fcafotodigital/E+ via Getty Images

We are writing to update the coverage on Tattooed Chef (NASDAQ:TTCF) after our last article. We find the results of 2021 have been quite disappointing for the company.

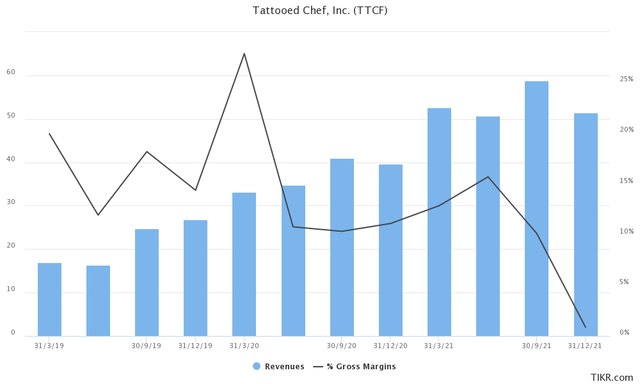

An increase in shelf exposure did not bring the expected revenue boost for the company, which did not reach an evident sequential revenue growth.

This article explains why we subsequently turned less bullish on the stock.

Expectations Vs Reality

At the beginning of the year 2021, TTCF Management guided for a Revenue of $222M. That would have been 49% revenue growth compared to 2020. In our first article, we explained why an actual 49% revenue growth would be even better if we focus on the TTCF brand: TTCF sells both products from its brand and private label, where they produce products that are sold with other brands. The trend at the end of 2020 and the beginning of 2021 was negative for the private label segment, which brought us to expect a massive growth for the TTCF brand, where they can have way better margins in the long term.

However, the end of 2021 did not go in that direction. In particular, from the Q4 2021 Press Release, we see that:

- Revenue rose 32.2% to $52.3 million

- Tattooed Chef branded product revenue increased 21.7% to $29.2 million, or 56% of total revenue

What does this mean? In Q4, TTCF had a more significant increase in private label products than TTCF products. That also impacted gross margin, which has never been so low in the past three years.

The growth in branded products revenue is essential for a bull theory behind this company. To justify a higher valuation for the stock, we need to expect long-term margins at the high end of the food industry. Tattooed Chef can only reach that type of marginality through a strong brand.

Therefore, the year-end increase in private label sales and lower sales than expected was a disappointment for us.

However, everything has an explanation and how you judge it depends on how you look at it:

- In Q4 2021 Earnings Call, Stephanie Dieckmann (CFO) explained, “Gross profit also reflected the impact of lower margin private label and co-packing products being produced at our recently acquired New Mexico and Belmont Confection facilities, partially offset by higher revenues and improved production capacity. We expect that gross margin will be positively impacted as we transition the acquisitions in both New Mexico and Ohio from private label co-manufacturers into manufacturing Tattooed Chef-branded products”.

- That means the new acquisitions made by TTCF in 2021 (New Mexico Food Distribution – NMFD – and Belmont Confection) are now producing private label products, which now explains why private label increased so much during the last quarter compared to the branded products. TTCF expects to use this capacity in the future to produce branded products, which will help reach higher margins.

- In Q3 2021 Earnings Call, the CFO, again, explained that “[…] in Q1 and Q2, we ran very large promotions within the Club channels. Q3, those promotions back off in the form of limited time offers. And then in Q4, honestly, there’s no giant promotion. There’s a little bit of limited time offer lift that will still occur. But even Q3 is pretty much the growth that we’ve seen in Tattooed Chef at mass and grocery and not as reliant on club as Q1 and Q2 were this year.”

- That could explain why TTCF branded revenue was sequentially down QoQ in Q4 ($29.2M against $35.3M in Q3). Promotions are significant to increase sales and let people know about the products. Obviously, they skew revenues, as with more advertisements, the company can sell more.

2021 has undoubtedly been a challenging year, particularly for a smaller company like TTCF. Inflation, supply chain issues and, in particular, freight costs might have hurt the final results. However, we feel a little disappointed by the overall picture.

TTCF Management

How to judge 2021 and TTCF management?

We see that Tattooed Chef was slightly short its target of $220M in revenue. However, what worries us most is that the 2021 initial guidance did not consider the NMFD acquisition, which bumped the guidance by about $15M later on in the year. Therefore, revenues were about 10% lower than the beginning of the year expectations.

Unfortunately, TTCF management does not guide branded revenue, so we cannot compare expected revenues with the actual result. However, considering the trend of the past years and the growth of the TTCF brand in the previous years, we were expecting a more substantial growth there than what was obtained (TTCF obtained $132.5M in branded revenues against about $150M that we expected).

Financial results were overall acceptable, even if lower than expected. Our feeling is that the management over-promised growth that was not reachable on the financial side. We prefer management that under-promises and over-delivers: this gives a better sense of trustworthiness.

Secondly, the management was also unexpectedly unreliable in the institutional communication. The earnings released by mistake before market close and the quarterly call officially postponed only a few minutes before it are the two main incidents that come to our mind. That was unexpected and added a sentiment of unreliability to how investors see the company.

What We Expect And Our Conclusions

We expect Tattooed Chef to continue increasing sales through investments and acquisitions. The vegan and vegetarian trend has an attractive addressable market, and there is space for growth in the United States and later internationally.

The company is executing well on store and products expansion, and we expect the company to keep increasing its shelf space in the coming years.

However, we find it difficult to believe in the path to $1B in sales that the management showed on 2020 Analyst Day. One year of results after that, and we were already short of the projected revenue in 2021. 2022 guidance at about $280M is also lower than the expected $300M. That comes with a lower margin than expected, which should help the company sell more, as it means lower prices or more significant marketing expenses.

The management expects to see profitability in the second part of 2023; however, now, we do not entirely trust this expectation and rather see profitability coming in 2024 or 2025.

We still see the company as attractive at the current price, even after lowering our revenue and profitability expectations and increasing the cost of capital for the coming years. However, we will follow what happens in 2022 as negative signals are piling up.

Be the first to comment