Ekaterina79/iStock Editorial via Getty Images

Elevator Pitch

I have a Buy investment rating assigned to Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), also referred to as Google.

I did a preview of GOOG’s Q1 2022 earnings in my prior article published on April 25, 2022. Alphabet’s actual Q1 EPS fell short of market expectations as I predicted in my late-April update, and GOOGL’s shares have remained weak with its stock price dipping by -21% year-to-date in 2022.

In this article, I came to the conclusion that Google stock is a Buy during the dip. Alphabet’s current valuations are below their five-year historical averages, and the company’s share buybacks could help to support its stock price. The company’s financial performance should exceed market expectations given the resilience of search advertising, notwithstanding a challenging macroeconomic environment.

Alphabet Stock Key Metrics

The key metrics for Alphabet are its share price performance and the forecasts for advertising spend.

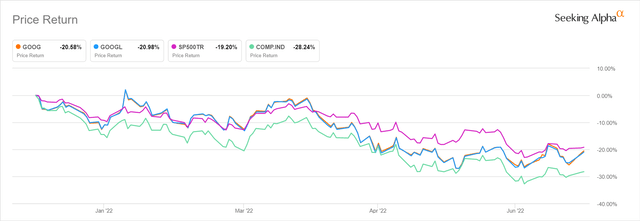

Alphabet’s Stock Price Chart For The 2022 Year-to-Date Time Period

As per the share price chart presented above, Alphabet’s shares have corrected by approximately -21% so far this year. During this period, the S&P 500 and Nasdaq Composite Index have declined by -19% and -28%, respectively. In other words, Alphabet has underperformed the S&P 500 slightly in 2022 year-to-date, but it has done much better than the Nasdaq Composite Index over the same period.

GOOG’s year-to-date share price weakness suggests that the company is expected to be negatively impacted by macroeconomic headwinds like most of its listed peers. This point of view is validated by the 2022 advertising spend forecasts done by some market research firms.

Magna Global expects the US advertising market’s growth to moderate from +25% in 2021 to +11% in 2022 as per its recent June 2022 forecasts, and this is lower than the +13% increase that it had projected earlier in December 2021. Separately, GroupM also revised its estimates for the growth in 2022 global advertising spend from 9.7% at the end of last year to 8.4% in the previous month. This also implies that the expectations are for global advertising spend growth to slow considerably as compared to the +25% increase for 2021.

In summary, GOOGL’s shares have dipped in 2022 alongside the broader market because the company’s 2022 financial performance is expected to be hurt by the slower growth in advertising spend this year as per the market research firms’ projections.

Is Google A Good Stock To Buy During A Dip?

Alphabet’s shares have performed better than the Nasdaq Composite Index in 2022 as mentioned in the preceding section. I am of the view that Google’s outperformance relative to the Nasdaq will continue, and that it is a good stock to buy during the dip.

There are two key reasons for my positive view of Alphabet.

Firstly, search advertising should grab a greater share of overall digital advertising budgets at the expense of social media advertising going forward, which is validated by Magna Global’s June 2022 forecasts which I referred to in the previous section.

Magna Global revised its 2022 US search advertising spend growth estimate upwards from +17.4% to +17.6% in its most recent forecast issued last month, but it reduced its US social media advertising spend growth projection for this year from +15.7% previously to +10.5% now. Magna Global explained that advertisers are increasingly allocating a larger proportion of their digital advertising spend to “keyword formats and other campaign strategies that can directly attribute advertising spending to sales”, in view of “broader economic and inflationary pressure” and “Apple’s (AAPL) iOS privacy changes.” This implies that Alphabet should do better than other digital advertising peers such as Meta Platforms (META), given that the company is focused on search advertising, rather than social media advertising.

Secondly, continued share buybacks should help to provide some support for Alphabet’s share price, even if the broader market continues to trend downwards.

Alphabet disclosed in late-April 2022 that $70 billion in additional share buybacks have been authorized by the board, which is equivalent to approximately 5% of the company’s market capitalization. Notably, the new $70 billion share repurchase authorization is +40% larger than its prior $50 billion share buyback authorization revealed in April 2021. If Google’s share price continues to fall in line with the market, it is reasonable to assume that the company will make good use of its substantial share buyback authorization. This should allow Alphabet to continue its outperformance relative to the Nasdaq Composite Index in the foreseeable future.

What Is The Prediction For Alphabet Stock?

Wall Street analysts are all predicting that Alphabet’s stock price will be higher in the next six months to one year, the typical time horizon for a sell-side investment rating.

According to consensus financial data sourced from S&P Capital IQ, the current mean sell-side price targets point to GOOG’s and GOOGL’s shares rising by +34% and +38%, respectively. In addition, the lowest target price for GOOG is $2,650, which is still +15% higher than its last traded price of $2,304.27 as of July 6. Similarly, GOOGL’s last done share price of $2,291.44 is at a 12% discount to the lowest sell-side price target for GOOGL at $2,611.

The stock price predictions for Alphabet stock make sense because Google is undervalued as highlighted in the next section.

Is Google Stock A Good Value?

Google stock is at a good value now.

Alphabet (the difference in GOOG’s and GOOGL’s respective last traded stock prices is less than 1%) is currently valued by the market at consensus forward next twelve months’ EV/EBITDA and normalized P/E multiples of 11.3 times and 19.9 times, respectively according to S&P Capital IQ. Google’s five-year average forward EV/EBITDA and P/E multiples are considerably higher at 13.4 times and 26.5 times, respectively.

Moreover, Alphabet’s current forward P/E of 19.9 times is just 11% higher than its five-year trough P/E multiple of 18.0 times. In other words, Alphabet’s shares are reasonably undervalued now.

Is Google Stock A Buy, Sell, Or Hold?

I rate Google stock as a Buy. I think that Alphabet can continue to outperform the Nasdaq Composite Index, taking into account its undemanding valuations, the new $70 billion share repurchase authorization, and the company’s focus on search advertising which should do better than other digital advertising formats.

Be the first to comment