wolv/E+ via Getty Images

Energy Transfer (NYSE:ET) is a popular dividend stock, historically trading at high yields and low valuations for much of the past several years. The company has an impressive pipeline footprint that appears ever more relevant in today’s commodity environment. Yet while I have buy ratings for two midstream peers, I cannot endorse buying the stock of ET, as the company has not yet fully embraced the same business model reform seen across the sector. ET may be on course to increase its distribution to pre-pandemic levels, but this is a name which investors may wish to exercise great caution on.

(Important: ET issues a K-1 tax form. Consult your tax advisor before making any transaction.)

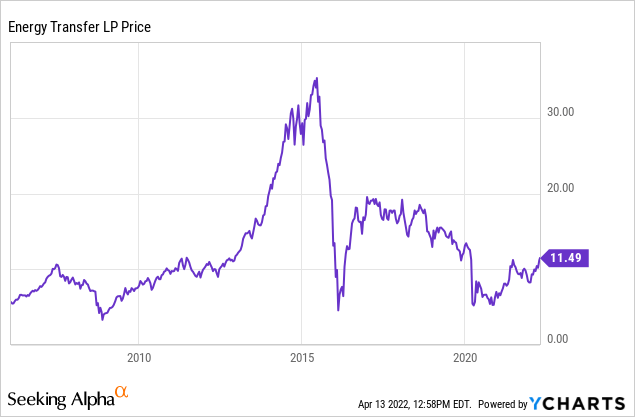

ET Stock Price

While ET has recovered much of its pandemic losses, the stock remains lower than pre-pandemic levels and trades at the same price it did more than 15 years ago.

While I do not typically assign great value to analyzing stock price trends, in this case, prospective investors should pay great attention to the past financial issues as they may continue to play an important role moving forward. I last covered the stock in November of last year, and the stock has since returned 27%. Since then, I have upgraded my views of peers Enterprise Products Partners (EPD) and Magellan Midstream (MMP), yet I will now explain why I will not upgrade my view of ET.

ET Stock Key Metrics

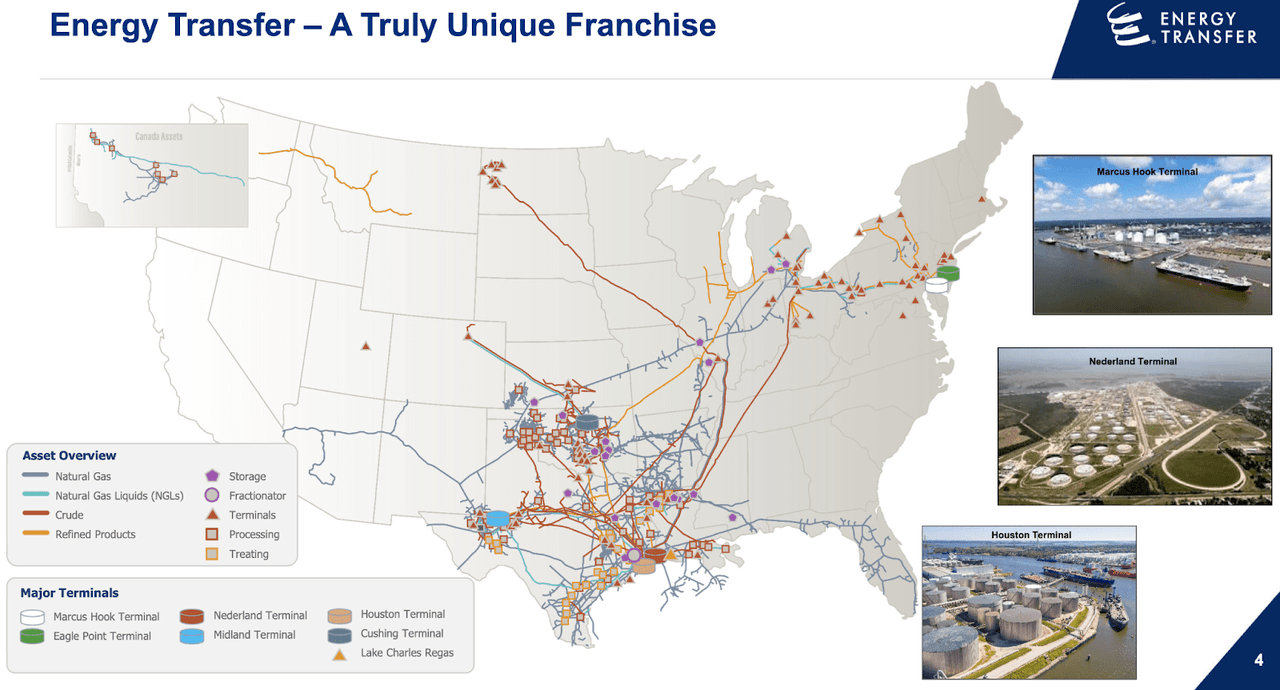

I will not rehash the well-known business model descriptions regarding ET – for that you can consult my prior article referenced above. For now, I will just show the impressive pipeline footprint of ET:

Energy Transfer 2022 Presentation

Let’s instead focus squarely on the key metrics. In 2021, ET generated $8.2 billion of distributable cash flow, paid out $1.8 billion of distributions, invested $1.4 billion in growth capital expenditures, and used the remaining cash flow to pay down debt. The company spent only $31 million on unit repurchases – a stark difference to the elevated buybacks at EPD and MMP. Still though, merely glancing at 2021 results may cause optimism that ET is moving in the same direction as peers in terms of prioritizing shareholder returns over growth projects. Unfortunately, that does not appear to be the case.

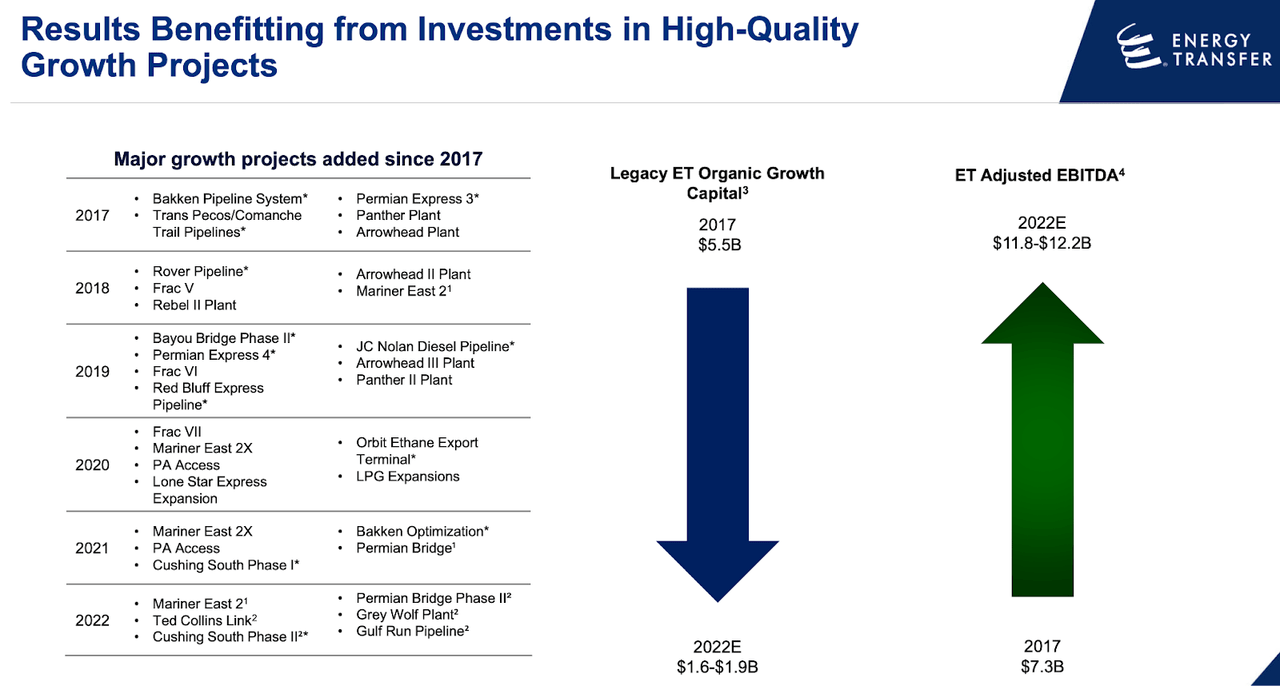

ET has guided for 2022 to see up to $12.2 billion in adjusted EBITDA and up to $1.9 billion in growth capital expenditures.

Energy Transfer 2022 Presentation

Based on those projections, ET should still comfortably cover its distribution, though I note that this coverage is largely due to the fact that the company had significantly reduced its distribution during the pandemic. In conjunction with the fact that debt to EBITDA is still quite elevated at above 4x, ET does not represent the same kind of low-risk story that is becoming more prevalent in the midstream sector.

Is Energy Transfer’s Dividend Yield Good?

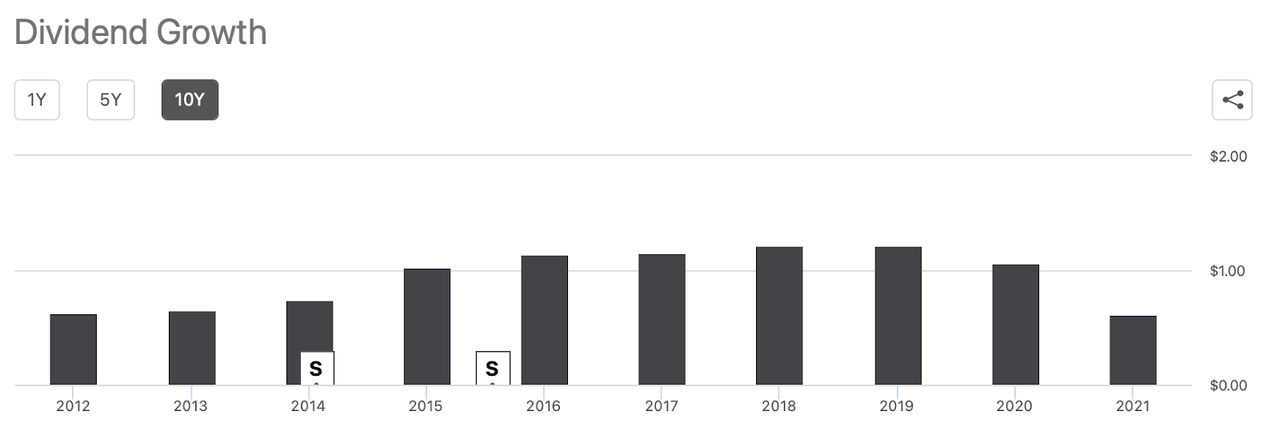

ET currently yields 6.2% based on its projected $0.70 forward payout. This yield is much lower than historic levels, as the stock has traditionally traded at an elevated yield relative to peers.

Seeking Alpha

The reason why the yield is lower now is due to the fact that ET had cut its distribution by over 50% in 2020 in order to prioritize debt paydown. At the time, the distribution cut represented a symbolic acknowledgement of capital allocation failures, as the company had invested heavily in growth projects in prior years yet needed to reduce its distribution to pay down low-yielding debt.

Is ET Stock’s Dividend Safe?

That’s a tricky question. At current levels, the distribution is covered several times over by distributable cash flow. Yet ET has not been a consistent grower of its distribution, as seen below:

Seeking Alpha

On the conference call, management stated that its priority would be to return the distributions to the former level of $1.22 per share. Based on that payout, ET would be trading at an appealing 10.6% yield. The company would comfortably cover the distribution by approximately 200% after accounting for growth capital expenditures, making the stock look compelling if management can deliver on its promises. The distribution looks safe, but that might not be the most important factor here.

Is Energy Transfer A Good Long-Term Stock?

It isn’t so clear if one should reach for yield here. As I stated in my prior article:

Since 2018, ET has invested $18 billion into capital expenditures (for reference, ET currently has around a $25 billion market cap). Over this same time frame, distributable cash flows have been more or less stagnant at $5.7 billion as of 2020. In other words, ET has been unable to show material growth even while aggressively investing in growth capital expenditures. If we take the ratio of distributable cash flows to total assets, ET’s 6% ratio is much lower than the 10% ratio at Enterprise Products Partners (EPD), indicating weaker execution.

The current 4x debt to EBITDA multiple is also representative of the missteps of the past, as the lower realized returns on growth projects have taken its toll on leverage. But perhaps investors are optimistic that the company has changed its ways, and will no longer invest in growth projects? I am skeptical. ET has historically been a growth-obsessed company and their investor slides still seem to show a desire to continue embarking on aggressive growth projects. The fact that the company is still guiding for $1.9 billion of growth projects in 2022, while EPD and MMP are guiding for minimal growth capital outlays, only solidifies that view.

I also note that the management compensation structure may help explain why this is the case. As stated in its 10-K filing, ET rewards its executives a bonus payout based on adjusted EBITDA and distributable cash flow targets. MMP, on the other hand, uses distributable cash flow per share as the target for its equity plans. The absence of per-share metrics in the ET compensation plan may help explain why the company has historically been so set on increasing the asset base. In a 2019 article on the company, I expressed confusion regarding why the company continued to embark on large growth projects and ambitious acquisition plans even as its own units traded so cheaply. That same argument still matters now, with the stock trading at only 4x DCF.

Is ET Stock A Buy, Sell, Or Hold?

As any value investor knows, there are many potential signs of a value trap. Sometimes it is due to the business model, but in this case, I view midstream assets as becoming more and more valuable in light of the healthy commodity environment. With ET, the issue is that of management. Sure, the stock is very cheap at 4x DCF and trading at a 10% distribution yield (assuming an eventual $1.22 per share payout), but poor management can still stand in the way of strong unitholder returns. I am of the belief that management will use its free cash flow to continue growth ambitions or acquire new assets. As discussed earlier, the company’s low ROA and high leverage indicate that investors should not have high confidence in management’s ability to drive strong returns on invested capital. If my predictions were to occur, then the distribution might not be increased so quickly, making this a highly risky 6.2% yielding stock. I would change my view if management aggressively pays down debt down to more conservative levels – 3.5x debt to EBITDA appears reasonable – and follows that debt paydown with aggressive unit repurchases. With the stock trading at 4x DCF, I do not find it justifiable to be prioritizing growth projects or M&A over unit repurchases. Based on the $49 billion of long-term debt, ET could theoretically hit that 3.5x debt to EBITDA target in this year and begin aggressively buying back units in 2023, but it is unclear if management will really embark on this path. While ET does indeed trade cheaper than EPD and MMP, the difference in yield is only around 2%, and that is assuming that the company increases its distribution to the pre-pandemic payout. I expect the greater driver of outperformance will be based on multiple expansion. I expect multiple expansion to take place at EPD and MMP due to their low leverage ratios and apparent embrace of unit repurchases. I view multiple expansion as being unlikely at ET, meaning that the stock is not compelling relative to EPD or MMP in spite of trading at far lower valuations. I rate units a hold, though my specific rating is that I prefer the stocks of EPD and MMP.

Be the first to comment