cofotoisme

Nu Holdings Ltd. (NYSE:NYSE:NU) reported solid 2Q22 results that demonstrates its ability to operate and grow in more challenges times with global headwinds. While operating conditions in Latin America are more challenging than ever, the best companies are the ones that are able to excel in these more difficult times.

Investment thesis

I have previously written an initiation article on Nu, highlighting the key investment case for Nu. The buy rating for the company is based on the following points:

- Nu services a consumer group in Latin America that has fallen through the cracks due to poor or lack of servicing from the traditional organizations. As a result, the company brings strong value add to a market that has a long runway and huge market.

- As a digital banking platform, Nu is one of the largest in the world with a customer base that is still growing rapidly. That said, this growth comes at a relatively lower customer acquisition cost and Nu has also achieved one of the highest customer engagements as well as satisfaction in the industry.

- Besides fast revenue growth, there is strong visibility into achieving profitability as Nu has a strong ability to grow ARPAU and reduce the costs associated with running the business.

- The company’s credit portfolio continues to post strong growth and maintain a decent credit quality amidst challenging times.

Accelerated revenue growth as a result of compounding effects

Revenues grew 230% year on year to $1.2 billion in 2Q22. This was a beat on expectations, especially when there were concerns that the weakening macroeconomic backdrop might affect Nu’s growth in its core markets. In particular, the beat in revenues came from the higher-than-expected levels of customer growth, customer activity and ARPAC, which I will explain below.

Customers were up 57% year on year in 2Q22, with active customers growing at a faster growth rate of 75%. Furthermore, activity rate also grew from 72% in 2Q21 to 80% in 2Q22. Nu has had many consecutive quarters of increasing activity rate, and the most recent one in 2Q22 suggests that the management’s strategy to improve activity rate is effective.

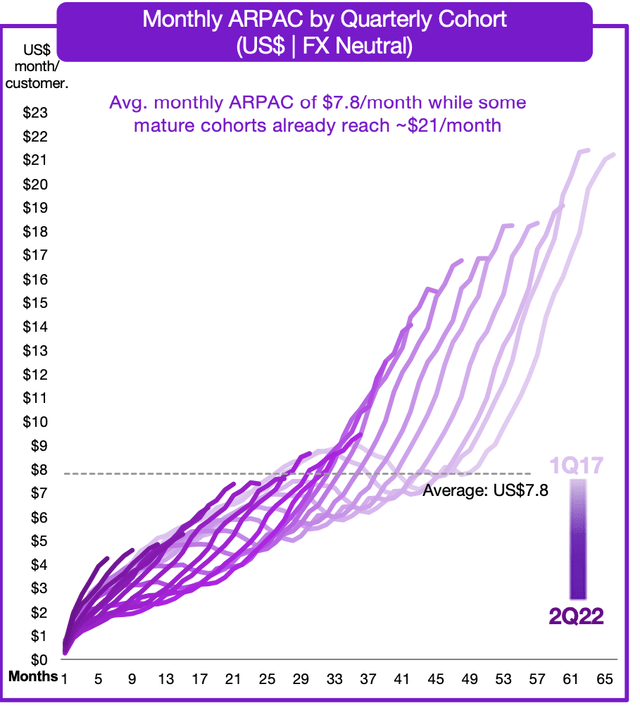

Below, we can see that the company has an excellent ability to cross-sell and upsell to its existing customers. The more mature cohorts that have been around for close to 65 months are spending an average monthly ARPAC of $21 per month. This is in comparison to the current average monthly ARPAC for the overall customer pool is at $7.8. If we were to imply that over time the overall customer pool could reach the average monthly ARPAC similar to its mature cohorts, we could see almost 169% upside for current ARPAC levels for the overall customer pool.

Monthly ARPAC by quarterly cohort (Nu Holdings 2Q22 slides)

The combined effects of the higher customer growth, higher customer activity and higher ARPAC suggests that Nu is doing something right with engaging with the customers, driving engagement and increasing the amount that each customer spend each month. This is also a validation to the highly effective strategy that Nu is utilizing to drive growth in a sustainable manner.

Cards business consistently gaining market share

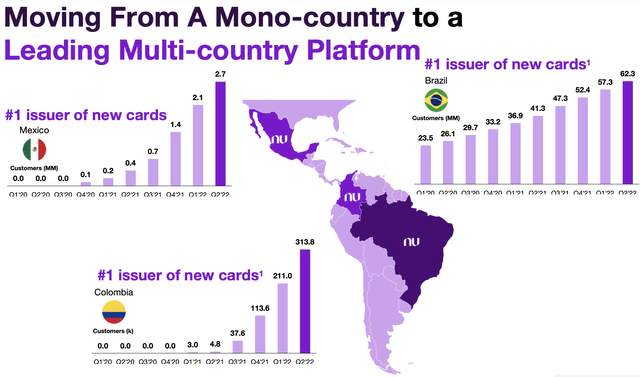

As we look at the company’s card business, I think that we continue to see the momentum of the growth in issuance of new cards in its 3 core markets. While Nu started off in its first market of Brazil, it is seeing huge traction and rapid growth in cards issuance in its two other core markets in Columbia and Mexico.

Number 1 issuer of cards in multiple countries (Nu Holdings 2Q22 slides)

Furthermore, during the quarter, Nu’s purchase volume increased by 94% year on year to $20 billion, due to the company’s ability to generate great engagement with customers and thus lead to higher cross-sell and upselling of its products. The most mature cohorts are already spending almost $300 per month in terms of purchase volumes per customer per month and the current average across the entire company is currently at $107, implying much room to grow for the relatively newer cohorts.

It was also stated by management that Nu become the 4th largest cards player in Brazil, beating several other incumbents in the industry.

Credit growth remains robust but likely to be stable in near term

Nu’s total credit portfolio grew by 209% year on year to $9 billion in 2Q22 driven by a growth of 82% year on year for its credit card portfolio and a growth of 250% year on year for its personal loans’ portfolio.

While this is quite a respectable growth level for the credit portfolio in my view, there are some concerns due to the slowdown in growth rates in the current quarter when compared to the past that mainly comes from the company’s personal loans portfolio.

As explained by the company, there was a deliberate decision by the company to moderate the growth in their portfolio for personal loans and to reprice these accordingly in anticipation of their own views about the near-term volatility in the Brazilian economy.

For personal loans origination, the focus has been to increase resilience of Nu’s credit portfolio and to ensure that the impact of higher interest rates is muted on Nu’s operations and personal loans business. As a result, the total personal loan book for Nu was largely stable in the quarter. Management guided that, in the future, this pace of origination would largely depend on the strength of the Brazilian economy in the near term and the performance of its current credit cohorts. As such, the guidance that management gave was that the 3rd quarter and 4th quarter personal loan origination levels would be stable compared to that of the current quarter. While origination pace of personal loans has been stable in the second quarter, yields have increase from 3.9% in the prior year to 5.6% in the current quarter.

Understandably, investors would react negatively to the slower personal loans origination and may raise questions and concerns about the real reasons behind the slower personal loan origination. However, I am of the view that this is positive for a few reasons.

First, it is positive because management is rather proactive in adjusting the pace of origination of personal loans rather than being passive and having credit quality deteriorate over time. Ultimately, with origination of personal loans, this is a balancing act between risk management and growth. Second, I think it’s good that management is prudent in origination ahead of what could be a challenging time for emerging markets like Brazil. If the near-term outlook is bleak, I think that management is doing the right thing to recalibrate growth for the long-term sustainability of the company.

As for its deposits franchise which is used for funding of most of its operations, this continued to grow at 87% year-on-year to $13 billion, and the current quarter loan to deposit ratio was healthy at 24%. The average funding cost on these deposits were also below Brazil’s risk-free rate.

Concerns about asset quality

The main concerns that investor had with the second quarter results came from worries that it seems that delinquencies are increasing. This comes as 90+ NPLs increase from 3.5% in the prior quarter to 4.1% in the current quarter. 15 to 90 NPLs was rather stable at 3.7% for both prior quarter and current quarter.

Management states that while NPL 15 to 90 is the main leading indicator that investors should be looking at and that the 90+ NPLs is a lagging indicator. As such, management suggests that the 15 to 90 NPL is the more informative figure to be analyzing.

In addition, it is important to note that there was a change in the methodology in write-offs in 2Q22 that is supposed to align with the accounting IFRS guidelines. As a result, the current 90+ NPL and 15 to 90 NPLs reflect this change in methodology. I think that as a lagging indicator, the 90+ NPLs will continue to rise and then normalize in the coming quarter assuming that there is no change to the external macroeconomic environment. This is because the leading indicator, the 15 to 90 NPLs, have already shown signs of the post-covid-19 normalization.

Second, in Q2 of 2022, we made a change in the write-off methodology for personal loans to better align it with recovery expectations as per IFRS guidelines. This resulted in anticipating write-offs for nonperforming personal loans from 360 days to 120 days of delinquency. This change has two distinct impacts on NPL metrics.

I am of the view that the asset quality worries were overblown and standby management that the 15 to 90 NPLs are probably the better metric to be monitoring that is a leading indicator of delinquencies.

Valuation

Based on utilizing the discounted cash flow (“DCF”) methodology and comparable-based methodology, my target price for Nu is $9, implying 80% upside from current levels. By using a comparable-based method including companies with exposure to digital banks, super apps or exposure to Latin America, this group recently traded between a range of 6x to 12x 2022F revenues. With the higher revenue growth profile than other competitors in the peer group, it is justified that Nu has a premium in its multiples.

Risks

Macroeconomic environment

At a time of increasing economic uncertainty, there is the risk that the global external environment as well as that of Brazil deteriorates in the months to come. With Brazil’s inflation rising to 12% and to levels not seen for the past 26 years, there are growing risks that the economy could be headed for a slowdown or a downturn. If the economic environment worsens, this will have a negative impact on purchase volumes, credit and demand. Furthermore, asset quality may decline as delinquencies go up.

Competitive pressures

While Nu has been able to grow at a rapid pace and challenge the traditional financial incumbents in Brazil, these large, well-capitalized companies are starting to get nervous about the rapid rise of emerging fintech players like Nu. As a result, they could take measures and actions to increase competitive pressures in the industry, thereby slowing Nu’s growth and dampen its profitability.

Conclusion

There are many things going well for Nu and the future looks bright, as there are many levers for the company to pull for growth. With the fast-growing revenues driven by increasing engagement, customer growth and ARPAC, the compounding effects of each metric is accelerating growth further. The cards business looks set to rival the larger incumbents in its core markets, and while credit quality may appear to be weaker than it was one quarter ago, I continue to have confidence that there is no material deterioration in asset quality. Despite what investors are saying, the leading indicators of asset quality shows that, barring any external shocks, the asset quality remains healthy. My target price for Nu is $9, implying 80% upside from current levels.

Be the first to comment