SeregaSibTravel

Carnivals are associated with fun-filled activities, love, and joy. Carnival Corporation & plc (NYSE:CCL), however, has enjoyed none of this in the last couple of years. The world’s biggest cruise operator’s market value has crashed by more than 58% this year, mostly due to the continuation of COVID-19 instances, which hampered the travel plans of many people at the beginning of the year. China has been under some form of lockdown throughout the year so far and the country continues to enact its zero-Covid policy, which has been difficult for many businesses, particularly in the travel sector, and has continued to harm cruise operators. Given the unpredictability of the health crisis, Carnival is facing a material impact on all parts of its business, including liquidity, financial condition, and operating performance. Meanwhile, the invasion of Ukraine prompted the company management to suspend all operations in Russia, dealing another blow to its business. In addition, supply chain problems, increasing fuel prices, and the energy crisis have hurt the company’s business this year.

Although the struggling cruise line has successfully navigated the worst effects of the pandemic, the challenges are far from over, as most industries have either lost ground since the Covid outbreak or are still dealing with weak demand. Contrary to the airline industry, which saw a scorching summer and booming sales, cruise lines did not experience a substantial rebound. The cruising operators did not receive the same government support as the airline industry either, so they had to rely on capital markets to raise funds to survive the pandemic. At a time when interest rates are rising and inflation is peaking, the debt pile of Carnival has come back to haunt the company as well.

As we inch closer to 2023, this analysis tries to determine whether the new year will bring about a notable change in Carnival’s prospects.

What Are Carnival Catalysts To Watch For?

With an increase in bookings, Carnival may see better days ahead. In the third quarter, the company posted positive adjusted EBITDA for the first time since resuming cruises. Occupancy and revenue both increased sequentially. Furthermore, the company added that the volume of reservations for upcoming cruises has surpassed an already excellent 2019 level.

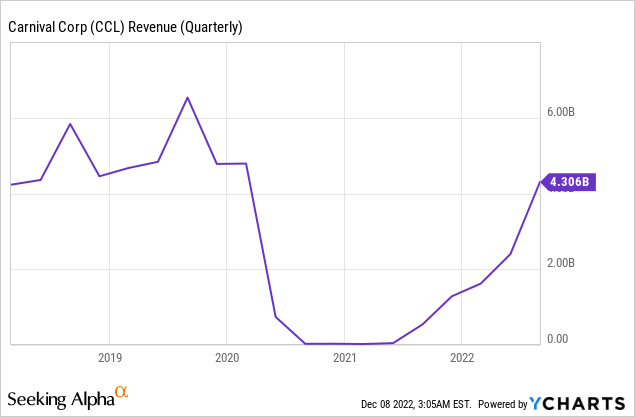

Revenue climbed by approximately 80% sequentially in the third quarter of 2022 and increased by 688% YoY to $4.31 billion, aided by increasing booking volumes with less stringent regulations and improved alignment of land-based vacation alternatives. The revenue per passenger cruise day (“PCD”) for the third quarter was $17.7 million, up 55% from the second quarter. As illustrated below, quarterly revenue has come a long way from the pandemic lows but the company still has its work cut out to reach the pre-pandemic levels. Not to forget, operating expenses have skyrocketed since the beginning of the pandemic, so Carnival will not be as profitable as it was even if it reached pre-pandemic revenue levels anytime soon. One major catalyst to look out for is whether Carnival’s revenue will reach pre-pandemic levels in the first half of 2023 amid record bookings.

Exhibit 1: Carnival quarterly revenue

According to the management, following the introduction of the company’s relaxed protocols in mid-August, cumulative advanced bookings for the first half of 2023 reached historical ranges and at higher prices than in 2019. New bookings in the third quarter of 2022 largely offset the usual third-quarter seasonal decrease in client deposits, which was $0.3 billion in the third quarter of 2022 versus $1.1 billion in the same period in 2019. Meanwhile, total customer deposits as of August 31 were $4.8 billion, down from $5.1 billion as of May 31 but close to the $4.9 billion as of August 31, 2019. It was a record third quarter for the company since the reopening of the economy and international travel. If bookings continue to remain strong even amid inflationary pressures, it could act as a catalyst driving CCL stock higher in the new year.

In Q3, 95% of the company’s capacity resumed guest cruise operations, with occupancy increasing by 15% from the previous quarter. For the third quarter, Carnival recorded an adjusted net loss of $688 million and ended the quarter with $7.4 billion in liquidity, including cash and borrowings available under the company’s revolving credit facility. An improvement in Carnival’s financial position could act as a catalyst for its market performance as well.

Despite solid booking increases, supply chain problems and higher gasoline prices remain obstacles. Carnival, on the other hand, continues to prioritize fleet efficiency to drive growth. The company highlighted the exit of 23 less efficient ships from its fleet in exchange for the delivery of 9 larger and more efficient ships. Carnival is hopeful about replacing old ships and believes that 50% of its capacity will be made up of newly delivered, larger, and more efficient ships. The company also announced the global implementation of Service Power Packages in August to reduce both fuel usage and greenhouse gas emissions while also contributing to cost reductions. This includes technological enhancements, which the company believes will save around $150 million in yearly fuel costs by generating an average of 5%-10% fuel savings per ship. Carnival is paving the way for a return to profitability with fleet efficiency and cost-cutting efforts while continuing to capitalize on pent-up demand. If Carnival makes progress on these fronts in 2023, it could be a catalyst for its stock.

What Do Analysts Believe About Carnival?

Carnival’s financial performance, as highlighted above, has not returned to pre-pandemic levels. Revenue is much lower than in 2019, and the cruise line has now reported 11 straight quarters of larger-than-expected losses. Although demand has been robust in recent months, prices have risen as well. Today, the company faces a major challenge: rising interest rates. Higher interest rates raise the cost of variable-rate borrowings, increasing the company’s expenses and decreasing demand for cruises in the short term as consumers prioritize their spending for necessities.

Carnival’s long-term debt was $28.5 billion as of the third quarter, up from $8.9 billion in 2019, and interest expenses have jumped as well. This problem might intensify with the Federal Reserve continuing to raise interest rates, increasing the interest expense on the company’s existing debt, and potentially making refinancing expensive. In October, the company issued $1.25 billion in Senior Priority Notes using 12 ships as collateral. Carnival anticipates using the net proceeds of the transaction to pay down debt and to use for basic business needs. Analysts are concerned about the interest expense that comes with it, as well as the long-term implications of these decisions on cash flow and profitability. However, analysts also believe that Carnival’s $2 billion in corporate debentures, which are due in April 2023, is the debt the company is most likely aiming to repay with new ones. Carnival is currently paying 11.5% interest on this, which was issued at the height of the pandemic and the company may utilize the new debt, which bears an interest rate of 5.75%, to settle the more expensive debt assumed during the pandemic.

Some analysts believe that Carnival may have only limited room for growth, with the company operating at 95% of its capacity as of September 30 and eight of its nine brands likely to use their complete fleet by the fourth quarter. The increase in demand is positive news but it also implies that the company may need to add new ships to expand from here.

A few days ago, Wells Fargo analysts recommended investing in Royal Caribbean (RCL) while assigning a ‘sell’ recommendation to Carnival stock. JPMorgan analysts are also not in favor of Carnival despite the company being the industry leader. Based on the ratings of 13 Wall Street analysts, CCL stock has an average price target of $11.65 on the Street, which still implies an upside of more than 30% from the current market prices.

Exhibit 2: Carnival stock price forecast

Source: TipRanks

What Is the Forecast For 2023?

The cruise industry was one of the hardest hit leisure travel sectors during the pandemic, but now that COVID-19 restrictions are easing, there is a robust demand among people looking to cruise again. Contrary to market expectations of diminishing demand for travel, Carnival reported record Cyber Monday bookings that were 50% higher than the volume for Cyber Monday 2019. The company’s move to ease its COVID-19 protocols for most ships are paying off since they no longer need guests to be completely vaccinated or tested for trips of 15 nights or less.

Despite the adverse interest rate environment, Carnival still has room to grow its topline meaningfully in 2023, and the company should benefit as the market leader as travelers remain resilient in making up for a lost couple of years.

Takeaway: Tread Cautiously

Investing in Carnival is not for the faint at heart. The risk-reward profile suggests that investing in Carnival could turn out to be a zero-sum game – expected returns lie at the two extreme ends. Long-term-oriented investors should continue to focus on Carnival’s financial health for the time being as surviving the next couple of years in one piece could set up a good platform for the company to thrive in the years ahead. Even in the best-case scenario, I expect lackluster returns from CCL in 2023 as the company navigates this challenging environment. Carnival’s financial performance next year, however, will give us a good indication of its long-term prospects.

Be the first to comment