Thurtell/E+ via Getty Images

A Quick Take On FTC Solar

FTC Solar (NASDAQ:FTCI) went public in April 2021, raising approximately $258 million in an IPO that priced at $13.00 per share.

The firm sells solar array tracking systems to industrial and utility scale solar facilities.

FTCI is experiencing significant supply chain issues due to regulatory restrictions and delays from suppliers in China.

Until the company can deal with these challenges, either through supply chain diversification or a release of contracted modules, I’m on Hold for FTCI.

FTCI Overview

Austin, Texas-based FTC was founded to develop its single axis solar array tracking system to maximize solar energy production efficiency throughout the day.

Management is headed by president and Chief Executive Officer Sean Hunkler, who has been with the firm since September 2021 and was previously EVP Global Operations at Western Digital and EVP of Global Operations for NXP Semiconductors.

The company’s primary offerings include:

-

Voyager Tracker – a two panel in-portrait single axis tracker solution.

-

Atlas – software database for project portfolio management

-

SunDAT – automated design and optimization software

The company sells its systems to engineering, procurement and construction companies as well as large development firms and independent power producers that build solar projects.

Market & Competition

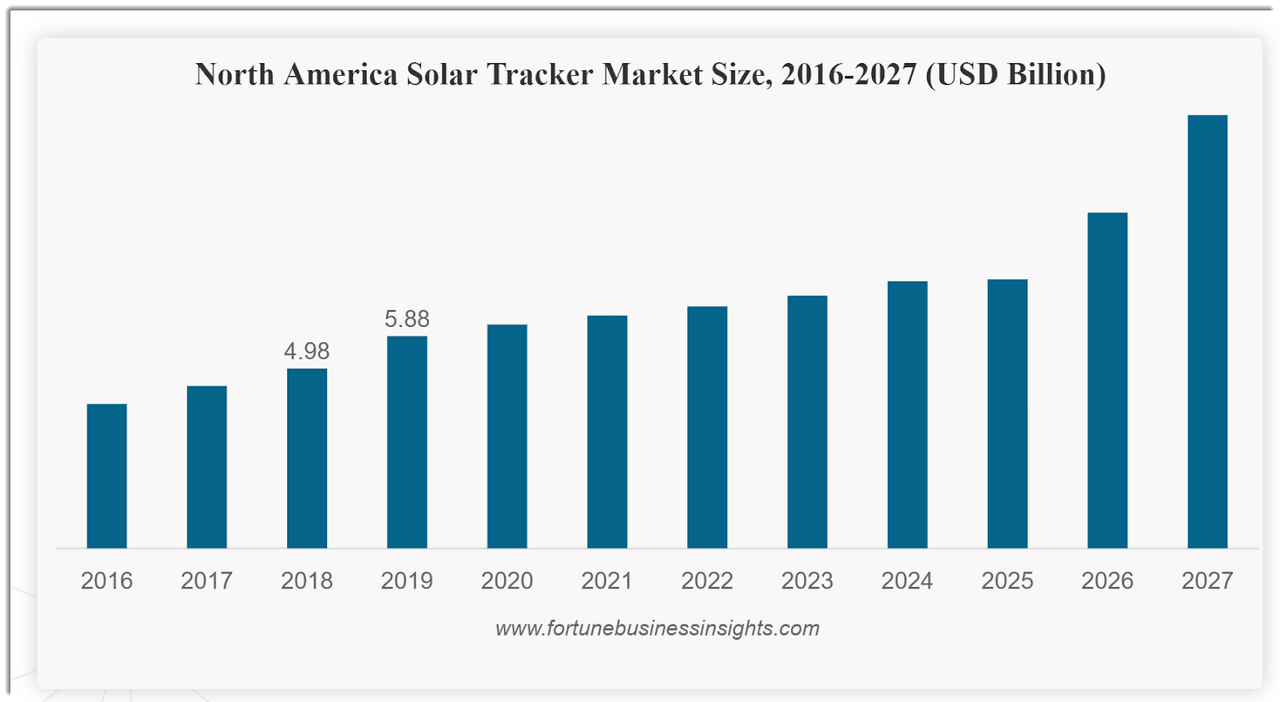

According to a 2020 market research report by Fortune Business Insights, the global market for solar trackers was an estimated $9.3 billion in 2019 and is expected to exceed $22 billion by 2027.

This represents a forecast CAGR of 12.6% from 2020 to 2027.

The main drivers for this expected growth are a continued effort by countries to reduce their carbon emissions through increasing renewable energy sources.

Also, the near term has seen a reduction in activity due to the Covid-19 pandemic’s effects on supply chains.

However, below is a chart indicating the historical and projected growth rate of the solar tracker market in North America:

N. America Solar Tracker Market (Fortune Business Insights)

Major competitive or other industry participants include:

FTCI’s Recent Financial Performance

-

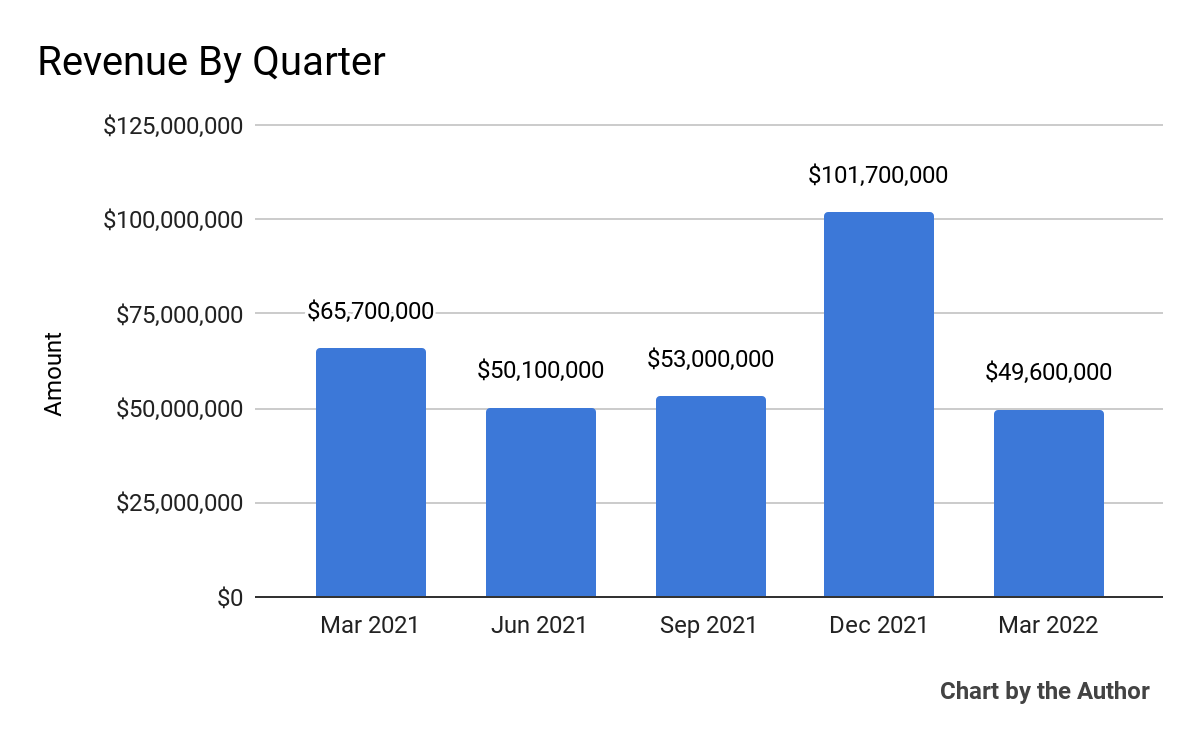

Total revenue by quarter has been highly variable over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha and The Author)

-

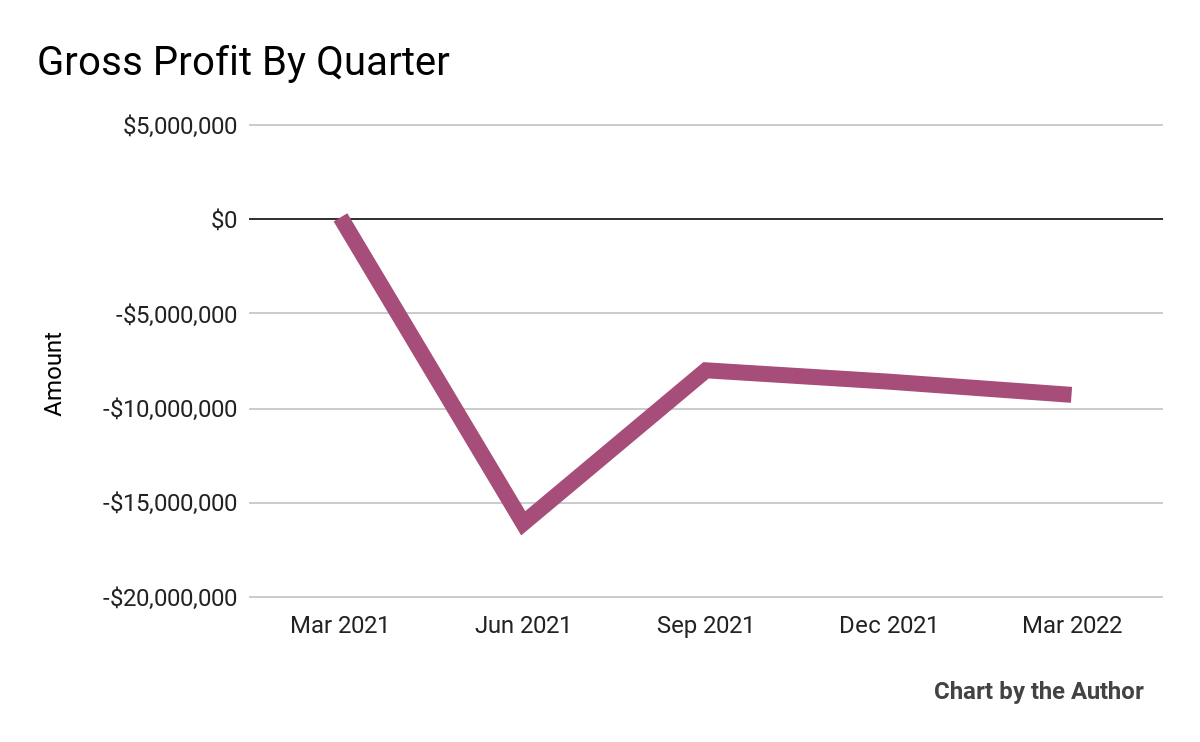

Gross profit by quarter has remained negative:

5 Quarter Gross Profit (Seeking Alpha and The Author)

-

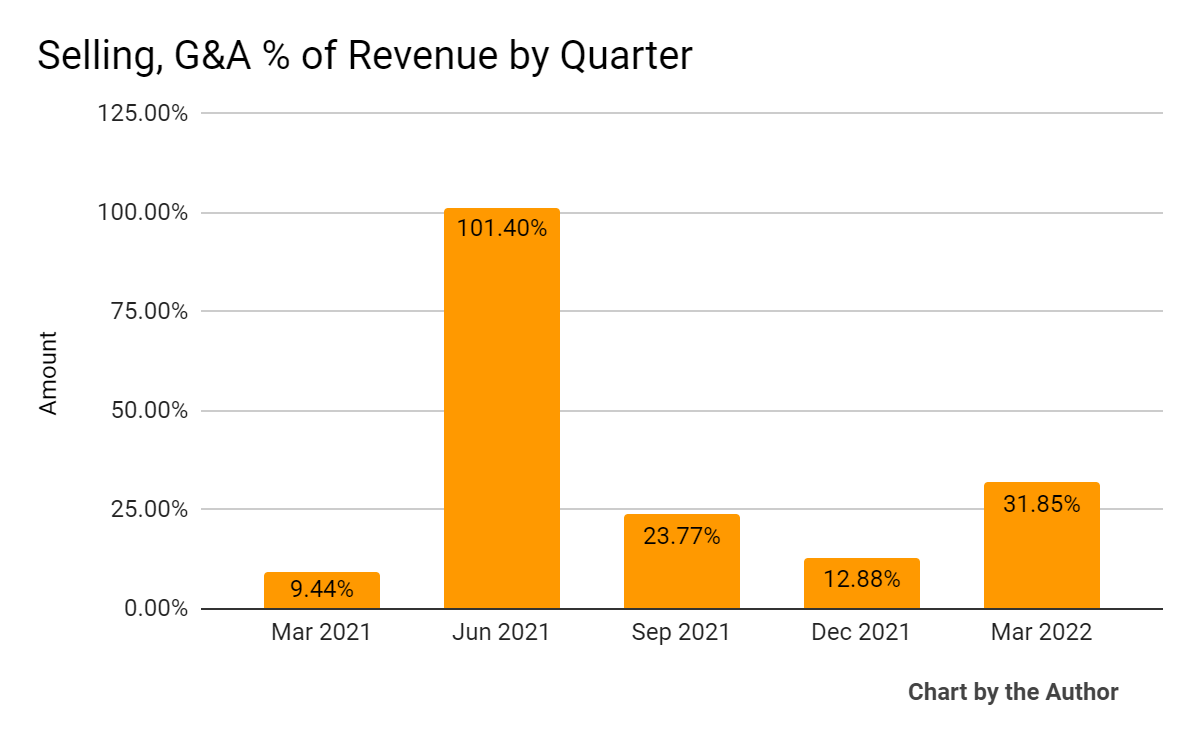

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated as follows:

5 Quarter Selling, G&A % of Revenue (Seeking Alpha and The Author)

-

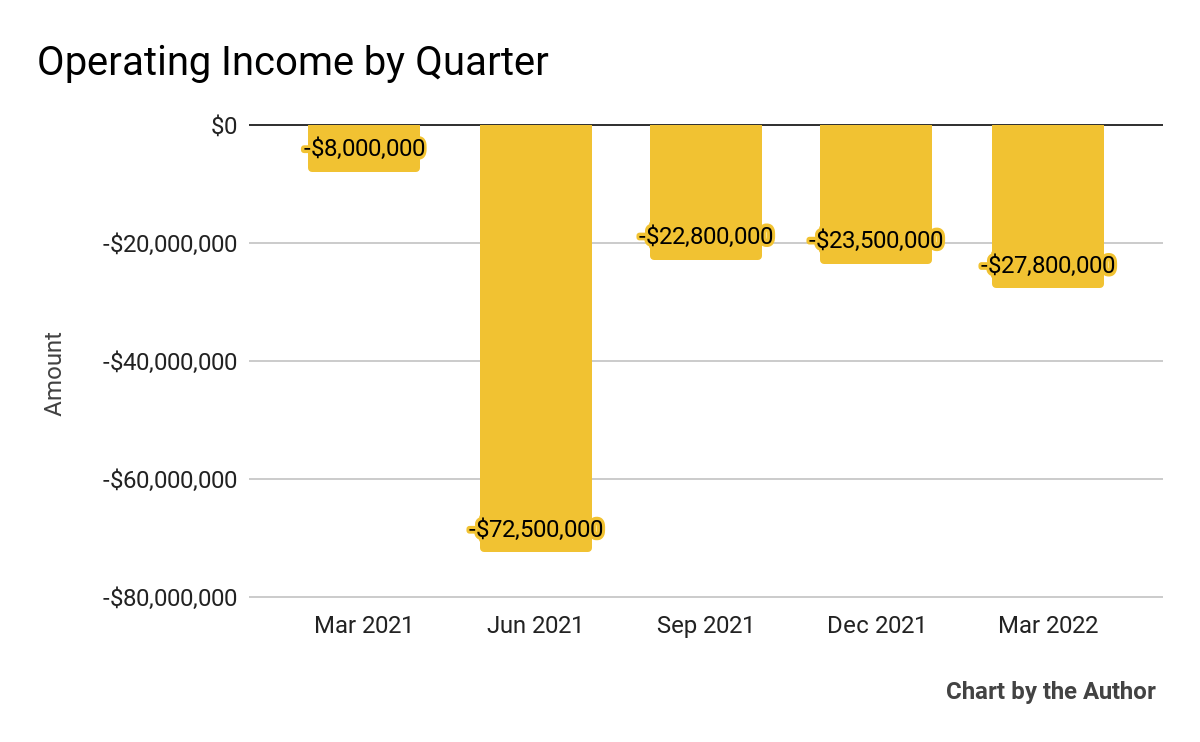

Operating income by quarter has remained significantly negative in recent quarters:

5 Quarter Operating Income (Seeking Alpha and The Author)

-

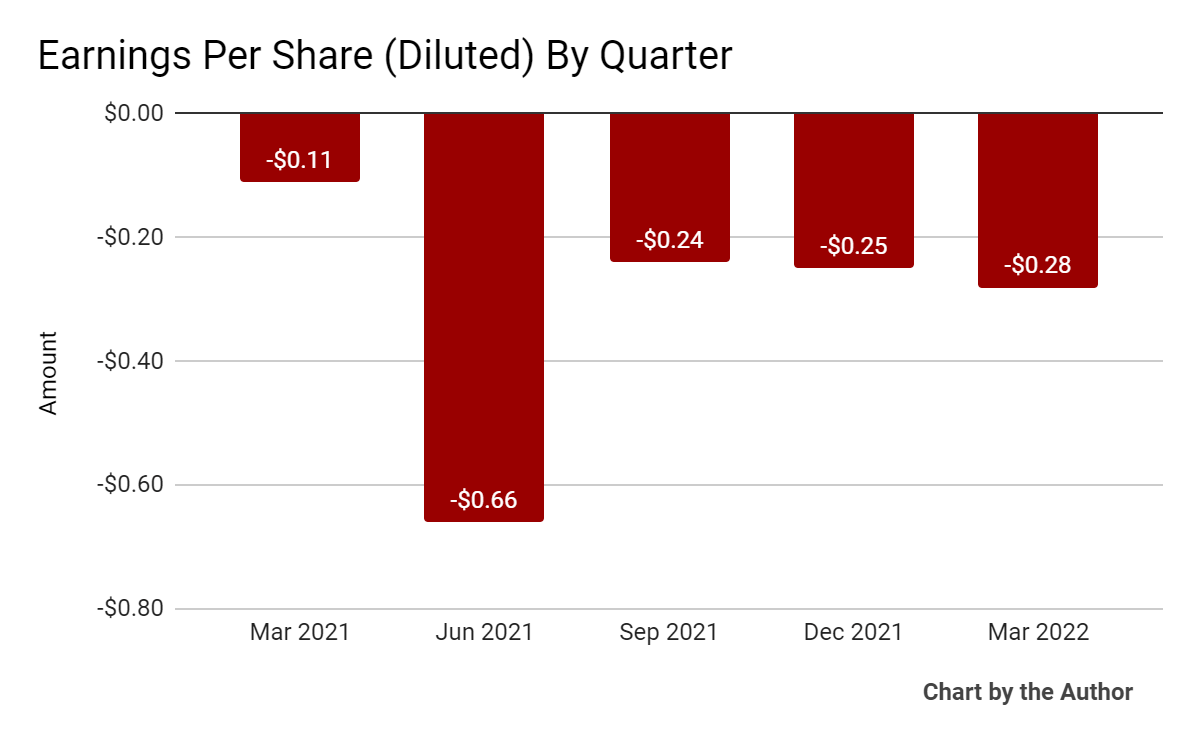

Earnings per share (Diluted) have also been materially negative over the past 5 quarters:

5 Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

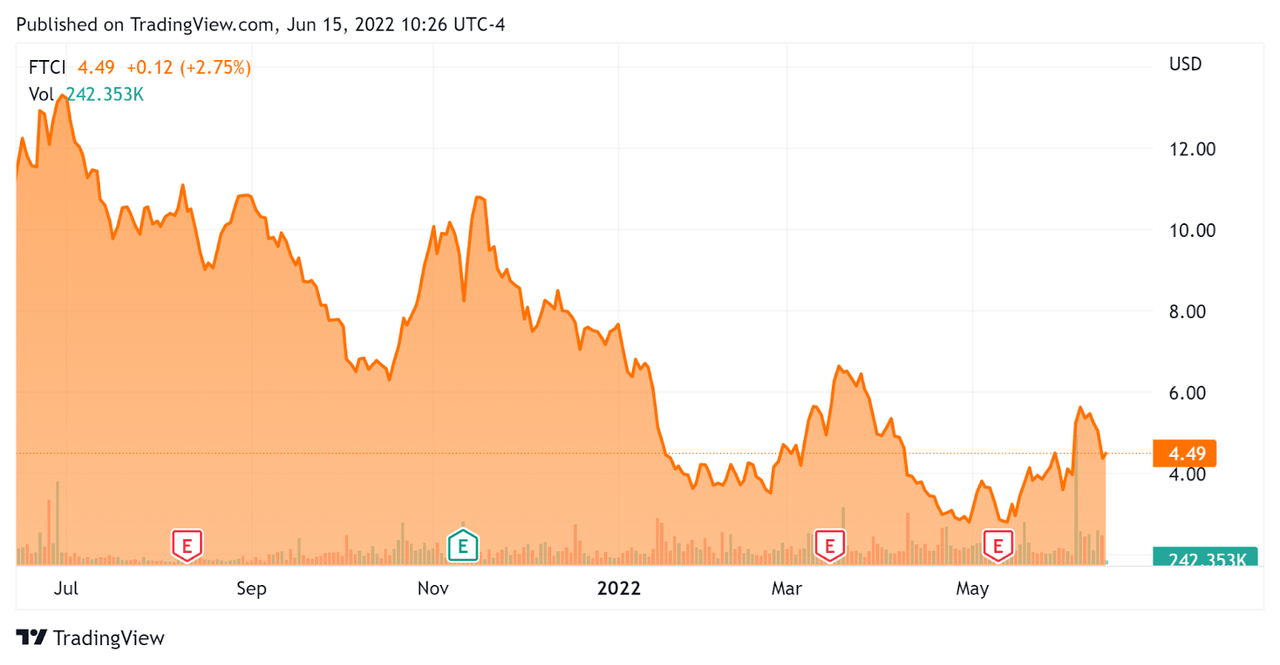

In the past 12 months, FTCI’s stock price has dropped 60.2 percent vs. the U.S. S&P 500 index’ fall of 10.9 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For FTCI

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$503,050,000 |

|

Enterprise Value |

$455,300,000 |

|

Price / Sales |

1.62 |

|

Enterprise Value / Sales [TTM] |

1.79 |

|

Operating Cash Flow [TTM] |

-$160,600,000 |

|

Revenue Growth Rate [TTM] |

15.27% |

|

CapEx Ratio |

106.70 |

|

Earnings Per Share |

-$1.43 |

(Source)

As a reference, a relevant public comparable would be Array Technologies (ARRY); shown below is a comparison of their primary valuation metrics:

|

Metric |

Array Technologies (ARRY) |

FTC Solar (FTCI) |

Variance |

|

Price / Sales |

1.75 |

1.62 |

-7.4% |

|

Enterprise Value / Sales [TTM] |

3.16 |

1.79 |

-43.4% |

|

Operating Cash Flow [TTM] |

-$271,140,000 |

-$160,600,000 |

-40.8% |

|

Revenue Growth Rate |

32.6% |

15.3% |

-53.1% |

(Source)

Commentary On FTCI

In its last earnings call (transcript), covering Q1 2022’s results, management highlighted the supply chain limitation issues it has been facing due to the U.S. withhold release order [WRO] concerning materials from Xinjiang province.

Also, more Chinese companies are being investigated by the U.S. under antidumping and countervailing duties provisions [AD/CVD] which has further restricted PV module procurement.

As a result, while FTCI has ‘a lot of business in contracted and awarded [stage], much of the construction has been delayed.’

Contracted and awarded bookings ended the quarter at $664 million, ‘with $112 million added in the past two months and no cancellations.’

As to its financial results, revenue dropped in Q1 year-over-year, while GAAP gross loss was slightly worse sequentially.

Operating expenses were also higher compared to last year as the firm has sought to ramp up operations despite significant supply challenges.

Looking ahead, management withdrew its previous 2022 guidance and will be providing only quarterly guidance for the foreseeable future.

Management expects gross margin to worsen due to delays in getting new, lower-cost modules.

Regarding valuation, the stock market is currently valuing FTCI at around the same Price/Sales multiple as that of Array Technologies.

The primary risk to the company’s outlook is the uncertain duration of the various orders and investigations into Chinese companies which supply FTCI’s modules, putting a damper on revenue growth and gross margin increase.

Until the company can deal with these challenges, either via supply chain diversification or a release of contracted modules, I’m on Hold for FTCI.

Be the first to comment