Mongkol Onnuan

Introduction

The global economy continues to face steep challenges and many economists are forecasting we are entering another Great Recession. My wife has some agricultural land, the rent from which have been growing every year for the past two decades and she doesn’t really care about its value as she never wants to sell it. It’s an interesting way of thinking about investing and I began wondering whether I could find a REIT with a dividend yield of over 7%, whose dividend payments have been growing steadily over the past 15 years. So far, the only name on the list is France’s Klepierre (OTCPK:KLPEF) and I think the company looks undervalued in light of how it managed to keep its dividend payments growing during the Great Recession. Overall, the market valuations of European REITs have been decimated YTD and this seems to be one of the few companies on the continent whose business model can allow it to weather another major recession. Let’s review.

Overview of the business

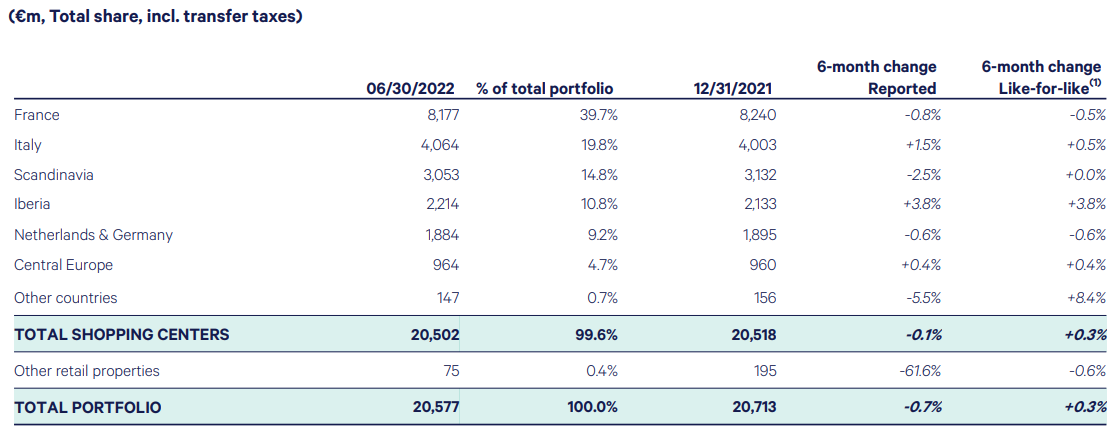

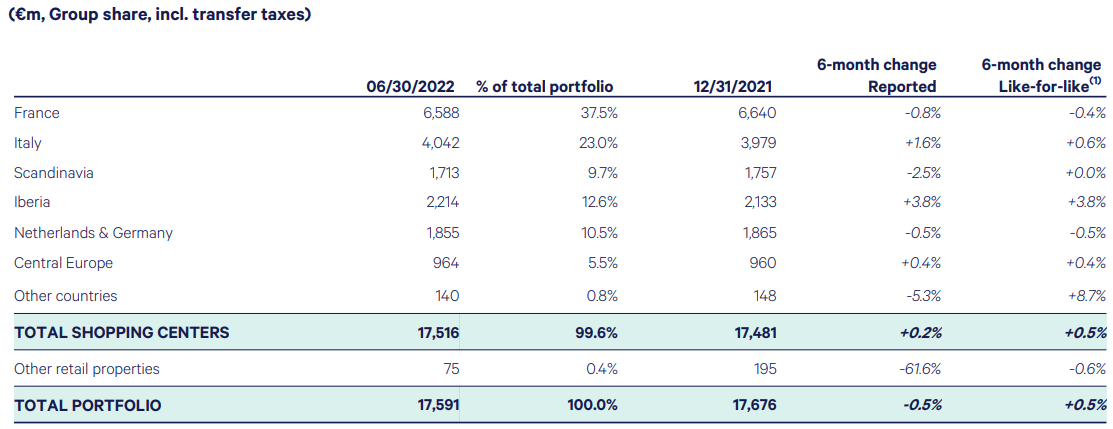

Klepierre focuses on high-quality shopping malls in dense, affluent and fast-growing metropolitan areas and it has a portfolio of more than 100 prime centers across a dozen countries in Continental Europe. The company also owns a 56.1% stake in Scandinavia’s Steen & Strom and its property portfolio was valued at €20.6 billion as of June 2022. The group share of that amount was €17.6 billion.

Klepierre Klepierre

Between 2007 and 2019, the company’s annual dividend payments slowly grew from €1.25 per share to €2.20 per share even as it completed several major acquisitions, including Steen & Strom (2008), and Corio (2015). In addition, Klepierre completed several large disposals along the way, the most notable of which included 126 Carrefour (OTCPK:CRRFY) anchored retail galleries for €2 billion in 2014. The COVID-19 pandemic-related restrictions affected the company’s results significantly over the past two years but annual dividend payments are about to return above the €2.00 per share mark in the near future (this is my own estimate, and not Klepierre’s). According to DividendMax, the next dividend payment is expected to be announced on May 5, 2023. The pay date is estimated to be June 21, while the ex-dividend date is forecast to be June 19.

Sport-histoire.fr

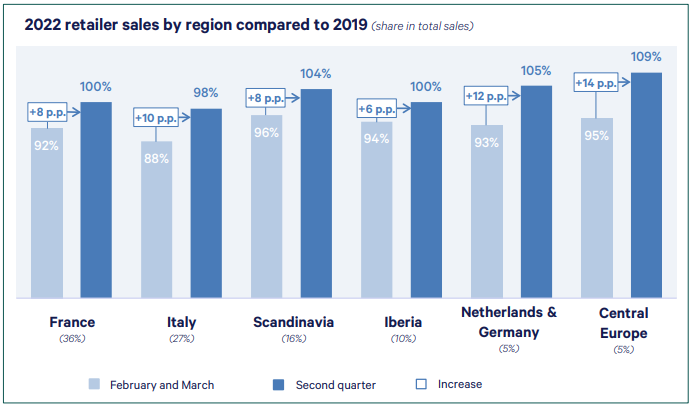

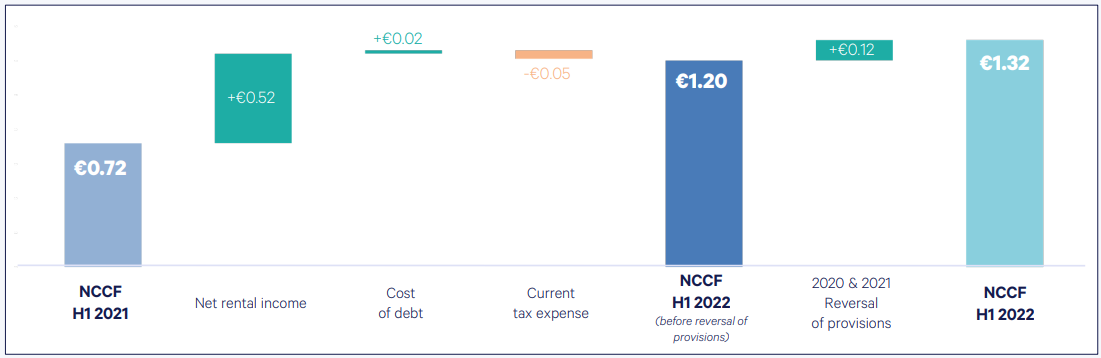

In H1 2022, retailer sales levels in most regions were above 90% of 2019 levels, with Scandinavia and the Netherlands are already surpassing pre-pandemic levels. The occupancy rate rose by 50 bps year on year to 94.7% and with rent abatements and provisions for credit losses declining rapidly, the net current cash flow soared by 83.7% to €1.32 per share.

Klepierre Klepierre

The current net current cash flow guidance for the full year is at least €2.45 per share and this amount includes disposals closed completed in the first half of the year. Speaking of which, Klepierre has been active on this front since the start of 2021, and it completed disposals for €1.3 billion by June 2022. The properties were sold at an average yield of 5.6% at 0.3% below book value. In H1 2022 alone, Klepierre’s disposals stood at €470 million, with a net initial yield of 6% and just 0.4% below book value. The company’s strategy is to focus on its best assets, so you can expect more disposals to follow in the next few months.

