alexsl/iStock via Getty Images

When we last covered NorthWest Healthcare Real Estate Investment Trust (OTCMKTS: OTC:NWHUF) (TSX: TSX:NWH.UN:CA), we warned of the risks that refinancings would bring. Q3-2022 results confirmed our fears, and we are now raising the risk of a dividend cut.

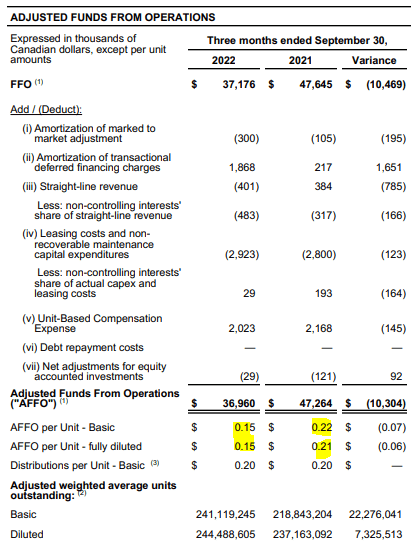

Adjusted Funds From Operations (AFFO) Drop

While Q2-2022 looked close to normal, Q3-2022 was anything but. AFFO dropped to 15 cents a share and that is lower than any single quarter that we remember. In fact, the very first full quarter for the REIT in 2010 produced 20 cents of AFFO per unit. That is something to keep in mind when you hear about the next round of “growth initiatives”. Getting back to Q3-2022, total AFFO dropped 22% and AFFO per unit dropped 32%. We are using basic AFFO here as we don’t expect convertibles to get converted into common units.

Q3-2022 Financial Results

The 15 cents was a stunning adjustment lower and management did address it.

During the quarter, revenue and NOI grew 21.2% and 19.9%, respectively on a YOY basis. However, as a result of several non-recurring items and lower transactional volumes, management fees decreased during the quarter while increasing interest expense coupled with the REIT’s temporarily elevated leverage level resulted in AFFO per unit decreasing to $0.151. With high visibility into near-term transactional activity which is expected to result in quarterly management fee income reverting to historic levels and adding ~$0.02/unit on a run-rate basis, the REIT expects earnings to be in-line with previous quarters when combined with the $0.04/unit annualized impact of balance sheet initiatives completed post quarter

Source: Q3-2022 Press Release

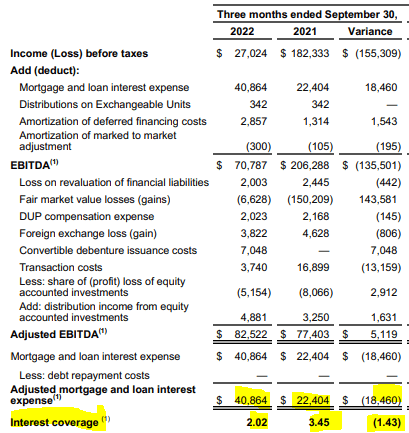

One-time expenses aside, it is the interest expense run-rate that we were warning about and you can see the impact in the quarter. Interest coverage has dropped from 3.45X to 2.02X.

Q3-2022 Financial Results

We have not seen a lot of interest coverage drops of that magnitude and it is quite alarming how rapidly the situation has deteriorated.

A Little Bit About Those Interest Expenses.

Weighted average rates were unchanged in European debt. Everywhere else, things looked grim. Australasia was up 1.64% year over year.

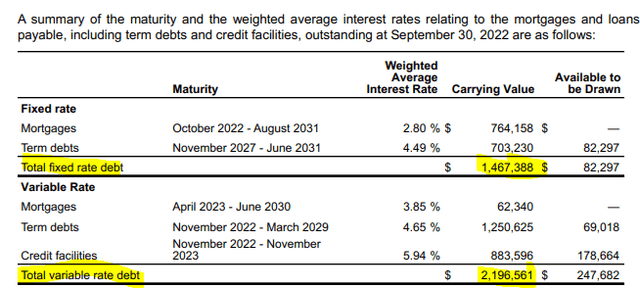

The increase over the comparable prior year periods is attributable to acquisition activity as well as an increase in weighted average interest rates. The weighted average interest rate as at September 30, 2022 increased to 4.74% compared to 3.10% as at September 30, 2021.

Source: Q3-2022 Financial Results

Corporate debt was up over 2% year over year.

The weighted average interest rate as at September 30, 2022 increased to 5.66% compared to 3.44% as at September 30, 2021.

Source: Q3-2022 Financial Results

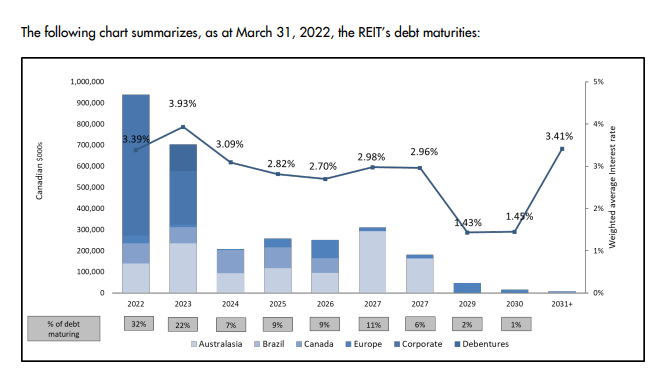

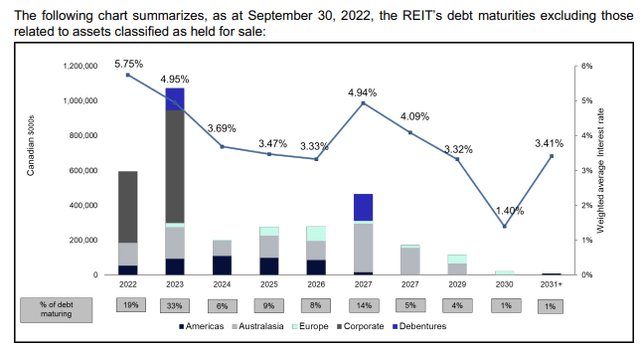

We can see similar jumps in all disclosed refinancing activities of the company. One way for the reader to visualize this is to just walk through the last three quarters of financial results. Keep your eye on the 2022 and 2023 average interest rates as you do so. The Q1-2022 numbers are up first.

Q1-2022 Financial Results

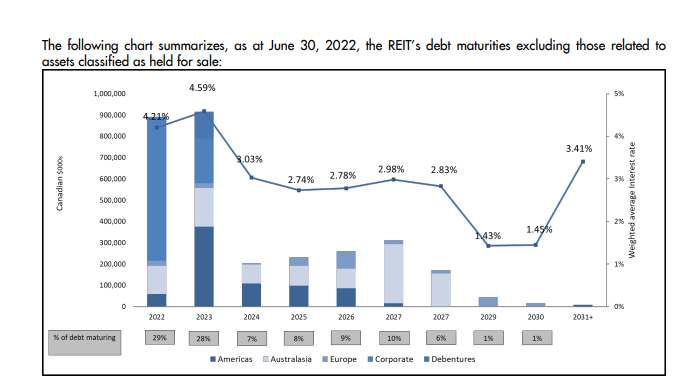

Here is Q2-2022.

Q2-2022 Financial Results

And finally, we have Q3-2022

Q3-2022 Financial Results

At the end of Q3-2022, $2.2 billion was still on a floating rate.

Q3-2022 Financial Results

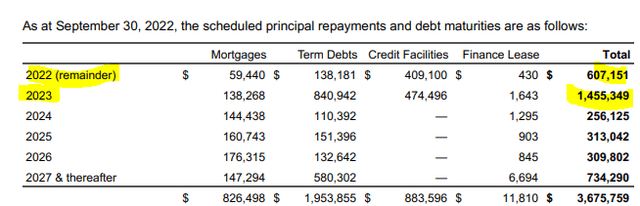

These are all coming at the REIT at breakneck speed. Over $2.15 billion is expected to be refinanced over the next 13 months.

Q3-2022 Financial Results

Outlook & Verdict

The game is going to be decided by three main factors. The first being whether NWHUF can unload those planned asset sales and joint ventures at good prices. Bulls may point to the actually completed transaction in the quarter as a sign that things are going well.

NorthWest has entered into agreements with a UK institutional investor (the “UK Investor”) in respect of a new joint venture targeting healthcare real estate in the UK (the “UK JV”) with an aggregate equity commitment of $765 million (£500 million) to be funded 85% by the UK Investor and 15% by the REIT as well as a $75 million (£50 million) investment in the REIT’s existing seed portfolio. The agreements are expected to be finalized by year-end.

Source: Q3-2022 Press Release

That does not do it for us. Only $75 million is for REIT’s existing seed portfolio. The amounts we need here are far, far higher and the US medical office needs to be divested as soon as feasible.

The second aspect here is how long can NWHUF continue paying an uncovered dividend. Yes, NWHUF expects some bounce into Q4-2022 and likely the higher resets in Q1-2023 also help. But we don’t see the dividend coverage improving to 100% any time soon.

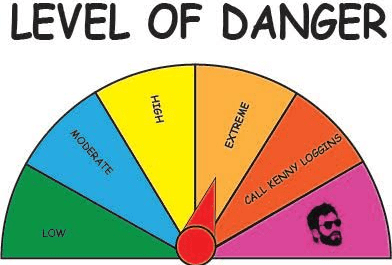

The final aspect is how much a of drubbing NWHUF takes on interest rates. So far, NWHUF has pretty much had to pay top dollar for all refinancings that we have seen year to date. Weighted rates are far higher today across the globe and headed higher for at least the next six months. Equally important, a quick rate cutting cycle is not in the cards. We think when all is said and done, interest coverage will deteriorate further and NWHUF will have a hard time holding on to even a 17 or 18 cent quarterly AFFO. The dividend will be cut ultimately in our opinion, and we are moving up the risk on our proprietary Kenny Loggins scale.

Kenny Loggins Scale.

We are also downgrading this to a sell and will revisit this should the news flow dictate.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment