ewg3D

One of the great things, but also one of the scary things, about investing is that the picture for any given business can change rapidly. This can lead to some really attractive opportunities. At the same time, it can also translate into some rather painful losses. Although not exactly in the lost category, one company that has seen its financial picture worsen rather quickly is LCI Industries (NYSE:LCII), a producer and seller of equipment in the recreation and transportation markets. The largest chunk of the company’s revenue is related to RVs, buses, trailers, and other related vehicles. In recent years, the enterprise experienced a nice bit of upside as the pandemic resulted in greater social distancing that proved to be a boon for the recreational vehicle market. I have known for some time now that a change in economic conditions could eventually lead to some weakness for the company. Having said that, the weakness has set on rather rapidly. This is not to say that the company makes for a bad investment at this time. But I do think the change in circumstances warrants a modest downgrade from a ‘buy’ to a ‘hold’ to reflect the likelihood that shares will perform along the lines of what the broader market should moving forward.

The picture is changing

The last article I wrote about LCI Industries was published in the middle of September of last year. In that article, I talked about the company’s great performance throughout much of its 2022 fiscal year. I acknowledged, at that time, that the trend did not look set to change, but that even if it did, a return to the levels of profitability seen in prior years would make it still an attractive opportunity. This led me to call the company a promising risk-to-reward prospect and was instrumental in my decision to keep it rated a ‘buy’. Since then, the company has not performed great. But it hasn’t been horrible either. While the S&P 500 is up 7.8%, shares of LCI Industries have seen upside of 6.7%.

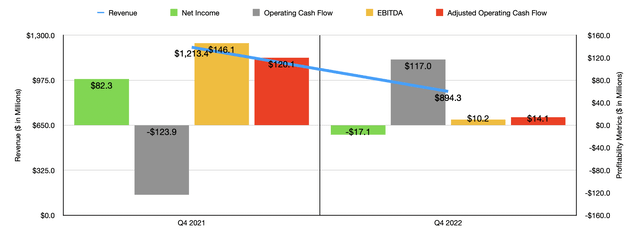

This performance seems to hide the fact that, most recently, LCI Industries has seen a bit of trouble. For the final quarter of its 2022 fiscal year, for instance, which just reported on February 14th, the enterprise reported revenue of $894.3 million. That’s 26.3% lower than the $1.21 billion generated only one year earlier. It also missed analysts’ expectations to the tune of nearly $18.2 million. Management attributed this downside largely to decreased North American RV wholesale shipments, with some of that pain being offset by higher prices, acquisitions the company made, and a rise in sales to OEMs in adjacent industries. To be clear, acquisitions the company made accounted for $21 million of additional revenue during the final quarter. it is worth mentioning that the company also reported data covering the month of January of this year. Sales of $273 million were down a hard 48% year over year. This was driven by, for the most part, an 80% decline in North American RV production that rendered demand for its offerings far lower than it otherwise would have been.

On the bottom line, the picture for the business was even worse. During the quarter, LCI Industries reported a net loss of $17.1 million. That compares to the $82.3 million profit reported the same quarter one year earlier. On a per-share basis, the company generated a loss of $0.68. This level was $0.30 per share lower than what analysts were anticipating. It is true that operating cash flow improved markedly, soaring from negative $123.9 million to positive $117 million. But if we adjust for changes in working capital, it would have plunged from $120.1 million to $14.1 million. Meanwhile, EBITDA fell hard as well, dropping from $146.1 million to only $10.2 million.

If these results seem peculiar, it’s important to note that management sees this process as a return to more normalized spending in the space. Management even went so far as to claim that the 2023 fiscal year would be a period defined by what can only be called a down cycle. Fortunately, they did say that their diversified holdings, such as their exposure to the marine market, as well as adjacent and aftermarket markets, will help during these difficult times. To illustrate just how new this pain is, we need only look at 2022 as a whole.

