Funtap

I’m doubling down on Blackstone Mortgage Trust Inc. (NYSE:BXMT), a 10.9% yielding mortgage real estate investment trust whose selloff makes no sense to me.

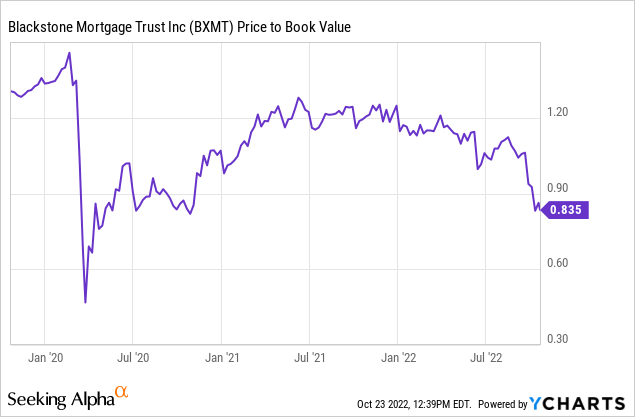

The trust pays a substantial dividend that is fully covered by distributable earnings, and the company’s stock is currently trading at a 16% discount to book value, which I believe is an anomaly.

Even recently, Blackstone Mortgage Trust has seen higher valuation multiples, indicating to me that the market is overreacting to the possibility of a real estate market recession.

Robust Originations

In the second quarter, Blackstone Mortgage Trust originated $3.0 billion in new senior loans, reflecting strong demand for capital in the commercial real estate sector.

Blackstone Mortgage Trust originated $3.4 billion in new senior loans in the first quarter. The senior loan portfolio of the real estate investment trust was valued at $26.5 billion at the end of the June quarter.

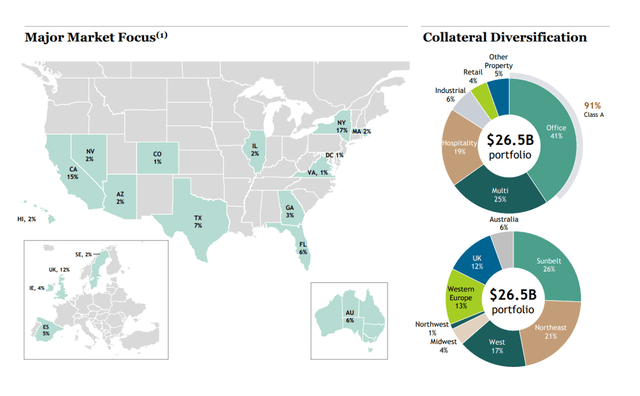

Blackstone Mortgage Trust is heavily overweight on senior loans (41%), which exposes the REIT to the cyclical economic risks associated with that sector.

With 25% and 19%, respectively, multi-family and hospitality real estate are the trust’s second and third highest exposures in its portfolio.

Blackstone Mortgage Trust’s originations in 3Q-22 are likely to have remained resilient around $3.0 billion, as there is no evidence that the commercial real estate market is currently experiencing a correction.

Market Focus (Blackstone Mortgage Trust)

Dividend Remains Covered

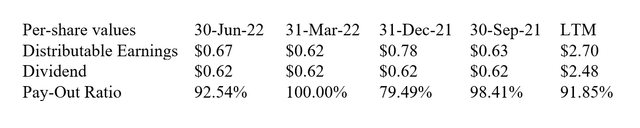

The loan portfolio of Blackstone Mortgage Trust generated $0.67 per share in distributable earnings in the second quarter and $2.70 per share in the previous twelve months. The dividend pay-out ratio was 93% in 2Q-22, giving Blackstone Mortgage Trust a moderate margin of safety.

For years, Blackstone Mortgage Trust has covered its dividend, and while the trust is not increasing its dividend payout (it remains constant at $0.62 per share per quarter), I think the current dividend is reasonably safe.

Dividend And Pay-Out Ratio (Author Created Table Using Trust Information)

The Fed To The Rescue

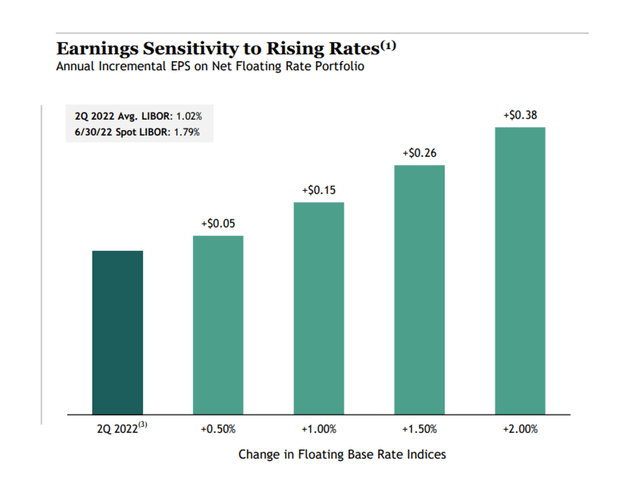

With three large 75-basis-point interest rate hikes in 2022, the central bank is raising short-term rates at the fastest pace in two decades.

This is actually a good thing for Blackstone Mortgage Trust because higher interest rates mean higher net interest income from a largely floating rate senior loan portfolio.

In 2Q-22, 99.9% of Blackstone Mortgage Trust’s senior loans had a floating rate, which protects the trust’s earnings momentum in a market characterized by high inflation. The chart below depicts Blackstone Mortgage Trust’s sensitivity to interest rates.

Earnings Sensitivity To Rising Rates (Blackstone Mortgage Trust)

Blackstone Mortgage Trust’s Nearly 11% Yield Now Available At A Discount

The 10.9% dividend paid by Blackstone Mortgage Trust is now available to income investors at a discount to book value, a significant change for the real estate investment trust, which previously traded at a premium to book value.

When I last covered the mortgage real estate investment trust in August, following the trust’s 2Q-22 earnings report, the stock of Blackstone Mortgage Trust was trading at a 14% premium to book value.

Blackstone Mortgage Trust’s high-quality dividend is now available at a 16% discount to book value.

Why Blackstone Mortgage Trust Could See A Lower Valuation

Blackstone Mortgage Trust’s origination volume is dependent on strong demand for new commercial real estate developments.

Because there is no evidence that the commercial real estate market is consolidating, the market has every reason to believe that the trust’s third-quarter origination volume will be as strong as it was in the second quarter.

Having said that, a rapid decline in originations and deteriorating dividend coverage could provide an excuse for income investors to apply a larger valuation discount to BXMT’s stock in the future.

My Conclusion

Blackstone Mortgage Trust is a well-managed REIT whose stock has been unfairly punished in the last six weeks.

With distributable earnings in the second quarter, the real estate finance company easily covered its generous $0.62 per share per quarter dividend pay-out, and the trust is likely to cover its dividend in the third quarter as well.

I believe that investors are currently undervaluing Blackstone Mortgage Trust’s earnings potential, which will likely attract more yield seekers over time.

The trust’s 11% dividend yield is relatively safe, and the stock trades at a 16% discount to book value.

Be the first to comment