AscentXmedia/E+ via Getty Images

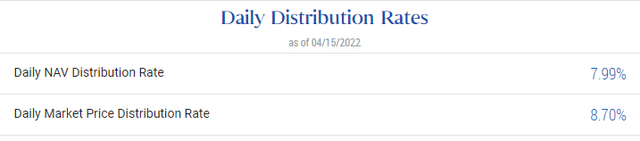

The PIMCO Dynamic Income Opportunities Fund (NYSE:PDO) is a diversified, leveraged, high-yield bond CEF. PDO’s diversified holdings, strong 8.7% distribution yield, market-beating returns, high discount to NAV, and low interest-rate sensitivity, make the fund a buy. On the other hand, PDO is a relatively risky fund, and so only appropriate for more aggressive income investors and retirees.

PDO – Basics

- Investment Manager: PIMCO

- Distribution Yield: 8.7%

- Expense Ratio: 2.61%

- Discount to NAV: 8.2%

- Total Returns CAGR 1Y: 2.6%

- Leverage Ratio: 1.88x

PDO – Investment Thesis

PDO is a diversified, leveraged, high-yield bond CEF. It is administered by PIMCO, the most successful fixed-income investment managers in the world. PDO’s investment thesis rests on the fund’s:

- Diversified holdings, with exposure to most relevant high-yield bond sub-asset classes

- Strong 8.7% distribution yield, which directly increases shareholder returns

- Market-beating returns, with the fund outperforming its peers since inception, and most relevant asset classes YTD

- High 8.2% discount to NAV, which boosts yields and potential capital gains alike

- Low interest rate risk, which is particularly beneficial when rates are rising, as they currently are

PDO’s many benefits make the fund a strong investment opportunity, and one which is particularly appropriate for aggressive income investors and retirees. Let’s have a quick look at each of the points above.

Diversified Holdings

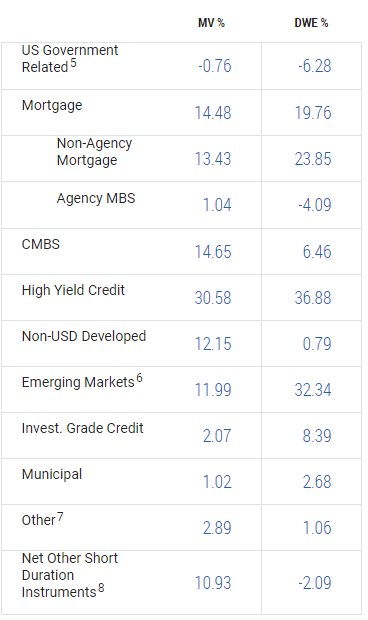

PDO invests in most relevant high yield bond sub-asset classes, including high yield U.S. corporate bonds, non-agency mortgage-backed securities, emerging market debt, and similar. There are also smaller investments in lower yielding, safer securities, but these account for only a small portion of the fund’s holdings. Sector allocations are as follows:

PDO Corporate Website

PDO provides investors with exposure to most relevant high yield bonds, a strong benefit for the fund and its shareholders. PDO is diversified enough that it could function as a core portfolio holding too.

On a more negative note, the fund’s holdings are mostly low-quality securities with low credit ratings. Expect significant losses if economic conditions were to worsen, as is generally the case during recessions and downturns. Leverage would magnify any potential losses, and with PDO boasting a massive 1.88x leverage ratio, losses could be quite high. Leverage ratios higher than 1.50x are rarely a good idea, but I’m confident in PIMCO’s (proven) capacity to handle the debt load without incurring in excess losses.

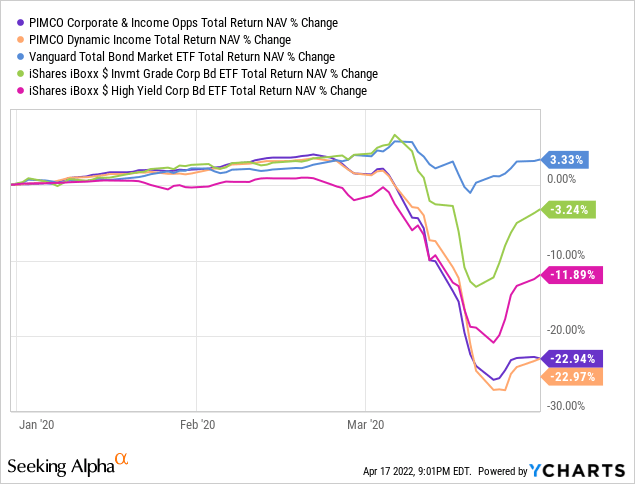

As PDO is a relatively new fund, it was created in early 2021, we can’t analyze its performance during any past downturn. Still, other PIMCO bond CEFs have underperformed relative to most bond indexes in previous downturns, and these are generally quite similar to PDO. As an example, PIMCO bond CEFs underperformed during 1Q2020, the onset of the coronavirus pandemic, and the most recent downturn. As such, and considering holdings and leverage ratios, I’m confident in my assessment that PDO would underperform during any future downturn.

Due to the above, PDO is only appropriate for more aggressive income investors and retirees. More risk-averse investors, for whom risk-reduction and capital preservation are paramount, should consider other funds.

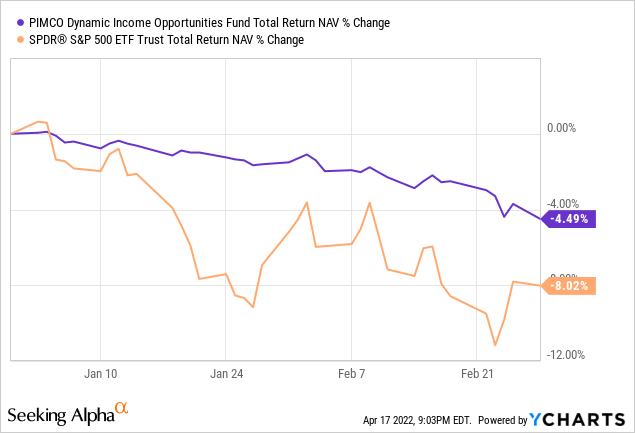

On a more positive note, as PDO focuses on fixed-income securities, it is less exposed to equity risk, valuations, and sentiment. Expect comparatively low losses when valuations soften yet economic conditions remain reasonably strong. This has been the case YTD, especially so in the first two months of the year.

PDO’s lack of equity exposure means the fund can be used to diversify and de-risk an investor’s equity holdings, a significant benefit. PDO is still a broadly risky fund, but the risks are somewhat different than those of most equity funds, and that distinction matters when minimizing portfolio risk and volatility.

Strong 8.7% Distribution Yield

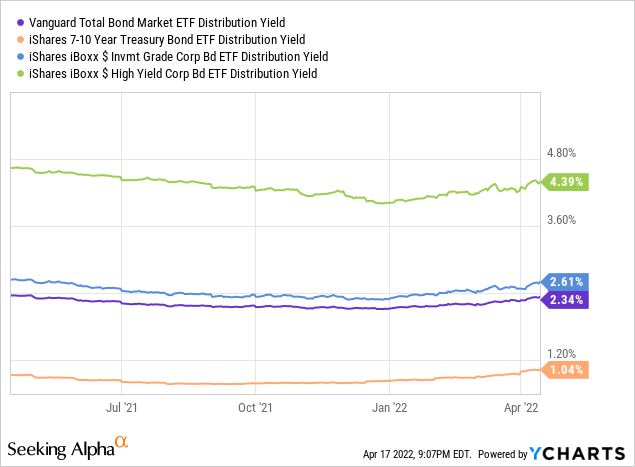

PDO focuses on high yield bonds, which generates a lot of income for the fund, and strong distributions for the fund’s investors. PDO pays a monthly $0.1184 distribution to shareholders, which results in a strong 8.7% yield. There was also a special $0.49 distribution in late 2021, and the potential for more special distributions moving forward, but these are not included in the fund’s current 8.7% yield.

PDO’s yield is quite strong on an absolute basis, and quite a bit higher than that of most relevant bond indexes. PDO yields almost twice as much as the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), the high yield corporate bond benchmark, with a 4.4% yield. PDO’s strong distribution yield is a significant benefit for the fund and its investors, and quite rare under current market conditions.

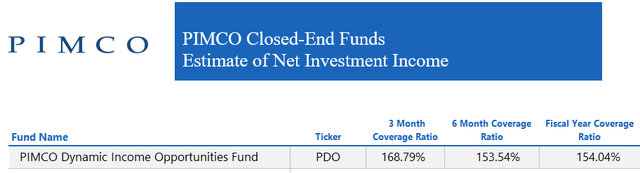

PDO’s distribution is more than covered by underlying generation of income, with the fund currently sporting a 150% distribution coverage ratio. Said ratio also covers other relevant time periods.

