adaask

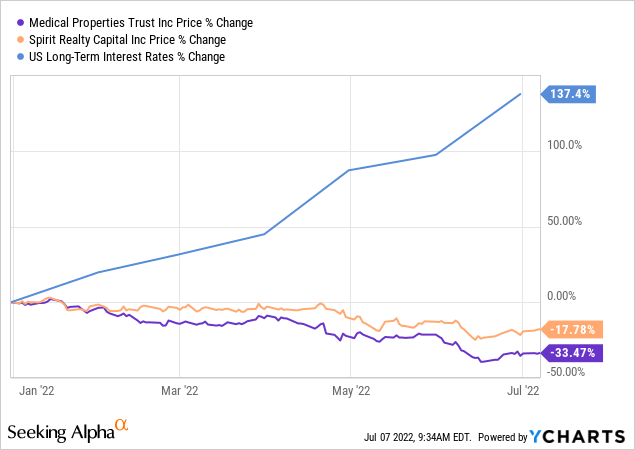

This year has not been kind to triple net lease REITs, as rising interest rates and the expectation of further hikes in the near future are causing Mr. Market to dump stocks that have traditionally been viewed as bond proxies.

While it is likely that the Federal Reserve will indeed raise interest rates a little bit more moving forward, there is also a growing consensus that we are headed for a recession.

In the event of a recession, it is very likely that the Federal Reserve will be forced to pivot back towards cutting interest rates. As Bloomberg recently reported:

Signs of a rapidly deteriorating US economic outlook have spurred bond traders to pencil in a complete policy turnaround by the Federal Reserve in the coming year, with interest-rate cuts in the middle of 2023.

While the current environment of high inflation and rising interest rates is a bad setup for triple net lease REITs (commonly viewed as bond proxies given their stable, long-term contracts with low single-digit fixed annual rent escalators), by mid-2023 we could be in an entirely different macro environment. If the U.S. does indeed fall into a recession sometime over the next year and the Federal Reserve’s arm is twisted into reversing course on interest rates, triple net lease REITs will suddenly find themselves in high demand by investors as their cash flows have proven to be very resilient in the face of recession and their high yields will then become more attractive relative to interest rates as the Fed cuts rates.

This is why we believe that now is the time to buy triple net lease REITs while they are cheap to lock in attractive current income and set up our portfolio for appreciation once this shift in Federal Reserve policy becomes more widely recognized by market forces. To help you get started, in this article, we compare two of the highest yielding investment grade triple net lease REIT opportunities in Medical Properties Trust (NYSE:MPW) and Spirit Realty Capital (NYSE:SRC).

Medical Properties Stock Vs. Spirit Realty Stock: Business Model

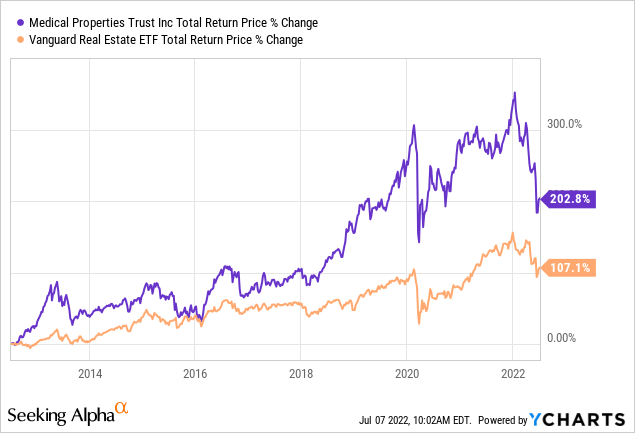

MPW’s business model is battle-tested and has proven to generate phenomenal returns for shareholders even after accounting for its sharp recent sell-off:

This outperformance is largely due to MPW’s competitive positioning as by far the largest investor in hospitals, giving it deal flow and cost of capital advantages that enable it to invest on more favorable terms and raise capital more aggressively to drive accretive growth. MPW has also leveraged its knowledge of the industry to invest in some of its tenants, generating tremendous returns in the process.

In addition to its conservative contract structuring with master leases that give MPW a senior positioning in the capital stack and the ability to withstand bankruptcy law scrutiny, MPW’s contracts are structured to be quite inflation resistant as well. With 5% CPI-based escalators, MPW should see its same-store rental income increase at a much brisker pace than the vast majority of its triple net lease peers. Management also believes that its tenants will be well-positioned to handle these increased rental costs, stating:

An important historical note to recognize, on a cumulative basis, Medicare reimbursements to hospitals have always exceeded inflation… we do not expect inflation to hit only the cost side of the income statement. It will also hit the revenue side…the very long-term history of CMS and other hospital reimbursements staying at least even and frankly over time ahead of inflationary pressures. So we expect even in a relatively steep inflationary environment that we think we’re in now that the revenue — first of all the revenue will keep up with increases. Secondly, hospital operators especially going back if you want to go back to the financial crisis and then again more so with the COVID impact, hospital operators had demonstrated a very strong ability to manage their cost labor and otherwise to maintain their margins.

While its relative tenant concentration and near full focus on hospitals do bring an element of risk to the picture, the mission-critical nature of its assets, their recession and inflation resistance, and conservative lease structuring make MPW overall a pretty safe and defensive investment that also offers inflation protection.

Meanwhile, SRC owns a well-diversified portfolio that consists of over 2,000 properties, including a rapidly growing industrial component (44.1% of its acquisitions since 2019 have been industrial). SRC only has 21.3% ABR exposure to its top 10 tenants and 35% ABR exposure to its top 20 tenants, while ~20% of its assets are industrial, 70% are retail, and the remainder are data center, personal storage, office, and other. It enjoys lengthy lease terms with an average weighted lease length of 10.4 years and 99.8% occupancy.

The main areas of weakness in the current environment are its fairly weak 22.2% ABR exposure to investment grade tenants and meager 2.1% expected forward same store sales growth.

Overall, SRC has a strong portfolio in the sense that its assets are more diversified by sector and individual tenant, but MPW has better inflation protection built into its portfolio.

Medical Properties Stock Vs. Spirit Realty Stock: Balance Sheet

MPW is junk rated by S&P, though only one notch below investment grade at BB+ (Stable). That said, its balance sheet does not appear at risk of experiencing distress thanks to FFO interest coverage of 2.16x and EBITDA interest coverage of 3.89x. Its current ratio is also very conservative at 5.22x.

In contrast, SRC boasts an investment grade credit rating at BBB (Stable), with a well-laddered debt maturity schedule (6.7-year weighted average length to debt maturity), an unencumbered portfolio (99.8% of debt is unsecured), a very conservative fixed charge coverage ratio (5.8x), and a low weighted average interest rate (2.92%).

Overall, SRC is the clear winner here with a credit rating that is two full notches above MPW’s.

Medical Properties Stock Vs. Spirit Realty Stock: Growth Outlook

MPW has a stronger growth outlook and also looks more appetizing on an organic growth level, thanks to its CPI-linked rent escalators. That said, both companies issue shares to fund much of their in-organic growth investments and neither has an attractive cost of capital at the moment due to soaring interest rates and both stocks’ recent selloffs. Analysts expect MPW to grow AFFO per share by 6.1% in 2022 and 5.5% in 2023 and its dividend per share by 3.6% in 2022 and 5.4% in 2023.

In contrast, analysts expect SRC to grow its AFFO per share by 7.1% in 2022 and 3.2% in 2023, and its dividend by 2.0% in 2022 and 2.6% in 2023. Overall, it appears that MPW has a slight edge in growth over SRC, driven by its superior inflation protection.

Medical Properties Stock Vs. Spirit Realty Stock: Valuation

Both stocks look very cheap right now:

| SRC | MPW | |

| Dividend Yield | 6.56% | 7.48% |

| EV/EBITDA | 13.63x | 13.43x |

| EV/EBITDA (5-Yr Avg) | 15.11x | 14.37x |

| P/NAV | 0.85x | 0.82x |

| P/FFO | 10.79x | 8.55x |

| P/FFO (5-Yr Avg) | 12.77x | 11.33x |

| P/AFFO | 11.10x | 10.81x |

| P/AFFO (5-Yr Avg) | 12.62x | 13.92x |

SRC looks cheaper relative to its history on an EV/EBITDA basis, while MPW is cheaper relative to its history on a cash flow yield basis. Overall, MPW gets the slight edge here as it is cheaper across the board and offers a greater discount to NAV along with a meaningfully higher dividend yield, despite also having slightly stronger growth prospects.

Investor Takeaway

Overall, both SRC and MPW look very attractively priced right now and warrant Strong Buy ratings in our view. We believe that both will see strong outperformance relative to the broader REIT sector within two years once a recession forces the Federal Reserve to do an about face on interest rates.

SRC appears better positioned to weather a recession with its stronger balance sheet and better diversified portfolio. However, MPW is better positioned to weather inflation and offers greater growth potential along with a superior current cash flow yield. If we had to pick just one, we would probably choose SRC given its more conservative positioning in the face of what we believe could be a prolonged recession. However, we really like both and see no reason for investors to choose just one of these REITs.

At High Yield Investor, we are building a portfolio of stocks similar to these that offer high current yields, solid inflation and recession resistance, and have high multiple expansion potential once that market’s attitude reverses. While it may hurt in the short term as Mr. Market throws the babies out with the bathwater in his panic over inflation, rising interest rates, and a potential recession, we believe that now is the time to buy these stocks before the discounts are gone.

Be the first to comment