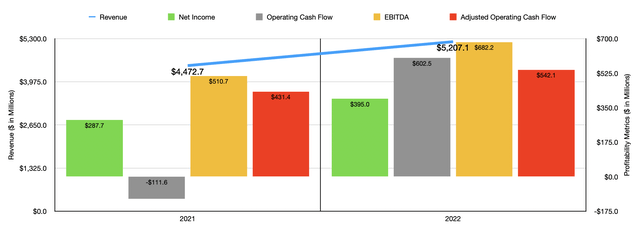

Revenue of $5.21 billion came in materially higher than the $4.47 billion reported just one year earlier. Net income shot up from $287.7 million to $395 million. The company also saw operating cash flow improve, turning from negative $111.6 million to positive $602.5 million. On an adjusted basis, this metric rose from $431.4 million to $542.1 million. Meanwhile, EBITDA for the enterprise rose from $510.7 million to $682.2 million. Any individual looking only at the four-year data would have completely missed the awful fourth quarter.

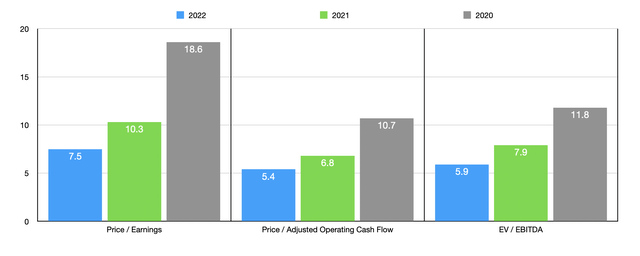

Valuing a company like this can be rather tricky. Clearly, we are going to see results revert back to what they were in prior years. We may even see a temporary downside that’s worse than that. As you can see in the chart above, shares are trading in the single-digit range from a valuation multiple perspective. But if we go back to the levels of profitability seen in 2020, the stock looks a bit pricier, with a price-to-earnings multiple of 18.6, a price to adjusted operating cash flow multiple of 10.7, and an EV to EBITDA multiple of 11.8.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| LCI Industries | 7.5 | 5.4 | 5.9 |

| Visteon Corporation (VC) | 37.4 | 63.0 | 16.3 |

| Adient plc (ADNT) | 3.5 | 12.4 | 9.5 |

| Fox Factory Holding Corp (FOXF) | 27.6 | 65.9 | 18.9 |

| Dorman Products (DORM) | 21.7 | 57.1 | 14.0 |

| Superior Industries International (SUP) | N/A | 1.2 | 3.7 |

Comparatively speaking, the picture is made even more complicated by the fact that we could compare LCI Industries to a wide variety of enterprises. In the table above, for instance, you can see how the company is priced compared to other producers of vehicle and other equipment. In this case, with the exception of one firm, LCI Industries was the cheapest of the group. But in the table below, you can see it compared to four similar businesses that focus instead on the RV space in various capacities. In this scenario, using the price-to-earnings approach, LCI Industries was the most expensive of the group. Using the price to operating cash flow approach, two of the four companies were cheaper than our target, while the EV to EBITDA approach results in our candidate once again being the priciest of the bunch.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| LCI Industries | 7.5 | 5.4 | 5.9 |

| Camping World Holdings (CWH) | 5.6 | 10.5 | 4.6 |

| THOR Industries (THO) | 5.1 | 5.0 | 3.8 |

| Winnebago Industries (WGO) | 6.2 | 5.9 | 4.2 |

| Patrick Industries (PATK) | 5.6 | 4.6 | 4.7 |

Takeaway

Fundamentally speaking, LCI Industries is changing rapidly. I anticipated some weakening in this market before too long. However, I am surprised by just how fast the market has changed. I do think that, long term, LCI Industries will do just fine for itself and its investors. But because of how fast the market is changing, I think a more prudent approach would be to rate the company a ‘hold’ at this time in order to reflect said changing conditions and the heightened risks that they bring.

Be the first to comment