Distribution coverage ratios are, sometimes, not incredibly informative for higher-risk funds. Risky securities tend to see consistent capital losses through defaults and the like, and these need to be taken into consideration when analyzing long-term distribution sustainability. My preferred metric for this is long-term NAV sustainability. Funds with unsustainable distributions tend to see consistent, long-term reductions in their NAVs, while those with sustainable distributions generally do not. PDO’s NAV has declined by about 11% since inception. From what I’ve seen, about two-thirds of the decline was due to lower bond prices caused by widening credit spreads, and the other third due to the special distribution in late 2021. In my opinion, this indicates that the fund’s ordinary, monthly distributions are sustainable, as these have not led to above-average NAV losses, but that the same is not true for the fund’s special distributions. As such, and considering the fund’s declining NAVs, I would not expect further special distributions moving forward. Importantly, the fund’s 8.7% distribution yield does not take into account these special distributions.

PDO’s strong, fully-covered 8.7% distribution yield is a significant benefit for the fund, and its core investment thesis.

Market-beating returns

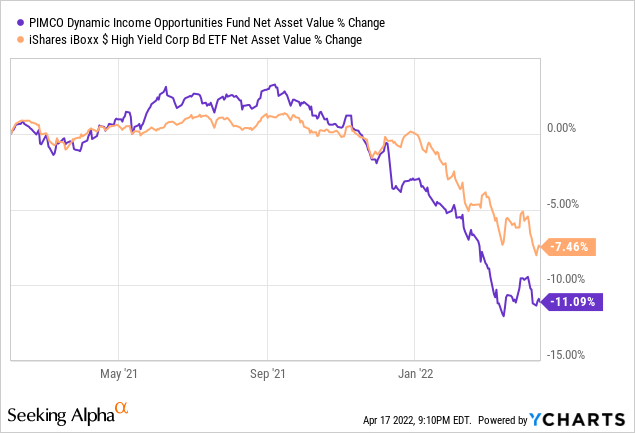

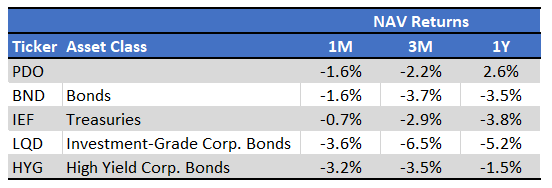

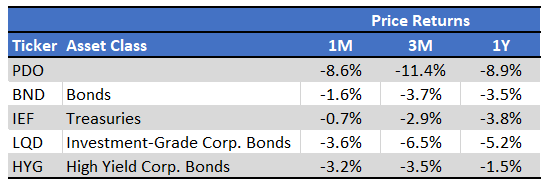

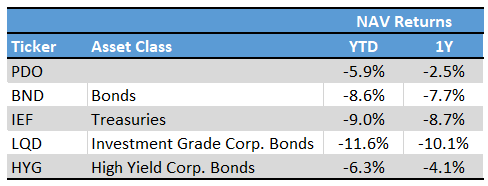

Strong distribution yields sometimes come at the expense of capital gains or total returns, but that is not the case for PDO. The fund has outperformed, on an NAV basis, most relevant bond indexes in its short history, from treasuries to high yield corporate bonds, and everything in between. On a more negative note, returns have been quite low on an absolute basis. PDO has posted NAV returns of 2.6% this past year, and small losses these past few months. Returns have been quite low for most bond asset classes, due to the prospect of higher interest rates. PDO’s returns have been good on a relative basis, less good on an absolute basis.

SeekingAlpha – Chart by author

The above figures are NAV returns. Price returns are much more negative, with the fund underperforming relative to all relevant peers.

SeekingAlpha – Chart by author

PDO has underperformed on a price basis exclusively due to a widening discount, which brings me to my next point.

