jetcityimage/iStock Editorial via Getty Images

Elevator Pitch

I have a Hold rating for Tesla, Inc.’s (NASDAQ:TSLA) shares. I discussed about TSLA’s above-expectations Q3 2021 deliveries in my earlier article published on October 15, 2021. In this current article, I look at how Tesla’s Q1 2022 deliveries offer a preview of the company’s upcoming quarterly earnings.

TSLA’s first-quarter deliveries were only slightly below the market consensus’ estimates, and this supports my view that the company’s upcoming Q1 2022 earnings will live up to the market’s expectations. However, there is greater uncertainty over Tesla’s full-year financial performance taking into account the current Shanghai lockdown and the potential drag of the new production facilities on its profitability. As such, I deem a Hold investment rating to be appropriate for TSLA’s shares.

TSLA Stock Key Metrics

On April 2, 2022, TSLA issued a press release announcing the company’s deliveries and production figures for Q1 2022.

Tesla’s deliveries increased by +67.7% YoY and +0.5% QoQ to 310,048 units in the first quarter of this year. Specifically, deliveries for Model 3/Y grew +61.5% YoY to 295,324 units in Q1 2022, but declined marginally by -0.5% on a QoQ basis. The company’s Model S/X deliveries expanded by +25.1% QoQ and +625.3% YoY to 14,724 units in the most recent quarter.

More significantly, TSLA’s actual Q1 2022 deliveries fell slightly short of the sell-side’s consensus forecast of 312,000 units. I go into detail about the current lockdown in Shanghai, China which could have accounted for the deliveries miss in a subsequent section of the article titled “What To Expect From Earnings”.

On the positive side of things, Tesla’s production numbers were roughly flat on a QoQ basis at 305,407 units in the first quarter of 2022 as compared to 305,840 units produced in the final quarter of the prior year. In fact, I estimate that TSLA’s daily production rate improved by +2% QoQ in Q1 2022 vis-a-vis Q4 2021 (different numbers of days in two quarters). In the “What Is Tesla’s Forecast?” section below, I touch on TSLA’s new production facilities in Berlin and Austin, which might have contributed to the increase in daily production rate for the first quarter of 2022.

In a later section of this article, I touch on how TSLA’s Q1 2022 key operating metrics give us an indication of how the company could have performed in the quarter.

When Does Tesla Report Earnings?

Tesla is reporting the company’s earnings for the first quarter of 2022 on April 20, 2022 after trading hours, as per its media release dated April 2, 2022 which was referred to in the preceding section of this article.

What To Expect From Earnings?

The Wall Street’s consensus financial estimates suggest that Tesla’s revenue and non-GAAP normalized earnings per share will grow by +71% YoY and +144% YoY to $17.8 billion and $2.26, respectively in the first quarter.

Notably, there have been very marginal changes made to the Q1 2022 consensus numbers for TSLA in recent months, even after the disclosure of deliveries in early-April. Tesla’s consensus Q1 top line and bottom line were raised by +0.6% and +0.9%, respectively in the past one months. In the last three months, TSLA’s consensus first quarter revenue was revised upwards by +0.5%, while analysts increased the consensus Q1 EPS by +0.3%. This implies that the market has confidence in Tesla’s ability to deliver the results in the first quarter of this year, and I think the analysts are right.

In terms of sales volume, Tesla is likely to have been negatively affected by the COVID-19 lockdown in Shanghai, China which began on March 28, 2022. But this should have a very limited impact on TSLA’s Q1 revenue given that the lockdown only happened in the last week of March, and this is validated by the fact that the company’s first-quarter deliveries only missed the consensus estimates marginally. But if the lockdown in Shanghai does not ease going forward, TSLA’s operating and financial performance for Q2 2022 could also be adversely affected.

With respect to pricing, TSLA has sent a strong signal to investors that the company has the pricing power to pass on cost increases to its customers. An April 7, 2022 Seeking Alpha News article mentioned that the company “has raised the price of the Model 3 Long Range and Performance variants in the United States” this month. In the news article, it is also highlighted that Tesla has previously raised prices in March as well. This should help to sustain TSLA’s profitability at the gross margin level.

In a nutshell, I don’t see any major surprises relating to Tesla’s Q1 2022 earnings announcement on April 20, 2022, as I expect the company’s financial performance in the first quarter to be in line with what Wall Street is forecasting.

