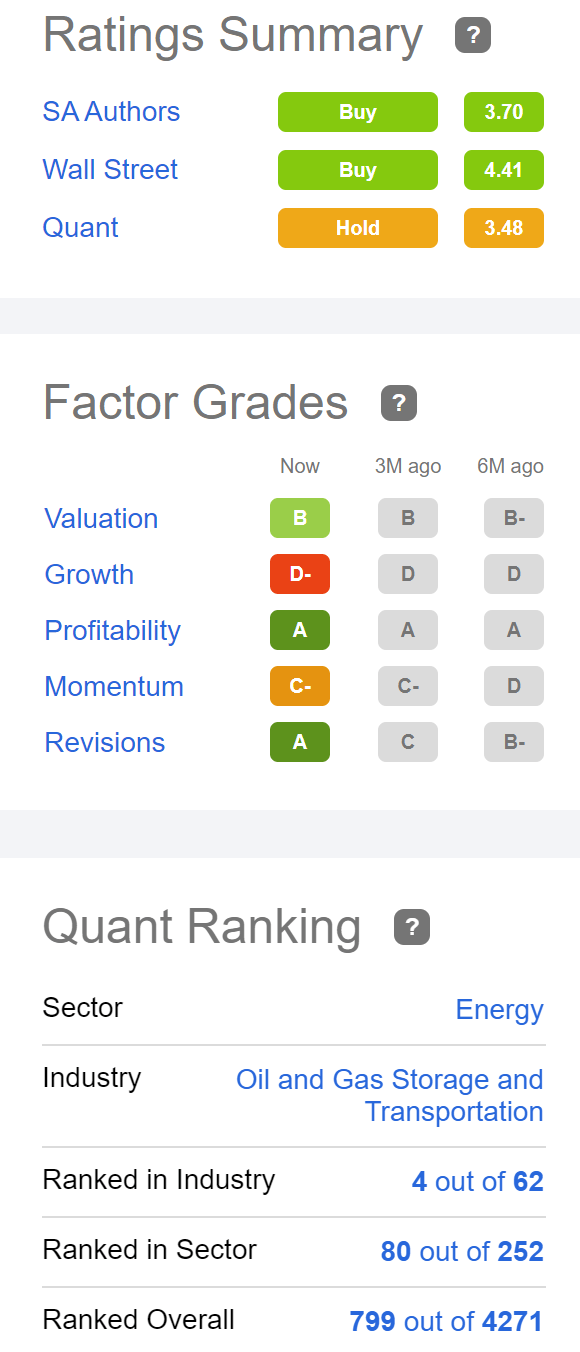

The stock generates a 7.5% yield, and according to Ball, “most of the company’s contracts have an inflation escalator – where the company’s prices to its customers rise as inflation rises.” This means the company can pass off rising costs to customers. The stock has a Buy recommendation from both Wall Street Analysts and SA Authors. On a Quant Basis, the stock ranks number three in its industry and it commands some very favorable factor grades as seen below.

EDP Has Solid Ratings and Factor Grades

Seeking Alpha

Quant Rankings & Factor Grades FAQ

Additionally, Ball recommends cybersecurity, like the ETFMG Prime Cyber Security ETF (HACK), “Cybersecurity is going to be a growth area and theme for a long time to come.” According to SA News, Cybersecurity exchange traded funds have come front and center as markets evaluate the heightened geopolitical tensions since Russia’s invasion of Ukraine. Last Wednesday, four ETFs stepped into the spotlight amid news from the FBI, as they warn organizations against Russian hackers. HACK was one of the four favorable funds in focus. The SA Quant team also wrote an article on the 3 Best Cybersecurity Stocks. Cybersecurity threats are putting individuals and companies around the world on the defensive. The buildup of Russia’s invasion of Ukraine has the world on edge, with cybersecurity defense in action and fears of cyberwarfare mounting. While there is no clear solution on how to thwart hackers, one thing is sure: governments, corporations, and individuals are equipping themselves with cybersecurity solutions and software, which is why cybersecurity ETFs and stocks are timely.

As the Head of Seeking Alpha Quantitative Strategy, I also share some of the same concerns on FAANG stocks. The stocks are significantly overvalued and vulnerable to government attack. Ball believes, instead of investing in a market-cap weight tech ETF, investors should consider an equal weighted ETF, such as Invesco S&P 500 Equal Weight Technology ETF (RYT). Ball states, “This is a technology ETF but it’s equal weighted. It removes the risk of dramatically overweighting a few (vulnerable) monopolies like FANG+s.” Along the same lines of Ball‘s concerns, I highlighted in an article from September 2020, The Truth: Your S&P 500 ETF Is Riskier Than You Realize, about the extreme concentration within the S&P 500 index and the five mega-tech stocks that have driven the index‘s forbidding valuation. The same strategy would apply to broadening out ownership of a Technology ETF as a way to remove concentration risk. I would ask you to consider George Ball‘s insights in putting your money to work and making the best portfolio decisions possible.

Conclusion: Keep Some Powder Dry, Be Ready to Put Your Money to Work

George Ball has decades of experience in the investment world. On a granular stock level, FAANG stocks like Apple (AAPL) and Amazon (AMZN) are overvalued and lack growth rates compared to other tech companies. Ball‘s key insight on these stocks is that they may face some tall regulatory battles ahead. Ball’s other key insights 1. Raise cash that you can put to work later; buy the dip, 2. Inflation is not permanent, 3. Corporate earnings are much stronger today than in past years, diminishing recession fears, and 4. Considering broader tech investments is so important. Ball’s lessons emphasize financial success, and we believe he’s right.

Mega-tech stocks are overvalued, while broader tech stocks with fair valuations and solid fundamentals can prove fruitful. Consider smaller alternative tech stocks that offer a good balance of profitability, growth, and solid value. Stay tuned for my next article that will give you the names of my Top Technology Stocks following George Ball’s insights. Meanwhile, if you want to lighten up on FAANG stocks, sink your teeth into our quant ratings and investment research tools to help ensure you’re furnished with the best resources to make informed investment decisions.

Be the first to comment