Adrian Vidal/iStock via Getty Images

The markets have continued to witness choppy price action as many external events are impacting investor sentiment. A 50 bps (0.50%) hike is on the table for the next FED meeting with a possible plan of reducing the balance sheet by $95 billion per month. I continue to allocate $100 per month to this portfolio series and witness positive results. The markets have experienced tremendous amounts of volatility over the past year, and many stock pickers have found out that stocks don’t always go up, contrary to popular belief in the back half of 2020.

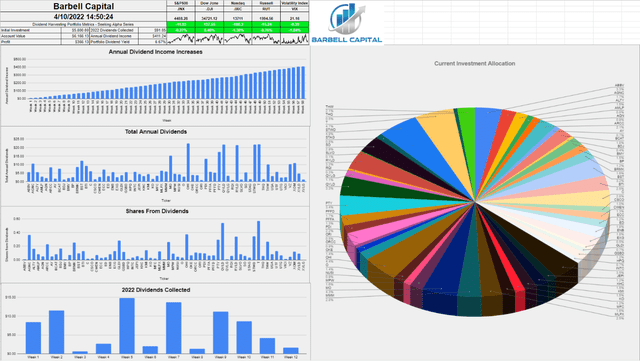

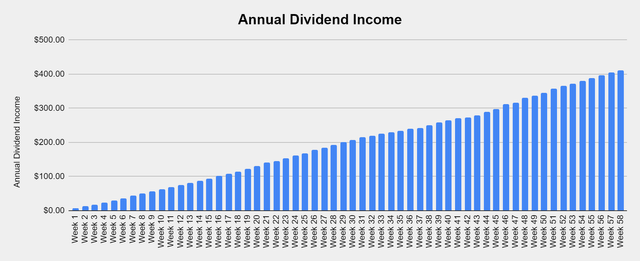

Over the previous 58 weeks, the Dividend Harvesting portfolio has been in the black 98.28% of the time, as it has finished positively 57/58 weeks since I started allocating capital to this portfolio. I have received criticism for having 63 positions across $5,800 of invested capital, but it’s hard to argue with the results. Over the weeks, my total projected annual dividend income has grown to $411.24, which is a 6.67% portfolio yield. Overall I am in the black by $366.13 (5.94%), and I am generating 50 weeks of dividend income. I am pleased with the Dividend Harvesting portfolio’s performance and feel that its foundational goals are being accomplished. It’s not about the amount of capital invested, as that’s subjective to an individual, but rather creating an investment plan and sticking to it while having positive results.

This series has never been about hitting a target yield, generating a certain amount of profit, or beating the market. I had two specific goals with this series. The first was to create a blueprint for constructing a dividend portfolio by documenting the journey starting from the beginning. The second goal was to illustrate how allocating capital each week toward investing, regardless of the amount, would be beneficial in the long run. Too many people are under the illusion that you need tens of thousands or even hundreds of thousands to benefit from investing. Instead of using my real dividend portfolio as an example, I decided to start a new account, fund it with $100, and add $100 weekly, providing a step-by-step guide to dividend investing. This methodology doesn’t have to be used for dividend investing, and it could be as simple as an S&P index fund or a Total Market fund. Hopefully, this series is inspiring people to invest in their future to attain financial freedom.

The Dividend Harvesting Portfolio Dividend Section

After 58 weeks, the annual dividend income from the Dividend Harvesting portfolio has breached the $400 level and is now generating $411.24. This chart represents exponential dividend growth as the snowball effect is still in its infancy. By making weekly investments in income-producing investments and reinvesting the dividend income, the annual income continues to grow at a rapid pace. Originally, the first week’s allocation of $100 allowed me to generate $7.44 in annual dividend income. Since the start of week 2, I have added 60 positions which have grown my annual dividend income by $403.80 (5,427.42%). By making these investments, I have created my own source of additional cash flow, which is the real premise of this portfolio.

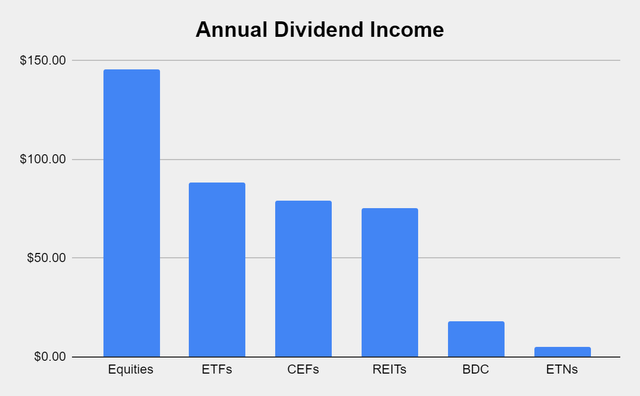

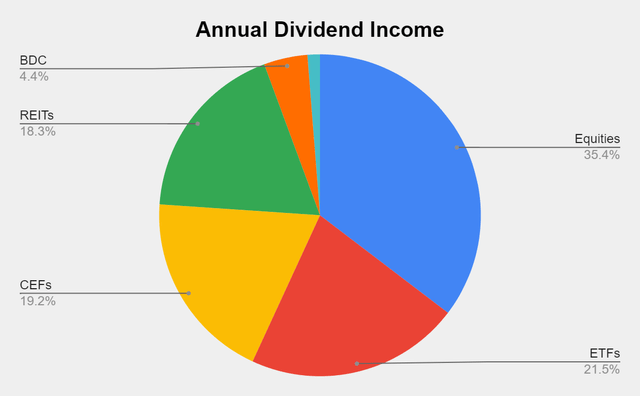

Here’s how much dividend income is generated per investment basket:

- Equities $145.42 (35.36%)

- ETFs $88.50 (21.52%)

- CEFs $78.93 (19.19%)

- REITs $75.20 (18.29%)

- BDC $18.04 (4.39%)

- ETNs $5.15 (1.25%)

Steven Fiorillo Steven Fiorillo

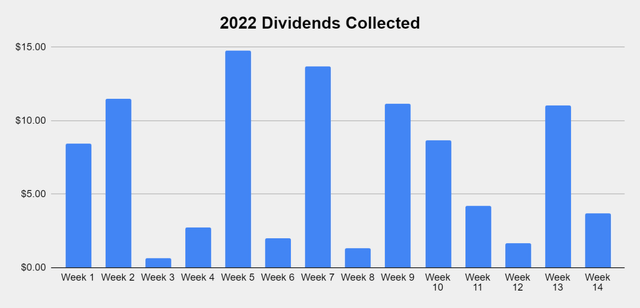

Collecting dividends can serve many functions in a portfolio. Some investors utilize dividends to supplement their income and live off. I am building a dividend portfolio for myself 30 years into the future. Since I am reinvesting every dividend, they serve multiple purposes today. In 2022 alone, I have collected $95.53 in dividend income from 132 dividends across 14 weeks. This has allowed the Dividend Harvesting portfolio to stay in the black while growing the snowball effect. In down markets, these dividends allow me to gain additional equity in my investments while increasing my future cash flow. This style of investing isn’t for everyone, but if you’re looking to generate consistent cash flow while mitigating downside risk, this method has worked for me. I am hoping to collect between $450-$500 in dividends in 2022, which will be reinvested, and finish the year generating >$700 in annual dividends.

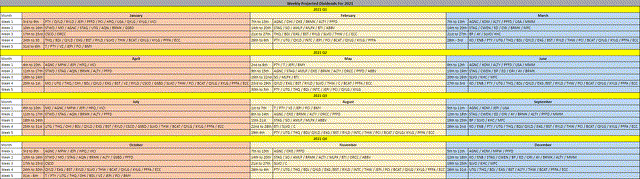

In week 58, I didn’t add new positions to the portfolio, so I didn’t pick up any additional weeks of dividend income. Week 60 is coming, and I am not sure if I will add new positions prior to the investments inspired by reader suggestions, but there are some companies at the top of the list.

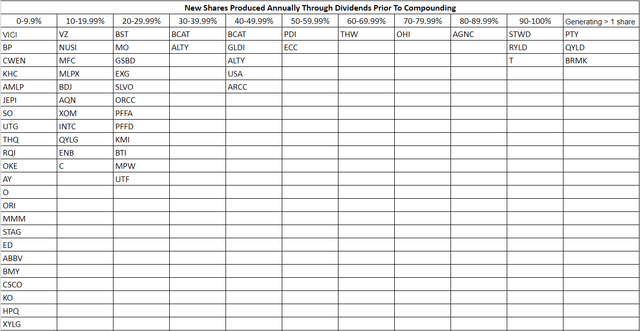

The goal of generating enough income from the dividends to purchase an additional share per year has been the never-ending project of this portfolio. There are now 3 positions that are now generating at least 1 share annually through their dividends which include the PIMCO Corporate & Income Opportunity Fund (PTY), Broadmark Realty Capital (BRMK), and the Global X NASDAQ 100 Covered Call ETF (QYLD). I am trying to get more of the current positions over the finish line. Eventually, more positions will generate one share per year in dividend income.

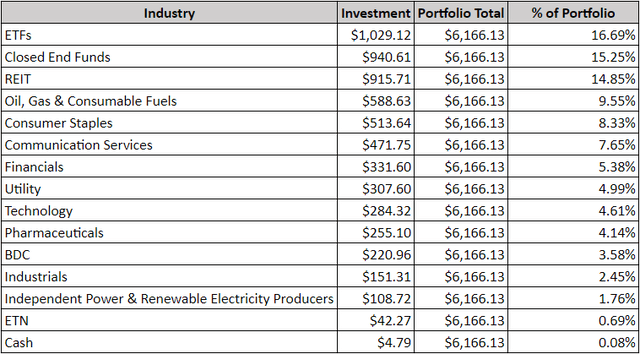

The Dividend Harvesting Portfolio Composition

ETFs remain the largest segment of the Dividend Harvesting portfolio. Individual equities make up 48.86% of the portfolio and generate 35.36% of the dividend income, while ETFs, CEFs, REITs, BDCs, and ETNs represent 51.14% of the portfolio and generate 64.64% of the dividend income. I have a 20% maximum sector weight, so when a singular sector gets close to that level, I make sure capital is allocated away from that area to balance things out. In 2022, I will make an effort to even out these portfolio percentages. As more capital is deployed, the bottom half of the portfolio weighting will increase.

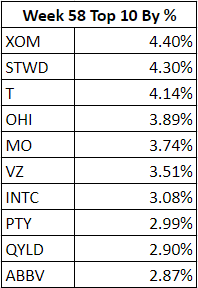

Exxon Mobil (XOM) had a big week and regained the top spot as the Dividend Harvesting portfolio’s largest investment. I have been watching the top allocations closely and am working on making sure I don’t exceed a 5% portfolio weighting again in any of my positions. Overallocation is dangerous, and by doing this, I’m capping my risk. If one of my investments goes under, the most I can lose is 5% of my capital.

Steven Fiorillo

Week 58 Additions

In week 58, I added 1 share of the following positions:

- Citigroup (C)

- Global X Alternative Income ETF (ALTY)

- BlackRock Capital Allocation Trust (BCAT)

- Broadmark Realty Capital

Shares of C haven’t been doing well as they are down -29.74% over the previous year and -19.37% YTD. C is a diversified financial services holding company providing financial products and services to consumers, corporations, governments, and institutions. C is one of the largest financial institutions in the U.S., and the declining share price has pushed its dividend just past 4%. I think C will do just fine in the coming years as rising rates should be beneficial. C currently has a low payout ratio of 20.26% and a 5-year growth rate of 30.94% for its dividend. I will probably add another share in the coming weeks to continue my dollar-cost averaging

ALTY is an interesting ETF from Global X which provides exposure to a range of alternative income-generating categories, including MLPs & Infrastructure, Real Estate, Preferreds, Emerging Market Bonds, and Covered Calls. ALTY has a mixture of holdings, including several Global X ETFs and some individual companies such as Enterprise Products Partners (EPD). I was down a few percent, and with the dividend yield just over 7%, I added another share.

BCAT has been one of the underwhelming investments I have made within this portfolio. I added another share to continue dollar-cost averaging into the position. As of the close on 4/8/22, BCAT seems undervalued as its market price closed at $16.40 with a NAV of $19.13, creating a -14.27% premium discount. I plan to buy another share or two over the next several months as I feel BCAT will turn around.

BRMK operates as a commercial real estate finance company in the United States. It engages in underwriting, funding, servicing, and managing a portfolio of short-term trust loans to fund the construction and development or investment in residential or commercial properties. I have been significantly down on this position, and with its yield exceeding 10%, I added another share. BRMK is now 1 of 3 companies in the Dividend Harvesting portfolio that produces an additional share annually from its dividends.

Week 59 Gameplan

In week 59 I plan on adding the InfraCap MLP ETF (AMZA) to the Dividend Harvesting portfolio. I am probably also going to add a share of the Virtus InfraCap U.S. Preferred Stock ETF (PFFA), and maybe another share of C or Intel Corp (INTC). We will see what happens.

Conclusion

Week 60 is around the corner, and I will be investing in positions recommended by the readers of this series. There have already been some great suggestions, so keep them coming, and let’s see where we end up.

Thank you to everyone who continues to read this series. Creating a passive income fund isn’t an investment approach that everyone believes in, but it’s one of my investment cornerstones. I have a comprehensive investment approach where I invest in growth companies, value companies, and dividend companies/funds. I also utilize an indexing approach with funds for my retirement accounts. Income generation is just one aspect that I focus on when planning for the future. The passive income I’m generating will act as additional income in retirement. I look at this as a Barbell approach because I utilize several aspects of investing in my overall approach.

Be the first to comment