Is TSLA Stock Overvalued Now?

It is natural to be concerned if TSLA’s shares are overvalued now considering its good share price performance.

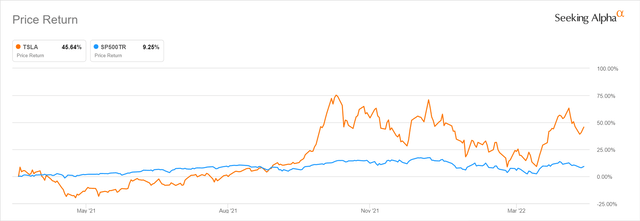

Tesla’s Stock Price Performance For The Past One Year

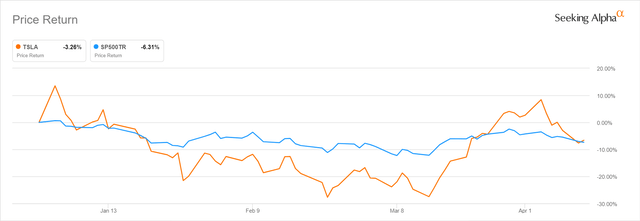

TSLA’s 2022 Year-to-date Share Price Performance

As per the charts presented above, Tesla’s shares have outperformed the S&P 500 for both the one-year and year-to-date time periods.

But I assess Tesla’s stock to be fairly valued.

My target price for TSLA is $1,026 based on a forward fiscal 2025 Enterprise Value-to-Revenue multiple of 12 times applied to the company’s consensus FY 2025 top line estimate of $144 billion, and discounted back to the present. My price target is only +4% above Tesla’s last traded share price of $985 as of April 14, 2022, and this supports my view that TSLA is currently at a fair valuation.

What Is Tesla’s Forecast?

It is more important to evaluate the expectations for Tesla’s full-year 2022 results rather than just focusing on the upcoming quarter.

TSLA is expected to expand the company’s top line and bottom line by +54% and +57% to $82.8 billion and $10.67 per share, respectively for FY 2022. I have a mixed view of whether Tesla can achieve these numbers.

There has been a slight easing of pandemic restrictions in Shanghai, evidenced by the fact that “some residents of Shanghai were allowed out of their houses and apartments following a two-week shutdown”, according to a recent Seeking Alpha News article published on April 13, 2022. But as long as China sticks to its “COVID-zero” policy, there is always a risk that there could be tightening of COVID-19 restrictions or new lockdowns in Shanghai going forward assuming another spike in pandemic cases somewhere down the road. In other words, this poses downside risks to Tesla’s full-year 2022 deliveries and revenue.

Separately, new production facilities in Berlin and Austin should be positive for Tesla in terms of increasing the company’s production capacity to meet future demand. According to an April 8, 2022 sell-side report (not publicly available) published by Wedbush titled “Giga Austin Rodeo Takeaways”, Tesla is estimated to “have the run rate capacity for overall ~2 million units annually (by end-2022) from roughly 1 million today” thanks to the Austin and Berlin factories. But it is also inevitable that Tesla’s profit margins will be hurt in the short-term, as the production facilities in Berlin and Austin will naturally be unable to run at their optimal capacities in the early stages of production ramp-up.

In summary, there are downside risks to TSLA’s revenue and earnings which should warrant attention. It is necessary to watch the China/Shanghai COVID-19 situation and the progress of the Austin and Berlin factories closely to determine if Tesla can deliver a good financial performance for full-year 2022.

A wildcard for Tesla’s future outlook is Elon Musk’s proposed buyout of Twitter (TWTR). Assuming Elon Musk’s acquisition of TWTR is successful, he could potentially leverage on the Twitter platform to build a stronger community of Tesla buyers and owners. However, as it stands now, Twitter’s board does not seem receptive to the buyout offer, so the deal might not go through.

Is TSLA Stock A Buy, Sell, or Hold?

Tesla stock remains a Hold. I see TSLA’s delivering in-line earnings Q1 2022, implying that there won’t be a substantial beat or miss for the quarter. Also, Tesla’s valuations are deemed to be fair according to my price target; and I have a mixed view of Tesla’s outlook for full-year 2022.

Be the first to comment