Liudmila Chernetska

Investment Thesis

Rent the Runway, Inc. (NASDAQ:RENT), a company focused on renting high-end clothing and accessories, delivered its shareholders with a very welcome respite. Critically, its guidance into the year-end took many investors by surprise.

Let’s keep something in mind, we have a cost of living crisis, together with countless retailers heavily discounting their inventory. This is not an environment where Rent the Runway is supposed to thrive. But that’s where the market got this wrong.

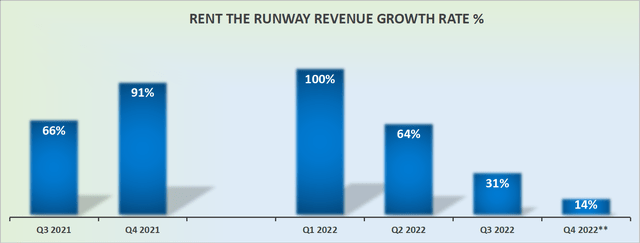

Revenue Growth Rates Impress

To be clear, expectations going into this earnings report were low. Really low. After all, not only was RENT up against a really challenging comparable with last year, but most importantly, the macro environment this time around was materially more challenging than last year’s.

That being said, this didn’t stop active subscribers from moving higher and were up to 134K, a 15% increase y/y. On this front, this is what founder and CEO Jennifer Hyman said:

The brands we offer are unmatched by other fashion rental companies and our cost actions allow us to deliver even more Rent the Runway to customers.

Furthermore, during the earnings call, Hyman described how RENT is a bigger business in 2022 than it was in 2019. And that things are changing.

How Things Change?

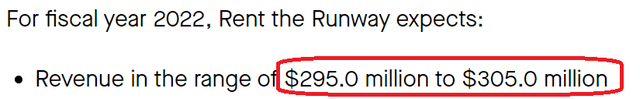

- Consider this outlook that RENT provided together with its Q1 2022 results:

You can see that at the low end, at least $295 million was expected for the full year.

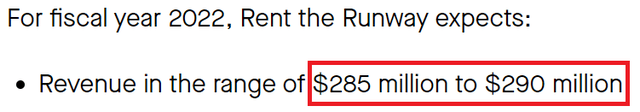

- Next, this was the outlook provided with its Q2 2022 results:

At that time, back in Q2, investors were led to believe that even the low end of $290 million was off the cards.

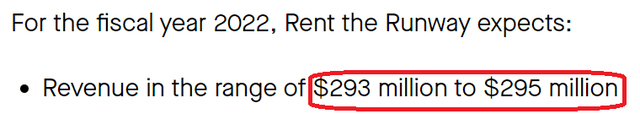

- And now consider this guidance provided yesterday, Q3 2022:

RENT now guides that over the all-important holiday season it can get its revenues back +$290 million.

Indeed, during the earnings call, Hyman stated,

So we can be opportunistic right now in the market, whereas everyone else needs to be promotional.

So what we are doing is we are going to our 800-plus brand partners, we are looking at what they have available and we are acquiring inventory at very healthy discounts pulling forward some of the inventory spend that we would have spent in 2023.

There’s no doubt that the tone of call was very bullish.

But What About the Risks?

The way I see it is that one good quarter doesn’t solve all RENT’s problems.

- You still have a company that’s burning through free cash flows. Yes, the company believes that it can improve its cash burn. But the fact is that for now, it’s still burning through cash.

- What’s more, recall, this time last year, RENT had a slightly net cash position. While for Q3 2022, it ended the quarter with about $100 million of net debt.

So, is Rent the Runway, Inc. out of the woods? It absolutely is not.

But surely, the stock is cheap enough?

RENT Stock Valuation — How Cheap?

There are two problems at hand. Firstly, Rent the Runway, Inc. is capitalizing its expenses. This is something that is highly contentious. How long does a designer item last?

For their part, RENT is capitalization apparel over 3 years. Being a guy, I have no idea how long a fashion item lasts. How long does it remain fashionable?

What I will say is this, if your operating losses over the trailing 9 months are about $86 million, and on top of that you are capitalizing your rental product by approximately $44 million, I don’t believe you have a viable business model.

Secondly, I know better than most, that something that is down +80% in a year may seem cheap. Particularly when the stock is soaring after this quarterly earnings result. But experience has taught me that something that starts off cheap, can get a lot cheaper over time.

The Bottom Line

This was unquestionably a very positive report from Rent the Runway.

The company is clearly benefitting while most of its peers are struggling. In fact, we’ve seen countless reports of how HENRY consumers (High Earners Not Rich Yet), are moving down the discretionary spending ladder.

So, for a company to go against that trend, it’s strong evidence that they are doing something right.

But for my part, if you have a business with a net debt position, that’s still burning cash, I’m not going to feel comfortable owning this stock.

Be the first to comment