Oleg Elkov

AerSale (NASDAQ:ASLE) shares are down 7.31% (YoY), and still down 18.95% from its 52-week high of $21.74 set on November 9, 2021. The company announced its earnings per share of $-0.03 on revenue of $51 million representing a decline of 30.42% (Y/Y). The EPS missed consensus estimates by $0.08 even as the company reaffirmed its revenue guidance for FY 2022 at a range of $420 million to $450 million versus the consensus of $444 million.

Thesis

AerSale is making headway towards the certification of its AerAware with the Federal Aviation Administration (‘FAA’) expected to commence scheduling the final certification flights before 2023. Additionally, scale has always been rewarded in the US airline industry since the growth of fixed administrative costs varies from production costs making it lower in the long term. AerSale hopes to increase the sale/leasing of aircraft and constituent parts in bulk and capitalize on the purchase efficiency involved. The company is set to receive a launch order from one of its potential customers for the AerAware to use on a 737 which could be a game-changer in the industry.

Quarterly Overview

Despite the 30.42% (Y/Y) revenue decline in Q3 2022, AerSale’s management reduced the cost of revenues by 58.04% (QoQ) to $35.5 million from $84.6 million. The last time the company hit these levels was between September 2020 and March 2021. Airlines in the US and across the world since the Covid19 pandemic have been through a conversion process with many facing supply chain and labor constraints. AerSale’s gross profit was down 73% (QoQ) at $15.5 million even as its quarterly net loss stood at $9 million.

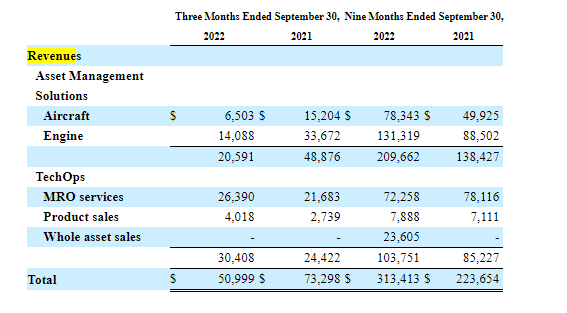

AerSale’s revenue is attributed to two main segments, asset management solutions and the TechOps. As will be seen, these revenue results from the first segment dropped on a 3-month analysis against a longer 9-month analysis (as compared to the same period in 2021).

AerSale’s asset management solutions such as aircraft and engine solutions were down 57.87% (in the three months ended on September 30, 2022) at $20.591 million as compared to the same period in 2021 where it stood at $48.876 million. However, revenue from these solutions was up 51.46% (in the nine months to September 30, 2022) at $209.662 million as compared to the same period in 2021 where it sat at $138.427 million.

AerSale

There was a different reaction in the second segment- TechOps services that include MRO, product sales, and wholesale assets. Revenue from TechOps increased 24.51% (in Q3 2022) to $30.408 million as compared to $24.422 million realized in Q3 2021. In the nine months ending on September 2022, TechOps revenue grew 40.13% to $313.413 million as compared to $223.654 million realized in the nine months ending on September 2021.

As seen above there was a positive market reaction to the technological operations services that included aftermarket support and service provision for aircraft, their components, and engineering solutions as pandemic restrictions were lifted into 2022.

Aftermarket Value Proposition

In 2020, the global aftermarket parts market size was estimated at $29.44 billion. After exhibiting a dismal growth of 9.2% in the year due to Covid19 headwinds it is expected to grow at a CAGR of 6.12% between 2021 at $31.22 billion to $47.33 billion in 2028.

AerSale has stated that over the past 10 years it has disassembled hundreds of aircraft/ engines to meet the surging demand for used serviceable material (USM) parts. The company stocks about 700,000 USM line items of all major aircraft and engine models providing lower-cost alternatives to operators and MROs globally. However, in Q3 2022, AerSale’s USM parts business declined due to an extended turnaround time for overhauled parts. Aircraft gross profit margins were down 38.1% for the quarter due to the lower margins generated on USM sales.

The gross profit margins for engines (part of TechOps) was up 44.1% (QoQ) an increase from 29.9% realized in Q3 2021 due to higher margin on the sale of flight equipment. Looking beyond 2023, AerSale will anticipate higher USM sales since it will be able to broaden its asset availability in the market. In my view, the market for feedstock availability will grow against the rising demand for parts of airframes and engines as the consumption of USM parts expands.

AerAware Certification

AerSale has stepped up its marketing efforts with airlines as it nears the commercialization phase of its AerAware model. As earlier indicated, the certification is expected to end by Q1 2023 (subject to the FAA’s performance). AerAware’s certification will make AerSale to be the first aviation component company to certify a head wearable flight display. It will be a primary flight display on a commercial transport aircraft. This head wearable display will contain a combination of data from real-time systems, synthetic vision, and heightened multispectral camera imaging. It will also help pilots with the needed landing references and proper visual approach for a safe landing.

From an investment viewpoint, this certification shows the successful investment approach made by AerSale after it awarded Universal Avionics with the $33 million contract to supply Enhanced Flight Vision Systems (EFVS) for Boeing (BA) 737NG aircraft back in July 2022.

This head wearable display (‘HWD’) that comes with the EVS-5000 cameras came about after AerSale developed a supplemental type certificate (‘STC’) for Universal’s Skylens wearable head-up display (‘HUD’). The HUD was to be used on the Airbus 320. Skylens HUD was developed by Universal Avionics’ parent company Elbit Systems (ESLT). Its main feature includes an unlimited field of view for pilots that only takes a few days to install as opposed to a traditional HUD that takes weeks. According to reports, this development tracked the mandate by the Chinese government that required Chinese airlines to install their fleets with HUDs by 2025.

The EVS-5000 camera on AerAware has six sensors and a 3D synthetic vision system (SVS) that will perform the multispectral camera imaging process. Post Covid19, the global airline industry is struggling to meet a higher volume of passengers as well as growing delays caused by poor weather. The company will likely want to launch AerAware as it releases its full-year financial report for 2022. Additionally, AerSale intends to bring AerAware to market after indicating that it had contacted multiple potential launch customers.

In its Q3 2022 earnings release, AerSale noted that its backlog of Boeing 757 passenger-to-freight (P2F) conversions was robust and it was aiming to increase the momentum of product deliveries into 2023. I see the FAA hastening the certification process since as we know, AerSale has to demonstrate AerAware’s performance in varying weather patterns such as fog, sleet, snow, hail, and all stormy conditions that will reveal the software’s strength.

The company explained that it was on course to secure a deal with a 737. It has also lined up other potential customers for various aircraft types and OEMs. AerSale may get a launch order within 90 days of AerAware’s certification.

Risks to Consider

Q3 2022 saw AerSale suffer a net loss of $9 million after attaining a net income of $26.5 million in Q2 2022. The adjusted EBITDA also stood at $500,000 compared to a gain of $13.9 million in Q3 2021. The company’s cash balance also declined 22.75% (QoQ) to $154.8 million from $200.4 million. Despite the decline, the company still has an unwithdrawn revolving credit amounting to $108 million since it did not conduct any borrowings in the 9 months ending on September 30, 2022.

A decline in the sale of flight equipment into 2023 will affect cash generation, especially in CapEx. The net cash used in operating activities also decreased by $28.8 million for the nine months that ended on September 30, 2022, as compared to the same period in 2021. Cash generated from CapEx also grew 293% (YTD) driven by the sale of flight equipment further supporting AerSale’s liquidity until September 2023. This period may be affected if the company does not meet its target sales by the first half of 2023.

Reports indicate that there is softening demand for air freight, especially for the Boeing 737-800 due to an oversupply and inflationary pressure. AerSale had indicated that it had 12 P2F converted assets expected for delivery through 2023. However, 2 assets had been deferred to be put into the P2F conversion program and sold to generate higher returns. AerSale’s revenues will be affected if the company does not sell these assets in 2023 seeing there is already an oversupply.

AerSale’s share price can nosedive if the FAA fails to certify AerAware within the intended period or even fail to certify AerAware altogether. In the earnings call, AerSale’s management was optimistic that the FAA would certify AerAware “within weeks” after the release of the earnings call. The market may get impatient if the certification process is delayed seeing the company stands to become the first to certify an HWD as a primary flight display in a freight aircraft.

Bottom Line

AerSale is nearing the commercialization of AerAware which will increase revenues in the long term. The product carries safety and reliability features that will help operators to save on costs and navigate through weather-related challenges. The company also hopes to reach its full-year financial guidance in 2022 and we are hoping for a strong fourth quarter into 2023. Still, it remains to be seen if the company clears the backlog of Boeing 757 P2F conversions within the remaining segment of the year. For these reasons, we propose a hold rating for the stock.

Be the first to comment