banjongseal324/iStock via Getty Images

The market has been fixated on the FTX-Crypto debacle – understandably so, given the scale of fraud seen at the expense of retail investors.

This saga has overshadowed how equities continue to climb steadily after a weaker-than-expected inflation reading in November. Some sectors are putting in stealth rallies that the market has not picked up on yet.

Not getting much attention is the strength in the Dow Jones Industrial Average (DIA), which has rallied 17% off the lows. Despite being in a bear market, the index is just 9% off its all-time highs! The index is now trying to break out higher from a multi-month base, with 341 as the important pivot level.

Daily Chart: DIA

The Dow Jones Industrial Average is outperforming the S&P 500 (SPY) and Nasdaq 100 (QQQ), and the former’s chart is technically more constructive. This observation is important as it shows the types of stocks/sectors that are leading the market recovery.

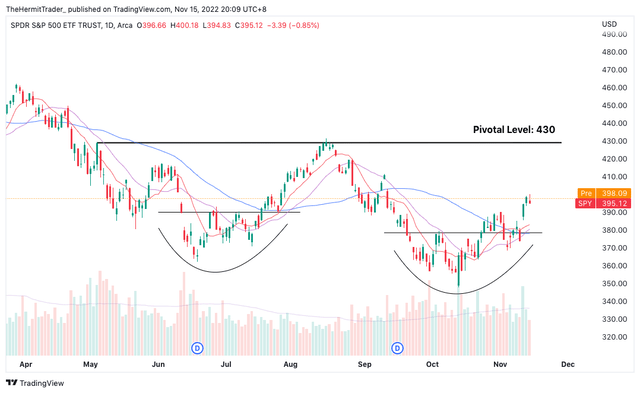

Looking at the chart of the S&P 500 below, we can see that although the index has broken out higher from a mini base (that was formed in close proximity to another back in June-July), prices are nowhere near their pivotal breakout level at 430.

Daily Chart: SPY

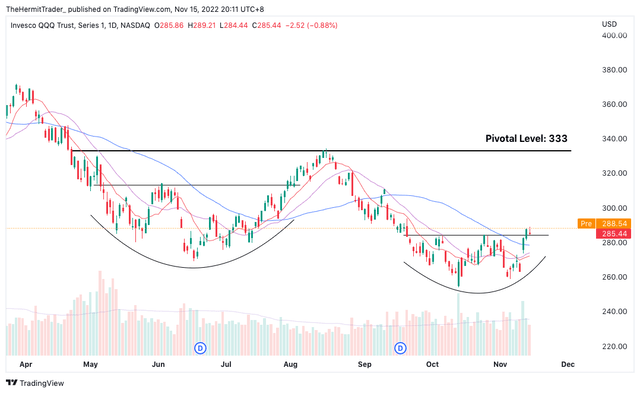

Below is the chart of the Nasdaq 100. We can see that the technology-heavy index is the weakest out of the three. The index has only just broken out higher from a mini base, a feat that was achieved by DIA and SPY much earlier.

Daily Chart: QQQ

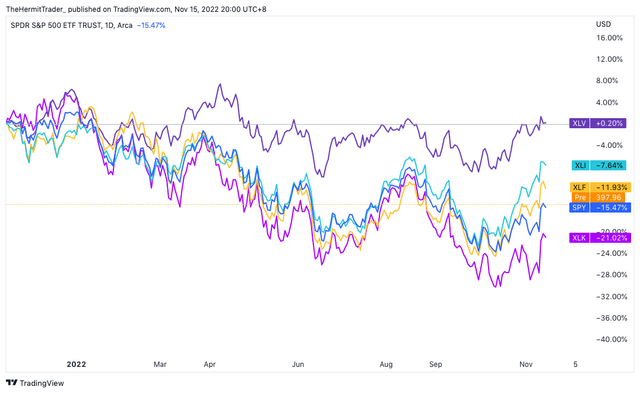

The 30 constituents in the Dow Jones Industrial Average are largely in Healthcare, Industrial and Financial sectors. The below chart shows the 1-year performance of Healthcare (XLV), Industrials (XLI), Financials (XLF), Technology (XLK), and S&P 500 (SPY). The former three sectors are clearly outperforming the broad market right now.

Looking at some of the bellwethers in the Healthcare, Industrial, and Financial sectors within the Dow Jones Industrial Average, I get the sense that the picture is more bullish than bearish. Some of these stocks have already made it to new all-time highs.

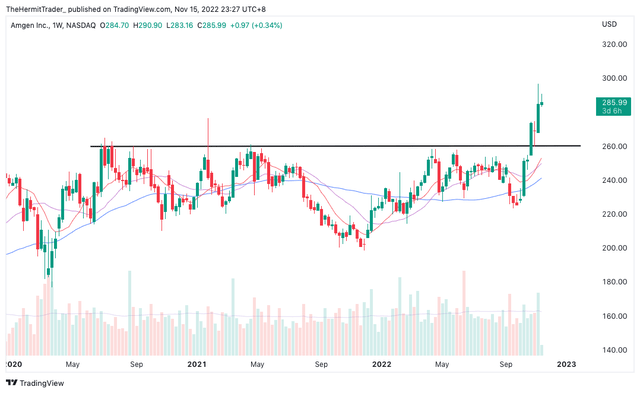

Here is the weekly chart of Amgen (AMGN), which shows price breaking out of a multi month base to new highs.

Weekly Chart: AMGN

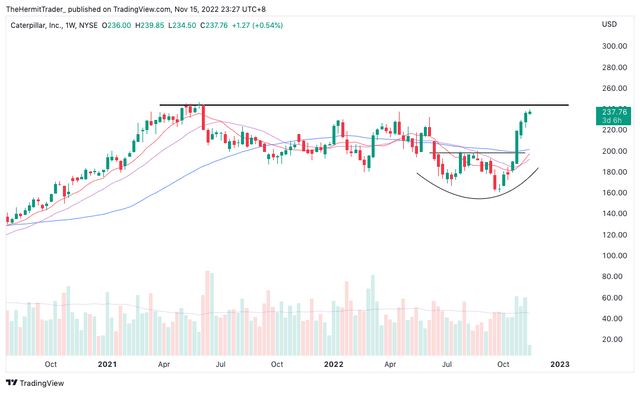

Caterpillar (CAT) looks poised to test previous all-time highs at the very least.

Weekly Chart: CAT

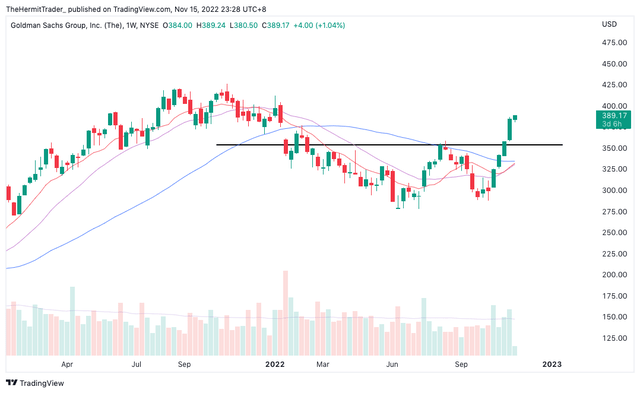

Goldman Sachs (GS) is only about 9% below its all-time highs.

Weekly Chart: GS

The market has been focusing on the technology/growth stock carnage, but there are signs of life in other sectors.

Should we then be more flexible in our mentality, to focus on the stocks and sectors that are leading the market higher? These are stocks that have made new highs (or about to) despite the broad market being in a bear market. Imagine how they could perform when the bull market finally comes.

Buy tennis balls, not eggs!

Be the first to comment