Charday Penn

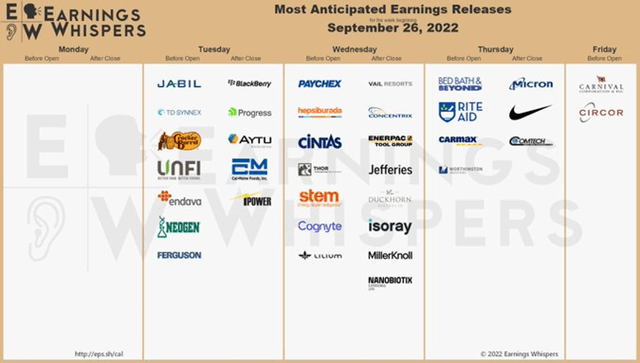

Earnings season begins in just two weeks, but this week we hear from a host of companies across sectors and geographies. Big names like NIKE (NKE) and Micron (MU) report results, but some smaller players could rock individual investors’ portfolios, too.

One small tech company with a new CEO that recently bagged a key foreign military sales contract has its Q4 earnings date Thursday night.

This Week’s Earnings Calendar

According to CFRA Research, Comtech Telecommunications Corp. (NASDAQ:CMTL), together with its subsidiaries, designs, develops, produces, and markets products, systems, and services for communications solutions in the United States and internationally. It operates in two segments, Commercial Solutions, and Government Solutions.

Despite positive news last week that the firm snagged a new military sales contract, shares remain sharply lower year-on-year. The stock had rallied during August when it was announced that Ken Peterman was named as the new CEO. Finally, there has been on-again, off-again speculative takeover chatter with this small company.

The New York-based $273 million market cap Communications Equipment industry company within the Information Technology sector has negative trailing 12-month GAAP earnings, but pays a 4.0% dividend yield, according to The Wall Street Journal.

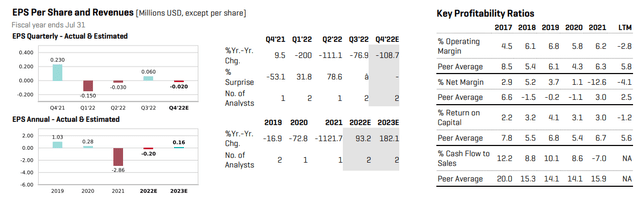

On earnings and valuation, Comtech sports an “A” valuation rating, but profitability is just a “C” while growth is a big fat “F,” according to Seeking Alpha. CFRA Research shows per-share profits bouncing back and forth between the flat line. On an annual basis, EPS is seen as improving, though stubbornly slowly, through 2023. Given sluggish growth, it’s hard to get excited about this tech company right now.

Comtech: Earnings & Key Profitability Ratios

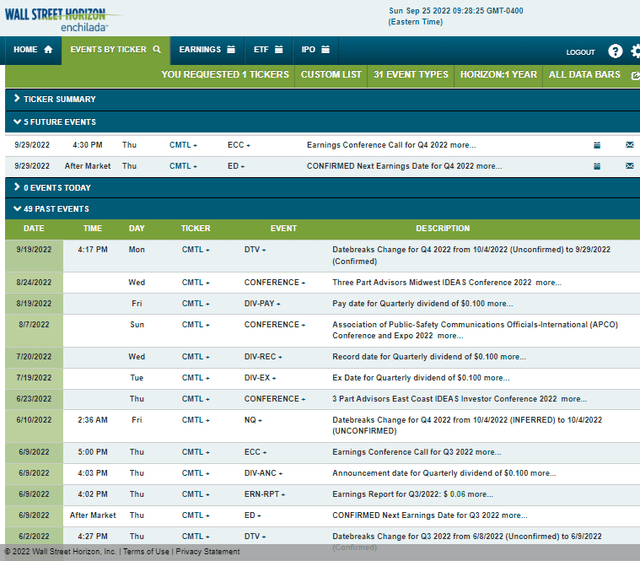

Looking ahead, data from Wall Street Horizon show a confirmed Q4 earnings date of Thursday, Sept. 29 AMC with a conference call immediately after the report’s release. You can listen live here.

Corporate Event Calendar

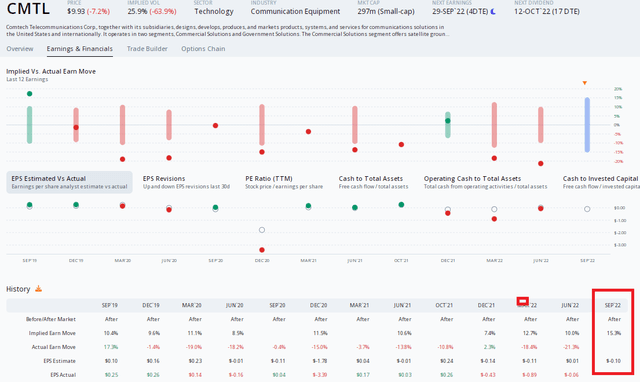

Digging into earnings expectations, data from Option Research & Technology Services (ORATS) show a consensus EPS forecast of $-0.10 which would be a sharp decrease from last year’s positive per-share amount. CMTL has also missed analysts’ earnings expectations in each of the last three reports – another arrow in the bears’ quiver.

What really catches my eye is the big implied stock price move. ORATS options information shows a whopping 15.3% post-earnings stock price swing expected using the nearest-expiring at-the-money straddle. The last two earnings reactions have been big at more than 18% each. With a bearish fundamental outlook and weak technicals (see below) but with expensive options, a way to play this is with a bear put spread or perhaps a bearish risk reversal strategy.

CMTL: Expensive Options As Implied Volatility Runs High

The Technical Take

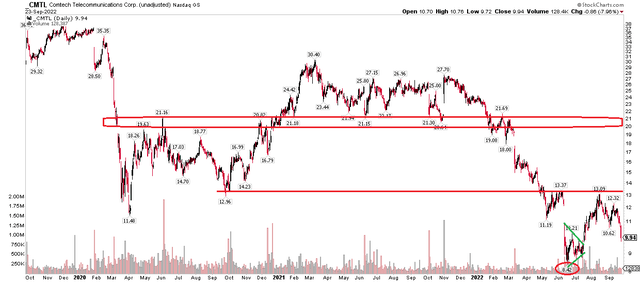

I see CMTL shares heading toward $9 in the near term. That was a breakout point back in July. It could also have further downside to the June low of $8.42.

The problem is there is heavy resistance around $13 on any rallies with another layer of major supply in the $20 to $22 range.

With an overall downtrend firmly in place, I see bearish risks heading into and through earnings this week.

CMTL: Shares Continue Lower, Eye $9 Support

The Bottom Line

With tepid profit growth, a poor earnings beat rate history, and a downtrending share price, I lean toward the bearish side this week as Comtech reports quarterly results Thursday night. Buying shares around $9 could be a trade, but long-term investors should stay away from this one.

Be the first to comment