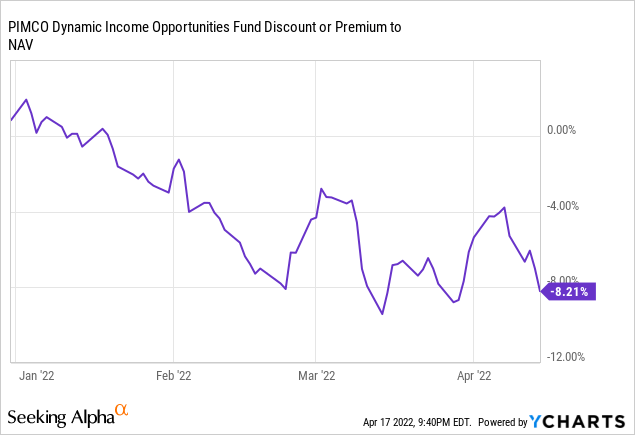

High 8.2% discount to NAV

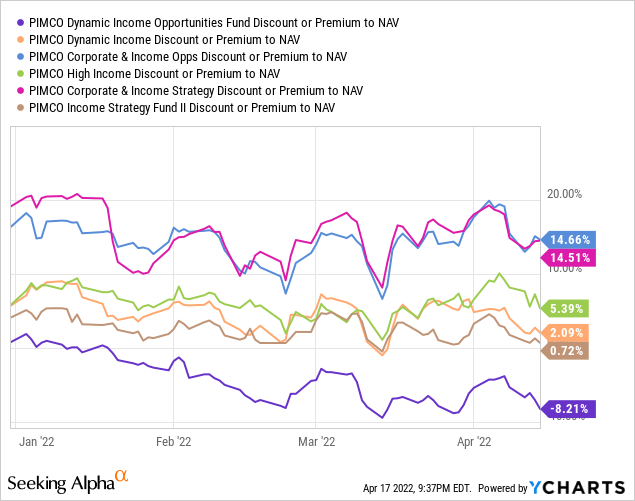

PDO currently trades with an 8.2% discount to NAV. It is a reasonably good discount, and the largest discount in the fund’s entire, albeit short, history.

PDO’s discount increases shareholder returns in two key ways.

First, discounts to NAV are equivalent to lower share prices, and lower share prices means higher yields. PDO sports an 8.0% distribution rate on NAV. Investors, however, receive an 8.7% distribution yield (on price), as they are able to buy shares at a heavily discounted price. PDO’s discount means 0.7% in extra distributions, a small, but direct benefit for shareholders.

Second, discounts can always narrow, resulting in capital gains for investors. In my opinion, as PDO’s discount is at historically above-average levels, narrower discounts seem warranted.

PDO’s large 8.2% discount to NAV directly increases the fund’s distribution yield, and could potentially lead to capital gains, a solid combination.

Low Interest Rate Risk

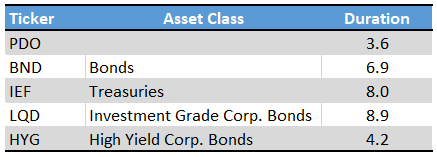

As mentioned previously, PDO has outperformed most of its peers on a NAV basis since inception.

SeekingAlpha – Chart by author

PDO’s outperformance is relatively simple to explain.

Most bonds and bond funds have seen losses this past year, as investors are selling their low-yielding bond holdings, in anticipation of newer, higher-yielding alternatives once the Federal Reserve hikes rates. Selling pressure has caused bond prices to drop, leading to capital losses for bond investors, including most bond funds.

PDO’s managers knew that the above was a likely scenario, and so decided to hedge the fund against rising interest rates through the use of financial derivatives / interest rate swaps. These derivatives reduced the fund’s interest rate sensitivity, as measured by its duration (higher duration equals higher interest rate sensitivity equals higher losses when interest rates rise, and vice versa). PDO has the lowest duration of its peer group, which allows the fund to outperform during periods of rising interest rates. Duration remains positive, so the fund should experience losses when interest rates rise, but these should be relatively small.

Fund Filings – Chart by author

PDO’s low interest rate sensitivity reduces risk, volatility, and the magnitude of losses when rates rise, all significant benefits for the fund and its shareholders. Although PDO is, on net, a relatively risky fund, it has a below-average level of interest rate risk, an important factor for investors to consider.

Conclusion

PDO’s diversified holdings, strong 8.7% distribution yield, market-beating returns, high discount to NAV, and low interest rate sensitivity, make the fund a buy. The fund performs comparatively well when valuations soften and interest rate increase, as has been the case these past few months. PDO is a relatively risky fund, and inappropriate for more risk-averse income investors and retirees.

Be the first to comment