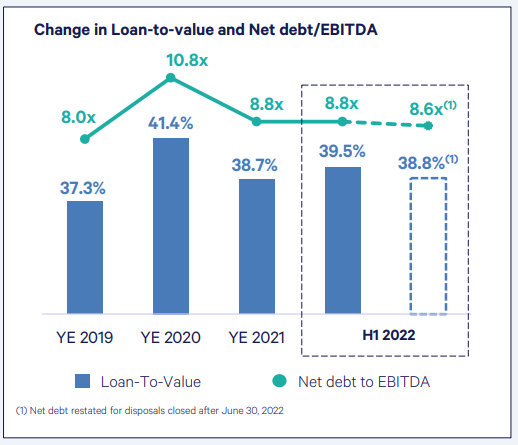

The recent asset sales allowed Klepierre to slash its net debt by €963 million to €7.87 billion between December 2019 and June 2022 and this has pushed down the loan-to-value (LTV) ratio to an easily manageable 38.8%. The cost of debt was just 1.1% as of June 2022 and I think the company should be well insulated from interest hikes over the next two years. About 88% of net debt was hedged at fixed rates in 2022, and the figure is 84% for 2023, according to Klepierre’s H1 2022 earnings call.

Klepierre

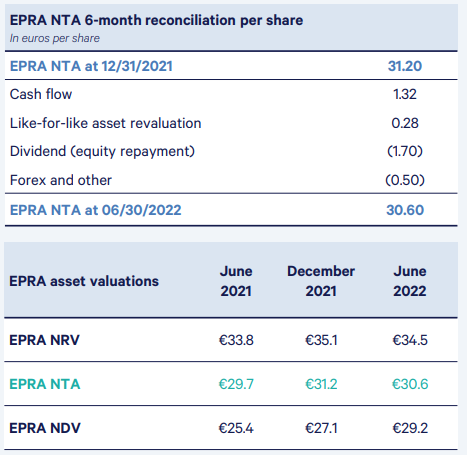

Turning our attention to the valuation of the company, EPRA net tangible assets (NTA) per share stood at €30.60 as of June, which represents a slight decrease from December mainly due to dividends paid in May. This was an annual payout, so there won’t be another dividend payment in the second half of 2022.

Klepierre

Klepierre is trading at €18.86 as of the time of writing, down 10.81% YTD. This might sound bad but is actually much better than the majority of European REITs as the continent is gripped by recession and energy security fears. As of the time of writing, the iShares European Property Yield UCITS ETF is down a whopping 41.47% YTD.

JustETF

In my view, this could be a good time to buy some quality European property stocks and I think that Klepierre’s track record looks compelling. The company has a low LTV ratio and almost all of its debt is hedged at fixed rates. The business model of focusing on prime centers allowed it to keep its dividend payments expanding during the Great Recession and the company is highly selective on capital expenditures, focusing only on accretive projects with a clear target. The most recent example of this is the €143 million Gran Reno mall extension in the Italian city of Bologna, which was 98% let at opening in early July. It delivered a 7.6% yield on cost.

Looking at the risks for the bull case, I think that there are two major ones. First, consumer spending pressures are intensifying in the EU at the moment, and this could slow down the recovery of retailer sales to pre-pandemic levels across some markets. Second, the share prices of many European REITs are in free fall at the moment, and this is likely to keep spreading even to companies that are faring well during these challenging times. Overall, if you’re are interested only in the dividend yield and plan to hold Klepierre over a period of at least several years, these risks shouldn’t be a major concern.

Investor takeaway

Chaos is a ladder and I think that the capitulation in the European REIT market creates a compelling window of opportunity to open positions in quality companies like Klepierre. Sure, the share price could continue to fall in the near term but things should work out well over the long term, especially if you never plan to sell. The firm has demonstrated that its business model of focusing on high-quality malls and keeping debt levels low works well during a recession and with net current cash flow expected to reach at least €2.45 per share in 2022, I think that annual dividend payments will be back above €2.00 per share soon.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition which runs through November 7. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment