gremlin/E+ via Getty Images

Growth stocks continue to be under pressure as we enter the second quarter of 2022, and that has resulted in some truly staggering declines in many sectors. One of those sectors is software, which relies upon high growth multiples for rising share prices, so when those multiples contract, the declines can be eye-watering.

One stock that has seen a decline of more than half in recent months is Unity (NYSE:U), a content platform focused on gaming and non-gaming applications. As we’ll see, the stock is facing a critical test, coinciding with one of the cheapest valuations it has ever seen. Something has to give, as they say.

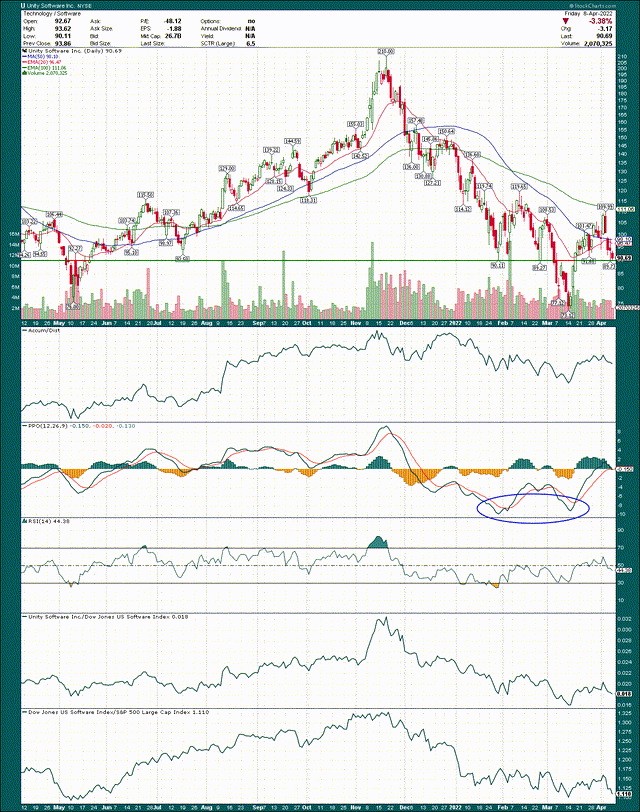

I’ve annotated the critical support level, which is about $90. That’s the level that held in January and February, before the ultimate breakdown in March. However, a big rally took place off the spike low at $73, and Unity has remained above that critical support level since mid-March. The stock is testing that level again today, and the result of this test will likely determine the direction of the stock’s next move.

The accumulation/distribution line is roughly flat, so we aren’t getting any clues there. The 14-day RSI is middling as well, so again, neither bullish nor bearish.

However, the PPO made a double bottom while the stock was declining into its ultimate low earlier this year, which is a bullish positive divergence. We saw the stock rocket higher out of its bottom in March on this positive divergence, and the PPO actually looks quite good at this point. This is the one thing that makes me think the stock has a decent chance of bouncing off of support again.

If the ~$90 level is lost, the key will be making a new higher low somewhere above $73, and preferably, above $77. If we can see that, it will show the low has been made, and Unity would be safe to buy for swing traders.

That’s the short-term outlook, so let’s now turn our attention to the longer-term outlook.

So much growth, but some faith required

As with just about any growth stock, you have to believe Unity is going to hit ambitious growth targets. After all, if you want something that’s predictable, there are plenty of consumer staples or utilities you can go get. But if you want the big returns, you have to see the vision and have faith it will occur. In addition, you have to be willing to take the volatility of growth stocks, which can be pretty painful during weak periods, such as the one we’re in now.

However, Unity’s future looks very bright, and it appears the selling we’ve seen has greatly improved the valuation, which therefore lowers the risk of buying today. It also amplifies the potential rewards.

Unity continues to grow at torrid rates, irrespective of the economic and inflationary malaise that has befallen the US. The company’s most recent quarter showed 43% year-over-year revenue growth, expanding operating margins, and a rapidly-improving customer count. Net dollar expansion was 140% in Q4, and Unity signed up 259 new customers of at least $100k in annual revenue, ending the year with 1,052 such customers. These are the metrics you want to see from a growth stock; margins are extremely high with gross margins in the high-70s while the company’s customer retention is outstanding, and it adds more customers. Seriously, what more could you want from a growth stock?

Unity continues to spend very heavily on R&D, which is what you’d expect to see from an early-stage growth company. Unity is following the tried-and-true tech stock playbook of spending an enormous amount of revenue on R&D to secure its place in the market three, five, or ten years from now. Current year profitability is of no concern, so again, this one requires some faith that these investments in the product will pay off. I’d suggest the company’s focus on the platform is working, because Unity continues to add customers at a rapid rate. But there is no guarantee this will continue, so you have to be willing to take that risk.

Unity said it expects “long-term” revenue growth to be at least 30%, implying that we are many years away from seeing something lower than that. That’s the kind of stock I want to own as long as the company has a history of executing to give it the credibility to make such a claim; Unity does, but keep in mind that as growth rates slow, investors sometimes panic and assign lower multiples to growth stocks. That’s likely at least some of the reason the stock has been more than cut in half in the space of a few months, but I think it’s overdone.

Importantly, the company said adjusted operating margins should be around breakeven next year, which is a big inflection point in the lifecycle of a tech growth company. Unity today is a revenue growth story only, but once it begins to produce earnings, it will open the stock up to things like inclusion in indices, as well as institutions that eschew unprofitable companies. Both of these things can drive meaningful buying interest in the stock, and I think we’ll see Unity much higher at the end of 2023 than it is today, in part for this reason.

Unity’s addressable market is estimated by the company at about $45 billion, which it believes is driven by the transition from 2D gaming to 3D, a move that is still very much in its infancy. Unity has spent years building expertise in this area, so as long as gaming is popular, Unity stands to do very well. There are also other end markets where it is less about entertainment and more about a specific industrial or business purpose, such as with its architecture and automotive applications. That’s something I think may be lost on investors; Unity is not just a gaming play, as its non-gaming business continues to grow more quickly than the core gaming business. The company’s platform has countless real-world applications that let it diversify its revenue streams over time, and it’s adding to growth as well.

In addition to in-house development, Unity’s strategy of buying strategic partners continues to pay dividends, figuratively speaking. The company’s Weta acquisition closed earlier than expected, and management is quite bullish on that business’ prospects. But Unity has been an aggressive acquirer of great platforms and talent and will continue to do so in the years to come. Again, this is all about building a best-in-class platform at this point, positioning it for success years down the road.

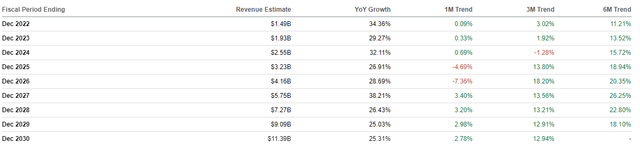

Now, the net result of all of this from an estimate perspective is below, with consensus from analysts on the topline below.

These estimates go out a long way, so there’s likely to be significant variation – up or down – in these numbers as the years go on. However, the main thing is that there’s a lot of green here, indicating analysts continue to raise targets to keep up with Unity consistently beating its own guidance. That’s exactly what you need to see from a growth stock, and Unity ticks the box there.

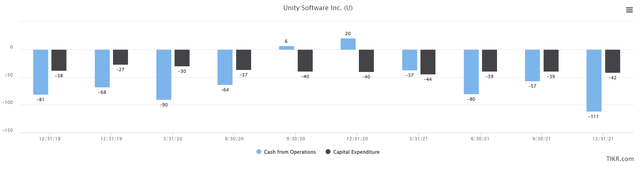

The one concern investors should have is on the balance sheet and cash flow situation, simply because investing constantly in a better platform means cash is being burned. Below, we have operating cash flow and capex, which are the two components of free cash flow. Numbers are in millions, and on a trailing-twelve-month basis.

Operating cash is negative for most quarters given working capital changes, as well as a lack of profitability. Expect to see negative operating cash numbers through 2023, with the magnitude shrinking and getting closer to zero as operating margins improve.

Capex has been very steady in the area of ~$40 million annually, so barring a major strategy shift, that should remain. Remember that Unity also spends heavily on acquisitions, so that’s another use of cash, although that’s quite lumpy, for obvious reasons.

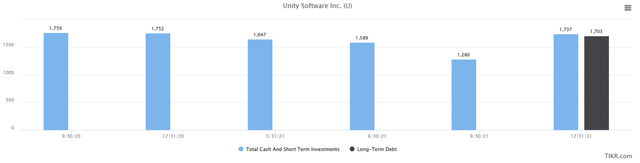

Now, let’s take a look at the balance sheet to see if Unity is ruining its financial health through this strategy.

Cash and equivalents came to $1.7 billion at the end of the year, and the company now has a similar amount of long-term debt, after issuing convertible notes. That amount of debt is fine, but if cash burn persists longer than expected, for instance, or Unity makes a massive acquisition, it will either have to issue more debt, or issue a bunch of common stock.

Neither of those is a good outcome for shareholders unless whatever the cash is spent on generates economic returns over and above the cost of capital, but for now, I think the balance sheet is okay. As we get further into 2022 and 2023, Unity’s financing situation will become much clearer in terms of whether it will become cash flow positive or not. I don’t think this derails the bull case, but it is something to keep in mind.

Final thoughts

I think Unity is positioned quite well for the coming years in terms of growth. It has a platform that has proven extremely popular, it has great customer retention, and continues to sign up large customers. It is also continuously innovating to ensure it is competitive five or ten years from now. All of this comes at a price, but as it turns out, the price is much, much lower than it once was.

Since Unity has no earnings, we’ll use price-to-sales, which you can see above. Unity has a short trading history, but over its time as a public company, it has averaged 31X forward sales, with a low of 15X, and a high of 52X. I don’t expect 52X forward sales again, unless there’s some bizarre short-squeeze-type move. However, we could certainly see a multiple in the 25X to 30X range once growth stocks are back in favor with the market.

If we look at 2023 revenue estimates of $1.93 billion and place a multiple of 25X sales on it, we get a prospective year-end 2022 valuation of $48 billion. That would be 25X forward sales estimates by the end of this calendar year. Now, if we assume 30X forward sales, that target valuation goes to $58 billion. The stock trades for $26 billion today, implying an upside of 85% to 125%, roughly. That’s why I’m excited about Unity, and why I think it’s a strong buy.

To be clear, I don’t know when growth stocks will be back in favor and neither does anyone else. But when it does happen, Unity stands to do very well. Keep in mind that sales continue to rise rapidly – at 30%+ annually – so while the stock remains down, it becomes cheaper all the time. That also means that when the multiple does come back, it could come back very quickly, resulting in a big rally. That’s what I think is going to happen, and while there are risks along the way – called out above – this one looks skewed towards the bulls.

Be the first to comment