Stefan Tomic/E+ via Getty Images

Investment Thesis

Tilray Brands, Inc. (NASDAQ:TLRY) is a leading Canadian cannabis company with operations spanning major international markets. Tilray highlighted that it owns the “#1 leadership position in Canada with 10.2% cannabis market share.” It also accentuated that it is the German medical cannabis market leader with a 20% share.

However, despite its claimed leadership positions, the company is still deeply unprofitable. But, it’s hardly surprising given the intensely competitive nature of the industry.

In addition, Tilray expects to make further inroads into the EU and the US cannabis market with potential M&As and possible legalization moving forward. While we applaud management for its optimism, we think these optionalities place undue pressure on the company to deliver what it cannot control. Furthermore, management telegraphed a highly ambitious $4B revenue guidance by FY24 (ending May 2024) that looks “aspirational” for now, given the consensus estimates.

We discussed in our previous article that investors should look elsewhere as TLRY stock seemed overvalued. It has fallen 53% since our article was published. Nonetheless, we continue to maintain our view after its recent earnings. As such, we reiterate our Hold rating on TLRY stock.

What To Expect After Earnings?

Tilray reported revenue of $151.9M, up 22.6% YoY in its FQ3’22 earnings card. It also reported an adjusted EBITDA margin of 6.6%. Tilray prefers to refer to its non-GAAP profitability in its commentary. However, we need to highlight that the company is still deeply unprofitable. Its GAAP EBITDA margin was -26.1%. Therefore, investors must be wary of relying on its adjusted numbers to validate the strength of its business model.

Tilray also reported gross margins compression due to intense competition in Canada. Benchmark also expected the competitive pressure to continue. It emphasized (edited): “We expect continued competitive pressure in the Canadian market will challenge market share expectations. Growth continues to benefit from non-cannabis segments including alcohol and wellness categories. But, the significant cost synergies from the Aphria-Tilray combination are not offsetting revenue weakness.”

What Is Tilray’s Long-Term Outlook?

Tilray and its cannabis peers received a boost recently as the US House of Representatives voted in favor of its Marijuana Opportunity Reinvestment and Expungement (MORE) Act. The Act is intended to legalize marijuana at the federal level. Cannabis investors consider the signal positive for the industry.

However, investors should be wary of adding TLRY stock over the recent developments. The Act still needs to gain the necessary votes in the Senate. However, industry experts are skeptical that the Senate would consider the Act in its current form, as it’s too “progressive.” Therefore, investors should temper their optimism and not invest in TLRY over the legalization cadence.

Nevertheless, Tilray remains optimistic that the MORE Act “will provide additional momentum for legalization.” Notably, the company also seemed more confident about legalization in the EU. CEO Irwin Simon accentuated (edited):

With Europe, we continue to believe the European market is on the cusp of broad-scale adult-use legalization. And you can be certain of one thing, companies with EU GMP-certified operations like Tilray Brands possess a significant advantage as legalization spreads. (Tilray’s FQ3’22 earnings call)

Bloomberg recently reported that “more than half of Europeans favor legalizing cannabis.” Hanway Associates also highlighted that Europeans are moving “away from resistance to acceptance…”

Nonetheless, investors shouldn’t simply assume that legalization would necessarily validate the business models of cannabis companies like Tilray. The intensely competitive nature of the industry continues to be a headwind even in Germany. A Jefferies analyst on the earnings call also suggested the competitive headwinds as he added (edited): “Can Tilray comment on the competitive dynamics in Germany? It does look like that market is becoming very crowded now and probably getting even more so with planned recreational legalization.”

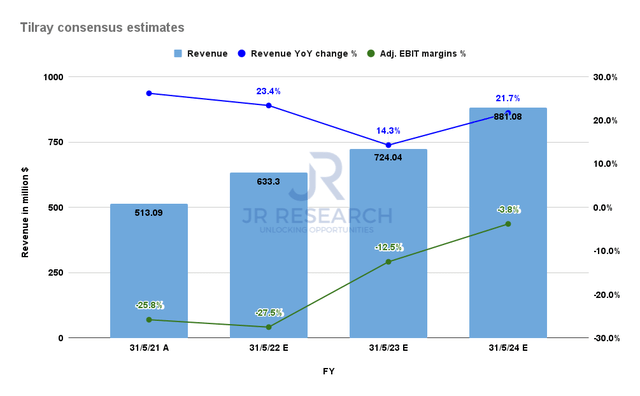

Tilray consensus estimates (S&P Capital IQ)

In addition, consensus estimates suggest that Tilray’s $4B revenue guidance seems miles away. Therefore, the Street has also not bought into management’s aggressive commentary. Furthermore, Tilray is not expected to be profitable even on an adjusted EBIT basis through FY24.

We also consider these estimates too aggressive. For example, the revenue estimates suggest Tilray’s topline growth could decelerate in FY23. However, Tilray is expected to improve its adjusted EBIT margins from -27.5% to -12.5%. Therefore, investors are reminded to discount the estimates through FY24, as visibility ahead still seems pretty murky. We are certainly not confident of the company reaching profitability over the next few years.

Is TLRY Stock A Buy, Sell, Or Hold?

TLRY stock NTM revenue multiple (TIKR)

TLRY stock NTM FCF yield % (TIKR)

What can investors gather from Tilray’s and peers’ NTM revenue multiple trends? It’s simple. The market is not confident of their momentum as their valuations continue to compress.

Furthermore, none of the companies listed above are free cash flow (FCF) profitable. Moreover, TLRY’s NTM FCF yield of -1.7% demonstrates the difficulty of valuing these cannabis companies. Despite Tilray’s proud proclamation of market leadership, its struggle with profitability has been uninspiring.

As such, we reiterate our Hold rating on TLRY stock.

Be the first to comment